Are Real Estate Markets Addicted to Easy Money?

Without the Fed’s easy money, demand for housing would collapse, according to Ryan McMaken. McMaken, who authored the below article, is a former housing economist for the State of Colorado. He believes once the Fed pivots back to forcing down interest rates and again buying mortgage-backed securities (MBS), housing prices that have recently dipped, will again continue their march upward. He makes the case here that the housing market, without Fed support, faces difficult headwinds. – Paul Hoffman, Managing Editor, Channelchek

Last Friday, residential real estate brokerage firm Redfin released new data on home prices, showing that prices fell 0.6 percent in February, year over year. According to Redfin’s numbers, this was the first time that home prices actually fell since 2012. The year-over-year drop was pulled down by especially large declines in five markets: Austin (-11%), San Jose, California (-10.9%), Oakland (-10.4%), Sacramento (-7.7%), and Phoenix (-7.3%). According to Redfin, the typical monthly mortgage payment is now at a record high of $2,520.

The Redfin numbers come a few days before new numbers from the Case-Shiller home price index showing further slowing in home prices growth since late last year. The market’s expectation for December’s 20-city index had been -0.5 percent, month over month, and 5.8 percent, year over year. But the numbers came in worse (from the seller’s perspective) than was hoped. For December—the most recent monthly data available—the index ended up showing a month-over-month drop of -1.5 percent (seasonally adjusted), and a year-over-year gain of 4.6 percent (not seasonally adjusted).

By most accounts, the rapidly-slowing market faces headwinds thanks to rising interest rates, including the standard 30-year fixed mortgage, which is now back up over 6 percent. This puts homeownership out of reach for many first-time buyers and is also a big disincentive for current owners to “move-up” into higher-priced houses since any new home would come with a much higher mortgage rate than was available a year ago.

Not surprisingly, demand for new mortgages has plummeted. CNBC reported last week:

“Mortgage applications to purchase a home dropped 6% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Volume was 44% lower than the same week one year ago and is now sitting at a 28-year low.”

So, sales have fallen and, at least according to Redfin, prices are falling too. This is what we should expect to see in any environment where the real estate market is not being incessantly fueled by easy money from the central bank. After all, easy money for real estate markets had been the main story since 2009. In recent months, however, the Fed has allowed interest rates to rise while pausing efforts to add more mortgage-backed securities (MBS) to the Fed’s portfolio. Without those key supports from policymakers, the real estate market simply lacks the market demand that is necessary to sustain rapid growth. Contrary to what countless mortgage brokers and real estate agents tell themselves and each other, there is precious little capitalism in real estate markets. It is a market that is thoroughly addicted to, and dependent on, continued stimulus and subsidization from the central bank.

Without the central bank propping up MBS demand in the secondary market, primary-market mortgage lenders have fewer dollars to throw around. That means higher interest rates and fewer eligible buyers. Similarly, by setting a higher target rate for the federal funds rate that banks must pay to manage liquidity, markets face less monetary growth in general. That comes with a lessening overall demand that—in the short term, at least—drives up incomes for both current and potential homebuyers.

Even worse, continued nominal income growth that does exist is not keeping up with price inflation. The result has been 22 months in a row of negative real wage growth, and that will translate to falling demand.

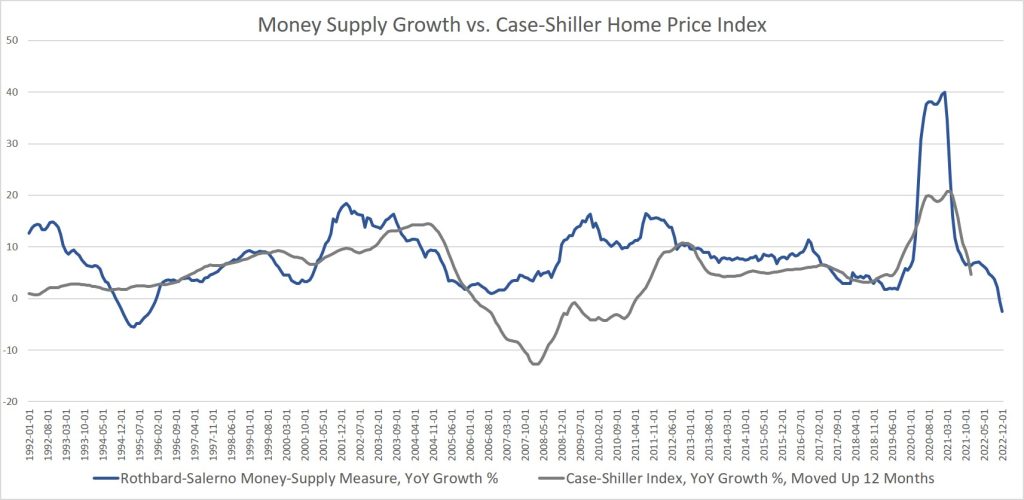

This close connection between easy money and demand for homes can be seen when we compare growth in the Case-Shiller index to growth in the money supply. This has been especially the case since 2009. As the graph shows, once money-supply growth begins to slow, a similar change occurs in home prices one year later.

As money-supply growth rapidly slowed after January 2021, we then saw a similar trend in home prices 12 months later, with a rapid deceleration in the Case-Shiller index. Remarkably, in November of last year, money-supply growth turned negative for the first time since 1994. That points toward continued drops in home prices throughout this year. If Redfin’s February numbers are any indicator, we should expect price growth to turn negative in the Case-Shiller numbers this spring.

