Research News and Market Data on VRA

Jun 7, 2023

Consolidated net revenues totaled $94.4 million

Net loss totaled ($4.7) million, or ($0.15) per diluted share; non-GAAP net loss totaled ($2.6) million, or ($0.09) per diluted share

Balance sheet remains strong, with cash and cash equivalents of $25.3 million, no debt, and year-over-year inventories down 11.8%

Management increases guidance for fiscal year

FORT WAYNE, Ind., June 07, 2023 (GLOBE NEWSWIRE) — Vera Bradley, Inc. (Nasdaq: VRA) today announced its financial results for the first quarter ended April 29, 2023.

In this release, Vera Bradley, Inc. or “the Company” refers to the entire enterprise and includes both the Vera Bradley and Pura Vida brands. Vera Bradley on a stand-alone basis refers to the Vera Bradley brand.

First Quarter Comments

Jackie Ardrey, Chief Executive Officer of the Company, noted, “We are pleased that meaningful gross margin expansion and diligent expense control led to significant year-over-year improvement in bottom-line performance for the quarter.

“On the revenue side, Vera Bradley factory stores experienced challenging traffic trends in March and April that led to weaker-than-expected performance for the quarter. This was partially offset, however, by several positive highlights in other areas of our business.

“First, we experienced our first positive quarterly revenue performance in five quarters at Pura Vida, primarily driven by non-comparable retail store sales. We also saw improved year-over-year sales trends in both our Pura Vida wholesale and e-commerce channels. Second, we delivered strong Vera Bradley e-commerce performance and solid Vera Bradley full-line store revenues. Vera Bradley Indirect revenues declined, as expected, due to a non-recurring key account order that took place in last year’s first quarter, but the underlying business remains healthy.”

“We are building a collaborative team with the mindset of generating long-term revenue increases, expanding gross margin, and ensuring strong financial discipline and cost control, which we expect will drive long-term profitable growth,” Ardrey continued. “The team is working hard and taking strategic, proactive steps to steadily grow Pura Vida’s revenues and to reverse the trends in Vera Bradley’s factory channel through the expansion of successfully tested targeted marketing programs designed to drive traffic and average order size.”

Ardrey added, “The hard work on Project Restoration began in the first quarter, which is focused on four key pillars of the business for each brand – Consumer, Brand, Product, and Channel – to drive this long-term profitable growth. To support Project Restoration and lay the foundation for our success, we made additional corporate changes and announced $12 million in incremental annualized cost reductions, including the elimination of approximately 25 corporate positions as part of an overall plan to further right-size the expense structure of the Company.”

Michael Schwindle joined the Company as Chief Financial Officer on May 8, 2023. “His track record of driving profitable growth, along with his passion for retail and operational excellence, will be instrumental as the Company executes Project Restoration and in the years beyond,” Ardrey noted. The Company also made several organizational changes in the Marketing, E-commerce, Product Design, and Product Development areas that flattened and streamlined the organizational structure to improve execution; make faster decisions; and provide support for the four pillars of Project Restoration. These most recent organizational changes and non-payroll expense reductions are expected to produce annualized savings of approximately $12 million, on top of the Company’s Fiscal 2023 cost reductions.

“We are committed to delivering improved value to our shareholders,” Ardrey continued. “These efforts will allow us to simplify our structure, be a more agile organization, and reset our expense base, so we can focus fully on Project Restoration and on delivering both healthy top- and bottom-line growth in the future.”

Summary of Financial Performance for the First Quarter

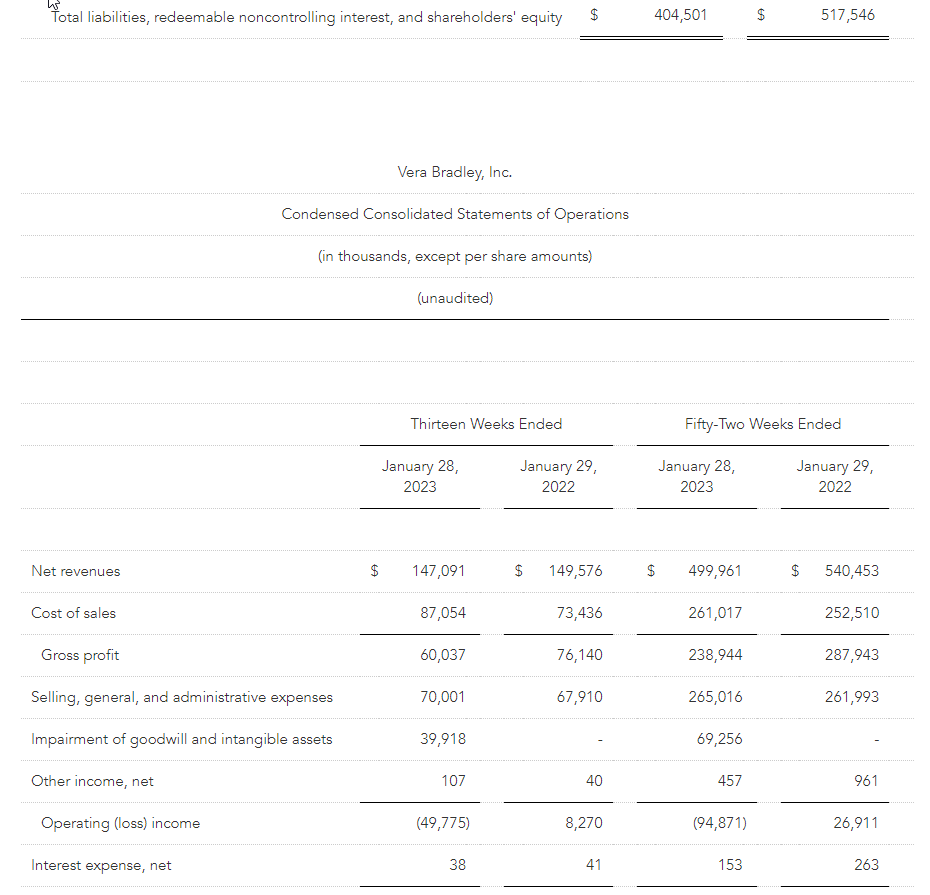

Consolidated net revenues totaled $94.4 million compared to $98.5 million in the prior year first quarter ended April 30, 2022.

