|

|

|

|

The Annual Russell Index Revision and Stocks to Watch

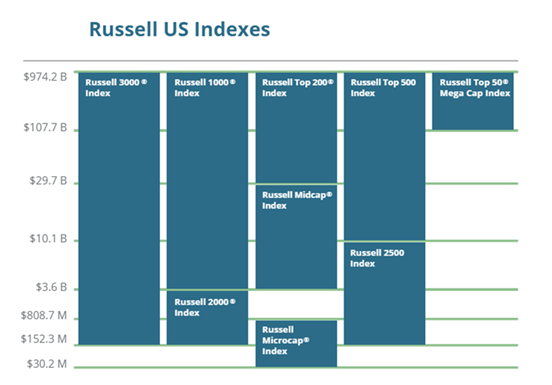

The yearly process of recasting the Russell Indexes began on May 8, 2020, and will be complete by market open on June 29. During the period in between, Russell will rank stocks for additions, for deletions, and to evaluate the names to make sure they conform overall. The methodology is largely transparent to help smooth the process. Still, as you might imagine, with over $900 million invested in passive index funds and $9 trillion in assets linked to Russell indexes, the trading volume of these companies should increase dramatically during this period, and there is, of course, the potential for very profitable long and short trades.

Investors should be aware of the forces at play so they may either get out of the way or become involved by taking positions with those being added or those at the end of their reign within one of the Russell measurements.

COVid-19 Dramatic Valuation

Shifts

The reconstitution mid-year 2020 is going to impact a much larger number of companies than most years. As with everything else related to the financial markets, the price swings will likely be more amplified than usual. That is to say, more companies than in the recent past will move in, out, or to another index. There should be large price swings as we approach the last trading days in June.

The 2020 Russell

US Index Reconstitution Calendar is as Follows:

• Friday, May 8 – “rank day” – Russell US Index membership eligibility for 2020 reconstitution determined from constituent market capitalization at market close.

• Friday, May 22 – “query period” begins – preliminary shares & free-float information for Russell 3000 Index constituents are published daily & queries welcome (query period runs through June 12)

• June 5 – preliminary U.S. index add & delete lists posted to the FTSE Russell website after 6 PM US eastern time.

• June 12 & 19 – U.S. index add & delete lists (reflecting any updates) posted to the FTSE Russell website after 6 PM US eastern time.

• June 15 – “lockdown” period begins – U.S. index adds & delete lists are considered final • June 26 – Russell Reconstitution is final after the close of the U.S. equity markets.

• June 29 – equity markets open with the newly reconstituted Russell US Indexes.

Stocks to Watch

The U.S. equity indexes that are subject to annual reconstitution include the broad-cap Russell

3000 and Russell

3000E, the Russell

Midcap index, the large-cap Russell

1000, Russell

Smallcap Completeness, Russell

2000, Russell

200, Russell

Top 50 Megacap, Russell

2500, Russell

Microcap, and the Russell

Top 500 Index. These links will provide the definition of each index, which will help if you’re trying to determine what companies will be put into each and what companies will be removed to create the new make-up until next year.

This link (Russell

2000 {19-00}) may help you get started to find stocks with potential movement within some of the indexes. It is a spreadsheet of last year’s Russell 2000, the current largest U.S companies by capitalization (close of business 5/13/20), and a side-by-side comparison to determine which stocks may wind up in the Russell 2000. We’ve identified 101 candidates shown on our spreadsheet that we are watching. We encourage investors that are looking to avoid or become involved with stocks added or removed to do their own analysis and review of price movements.

In a previous article titled There’s Opportunity When Stock

Market Indices are Reshuffled, there are samples of historical price and volume activity surrounding stocks being added or removed from a major index.

Suggested Reading:

Stock

Index Adjustments and Self-Directed Investors

The Correlation between Passive

Investing and Underperformance

Enjoy Premium Channelchek Content at No Cost

Source: