What Sectors Outperformed the Market after the PCE Inflation Shock?

When an investor inquires, “What stocks do well with high inflation?” they are often asking, “What sectors do well with rising interest rates?,” because inflation expectations often drive rate moves. The text book response usually given are: consumer staples, banks and financials, and commodities. The PCE indexes are considered the Fed’s preferred indicator of inflation trends. The PCE surprised markets on the high side when released on February 24th. What can investors now expect from higher-than-forecast inflation?

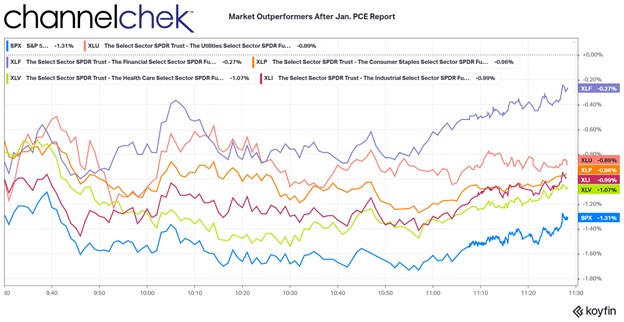

Rather than look at old information on what outperforms the overall market when inflation expectations rise, I thought it would be informative and more useful to see what is outperforming under current 2023 conditions and climate. The chart below and the remainder of this simple study is a snapshot three hours after the news settled in among investors (11:30am ET, February 24th).

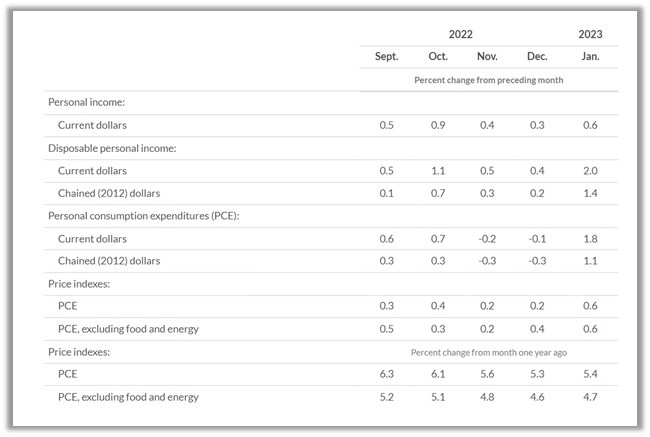

Personal Income and Outlays

Sectors Outperforming Overall Market

There were five S&P sectors that outperformed the S&P 500 a few hours after the inflation number showed an almost across-the-board acceleration in price increases. At this point, the S&P 500 had already fallen 1.31%.

Beating the S&P larger index, but the worst of the five outperformers was Health Care (XLV). The Health sector is considered to be a necessity that consumers find a means to pay for regardless of cost. Within the sector there are companies providing goods and services that are more embraced by investors than others. Within the XLV, many stocks were green after the report.

Outperforming the Health Care sector were stocks making up the Industrial Sector (XLI). This includes large industrial manufacturers like John Deere, General Electric, and Caterpillar. Many of these companies have contracts well out into the future that assures business. What is not ordinarily assured is the cost of manufacturing which can go up with inflation. A number of the top holdings in XLI barely budged on the morning – GE was up .08%, Honeywell was down .18%, and UPS was down just .20%.

Almost even with the Industrial Sector was Consumer Staples (XLP). As with Health Care and to a lesser degree Industrials this sector is where money moves to during inflationary periods. Consumers may be postpone a new car purchase, but they’ll keep their buying habits unchanged for products produced by Colgate, Coca-Cola, Proctor and Gamble, or cigarette manufacturers.

Performing second best after the inflation numbers was the Utility sector (XLU). Again this follows the mindset that consumers can only cutback on water, electricity, and natural gas so much. It is more likely that cutbacks would come in other areas like entertainment, or technology. Technology was the worst performing sector.

The top performer, although still modestly negative, was the Financial sector. This includes insurance, banks and credit card companies, as well as investment firms. Banks, particularly those with a higher percentage of traditional banking business, benefit from a steepening yield curve. Banks use cash as their product line. They borrow short from customers, and lend longer term. As the yield curve steepens, their net income can be expected to rise. This may explain why two of the top three holdings were positive after the report, JP Morgan (JPM), and Wells Fargo (WFC). Brokerage firms also may benefit as accounts uninvested balances can be a source of revenue as financial firms earn interest on them. Rising rates means every balance they can earn on creates additional income.

Larger Index Observations

As indicated earlier, technology was the worst-performing sector. This causes the tech heavy Nasdaq to far underperform the other major indexes. The best performing a few hour after the open was the Dow Industrials, which is comprised of just 30 industrial stocks, many paying consistent dividends. The second best performer, beating both the Dow and S&P 500 was the Russell 2000 Small-Cap index. Small-cap stocks tend to be less affected when borrowing costs change, and tend to have more of their end customers located domestically. The U.S.-based customers is an advantage to smaller stocks when rising rates cause rising dollar values. A rising dollar makes goods or services from the U.S. more expensive overseas.

Take Away

The textbook reply to questions related to rising rates, inflation, and sector rotation in stocks held up after the surprise PCE index increase. Banks, and necessities like heat and consumer goods outperformed. Also small-cap stocks did not disappoint, they also held up better than the overall large cap universe.

One difficulty small and even microcap investors face is that information is less available on many of these companies. And there are a lot of them, including in the sectors that outperform with inflation. One easy way to find which smaller companies are rising to the top is Channelchek’s Market Movers tab. This can be viewed throughout the trading day by clicking here for the link.

Managing Editor, Channelchek

Sources

https://www.bea.gov/news/2023/personal-income-and-outlays-january-2023