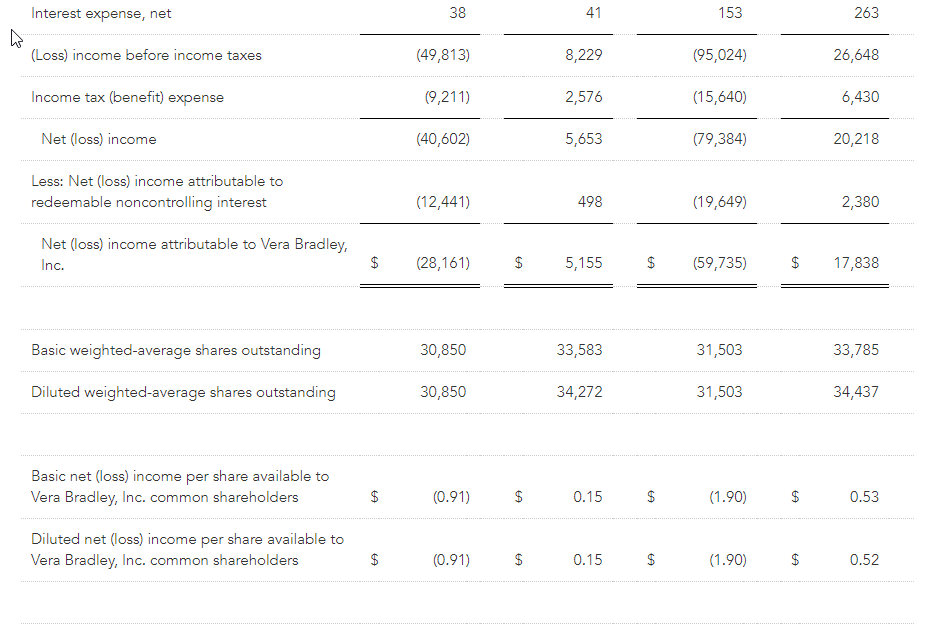

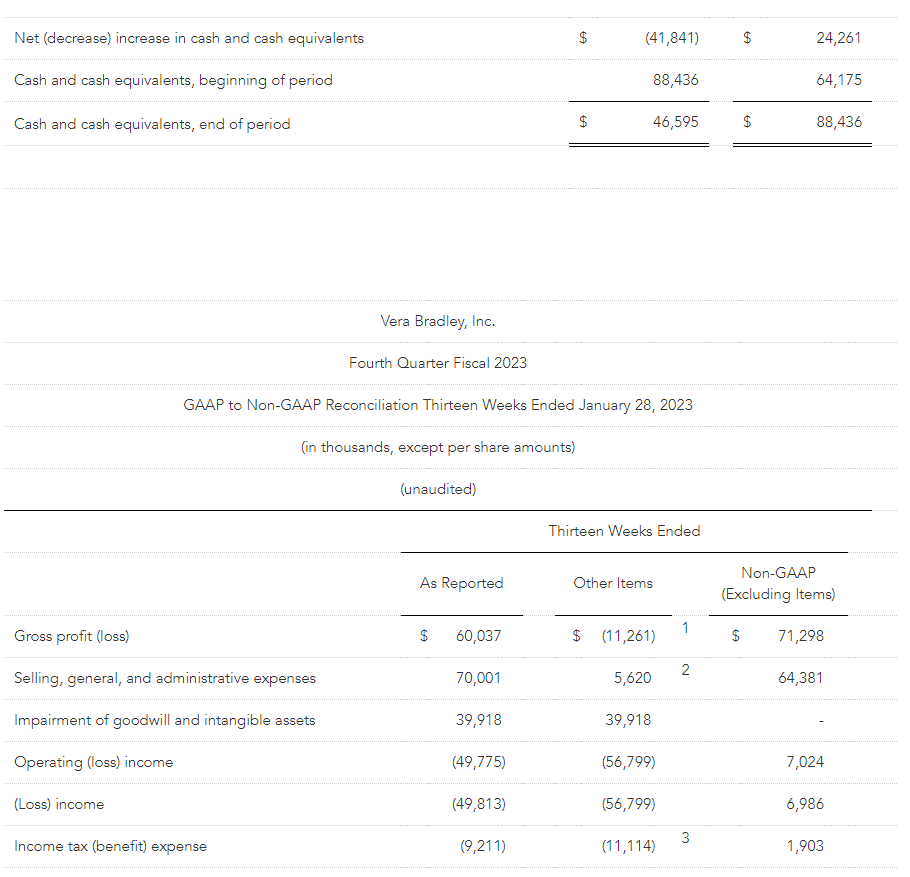

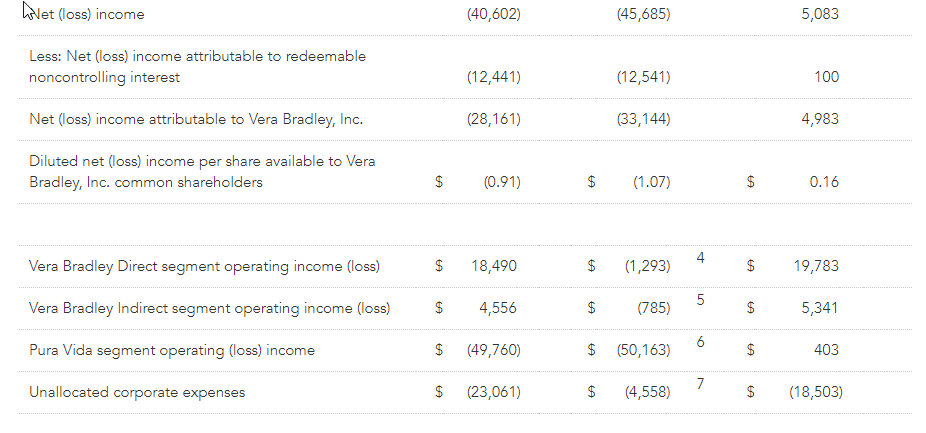

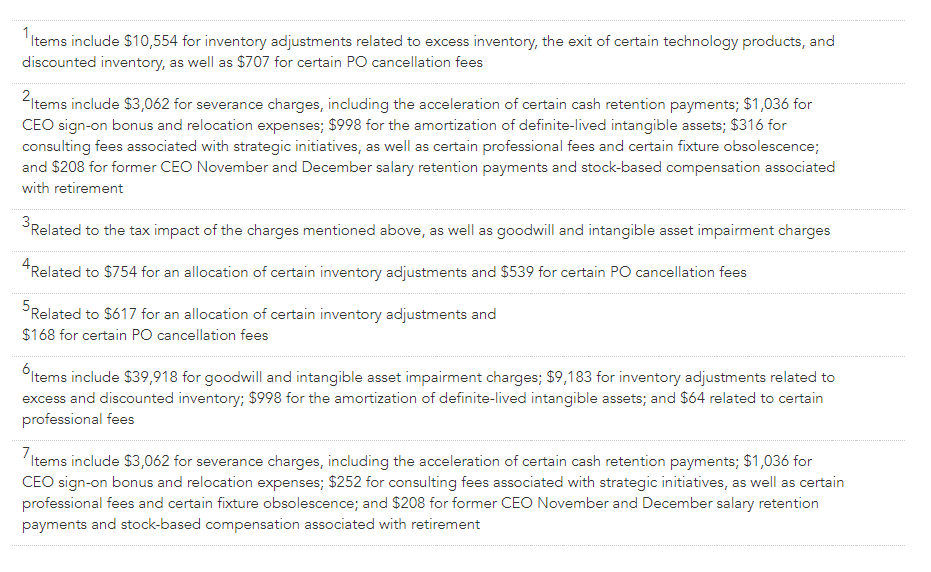

For the current year first quarter, Vera Bradley, Inc.’s consolidated net loss totaled ($4.7) million, or ($0.15) per diluted share. These results included $2.0 million of net after tax charges, comprised of $1.4 million of severance charges, $0.5 million for the amortization of definite-lived intangible assets, and $0.1 million of consulting and professional fees primarily associated with cost saving and strategic initiatives. On a non-GAAP basis, Vera Bradley, Inc.’s consolidated first quarter net loss totaled ($2.6) million, or ($0.09) per diluted share.

For the prior year first quarter, Vera Bradley, Inc.’s consolidated net loss totaled ($7.0) million, or ($0.21) per diluted share. These results included $0.9 million of net after tax charges, comprised of $0.4 million of intangible asset amortization and $0.4 million of impairment charges, and $0.1 million of consulting fees associated with cost savings initiatives. On a non-GAAP basis, Vera Bradley, Inc.’s consolidated first quarter net loss totaled ($6.0) million, or ($0.18) per diluted share.

