Will the Twitter Board Consider Musk’s Offer as Best for Shareholders?

By now you’re aware that Elon Musk has offered $43 billion for every share of Twitter (TWTR). His offer is to buy the company outright and run it as a private company.

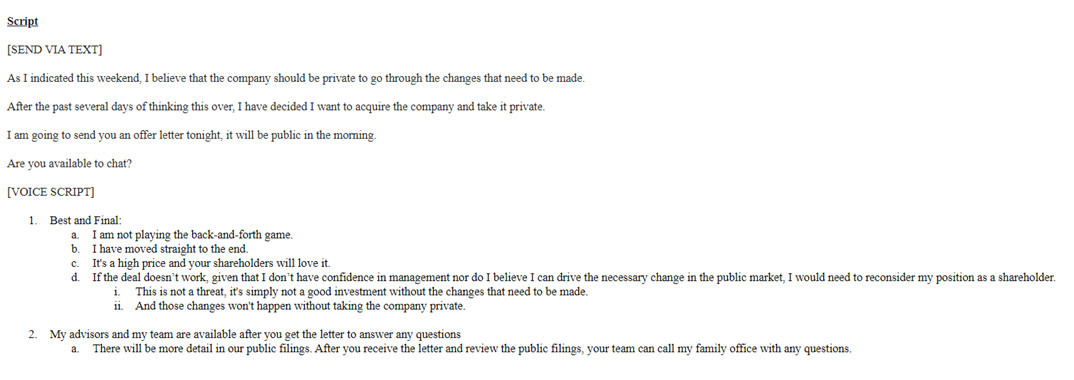

The offer is not, according to the filing, a negotiation. Management will have to make a recommendation to the Board of Directors which will then be expected to decide as a fiduciary and act in the shareholder’s best interest. A counter offer may end the deal. In Musk’s words, “I am not playing the back and forth game.” He also said, “It’s a high price and your shareholder’s will love it.”

The richest man alive also made it clear that if the offer is declined, the 9.2% stake he owns may go up for sale. This could have the opposite impact on the stock price.

Elon’s Notes to Bret Taylor, Chairman of Twitter’s Board

|

|

Source: SEC.Gov Amendment #2 to 13D Filing |

|

|

Source: SEC.Gov Amendment #2 to 13D Filing |

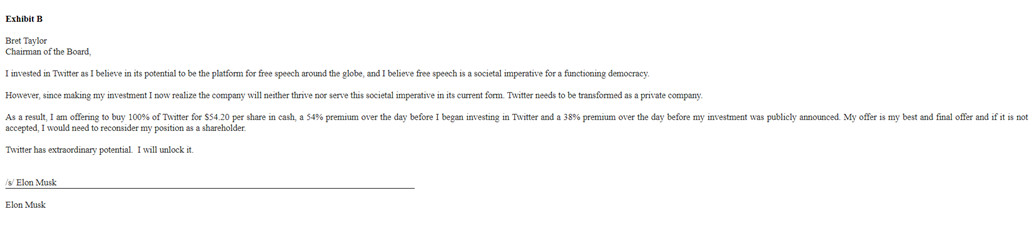

In the filing Mr. Musk includes his text and follow-up note to Twitter’s Board chairman. The communications are peppered with language that includes “free speech” and “societal imperative.” It is clear that the offer is designed to either cause the board to accept, as it is a high relative price for the company, or embarrass the company as it would seem akin to saying they don’t have his concerns about society.

The Price

$43 Billion is the approximate valuation of Twitter as per Musk’s offer. This should help avoid trouble and concerns of stock manipulation from the regulators as it represents a 54% premium over the company’s value the day before he began investing in it.

The price of 54.20 per share may reflect Musk’s sense of humor. The number 420 is code for smoking marijuana. Musk has used the number before to amuse

his girlfriend and others that are aware of this.

Next week, April 20 is celebrated as the high holiday, National Weed Day, perhaps he is looking to settle this by then.

Managing Editor, Channelchek

Stay up to date. Follow us:

|