Image Credit: Steve Jurvetson (flickr)

Tesla’s Market Cap Versus Tesla’s Market Share and Risk to Investors

Elon Musk was surprised at the price increase of Tesla stock as his personal worth rose by $36 billion yesterday (October 25). Shares of Tesla (TSLA) jumped by 12.7% to $1,024.86. This equated to a market capitalization of $1.01 trillion. The trillion number has been thrown around loosely in recent months, but it remains an unfathomable amount.

Risk to Index Investors

Tesla now has a price-earnings (P/E) ratio of 332. The automotive industry P/E ratios generally fall between 10 to 30 depending on expected results. In the broader market, there are very few trillion-dollar companies. They are the top five companies by market cap in the S&P 500, Apple, Microsoft, Google parent Alphabet, Amazon, and Tesla. In the aggregate, they are worth $9.3 trillion. That’s almost 23% of the benchmark S&P 500 US stock index’s total value. Add in Facebook, which is a bit short of a trillion and these six stocks have a 25% influence over the S&P 500 movement. The result is risk is not as diversified as some investors might prefer in an index of 500 stocks.

Automotive Company Valuations

In just one day Tesla’s share price move increased its market value by $115 billion. The main driver was news that it might sell $4.2 billion of rental cars to Hertz through 2022. The potential sale of 100,000 vehicles by Tesla, pales in comparison to the 2-3 million average rental car sales by other automakers most years.

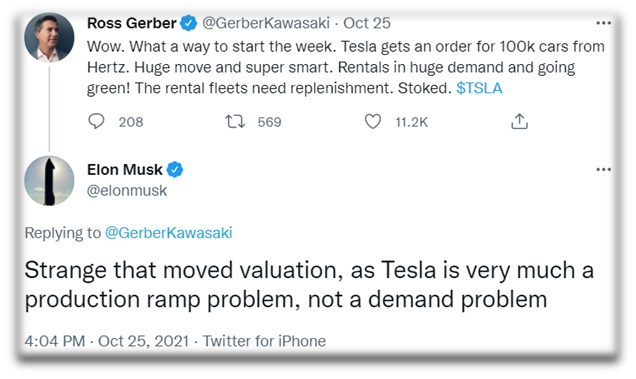

Mathematically, the $115 billion notch up in value added the equivalent of Daimler+Nissan+ Renault to Tesla’s value. Does this make sense? Elon Musk thinks it’s “strange.” He tweeted yesterday suggesting that the company doesn’t have a demand shortage, instead production is what limits higher sales.

Source: Ross Gerber/Elon Musk

Tweets October 26, 2021

Automotive Market Share

Worldwide, Tesla’s sales have soared over the years from zero to well-below average for an automaker. So far in 2021, Tesla has delivered 627,000 cars globally for the year. Total deliveries are expected to be at most 900,000. From all other car companies, total worldwide deliveries of light passenger vehicles are estimated to be 75 million. If these numbers play out, this would put Tesla’s market share at 1.2%.

The 1.2% market share contrasts sharply with its excess valuation.

Take-Away

Increasingly, the market value of a handful of corporations have had significant influence over market index weights and the perceived direction of value of many other companies also in the index. With recent bullish times, these companies have helped drive stock market gains. The overall value of these few stocks could have an outsized impact if any one of them disappoints the market.

Tesla’s P/E ratio of 332 is extremely high. It’s based on potential and expectations. Demand for the vehicles the car manufacturer produces is currently high and largely unfulfilled. Ramping up production to be tens of times more than it is currently would bring expectations and reality more aligned. This is the bet investors that are holding Tesla directly and even those invested in indexes like the S&P 500 and Nasdaq 100 are placing.

Managing Editor, Channelchek

Suggested Reading:

How Much is a Trillion?

|

Will U.S. Car Companies be Handed Different EV Advantages?

|

Michael Burry’s Earlier Bet Against Tesla Has Been Closed Out

|

Deflation Not Inflation is Risk Says Cathie Wood

|

Sources:

https://www.actionnewsnow.com/content/national/575610322.html

https://twitter.com/elonmusk/status/1452727731452588041?s=20

https://www.flickr.com/photos/44124348109@N01/36083811822

Stay up to date. Follow us:

|