What’s Moving the Market: Explained in Three Graphs – Part 1

The pandemic shuts down the economy … and the stock market goes up. People are rioting in the streets to protest racial injustice … and the stock market goes up. The United States threatens to strip Hong Kong from special trade status, potentially reigniting trade wars with China … and the stock market goes up. The rise in the general stock market seems at odds with the economic data being reported. Granted, the market is supposedly a measure of future results, not current results. But then how does one explain the market’s strength at the same time that management teams and analysts are racing to lower earnings and cash flow projections? The following three charts perhaps offer some explanation.

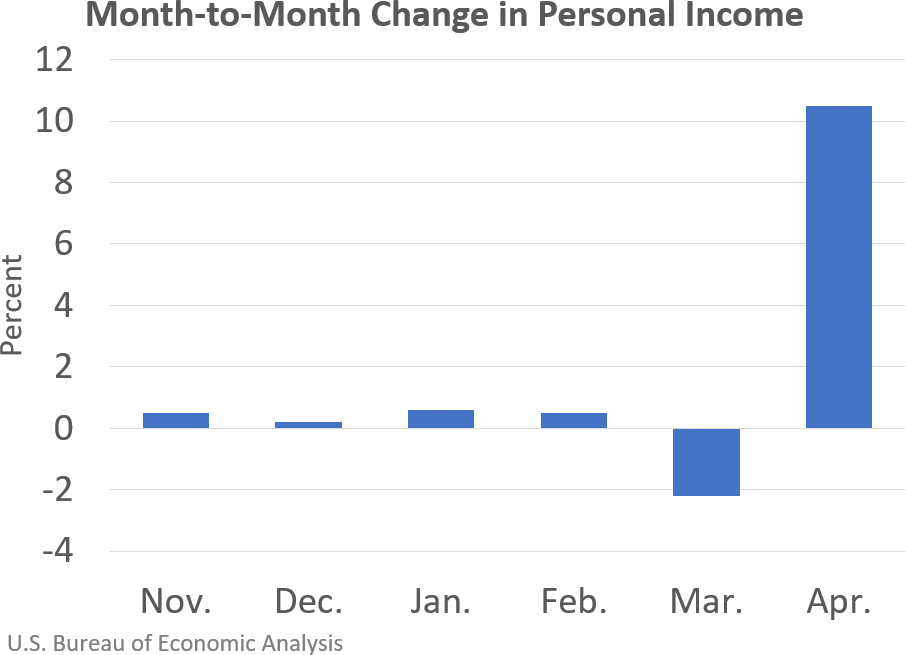

Personal income is up. Personal income in the US surged 10.5% in April, the biggest jump since the US Bureau of Economic Analysis started compiling data in 1959. Disposable income rose by 12.9%. The increase is largely due to an increase in government spending. Government social benefits accounted for $6.3 billion, or 30% of the personal income in April, almost twice the normal percentage. One can debate the merits of the government bailout, but the impact is clear. Government spending has put additional dollars into the hands of consumers. However, consumers are not spending the increase in income, instead choosing to save it.

