image credit: Mikhail Nilov (Pexels)

Margin Debt Increases are Eye-Popping

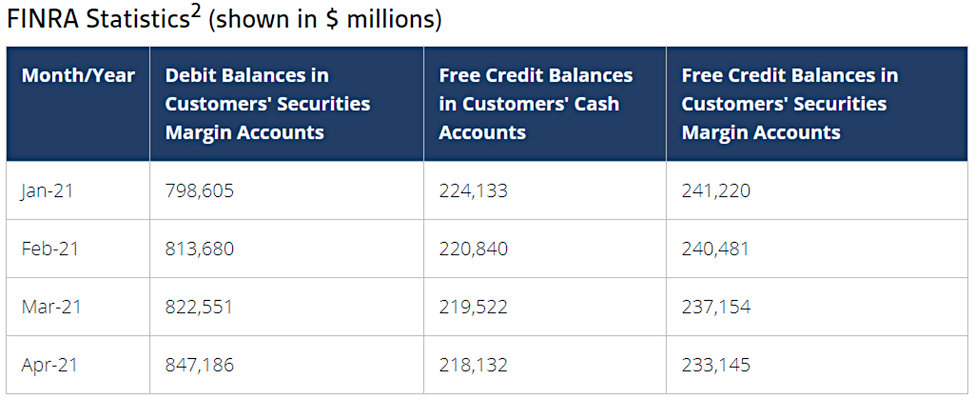

Stock market margin debt jumped by $25 billion in April and $48.5 billion since the beginning of the year based on FINRA statistics. The level reached a historic high of $847 billion from $552.5 billion a year ago. This 53% increase in a year is growth well above average. The unsustainability of this pace, and the idea that margin rates charged by brokers will rise as interest rates do, add an overlooked element of risk in today’s stock market.

The seeming precariousness of the level of leverage measures only two types of accounts, this includes brokerage accounts and advisory customers that are overseen by FINRA. It excludes unreported borrowing by professionals and others that have used debt for investments in the financial markets.

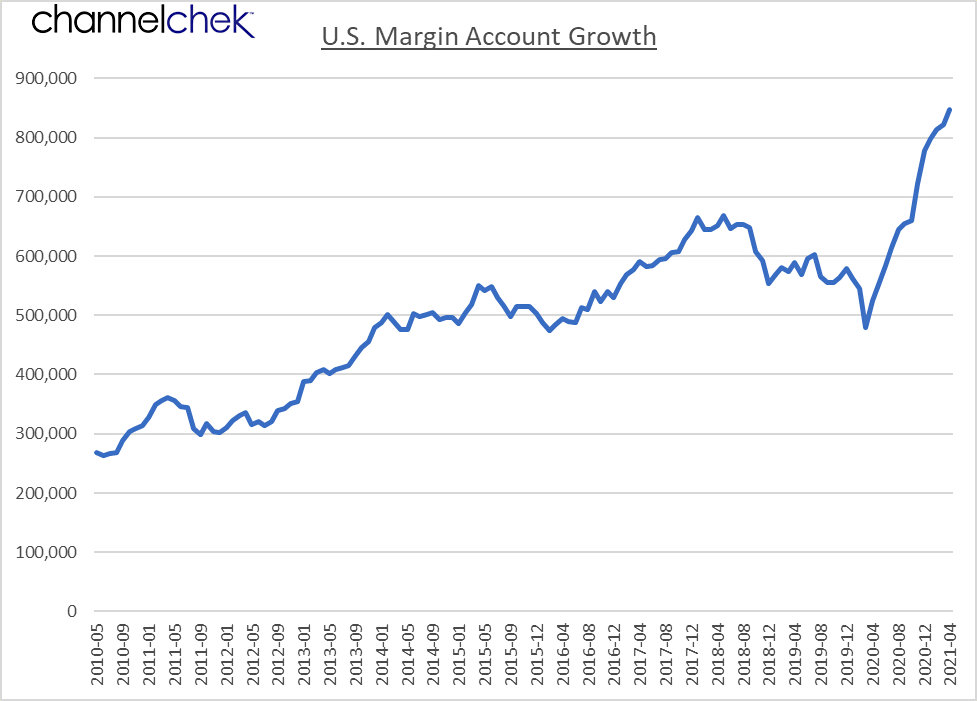

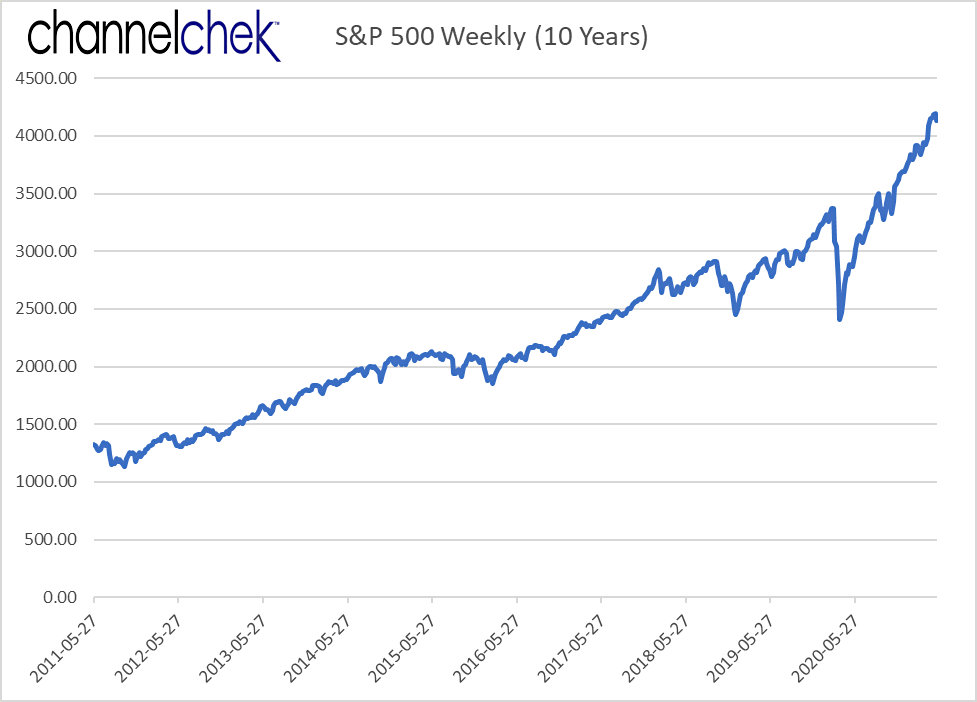

The below graph shows weekly data on the growth of margin debt reported by FINRA. The current pace is faster than at any point found on the FINRA website. The market, as measured by the S&P 500, is following the same path of growth (see second chart). Although correlation is not proof of cause; experience has shown that as the market rises, people will borrow to compound their returns. Further, as the value of the accounts that serve as collateral then rise, they are capable of leveraging up even more.

The snowball effect of the increases in both the S&P performance and the borrowing that is in part fueling the market increases could continue until something disrupts the chain reaction.

Possible Disruptors to Margin and Market Growth

This disruption could come in the form of an increase in interest rates. This would cause brokers to raise their broker’s call rate. Investors would then have to weigh their expected return versus the cost of the borrowing. The cost of borrowed funds to the expected return equation would not be as favorable even if their market view has not changed. This could cause some investors to retreat from their aggressive position. It wouldn’t take much at these levels to create a chain reaction of selling to reduce borrowed capital.

Another potential disruptor could be a few bad days in a row for the market. Again this impacts expected return versus the cost of (borrowed) money. The chart above suggests just how large the profits are that many investors are sitting on. A few days of market decline can signal ti investors that it’s time to book some of those profits. This further weakness could trigger enough margin calls where investors either sell positions and pay off the interest, or cough up additional cash. The margin calls could create a march downward as the same forces that brought it up, act in reverse to tear it down.

Other Borrowing

In a previous article, Channelchek reported that 2.5 million homes or 4.9% of homeowners’ mortgages are in forbearance. The hurdle to pause payment on a federal agency-backed mortgage is quite low. It’s suspected that some of this money that will be owed later has been finding its way into the market. In reality, this is borrowed money, and the payments are (under current stipulations) required to resume by mid-year 2021. This could curtail the flow of these borrowed funds, not accounted for by FINRA, from entering the market. The reduced inflows and possible outflows would reduce investment growth and the upward pressure on prices.

In another Channelchek article, we described how family offices are not overseen by regulatory authorities like FINRA, any borrowing from money managers is not accounted for in much the same way hedge fund borrowing is not regulated or overseen. The leverage from these investment groups is not known. Earlier this year, there was an instance when the firm Archegos Capital Management suffered losses large enough to impact markets and earnings of some of their large banking relationships. The amount of risk and, therefore, the potential impact on the market to trade-off from this category is not known.

Take-Away

The strength of the market comes from many places. The amount of cash in the system undoubtedly has driven prices up. The low return on interest rate investment alternatives is another which pushed money into higher-risk investments, and then there is the availability of borrowed money. The use of borrowed money is at historic highs.

Borrowed money has a cost. That cost is measured against the expected return. If the expectations change or the cost of money increases, the market could sink to find a new balance from which to try to build again. Just as sure as markets go up and down, this will occur to some degree. Why a selloff may be triggered is debt-funded investing. When a larger selloff may be triggered, is unknown.

Suggested Reading:

|

|

Is Inflation Going to Hurt Stocks?

|

The Limits of Government Economic Tinkering (June 2020)

|

|

|

A Look at Real Estate Risks to the Stock Market

|

Understanding Family Offices

|

Sources:

https://www.finra.org/investors/learn-to-invest/advanced-investing/margin-statistics

https://www.federalreserve.gov/publications/files/financial-stability-report-20210506.pdf

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|