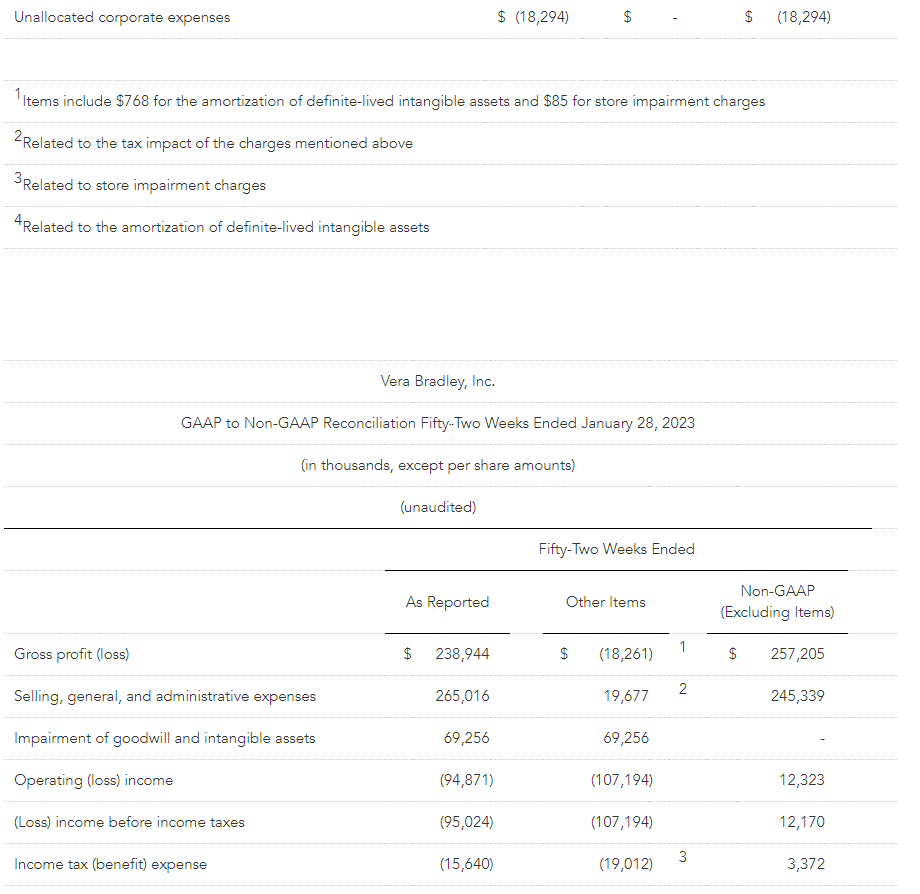

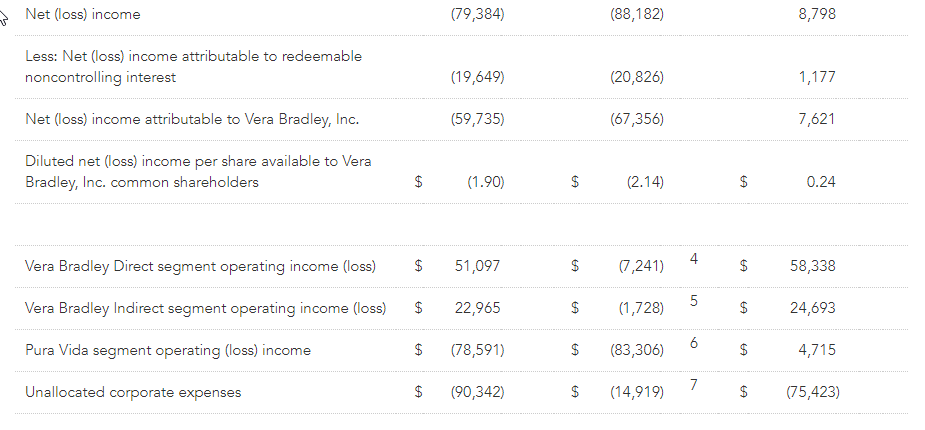

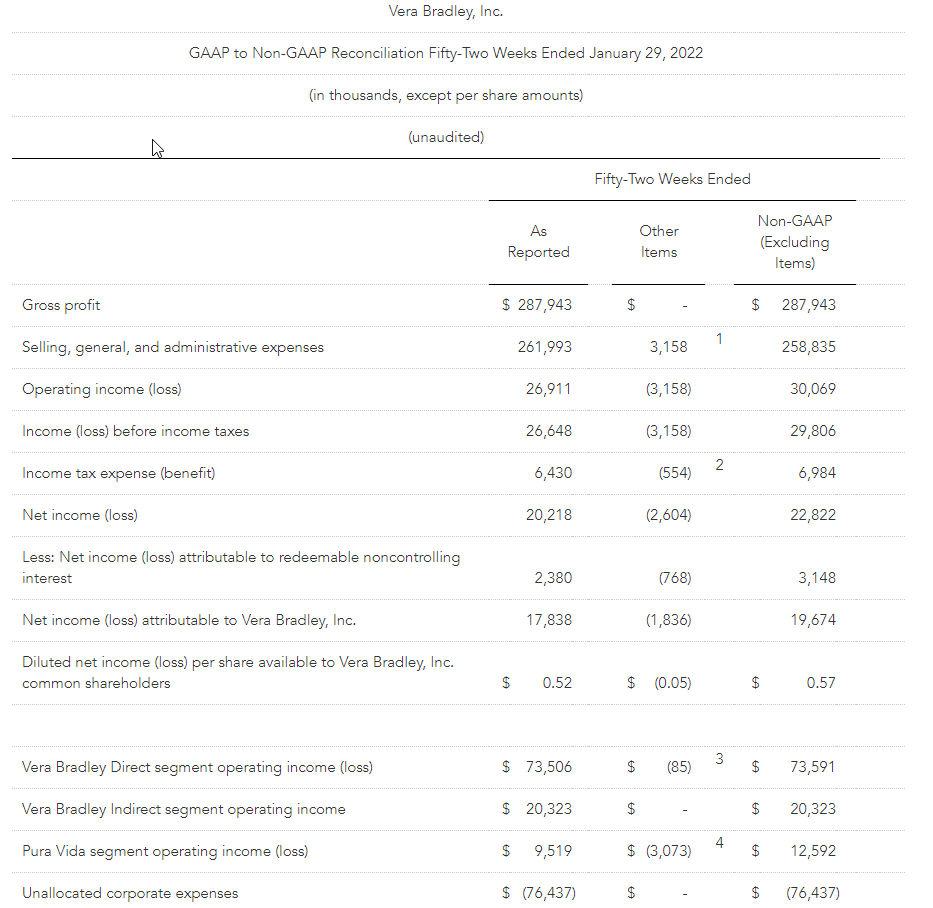

Non-GAAP Numbers

The current year non-GAAP first quarter income statement numbers referenced below exclude the previously outlined severance charges, intangible asset amortization, and consulting and professional fees. The prior year non-GAAP first quarter income statement numbers referenced below exclude the previously outlined intangible asset amortization, impairment charges, and consulting fees.

First Quarter Details

Current year first quarter Vera Bradley Direct segment revenues totaled $58.9 million, a 4.4% decrease from $61.6 million in the prior year first quarter. Comparable sales declined 3.3% in the first quarter, primarily due to weakness in the factory channel. The Company permanently closed 19 full-line and two factory outlet stores and opened five factory outlet stores over the last twelve months.

Vera Bradley Indirect segment revenues totaled $15.4 million, a 9.4% decrease from $17.0 million in the prior year first quarter. Prior year revenues reflected a large one-time key account order that was not repeated in the current year.

Pura Vida segment revenues totaled $20.1 million, a 1.2% increase over $19.8 million in the prior year first quarter, primarily driven by new store growth resulting in non-comparable retail store sales.

First quarter consolidated gross profit totaled $51.7 million, or 54.8% of net revenues, compared to $52.5 million, or 53.3% of net revenues, in the prior year first quarter. The current year gross profit rate was favorably impacted by lower year-over-year inbound and outbound freight expense and the sell-through of previously-reserved inventory, partially offset by an increase in promotional activity.