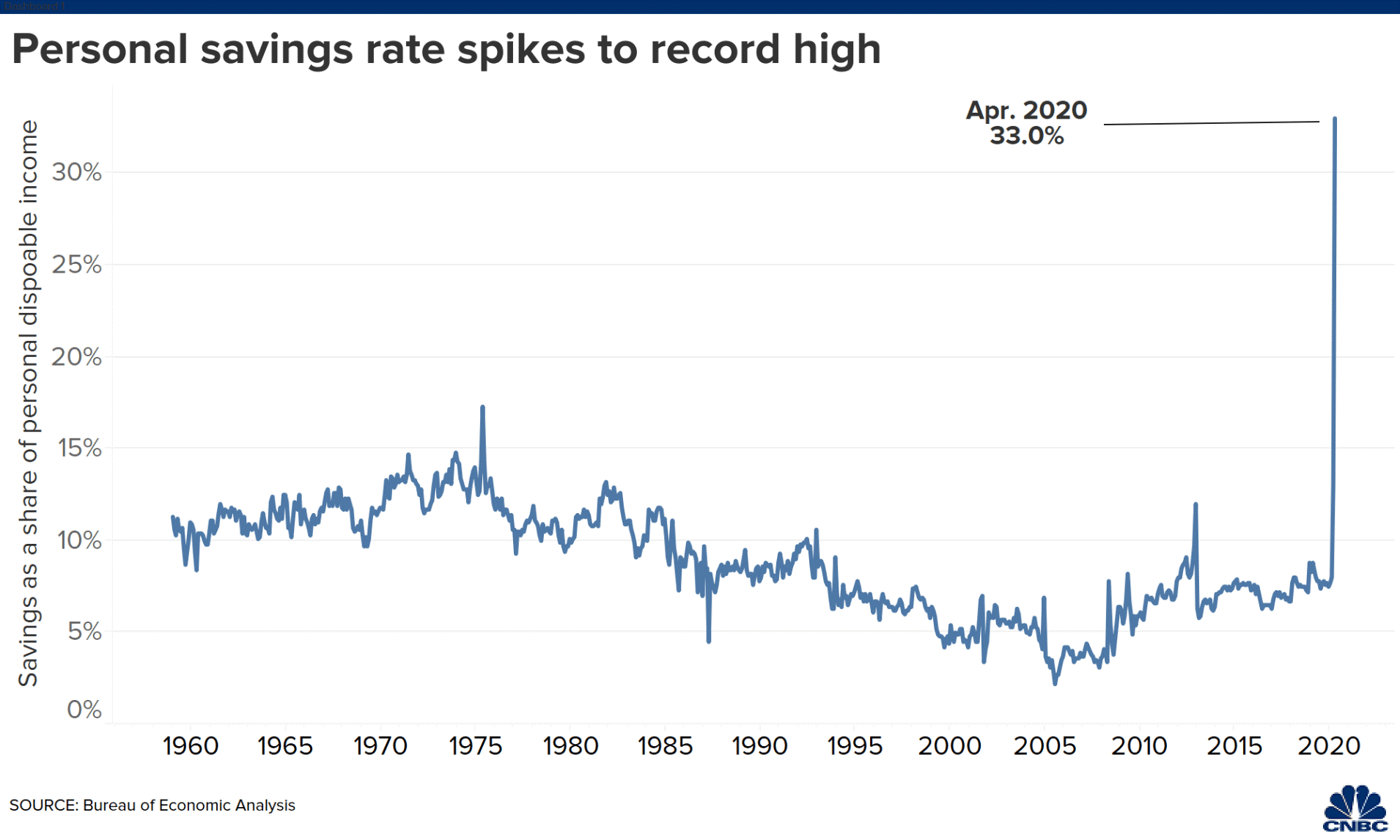

People are saving, and there is nowhere else to put

money. People have responded to COVID-19 concerns by staying at home, which has reduced the money they spend on entertainment. They are also foregoing other discretionary spending due to employment and economic concerns. The personal savings rate has skyrocketed to historic levels. The personal savings rate is a measure of savings as a percent of disposable income. Brian Moynihan, CEO of Bank of America, tells CNBC that checking accounts have 30% to 40% more money in them than 12 weeks ago. This comes despite historically low-interest rates. Put plainly; the money must go somewhere, so why not the stock market? And why not put those dollars in stock that are well known?

