Economic Disparity Issues May Lead to a “K” Shaped Recovery

The economic retreat associated with the COVID pandemic was sharp. The U.S. GDP declined by 32% in the second quarter. Indications are that the economy is beginning to improve, although the pace of improvement is uncertain. This uncertainty opens the questions:

Will it bounce back quickly, creating a V-shaped recovery?

Will the economy slowly accelerate upward in a U-shaped recovery?

Could we experience a slight rebound and then fall back before rising again in a W-shaped recovery?

What if the economy stagnates at current low levels, this would create an L-shaped growth trend?

A fifth option is a “K” shaped recovery. The concept of a K-shaped recovery has become a rallying point for the Joe Biden presidential campaign. Biden referred to the concept in a speech on September 4th describing how high earners are fairing better than low-wage workers during the recession. Symone Sanders, a senior campaign adviser to Biden, reiterated the claim on Fox News Sunday. Tim Murtaugh, the communications director for the Trump campaign, fought back, claiming that working-class and middle-class Americans are both benefiting from the rebounding economy, even if not equally. The extent of the division between the haves and the have nots has implications that affect more than just the upcoming presidential election. If true, it can help identify the industries and companies that will do well as the economy rebounds and those that will do poorly.

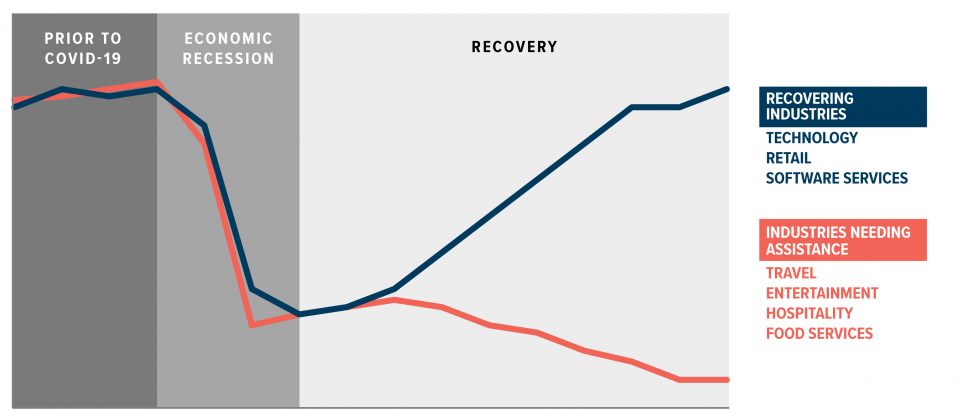

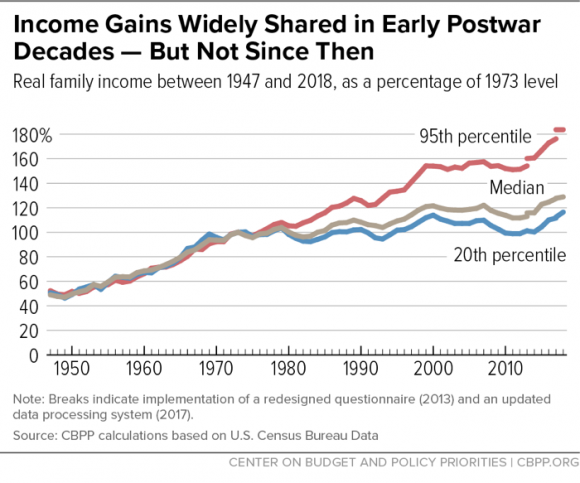

Source: U.S. Chamber of Commerce

recently, a new letter is being used to describe the economic recovery: a K-shaped recovery. In a K-shaped recovery, some industries do very well, such as office and tech companies. Other industries do poorly, such as entertainment and food services companies. The recovery would affect workers differently. White-collar workers with adequate technology can adjust their jobs to work from home. Blue-collar workers, who work at manufacturing plants and restaurants, can not. Single paycheck families are less affected by homeschooling and reduced daycare options. Dual income families are not as flexible. Households fortunate enough to own stocks and homes are thriving while those straddled with debt are not. Such a recovery would increase the wealth disparity that has been growing in recent decades.

