The FAANGs Come Out During Election Uncertainty

Investors trying to determine what impact the tight presidential race has had on the stock market may find stocks related to remote working and online communication have again become stock market leaders.

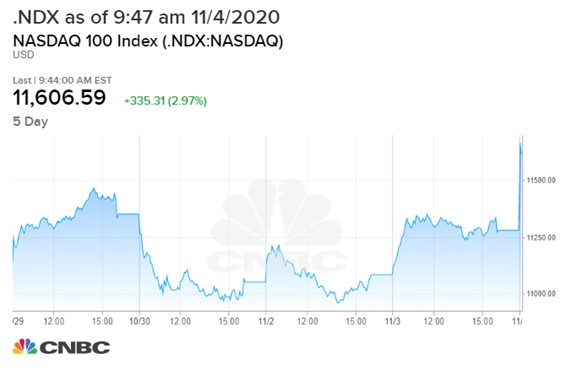

Clear election night winners include the NASDAQ 100 as indicated by futures contract trading. The tech-heavy Nasdaq 100 Index (NDX) is a basket of the 100 largest, most actively traded U.S companies listed on the Nasdaq exchange. Among the largest within the index are Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Facebook (FB).

December 2020 contracts were up more than 3% overnight, with some of the largest gains coming after the President shared his concern about vote-counting efforts. Currently, both President Donald Trump and Challenger Joe Biden still have mathematical paths to occupying the White House over the next four years. Mega-cap stocks running out ahead of other stocks has been a theme during the COVID-19. The FAANG trend had recently reversed as election polls pointed to a Biden win.

In addition to the uncertain presidential race outcome, many expected a clear Democratic sweep within Congress. The reasoning was that Democrats are expected to be more inclined to put forth the largest stimulus package. The coming make-up of Congress is not expected to alter the strength much in either direction.

Recently the small cap Russel 2000 Index (RUT) has been outperforming the Nasdaq 100. Investors, for now, seem to be again favoring big tech in the face of a divided government, which is less likely to agree on spending plans.

David Bianco, the chief investment officer of the Americas at DWS Group Americas, Inc., has been quoted as saying, “If it’s a mixed government, it’s still a good environment for tech companies.” He gave these reasons, “You’re unlikely to get a big increase in corporate taxes. Less change, more status quo, more stability in taxes and regulation is good for all businesses including tech.”

There are benefits to Washington being unable to pass as many changes. Uncertainty as to which person or which party will hold the executive branch is likely to create speculative flows until resolved.

Suggested Reading:

Which Stocks Do Well After a Presidential Election

Fintech Pirates are Looting Unsuspecting Trading Accounts

Many Investors are Keeping Their Powder Dry

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

https://www.nytimes.com/live/2020/11/04/business/us-economy-coronavirus

https://uk.finance.yahoo.com/finance/news/stay-home-nasdaq-trade-reasserts-031222341.html

https://www.wsj.com/articles/senate-election-2020-results-11604378353