Short Changing Investment Returns By Ignoring Time Horizon

Time horizon is part of every investor’s buy decision, or at least it ought to be. For example, in 2022 the 60/40 investment portfolio had its worst performance since 2008. This is despite a 5.3% increase in value during the fourth quarter of that year. Many headlines had read that the classic 60% stocks and 40% bonds portfolio is “broken.” After it’s stellar performance during Q4 2022, the first quarter of 2023 brought even higher performance – again compounding by an additional 5.9%. This example can highlight that time horizon is dependent on the investment goals proving 60/40 probably is not dead after all. The 60/40 diversification is considered conservative, it’s often implemented for retirement portfolios, typically portfolios with a lot of lead time to achieve its goal of historical returns. Goals should dictate investment strategy and they should include a realistic time horizon.

To Be Patient or Not to Be Patient

Entering the second quarter of 2023, economic trends, including commodity prices, interest rates, political power, inflation, and even peace between nations, all seem to be sending off mixed signals on future trends. A clear market read is far more difficult today than most years. This leaves a lot of questions on what to do with one’s money. If you leave it in the bank, inflation is likely to erode your purchasing power. If you move it to the U.S. government-backed treasury market, a rise in rates (as promised by the Fed) can leave you hurting like a few banks that saw their assets value plummet. Should stocks take a leading role – even if holdings wind up moving sideways or even down for the rest of this year?

As mentioned, this depends on your goal. If you can be patient and have a time horizon to achieve performance of more than a year, the tendency for reversion to mean suggests the answer is probably yes. However, if during the next six to 12 months, this money may need to be deployed for a purchase, it may be best to continually roll treasuries maturing in under a year.

For investments expected to be held longer than a year, there is the lazy way and a more hands-on approach that takes a little more digging. The lazy way says you plop a large percentage of your portfolio in an index fund and earn market returns. A more involved management approach of one’s portfolio would suggest that you’d prefer to avoid stocks considered overvalued or in a weakening industry. If, instead, one can achieve adequate diversity by owning many companies in different industries, and do enough evaluation (i.e., exploring trusted research) to have a sense of whether holding them would suit your needed time horizon, then the stocks selected as your holdings may avoid expected dogs weighing it down. It would make sense that this argues for patience, with expectations that not only will stocks follow history and go up over time, but your holdings have a reasonable expectation to outperform the market.

Time Horizon

Time horizon is a critical factor in investing. It refers to the length of time an investor is willing to hold onto their investments. The time horizon can range from a few months to several decades, depending on an investor’s goals, risk tolerance, and investment strategy. Most benchmarks are viewed daily, quarterly, and monthly. If your time horizon is five years, the quarterly or even annual returns should be a low consideration. Cathie Wood, CEO and founder of Ark Invest, says she invests on a five-year time horizon, considering the speculative growth names her funds have invested in, such as Tesla (TSLA), Roku (ROKU), Zoom Video Communications (ZM), Exact Sciences (EXAS), etc. she could not manage her funds properly if she looked shorter in term.

At least each quarter Portfolio Manager Chuck Royce and Co-CIO Francis Gannon of Royce Funds publish text of a “conversation” between the two. The subject is usually past market performance, expectations of the future, and even stocks that they believe, with the appropriate time horizon, will pay off.

In the discussion between the two, Francis Gannon covered the case for more extended time horizon investors to explore the small-cap sector. His expectation is that various sectors (viewed by market cap) will fall in line with historical performance averages. “The stocks that performed best under the previous decade’s regime of zero interest rates, low inflation, and low nominal growth—which were mega-caps and small-cap growth—are unlikely to lead going forward, regardless of what direction the U.S. economy ultimately takes. Conversely, those areas of the equity market that lagged during this long period are likely, in our view, to capture long-term leadership,” said Gannon. This is when Chuck Ross very clearly explained the importance of knowing one’s time horizon for maximum potential gain.

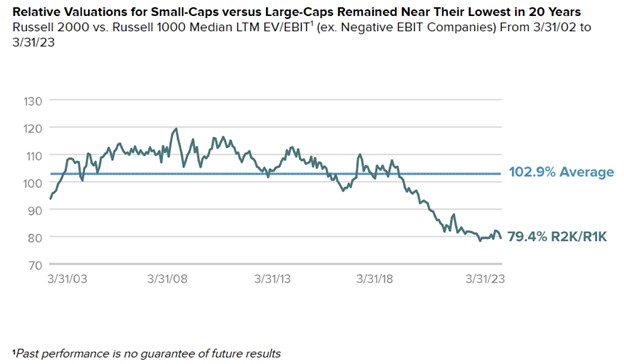

“We think small cap is ready to roll and expect the next three to five years to be strong on both an absolute and relative basis.” Said Mr. Royce. He explained that rising rates could help companies that can that don’t need to borrow from the outside. “Equally important, the Russell 2000’s valuation remained near its lowest rate in 20 years compared to the Russell 1000’s, based on our preferred valuation metric of the median last 12 months’ enterprise value to earnings before taxes (LTM EV/EBIT).” Royce explained.

The chart above shows that the 20-year performance of small-cap stocks averages 102.9% above that of large-cap equities. The underperformance began five years ago, and the current 20-year low in relative performance in small-caps could play out to be a long lag. With a long enough time horizon, one might expect that small-cap investors get rewarded for the additional risk and reduced liquidity in the sector.

Investment Strategy

While not everyone has five years or more to wait for performance to improve, intentional stock selection among small-caps could help those who do. A recent Barron’s article argued that “Small-Cap Stocks Look Ready to Rally,” the investment publication also believed that stock selection within the sector could pay off. The author wrote that as of March 31, “the Russell 2000 was at 44% of the S&P 500’s level, a ratio the index touched in early 2020 when the advent of Covid-19 had left the economy in perilous waters.” The publication then reported that the level is a technical low point, a support that wasn’t even breached with pandemic concerns and skyrocketing large-cap tech stocks. Expressed in the within the April 3 article was to a methodology of filtering stocks by reviewing companies with market caps of at least $200 million and free cash flow minimum of 4.5% of the share price. This would put them in line with the overall Russell 2000.

Then look at the consensus earnings forecasts among analyst, have they risen? A high short interest in the stock could also be part of the screening process for possible buys.

Take Away

The importance of time horizon in investing lies in the fact that different investment opportunities have different risk and return profiles over different time periods. Short-term investments tend to have lower risk but lower returns, while long-term investments tend to have higher risk but potentially higher returns. By understanding your time horizon, you can choose investments that align with your investment goals and risk tolerance.

For investors that can span many years holding and waiting for scenarios to play out, but don’t, perhaps are leaving long-term return on the table by investing as though their time horizon is short. Investible cash sitting in a bank will be eroded by inflation, the Fed with its deep pockets has said it is resolved to instigate a further bear market in bonds. Longer term, stocks outperform, what’s more, well-selected companies can outperform stock indixes that only promise to match the average of good and bad companies.

If you aren’t receiving equity research in your daily email, sign up here now.

Managing Editor, Channelchek

Sources

https://www.barrons.com/articles/small-cap-stocks-rally-cheap-russell-2000-5b35f854