|

|

|

|

Will the Fed “Put” Become Worthless?

At some point during Alan Greenspan’s long reign as Federal Reserve chairman (1987-2006), the term “Greenspan Put” was coined. The term refers to the Fed, under Greenspan, and their maintenance of an easy monetary policy that was conducive to economic growth and offered protection against volatile price swings in the stock market.

In 2006 Ben Bernanke replaced Greenspan as Chairman of the Federal Reserve Bank. He continued many of the policies of his predecessor through the end of his second term (2014). This lead to lower and lower interest rates, while inflation was maintained within an acceptable range. The policy of managing the economy for growth to help limit the risk of the stock market then became the “Bernanke Put.”

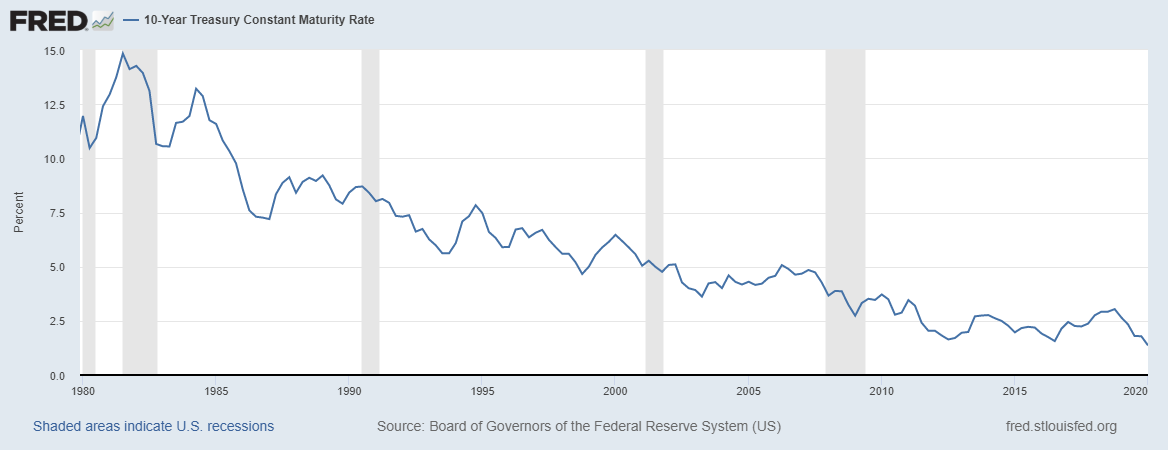

Interest rate quarterly on USTN 10 yr., since 1979. Source: St. Louis Fed Data

Economic growth was certainly a challenge during the periods the two chairmen had their hands on steering Fed policy. Greenspan dramatically intervened during the savings and loan crisis, the Asian crisis, the Gulf War, and the Long-Term Capital crisis. He also managed the “irrational exuberance” of the dot.com bubble and the risks surrounding Y2K. Bernanke, for his part, continued to ease policy through the final two years of President Bush’s time in office. This included the beginning of the 2008 financial crisis. During this time, the Fed’s easing quickly brought overnight rates to near 0%. This left them with no room to stimulate by lowering the key interest rate. This is when the Fed, under Bernanke, began a program they referred to as Quantitative easing (QE). QE increased the supply of money into the economy by $4 trillion.

Chairman Janet Yellen replaced Ben Bernanke and continued the “safety net” policies of impacting bond market prices to prevent the economy from softening. This period included the longest bull market in U.S. history.

Is There

a Powell Put?

Is Fed Chairman Jerome Powell continuing the safety net role the Fed implemented 40 years ago by the “The Great Maestro” Chairman Greenspan? Although not challenged like his predecessors had been until the global economic derailing earlier this year, Powell has moved quickly to drop rates to near-zero levels by targeting the overnight bank lending rate and purchasing Treasuries and mortgage securities. His actions have flattened the yield curve and provided massive amounts of “new money” into the system.

On Monday (5/11) the Fed announced it would take a step never before tried. It informed the markets it would begin purchasing corporate bonds via fixed-income ETFs. The purpose is to help companies borrow in the capital markets and at the same time, add cash into the system. At a press conference yesterday (5/13), Chairman Powell spoke of the need to use forceful policies to avert dire consequences from the historic downturn. He warned the United States is experiencing an economic hit “without precedent.” A situation so dire, it could permanently damage the economy if Congress and the White House did not provide sufficient financial support to prevent prolonged joblessness and bankruptcies.

As Chairman Powell expressed approval of the $2 trillion in relief Congress had already funded, he made clear the rebound would not be quick and could take months to materialize. Powell recommended more support to take the country past this hardship.

Take-Away

The stock market and others that benefit from a rebound in the economy can take some comfort that Federal Reserve Chairman Powell will also do everything in the Feds power to provide downside protection. It is unclear whether confidence in the “Powell Put” will continue to prop up stock prices. What has become clear, however, is that over the past 40 years, the resolve of the Fed has not weakened.

Suggested

Reading:

Feds Bond ETF Purchases Will Impact

Equity Investors

Why Index Funds Could Be a Mistake in

2020

Enjoy Premium

Channelchek Content at No Cost

Sources: