The FAANG Stocks Are Converging and Cracks Are Showing

The so-called FAANG stocks have dominated the technology sector in recent years. FAANG stocks refer to the stocks of Facebook, Apple, Amazon, Netflix, and Google. Each company has its origin in and is known for, a different component of the technology industry. Facebook is known for social media. Apple is known for hardware. Amazon is known for retail. Netflix is known for content streaming. Google is known for its search engine.

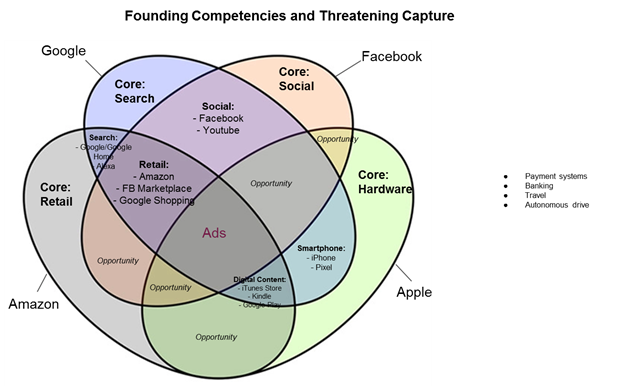

A funny thing has been happening in recent years; the FAANG companies have begun to converge and act like competitors, often copying each other. Amazon began making smart speakers (Alexa), so Apple (Homepod) and Google (Home) followed suit. Netflix began producing original movies and shows, and so did Apple (Apple TV+), Amazon (Prime Video), and Google (Google Play). Facebook expanded into other social media sites (Instagram) and messaging sites (Messenger), so Google purchased YouTube and Apple expanded iTunes. Apple began making smartphone accessories, so Google purchased Fitbit. All five companies have moved into cloud services.

The Overbite of the Companies

Today all FAANG companies have at least a foot in all aspects of technology, whether it be hardware, software, social media, media distribution, original content, search engines, or retail. In many ways, these founding fathers of modern technology are becoming more and more similar. And at the heart of all operations are advertisement dollars. In essence, they all want to control how a person accesses information and to sell visiting “eyeballs” to advertisers. That includes controlling the hardware devices (phones, computers, smart speakers, televisions), the social apps (Facebook, Instagram, YouTube, TikTok, iTunes), help apps (Google Maps, Uber, Weather apps), and original content (Netflix, Apple TV+, Amazon Prime).

The company that controls the eyeballs controls the advertising dollar. That’s why smart home speakers were sold so cheaply when they came out. That’s why companies are investing large dollars in speech recognition software. That’s why FAANG companies sell devices to connect televisions to the internet. That’s why companies are paying up to acquire the latest, hottest technology companies. The battle to acquire TikTok’s U.S. operations between Oracle and Microsoft/Walmart may have well been those company’s attempts to join the inner circle of technology giants. And, before you say “what was Walmart doing trying to buy a tech company,” remember that Amazon has been eating into Walmart’s retail operations.

Out for Blood

So, if these tech giants are headed for an all-out war for the advertisement dollar, how can we handicap their odds? Facebook and Netflix seem to be the odd men out, checking off the fewest categories to attract eyeballs. Facebook is strong in social media, but behind the game in other areas of technology. Netflix seems especially vulnerable given steps taken by the other tech giants and other media companies (Disney, Viacom, Universal, Fox). In fact, if AAG wasn’t such a bad acronym, Facebook and Netflix would probably not be included in the grouping. Not that Facebook and Netflix won’t do fine on its own in its sectors, but it’s hard to envision them as major technology companies involved in all aspects of technology unless they were to merge with a company like Oracle, Microsoft, or IBM.

New-FAANGled Opportunity?

On the other hand, there is one other component that we have not talked about yet – automobiles. If computers, phones, televisions, and smart speakers are important access points to the advertising dollar, what about cars? Perhaps the car manufacturers of the future will be paid for product placement when drivers make requests for the nearest restaurant, gas station, etc. Automobile computers could become especially important in the age of driverless vehicles. And who is the most innovative car manufacturer? Perhaps the FAANG group will become the TAAG group someday.

The technology industry moves fast. IBM dominated the space in the 1950s and 1960s and is now an also-ran. Microsoft dominated the 1970s and 1980s and is on the outside looking in. The next great tech company may not have even been formed yet. All it takes is a great idea. That’s where small microcap companies come into play. The investment environment has never been riper for new companies to develop and hit it big. At worse, a successful small company may be bought out by a giant looking to maintain their position, rewarding early investors for their foresight.

Suggested Reading:

Fear of Missing Out on Owning the Next Apple

Investors Should Pay More Attention to ATM Offerings

Ecommerce Adapts While in-Person Retail Struggles

Enjoy Premium Channelchek Content at No Cost

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 online investors. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 online investors. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

https://www.cnbc.com/2020/09/22/apple-amazon-and-google-will-emerge-as-winners-gene-munster.html, Stephanie Landsman, CNBC, September 22, 2020

https://towardsdatascience.com/who-is-winning-google-amazon-facebook-or-apple-45728660473, Rodrigo Salvaterra, Towards Data Science, February 10, 2020

https://www.marketwatch.com/story/the-faang-companies-are-starting-to-turn-against-one-another-2017-09-18, Jeff Reeves, MarketWatch, September 18, 2019