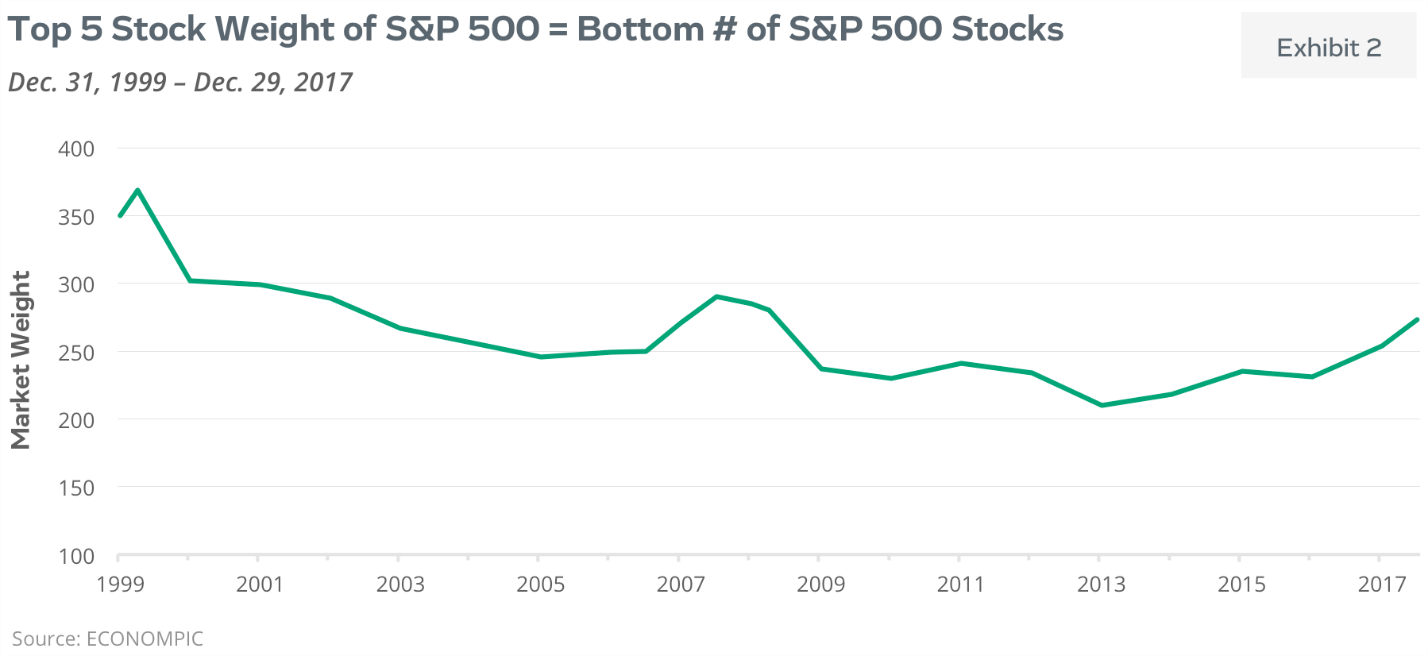

The stock market has become dominated by a handful of tech stocks. Since bottoming out on March 17, most major indices are up approximately 20%. Information Technology stocks have led the push with the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google) up more than 30%. Technology stocks are less affected by a reduction in consumer spending due to COVID-19 or racial tension. In fact, Apple and Google could become major players in the fight against the virus through contact tracing apps, while Facebook and Netflix are seeing increased usage, and Amazon is benefiting from increased home deliveries. Major stock indices such as the S&P 500 or the Russell 200 are meant to measure the performance of a broad group of stocks comprising all aspects of the economy. In actuality, the performance of the indices is heavily influenced by a small handful of large companies. Amazingly, five stocks (Apple, Microsoft, Amazon, Google, and Facebook) now comprise 18% of the S&P 500’s market capitalization, roughly equal to the market weight of the bottom 300 companies. This percentage has grown steadily in the last ten years. The strong performance by the stock market, then, does not necessarily reflect improving economic conditions but rather that of just one sector or maybe even only a handful of companies.

Suggested Reading:

Small-Cap vs. Large-Cap Investing

Should Economic Aid Target Business or Individuals and Families?

Should the Stock Market be up Double-Digits on the Year

Enjoy Premium Channelchek Content at No Cost

Sources:

https://www.cnbc.com/2020/05/29/us-savings-rate-hits-record-33percent-as-coronavirus-causes-americans-to-stockpile-cash-curb-spending.html, Maggie Fitzgerald, CNBC, May 29, 2020.

https://finance.yahoo.com/news/looting-protests-and-covid-19-havent-pounded-the-stock-market-160426990.html, Brian Sozzi, Yahoo Finance, June 2, 2020

https://finance.yahoo.com/news/5-powerful-tech-companies-now-make-up-18-of-the-stock-market-heres-why-this-could-be-a-bad-thing-145710881.html, Brian Sozzi, Yahoo Finance, February 3, 2020

https://qz.com/1862614/personal-income-in-the-us-shot-up-a-record-10-5-percent-in-april/, Karen Ho, Quartz, May 29, 2020

http://arnerichmassena.com/blog/faang-phenomenon-sustainable/, Jillian Perkins, Arnerich Massena, June 29, 2018

https://www.yahoo.com/news/faang-stocks-defying-coronavirus-bloodbath-115111875.html, Ritujay Ghosh, Zacks, May 26, 2020