Consolidated SG&A expense totaled $58.5 million, or 62.0% of net revenues, for the quarter, compared to $60.9 million, or 61.9% of net revenues, for the prior year first quarter. On a non-GAAP basis, consolidated SG&A expense totaled $55.6 million, or 58.9% of net revenues, for the current quarter, compared to $59.4 million, or 60.3% of net revenues, for the prior year first quarter. Vera Bradley’s current year non-GAAP SG&A expenses were lower than the prior year primarily due to cost reduction initiatives and a reduction in variable-related expenses related to lower sales volume.

The Company’s first quarter consolidated operating loss totaled ($6.4) million, or (6.8%) of net revenues, compared to an operating loss of ($8.2) million, or (8.4%) of net revenues, in the prior year first quarter. On a non-GAAP basis, the consolidated operating loss totaled ($3.5) million, or (3.7%) of net revenues, compared to ($6.7) million, or (6.8%) of net revenues, in the prior year.

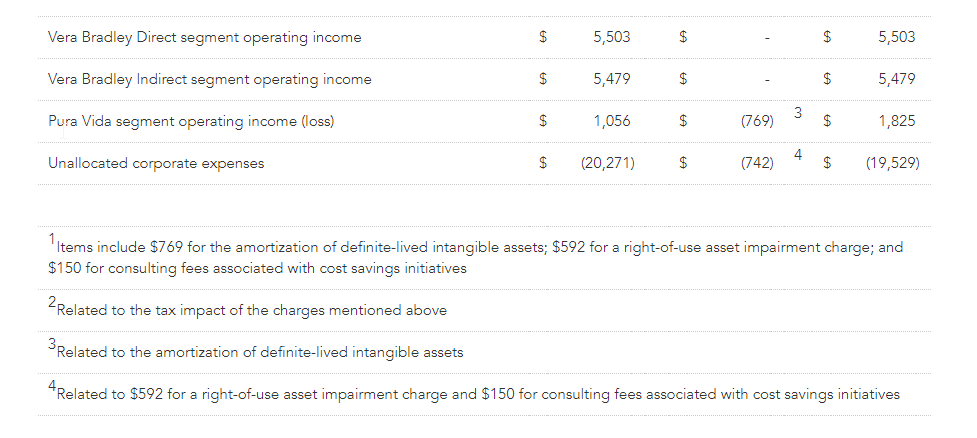

By segment:

- Vera Bradley Direct’s first quarter operating income was $7.3 million, or 12.5% of Direct net revenues, compared to operating income of $5.5 million, or 8.9% of Direct net revenues, in the prior year. On a non-GAAP basis, Vera Bradley Direct’s current year first quarter operating income was $7.7 million, or 13.0% of Direct net revenues, compared to $5.5 million, or 8.9% of Direct net revenues, in the prior year.

- Vera Bradley Indirect’s first quarter operating income was $4.7 million, or 30.6% of Indirect net revenues, compared to $5.5 million, or 32.3% of Indirect net revenues, in the prior year.