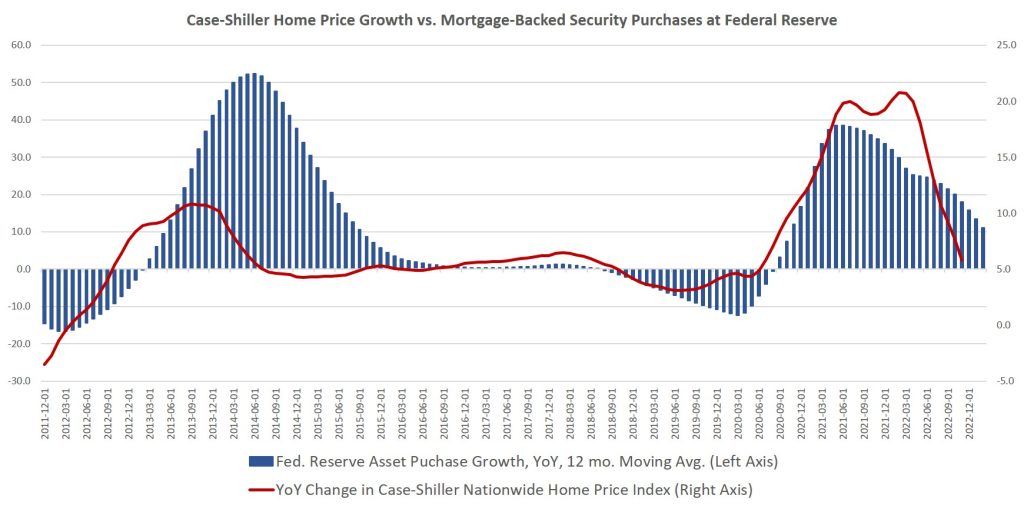

Now just imagine how much more lackluster real estate markets would be without the Fed buying up all those trillions in MBS over the past decade. It’s now been more than a decade since we had any idea what real estate prices actually would be without enormous amounts of stimulus from the Fed. The money-printing-for-mortgages scheme entered its first phase throughout 2009 and 2010, and then was almost non-stop from 2013 to 2022, topping out around $1.7 trillion in 2018. The Fed had begun to pull back on its MBS assets in 2018 and 2019, but of course reversed course in 2020 and engaged in a frenzy of new MBS buying. In that period the Fed purchased an additional $1.4 trillion in MBS. That finally ended (for now) in the fall of 2022. The Fed still holds over $2.6 trillion in MBS assets.

If we look at year-over-year changes in these MBS purchases along side Case-Shiller home prices, we again see a clear correlation:

It’s clear that once markets think the Fed may again increase its MBS purchases, home prices again surge. This close relationship should not surprise us since the volume of MBS purchases is a sizable portion of the overall market. Since 2020, the Fed’s MBS stockpile has equaled at least 20 percent of all the household mortgage debt in the United States. In early 2022, Fed-held MBS assets peaked at 24 percent of all US mortgage debt, but they still made up over 20 percent of the market as of late 2022.

Lest we think that real estate markets seem to be weathering the storm fairly well, let’s keep in mind this is all happening during a period when the unemployment rate is very low. Yes, the federal government has greatly exaggerated the amount of job growth that has occurred in the economy over the past 18 months. However, it’s also fairly clear that real estate markets are not yet seeing large numbers of unemployed workers who can’t pay their mortgages. When that does occur, we can expect an acceleration in falling home prices. For now, most mortgages are being paid, and even as real wages fall, most homeowners are cutting in places other than their mortgage payments. Once job losses do set in, all bets are off, and a wave of foreclosures will be likely. Many jobless workers won’t be able to sell quickly to avoid foreclosure either. With so few borrowers who can afford rising mortgage rates, there will be relatively few buyers. That’s when prices will really start to come down—when there is a mixture of motivated sellers and rising interest rates.

For now, though, the investor class remains relatively optimistic. Marcus Millichap CEO Hessam Nadji was on Fox Business last week flogging the now well-worn narrative that we should expect a “small recession,” but Nadji did not even entertain the idea that there might be sizable layoffs. Instead, he suggested that there is now a mere temporary softening of demand, and that will reverse itself once the Fed reverses course and embraces easy money again. In other words, the Fed will time everything perfectly, and it will be a “soft landing.”

This well captures the attitude of the “capitalists” heading the real estate industry right now. It’s all about the Fed. Without the Fed’s easy money, demand is down. Once the Fed pivots back to forcing down interest rates and buying up more MBS, well then happy times are here again. Gone is any discussion of worker productivity, savings, or other fundamentals that would drive demand in a areal capitalist market. All that matters now is a return to easy money. The real estate industry will get increasingly desperate for it. In 2023, it’s become the very foundation of their “market.”

About the Author

Ryan McMaken has a bachelors degree in economics and a master’s degree in public policy and international relations from the University of Colorado. He is the author of Breaking Away: The Case of Secession, Radical Decentralization, and Smaller Polities and Commie Cowboys: The Bourgeoisie and the Nation-State in the Western Genre. He was a housing economist for the State of Colorado. Ryan is a cohost of the Radio Rothbard podcast, has appeared on Fox News and Fox Business, and has been featured in a number of national print publications including Politico, The Hill, Bloomberg, and The Washington Post.