Evidence of a K-shaped recovery

There is an indication in the unemployment numbers. The financial services sector has already recovered 94% of its pre-pandemic employment, while the leisure and entertainment sector has only brought back 74%. Neiman Marcus, JC Penney, Pier 1, and J. Crew have all filed for bankruptcy this year. The U.S. Bureau of Labor Statistics report for July shows that teenagers were the largest group to return to work while unemployment measured among African Americans remained flat. These employment reports seem to bear out the trend that white-collar workers are doing better than blue-collar workers during this summer’s recovery.

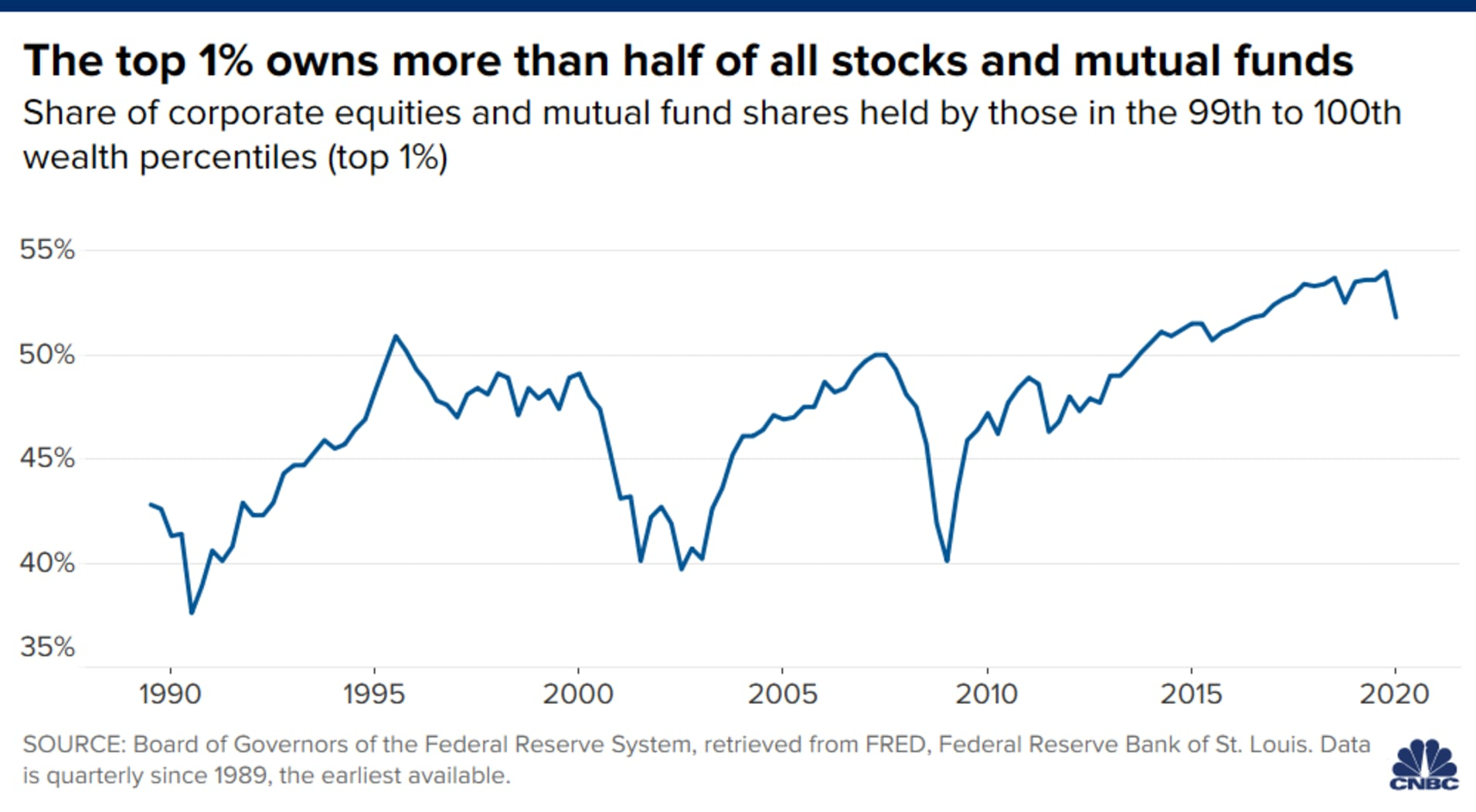

Stock market strength generally favors the rich. There’s a joke that the best way to become a millionaire is to start with a million dollars. Similarly, the best way to increase wealth is to be wealthy. The stock market has been strong this summer, shrugging off weak economic news. The strength has benefited the wealthy disproportionately at a rate that has never before experienced. The wealthiest 1% of the population now owns 52% of the stock market, up from a level of 40% just twelve years ago. The chart below shows that the percent owned by the top 1% has grown steadily in recent years.

