|

|

|

|

Is There Profit to Be Made Off Government Stimulus 2.0?

With all the conflicting chatter surrounding the next round of Covid related government stimulus, the only thing that’s certain is that there will be another round. Expectations differ as to what will be elevated to high priority and what may be different than the previous round. The amount of money involved, likely to be $1- $3 trillion or more, will impact the fortunes of both the industries targeted and ancillary businesses not directly touched. This, of course, keeps investors listening for clues to where stimulus dollars will be spent, which industries are incentivized, and if infrastructure spending will be ramped up as it was during the economic weakness in 2008-2009.

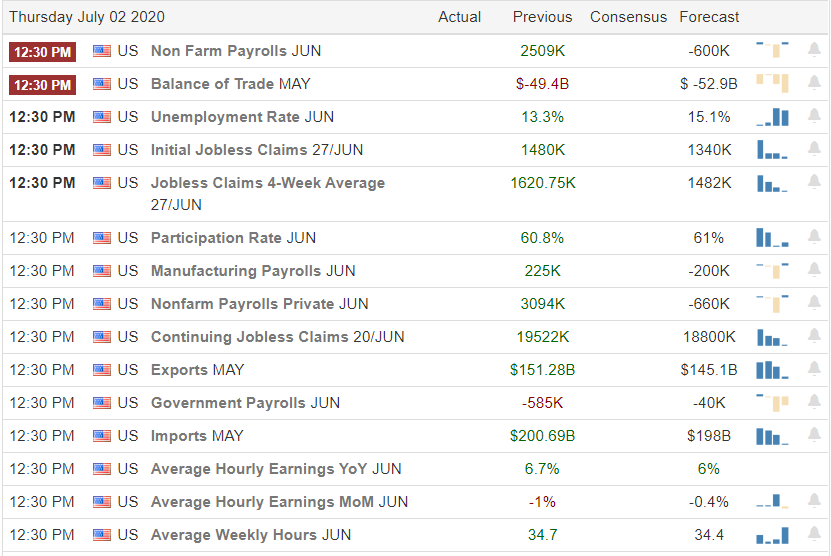

The direction the final package takes could depend on the soon to be released jobs report which will be out just before the long holiday weekend. The previous jobs report included many positive surprises. If the surge in Non-Farm Payrolls continued, it would weaken the argument for new stimulus checks and extended unemployment insurance.

U.S. Payroll, Actual and Forecast – May/June

Source: Trading Economics

(Calendar)

As with most things in Washington, the nature of the stimulus is a high stakes contest. Continued strength and employment gains could weaken the Democrats’ preferred plan of extending benefits to individuals. If Payrolls declined in June, that would pressure the White House and Republican-controlled Senate to support larger measures than they are now considering. The lawmakers are not expected to discuss any plans until they reconvene on July 17, after their Independence Day recess.

The Chatter

Most presume that the next mega-dose of stimulus out of Washington will set aside a large portion dedicated to infrastructure improvement projects, and perhaps manufacturing support. Much uncertainty lies in how individuals and small businesses are best supported.

In anticipation of any package, materials prices have been rising as commodity traders anticipate all competing plans to include infrastructure projects. Within infrastructure, there are expectations of spending on “green” energy and digital technology. In a CNBC article published on June 24th titled, “Welcome to the age of copper: Why the coronavirus pandemic could spark a red metal rally,” it’s shown that copper is seen as a bellwether for the general state of the economy. The demand turned sharply down during the height of the pandemic in March. In recent days, copper has been trading close to its pre-coronavirus high at $5,909 per metric ton. Both here and abroad, there are expectations that demand for copper will dramatically increase as investments in energy generation and distribution have more support from public funds. Any new demand would not create shortages, as copper mines that have been closed during the worst part of the pandemic are reopening throughout the globe.

Expectations from a White House stimulus plan are that it will be designed with an eye toward changing our economic landscape with more domestic manufacturing. According to White House trade advisor Peter Navarro, the president wants the next stimulus bill to be “at least $2 trillion.” This is close to double the $1 trillion Senate Majority Leader McConnell said he plans to target. However, it’s smaller by a third to the House bill asking for $3 trillion, which was passed on May 15th. The House bill is not scheduled for a Senate vote.