- Pura Vida’s first quarter operating income was $1.6 million, or 7.8% of Pura Vida net revenues, compared to $1.1 million, or 5.3% of Pura Vida net revenues, in the prior year. On a non-GAAP basis, Pura Vida’s current year first quarter operating income was $2.3 million, or 11.4% of Pura Vida net revenues, compared to $1.8 million, or 9.2% of Pura Vida net revenues, in the prior year.

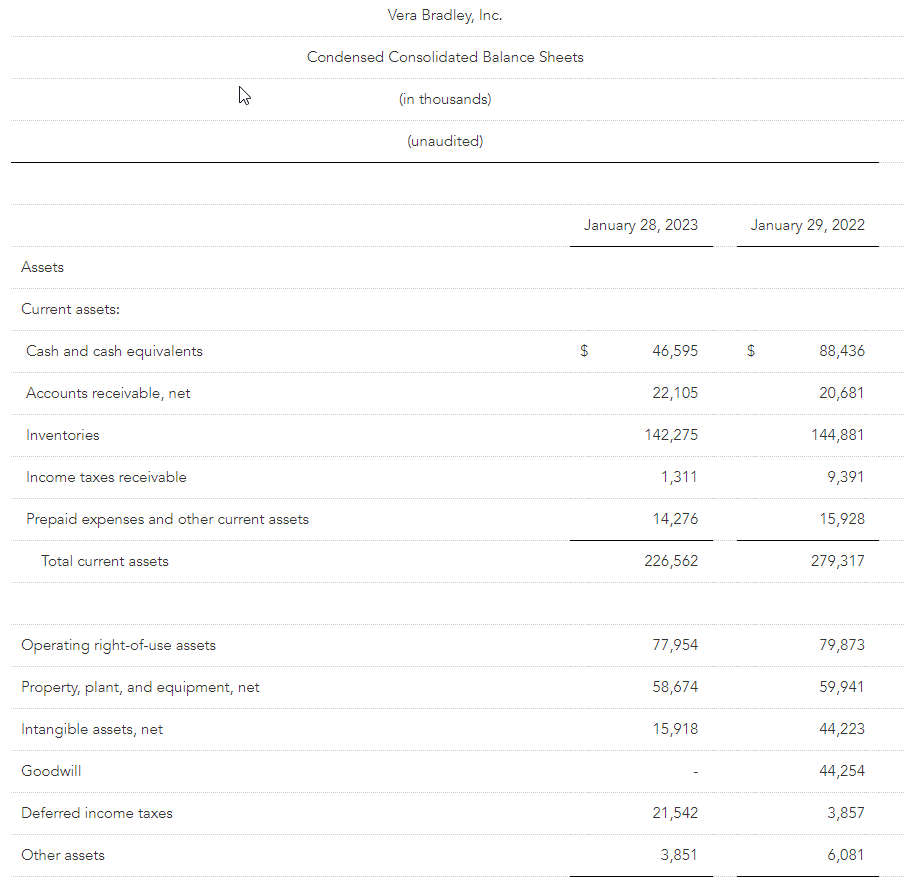

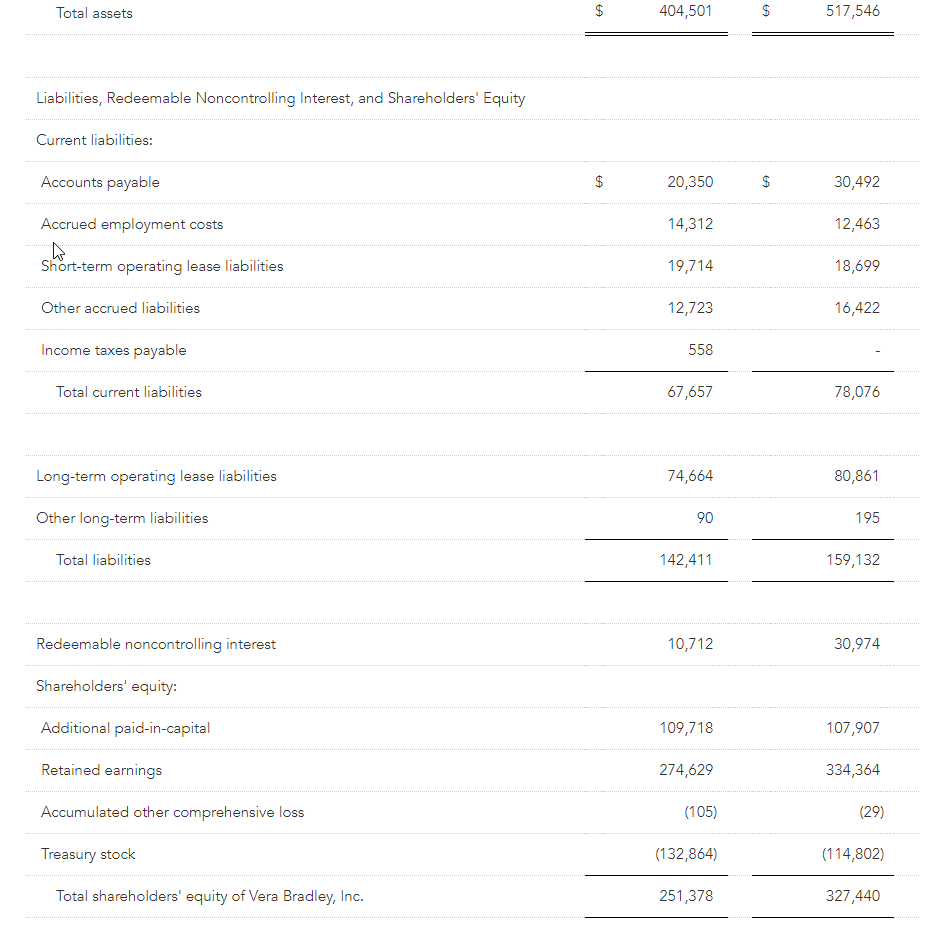

Balance Sheet

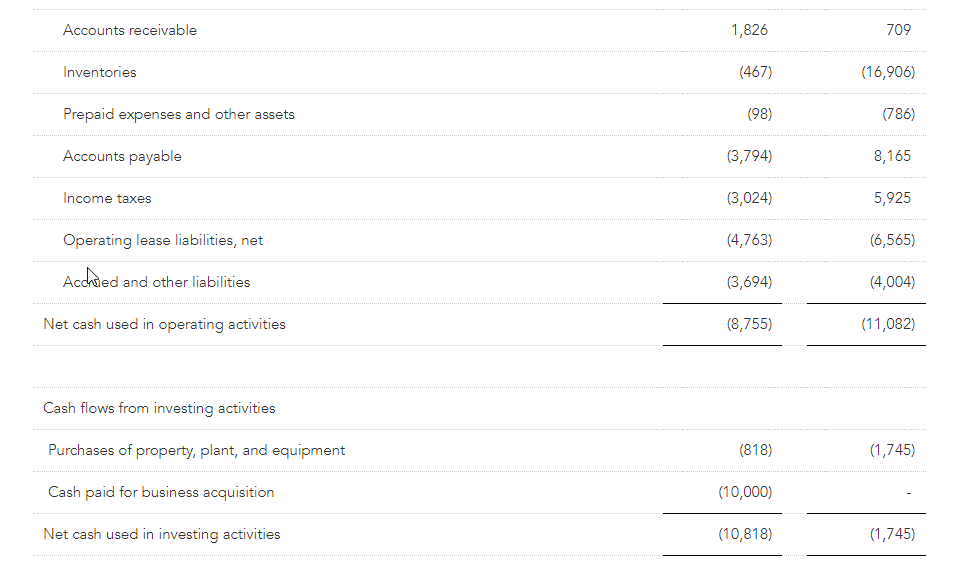

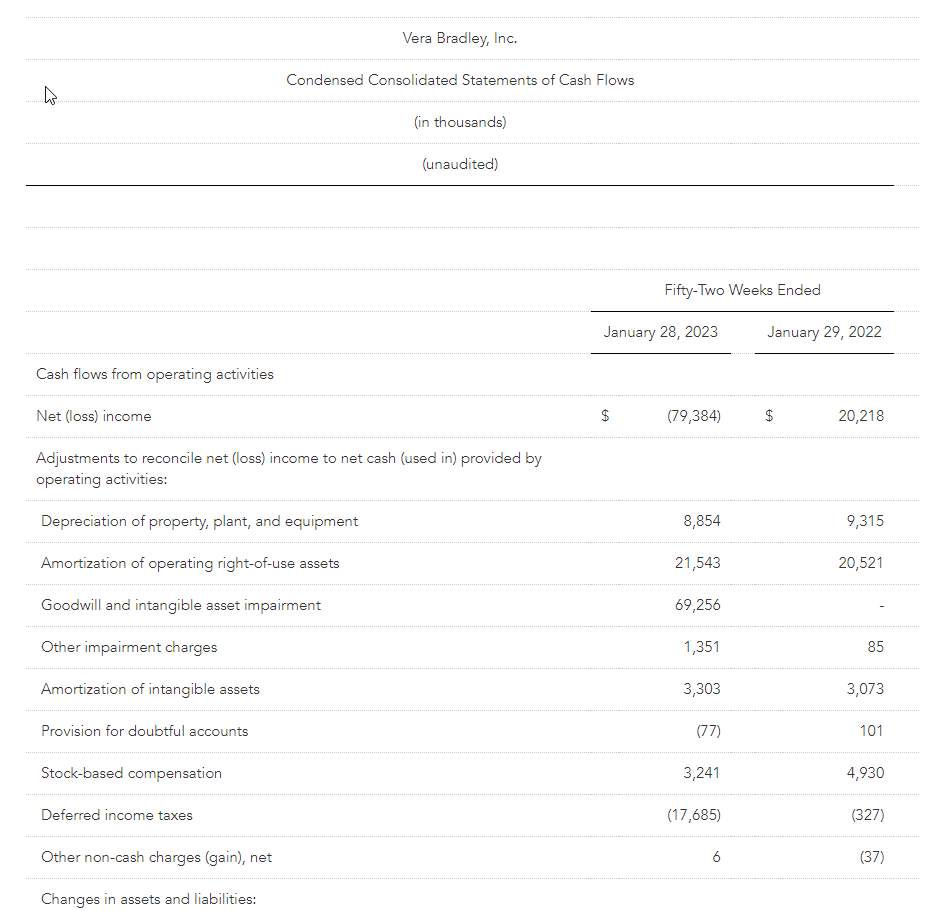

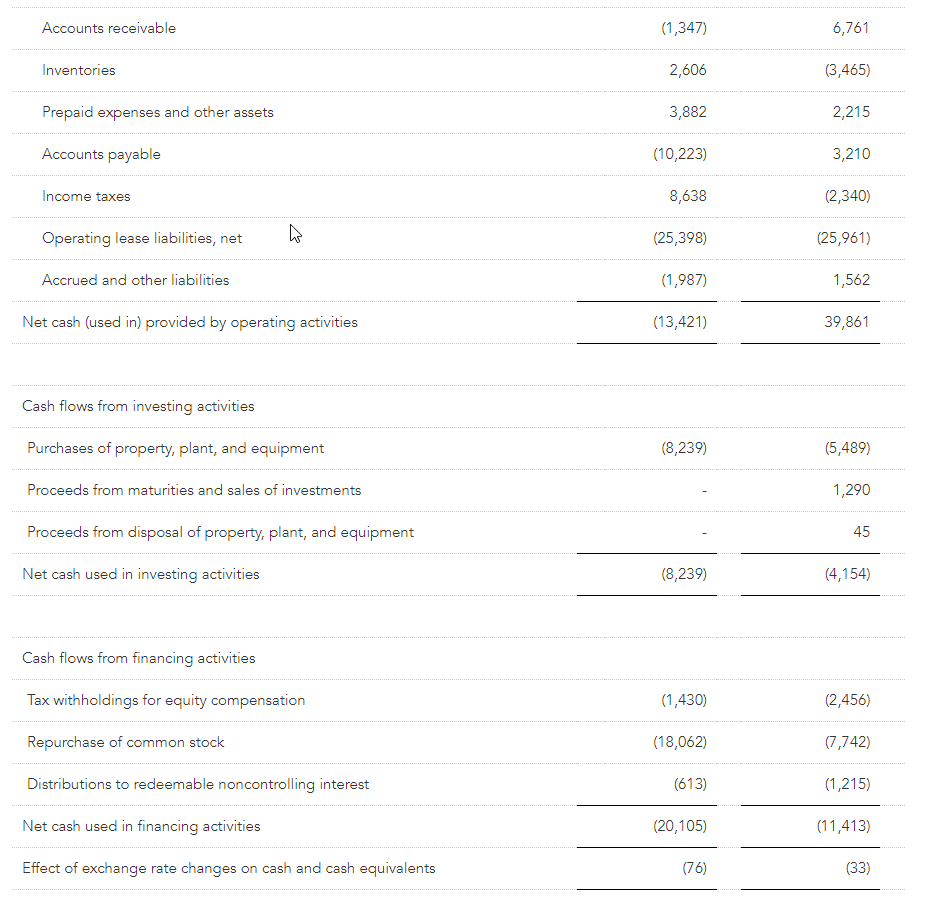

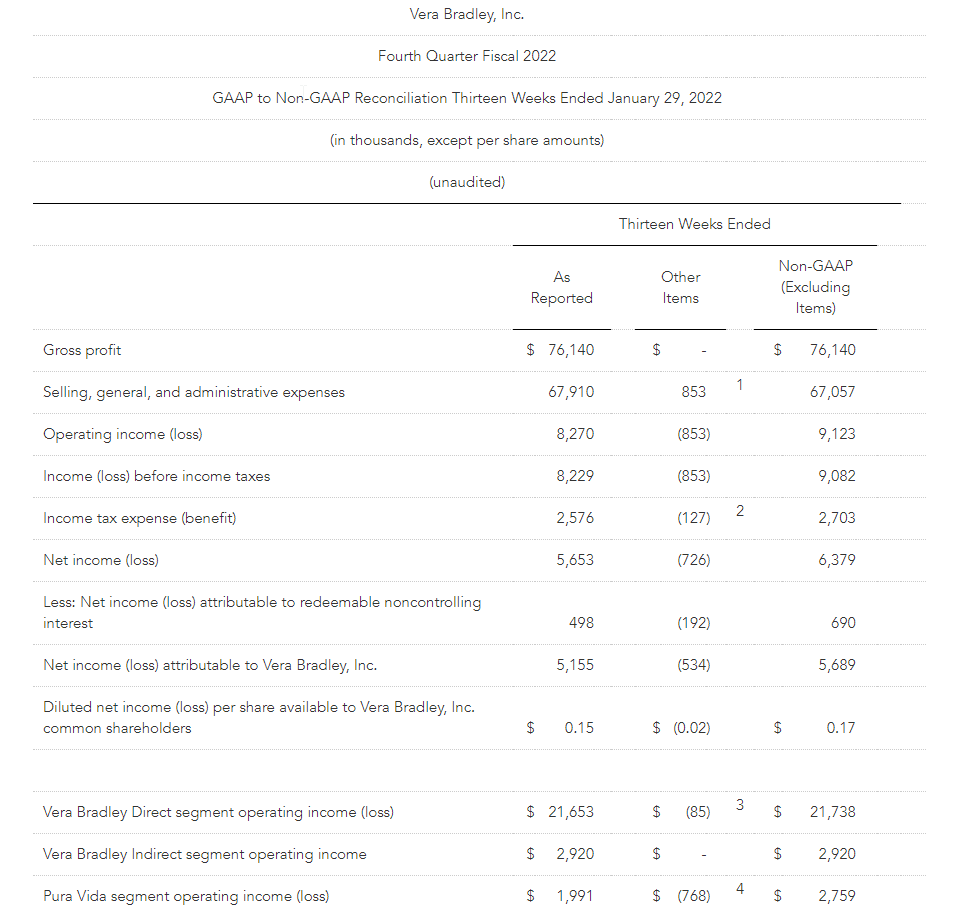

Net capital spending for the first quarter totaled $0.8 million compared to $1.7 million in the prior year.

Cash and cash equivalents as of April 29, 2023 totaled $25.3 million compared to $46.6 million at fiscal year end. The Company had no borrowings on its $75 million ABL credit facility at quarter end.

Total quarter-end inventory was $142.7 million, compared to $161.8 million at the end of the first quarter last year.

