Image Credit: Steve Jurvetson

Will the Fed Bring Down Skyrocketing Inflation and Hit its Employment Targets?

Fed Chairman Powell, who was just reappointed this week, is making no promises as to the results of his attempt at a soft landing. He told Marketplace that he couldn’t assure there won’t be bumps on the ride to inflation getting back to the 2% range while the labor market stays strong. “It’s quite challenging to accomplish that right now,” he said.

The current situation is often compared to the stagflation of the 1970s, but in reality, the last time the country was challenged by high employment coupled with high inflation was 1951.

The Challenge

It has been 70 years since the U.S. last had low unemployment with rapidly rising prices. Today inflation is more than a data point or a CPI headline, at an 8%-9% pace, most in America are feeling the numbers each time they make a purchase. Meanwhile, the job market is historically strong. As of April, only 3.6% of the labor force was jobless and looking for work, the lowest since the last time the Fed considered tightening.

Low unemployment is mostly a positive social and economic measure, but with inflation already climbing to its highest rate in more than 40 years, a tight labor market will lead to wage pressures and more costs for businesses that will be handed down to consumers.

Aggressive monetary tightening is often the medicine for rising inflation; just as low interest rates and quantitative easing stimulates activity, more expensive, and less money in the system reduces activity and that raises unemployment. The person or team of people at the controls are targeting two competing priorities, one is usually sacrificed.

History as a Measure of Success

Before March 2022, you would have to be 71 years old or older to have experienced inflation above 8% while the unemployment rate sat below 4% (Fed Chair Powell is 69). The cause in the early 1950s was the economy experienced a burst of inflation during the Korean War as government spending on national security increased.

Since 1948, the unemployment rate (monthly) has dropped below the 4% level 146 times. Of those months, inflation registered above 8% only 15 times. So statistically, the combination has occurred less than 2% of the time in three-quarters of a century.

There are bankers and investors like Jamie Dimon of JPMorgan Chase and Bill Ackman of Pershing Square Capital that believe the Fed is behind in its rate-hiking efforts and needs to act more aggressively in order to keep the explosive inflation under control. But the criticism is not without understanding. In April, Jamie Dimon was quoted as saying, “The Fed needs to deal with things it has never dealt with before and are impossible to model.”

Is the Fed Behind?

Former U.S. Treasury Secretary Larry Summers has noted, each time inflation has exceeded 4% while unemployment was below 5% over the past 75 years, which has happened in 70 months, the U.S. has fallen into a recession within two years.

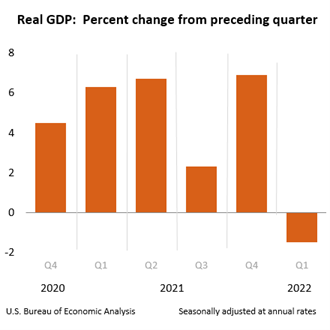

The first quarter of 2022 has already shown negative growth for the economy. A recession is defined as two consecutive quarters of negative growth, we may already be in a recession. It should be noted that the negative 1.5% growth rate followed a quarter of above-average growth.

Investment Portfolio Impact

Stocks tend to do well during tightening cycles. Since 1972 there have been eight of these cycles. Only in the 1972-1974 period did the S&P 500 produce negative results. In the seven periods that followed, with the most recent being 2015-2018, the market returned positive results to investors.

Higher material prices and increased cost of labor both raise the cost of doing business, which could reduce corporate net earnings. This is why inflation is an ugly word in the markets. But stock market results on a total return basis exceed cash or bonds. This makes them attractive and often leads to assets moving into stocks and pushing the market up. At the same time stocks can be a hedge against rising prices.

Different assets react differently to inflation, both within stocks and across other markets. Previously an allocation to value stocks generally performed better than others when inflation grew. Read quality research on the companies you’re considering, a company may have a pricing power advantage. Companies with large inventories or that own advantageous futures contracts may grow profits while their competition’s earnings falter. Making prudent adjustments to an allocation helps position portfolios for a changing environment, stock selection becomes more important, and understanding what is under the hood of an individual company can increaseyour probability of success.

Research provided on Channelchek is by the top-tier equity analysts at Noble Capital Markets. Timely reports are sent daily to your email inbox before the bell, and at no cost. Sign-up here.

Managing Editor, Channelchek

Suggested Content

Small-Cap Stock Category Sees Most Insiders Buying Since Spring of 2020

|

Is Michael Burry Frustrated that the Market Hasn’t Yet Crashed?

|

What Investors Haven’t Yet Noticed About the Value in Some Biotechs

|

Avoiding the Noise and Focusing on Managing Your Investments

|

Sources

https://www.marketplace.org/collection/unemployment-2020/

https://qz.com/2150562/jamie-dimon-wishes-the-fed-all-the-best-on-slowing-inflation/

https://www.bea.gov/data/gdp/gross-domestic-product

https://blog.nationwidefinancial.com/wp-content/uploads/2022/03/Picture1-1.png

Stay up to date. Follow us:

|