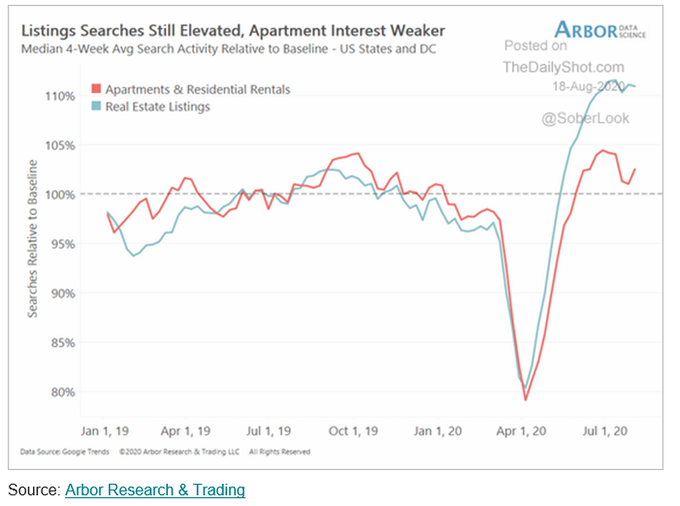

A similar story can be told when looking at housing. Housing Starts surged 22.6% in July while interest in renting stalled. The chart below shows that both housing listings and rental listings have risen during the economic recovery. However, it also shows that house listings are far outpacing rental listings. If homeownership is a reflection of wealth, the growth in housing relative to rental activity may be a sign of an increased disparity between the economic classes.

Counter Argument to the K-shaped Recovery

The start of a recovery may not affect all industries at

the same time but should eventually. It is easy to understand why white-collar jobs are better positioned to benefit from a new “stay at home” economy. However, these advantages may prove temporary if the pandemic eases and people return to restaurants and other entertainment venues. It certainly could be the case that there is pent up demand that may be unleashed if a vaccine is implemented.

Let the free market be. The success or failure of individual industries is largely a function of supply and demand. If blue-collar jobs are not coming back, it may be a sign that there is less demand for those jobs. Such a transition may require workers to retrain to new jobs. A restaurant cook becomes a package delivery person, for example. Such a transition is natural, and interfering with the transition only creates problems further down the road.

Suggested Reading:

Actively Managed Funds are No Guarantee for Beating the Market

Esports Betting is on a 4,000% Winning Streak

The Limits of Government Economic Tinkering

Enjoy Premium Channelchek Content at No Cost

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

https://www.cnbc.com/2020/09/04/worries-grow-over-a-k-shaped-economic-recovery-that-favors-the-wealthy.html, Jeff Cox, CNBC, September 4, 2020

https://thehill.com/homenews/sunday-talk-shows/515303-symone-sanders-warns-of-k-shaped-economic-recovery, Zack Budryk, The Hill, September 6, 2020

https://www.foxnews.com/politics/trump-campaign-biden-k-shaped-economic-recovery, Andrew O’Reilly, Fox News, September 7, 2020

https://www.washingtonpost.com/politics/2020/08/19/finance-202-economists-talking-up-k-shaped-recovery-stocks-surge-inequality-widens/, Brent D. Griffiths, The Washington Post, August 19, 2020

https://www.uschamber.com/series/above-the-fold/the-k-shaped-recovery-and-the-cost-of-inaction, Suzanne Clark, U.S. Chamber of Commerce, September 3, 2020

https://www.forbes.com/sites/lisettevoytko/2020/08/07/18-million-jobs-added-in-july-as-us-economys-pandemic-recovery-falters/#39a7c53b13db, Lisette Voytko, Forbes, August 7, 2020