During the first quarter, the Company repurchased approximately $0.7 million of its common stock (approximately 0.1 million shares at an average price of $5.71). $27.0 million remains under the Company’s $50.0 million repurchase authorization that expires in December 2024.

Forward Outlook

Management is updating guidance for the fiscal year ending February 3, 2024 (“Fiscal 2024”) based on first quarter performance, Company initiatives underway, and current macroeconomic trends and expectations.

Excluding net revenues, all forward-looking guidance numbers referenced below are non-GAAP. The prior year income statement numbers exclude the previously disclosed charges for goodwill and intangible asset impairment; net inventory and purchase order-related adjustments; severance, retention, and stock-based retirement compensation; consulting and professional fees primarily associated with cost savings initiatives, the CEO search, and strategic initiatives; amortization of definite-lived intangible assets; store and right-of-use asset impairment charges; new CEO sign-on bonus and relocation; and goodMRKT exit costs. Current year guidance excludes any similar charges.

For Fiscal 2024, the Company’s expectations are as follows:

- Consolidated net revenues of $490 to $510 million. Net revenues totaled $500.0 million in Fiscal 2023. Both Vera Bradley and Pura Vida revenues are expected to be approximately flat on a year-over-year basis.

- A consolidated gross profit percentage of 52.8% to 53.8% compared to 51.4% in Fiscal 2023. The Fiscal 2024 gross margin rate is expected to be favorably impacted by lower year-over-year freight expense, cost reduction initiatives, and the sell-through of previously-reserved inventory, partially offset by an increase in promotional activity.

- Consolidated SG&A expense of $237 to $247 million compared to $245.3 million in Fiscal 2023. An expected decline in SG&A expense is being driven by Company-wide cost reduction initiatives, partially offset by restoring short-term and long-term incentive compensation to more normalized levels and incremental marketing investment intended to accelerate customer file growth.

- Consolidated operating income of $24 to $28 million compared to $12.3 million in Fiscal 2023.

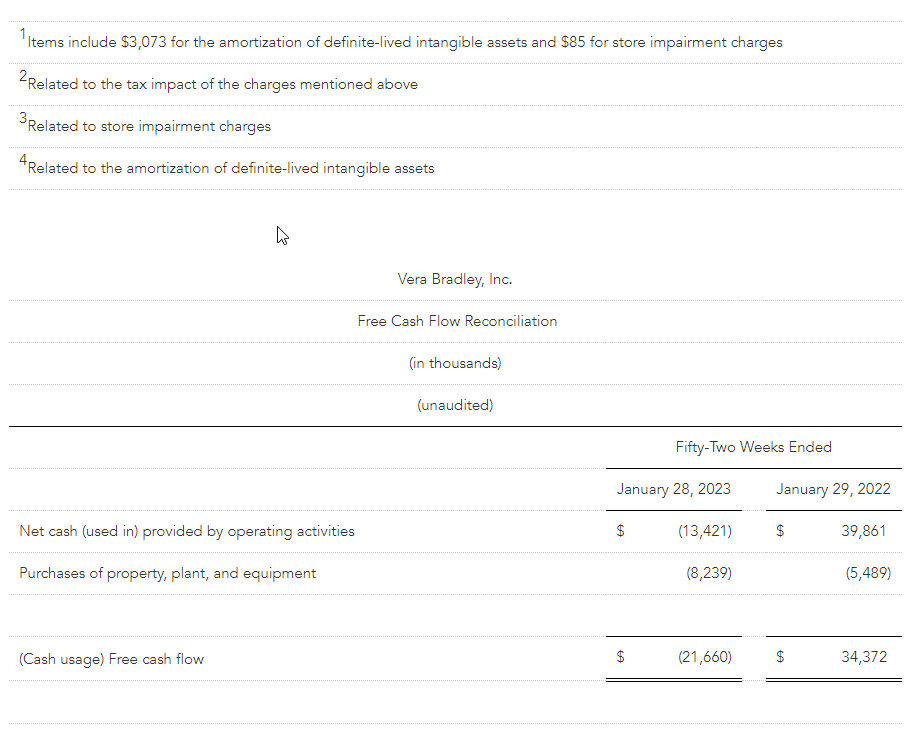

- Free cash flow of between $35 and $40 million compared to a cash usage of $21.7 million in Fiscal 2023.

