Although CPI is the Focus, Chairman Powell’s Discussion in Sweden Could Have a Long-Lasting Impact

As this full five-day trading week kicks off, stock’s YTD performance and the week-to-date performance are equal. This will change with the opening bell on Monday. It is a quiet week for highly scrutinized numbers or events. However, two scheduled events have the potential to change investor sentiment. The first comes on Tuesday when the US central bank chairman (Fed Chair Powell) speaks in Stockholm about central bank independence. This debate regarding politic’s role in central bank decisions is getting more intense. Channelchek recently published an article on the subject which can be found here.

The second is CPI which is the next look we get at inflation. If inflation is higher than expectations, the stock and bond markets could sell off; if lower, they may celebrate with a rally.

Otherwise, the week kicks off with the Investment Movement Index, which will get little attention, but is worth watching. The IMX is a behavior-based index assembled by TD Ameritrade designed to measure what investors are actually doing. More on the IMX below.

Monday 01/09

- 12:30 PM, The Investor Movement Index or IMX measures what investors are actually doing and how they are actually positioned in the markets. It accomplishes this by using data on the holdings/positions, trading activity, and other data from an anonymous sample of six million funded accounts. It reflects consumer retail portfolios. At its most basic level, the IMX can provide insight into whether investors are growing more bullish or bearish on equities.

- 12:30 PM, the President of the Atlanta Fed, Raphael Bostic, will be speaking. Any time a voting member of the FOMC is speaking publicly, there is the potential for insight into how that member may have adjusted their leaning on policy. Atlanta Fed events are often broadcast live on this YouTube channel.

Tuesday 01/10

- 6:00 AM, NFIB Small Business Optimism Index has been below the historical average of 98 for 11 months in a row. December’s consensus is 91.3 versus 91.9 and 91.3 in the past two reports. The index is a composite of 10 seasonally adjusted components based on the following questions: plans to increase employment, plans to make capital outlays, plans to increase inventories, expect the economy to improve, expect real sales higher, current inventory, current job openings, expected credit conditions, now a good time to expand, and earnings trend.

- 9:00 AM, Fed Chair Powell speaks at the Sveriges Riksbank International Symposium on Central Bank Independence in Stockholm, Sweden. It is not expected that micro discussions on current interest rate policy will surface in his conversation.

Wednesday 01/10

- 7:00 AM, Mortgage Bankers Association (MBA) will release numbers on mortgage applications. There has been a steady decline in applications over the past seven months.

Thursday 01/11

- 7:30 AM ET, Philadelphia Fed President Patrick Harker will be speaking. Any time a voting member of the FOMC is speaking publicly, there is the possibility of insight into how that member may have changed their leaning on policy.

- 8:30 AM, the CPI number will be such a distracting focus this week that trading may actually be subdued earlier in the week in anticipation of this inflation report. The consensus is for no monthly change in consumer prices. This would equate to a year-over-year rate of 6.6%.

Friday 01/12

- 10:00 AM, Consumer Sentiment is expected to inch up to 60.0 in the first reading for January versus 59.7 in December.

- 10:20 AM Philadelphia Fed President Patrick Harker will be speaking. Any time a voting member of the FOMC is speaking publicly, there is the possibility of insight into how that member may have changed their leaning on policy.

What Else

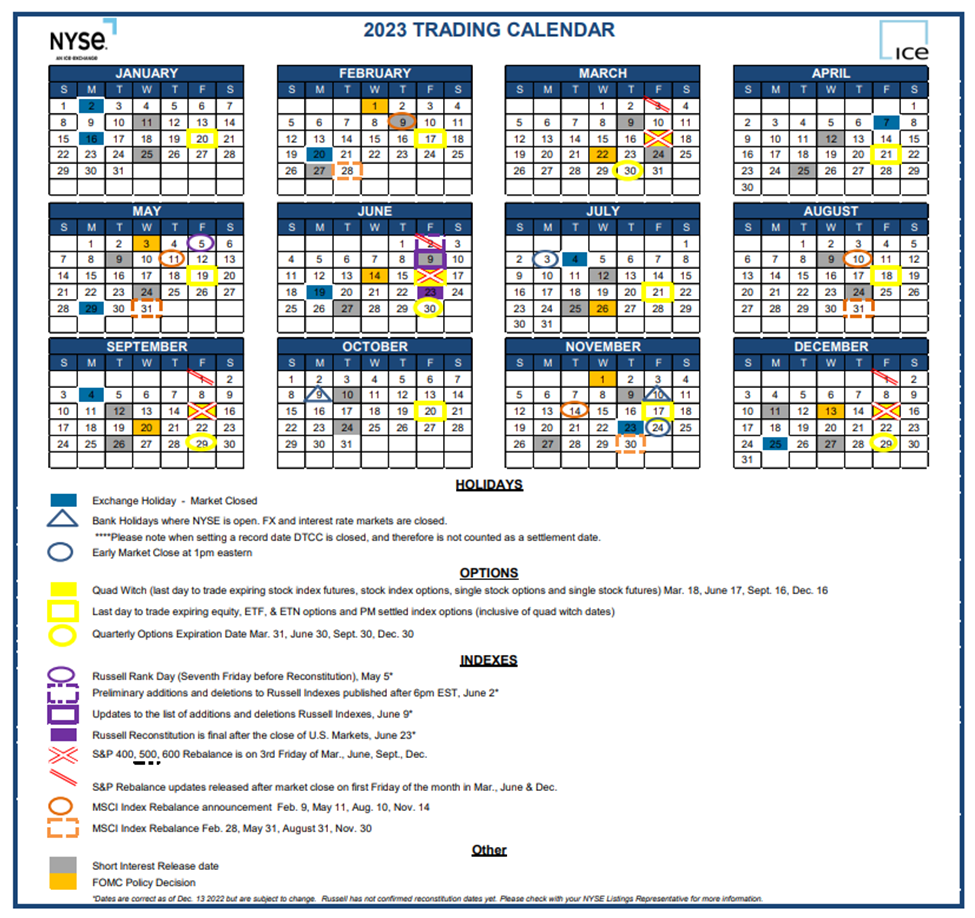

Guess what, the stock market is closed again on Monday the 16th. Below is a copy of the holidays along with Fed meetings and other important dates throughout the year. It was provided by the NYSE. Perhaps bookmark a link to this beginning of the year look forward so as to have on hand a snapshot of all of these market impactful dates.

Managing Editor, Channelchek

Sources