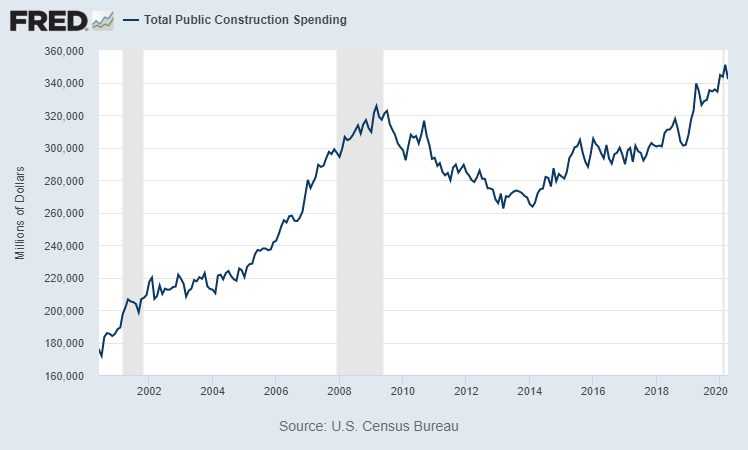

Government Led Construction Spending in Recessions

Spokesmen for the White House have been very public on what they believe should be the primary impetus of any stimulus spending. In an interview on Fox Business News trade advisor, Navarro said a “key thrust” to the stimulus bill should focus on manufacturing jobs. He followed this by highlighting an underlying theme of “Buy American” “Hire American” and “Make it in the USA.” The strategy would be to remake and improve on what we had before the lockdown. Although the service sector could benefit from more direct attention, the plan more likely would support manufacturing jobs. These jobs would then be expected to have a ripple effect creating more service sector demand. When asked for specific incentives to be included, Navarro said, the bill will be designed to create demand for more investment in the U.S. A payroll tax cut is also viewed as a “critical” part of the plan. The White House views this as critical to create the appropriate incentives for employers to keep workers working.” It also serves as a take-home “pay raise” for workers.

The Beneficiaries

What could tax cuts, deregulation, cheap energy, and beneficial trade deals mean for business? As mentioned, it would help rebuild the country’s manufacturing base. There is a particular focus on domestic production of pharmaceuticals, medical supplies, and equipment. The demand-driven growth could positively impact new tech, including biotech and what Navarro called the “SpaceX economy.” Other beneficiaries could be raw material providers and producers of infrastructure development, including electricity providers. Some of the expectations may already be reflected in equity prices.

Companies with high payrolls doing business in the USA will immediately see reduced costs. Investors should not just look for where revenues will be increased, as cost reduction immediately adds to income statement bottom lines. Government contractors should be busier with projects as diverse as drinking water, roadway construction, border barriers, waterway maintenance such as dredging, bridges, etc.

If stimulus checks are part of an approved plan, this could have a positive impact on discount brokers. After the last round of government checks, there was an increase in the newer breed of app-based traders. Additional funds in their accounts add to the bottom line of no cost per trade brokers that make money off the spread between what they earn on the balances and their cost. Additionally, household name stocks with per-share price equal to or less than the cost of a large coffee at Starbucks may also rise as these securities get more attention from investors on these apps.

Take-Away

Change brings opportunity. Determining what that change will be and how it will impact industries and businesses is how uncommon returns are made. Within political bargaining, there’s universal support for infrastructure projects as a way to update the old and take a giant step forward with the new. This explains why metals such as copper have experienced a strong rebound. The pandemic demonstrated the need to manufacture medicine and equipment within the U.S. Domestic pharmaceutical companies could continue to gain more investor attention. The attention from “app-traders” to low priced stocks, both those that were giants and have been beaten down, and small and micro-cap stocks that could be on their way to becoming giants, will continue to create runaway opportunities that can no longer be ignored by mainstream investors.

Suggested Reading:

The Limits of Government Tinkering

Are Individual Investors the “Smart Money?”

Will There be an Explosion of New Acquisitions?

Enjoy Premium Channelchek Content at No Cost

Sources:

Fitch Solutions maintains copper price forecast as economies start to reopen

Copper Demand

Could Soar Thanks to Coronavirus

TRANSPORTATION CONSTRUCTION WHAT IMPACTS

WILL COVID-19 HAVE ON PROJECT FUNDING?

A Wharton analysis predicts Trump’s infrastructure plan could create 1 million new jobs