- Consolidated diluted EPS of $0.57 to $0.67 based on diluted weighted-average shares outstanding of 30.7 million and an effective tax rate of approximately 28%. Diluted EPS totaled $0.24 last year.

- Net capital spending of approximately $5 million compared to $8.2 million in the prior year, reflecting investments associated with new Vera Bradley Factory stores and technology and logistics enhancements.

Disclosure Regarding Non-GAAP Measures

The Company’s management does not, nor does it suggest that investors should, consider the supplemental non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). Further, the non-GAAP measures utilized by the Company may be unique to the Company, as they may be different from non-GAAP measures used by other companies.

The Company believes that the non-GAAP measures presented in this earnings release, including (cash usage) free cash flow; gross profit; selling, general, and administrative expenses; operating loss; net loss; net loss attributable and available to Vera Bradley, Inc.; and diluted net loss per share available to Vera Bradley, Inc. common shareholders, along with the associated percentages of net revenues, are helpful to investors because they allow for a more direct comparison of the Company’s year-over-year performance and are consistent with management’s evaluation of business performance. A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures can be found in the Company’s supplemental schedules included in this earnings release.

Call Information

A conference call to discuss results for the first quarter is scheduled for today, Wednesday, June 7, 2023, at 9:30 a.m. Eastern Time. A broadcast of the call will be available via Vera Bradley’s Investor Relations section of its website, www.verabradley.com. Alternatively, interested parties may dial into the call at (888) 394-8218, and enter the access code 9903988. A replay will be available shortly after the conclusion of the call and remain available through June 21, 2023. To access the recording, listeners should dial (844) 512-2921, and enter the access code 9903988.

About Vera Bradley, Inc.

Vera Bradley, Inc. operates two unique lifestyle brands – Vera Bradley and Pura Vida. Vera Bradley and Pura Vida are complementary businesses, both with devoted, emotionally-connected, and multi-generational female customer bases; alignment as casual, comfortable, affordable, and fun brands; positioning as “gifting” and socially-connected brands; strong, entrepreneurial cultures; a keen focus on community, charity, and social consciousness; multi-channel distribution strategies; and talented leadership teams aligned and committed to the long-term success of their brands.

Vera Bradley, based in Fort Wayne, Indiana, is a leading designer of women’s handbags, luggage and other travel items, fashion and home accessories, and unique gifts. Founded in 1982 by friends Barbara Bradley Baekgaard and Patricia R. Miller, the brand is known for its innovative designs, iconic patterns, and brilliant colors that inspire and connect women unlike any other brand in the global marketplace.

In July 2019, Vera Bradley, Inc. acquired a 75% interest in Creative Genius, Inc., which also operates under the name Pura Vida Bracelets (“Pura Vida”). Pura Vida, based in La Jolla, California, is a digitally native, highly-engaging lifestyle brand founded in 2010 by friends Paul Goodman and Griffin Thall. Pura Vida has a differentiated and expanding offering of bracelets, jewelry, and other lifestyle accessories. The Company acquired the remaining 25% of Pura Vida in January 2023.

The Company has three reportable segments: Vera Bradley Direct (“VB Direct”), Vera Bradley Indirect (“VB Indirect”), and Pura Vida. The VB Direct business consists of sales of Vera Bradley products through Vera Bradley Full-Line and Factory stores in the United States, www.verabradley.com, www.verabradley.ca, Vera Bradley’s online outlet site, and the Vera Bradley annual outlet sale in Fort Wayne, Indiana. The VB Indirect business consists of sales of Vera Bradley products to approximately 1,700 specialty retail locations throughout the United States, as well as select department stores, national accounts, third party e-commerce sites, and third-party inventory liquidators, and royalties recognized through licensing agreements related to the Vera Bradley brand. The Pura Vida segment consists of sales of Pura Vida products through the Pura Vida websites, www.puravidabracelets.com, www.puravidabracelets.eu, and www.puravidabracelets.ca; through the distribution of its products to wholesale retailers and department stores; and through its Pura Vida retail stores.

Website Information

We routinely post important information for investors on our website www.verabradley.com in the “Investor Relations” section. We intend to use this webpage as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document.

Investors and other interested parties may also access the Company’s most recent Corporate Responsibility and Sustainability Report outlining its ESG (Environmental, Social, and Governance) initiatives at https://verabradley.com/pages/corporate-responsibility.

Vera Bradley Safe Harbor Statement

Certain statements in this release are “forward-looking statements” made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect the Company’s current expectations or beliefs concerning future events and are subject to various risks and uncertainties that may cause actual results to differ materially from those that we expected, including: possible adverse changes in general economic conditions and their impact on consumer confidence and spending; possible inability to predict and respond in a timely manner to changes in consumer demand; possible loss of key management or design associates or inability to attract and retain the talent required for our business; possible inability to maintain and enhance our brands; possible inability to successfully implement the Company’s long-term strategic plans; possible inability to successfully open new stores, close targeted stores, and/or operate current stores as planned; incremental tariffs or adverse changes in the cost of raw materials and labor used to manufacture our products; possible adverse effects resulting from a significant disruption in our distribution facilities; or business disruption caused by pandemics. Risks, uncertainties, and assumptions also include the possibility that Pura Vida acquisition benefits may not materialize as expected and that Pura Vida’s business may not perform as expected. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s public reports filed with the SEC, including the Company’s Form 10-K for the fiscal year ended January 28, 2023. We undertake no obligation to publicly update or revise any forward-looking statement. Financial schedules are attached to this release.

CONTACTS:

Investors:

Julia Bentley

jbentley@verabradley.com

Media:

mediacontact@verabradley.com

877-708-VERA (8372)