Research News and Market Data on ODP

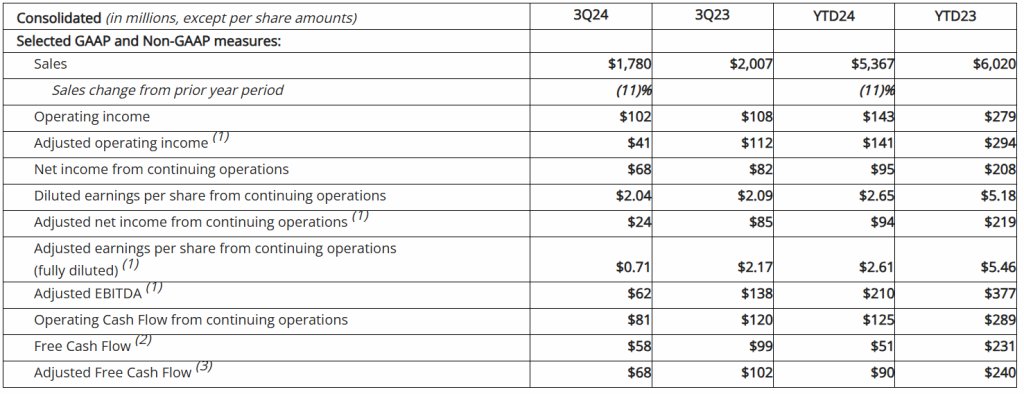

Third Quarter Revenue of $1.8 Billion with GAAP EPS of $2.04; Adjusted EPS of $0.71

Significant New Business Wins Improving Future Growth Profile

Progress on B2B Pivot; Pursuing Core Opportunities in New Adjacent Industry Segments

Company Repurchased Approximately $295 Million of Shares Year to Date

Company Completes Varis Sale Subsequent to Quarter End

BOCA RATON, Fla.–(BUSINESS WIRE)–Nov. 6, 2024– The ODP Corporation (“ODP,” or the “Company”) (NASDAQ:ODP), a leading provider of products, services, and technology solutions to businesses and consumers, today announced results for the third quarter ended September 28, 2024.

Third Quarter 2024 Summary(1)(2)(3)

- Total reported sales of $1.8 billion, down 11% versus the prior year on a reported basis. The decrease in reported sales is largely related to lower sales in its Office Depot Division, primarily due to 53 fewer retail locations in service compared to the previous year and reduced transactions, as well as lower sales in its ODP Business Solutions Division

- GAAP operating income of $102 million and net income from continuing operations of $68 million, or $2.04 per diluted share, versus $108 million and $82 million, respectively, or $2.09 per diluted share, in the prior year period

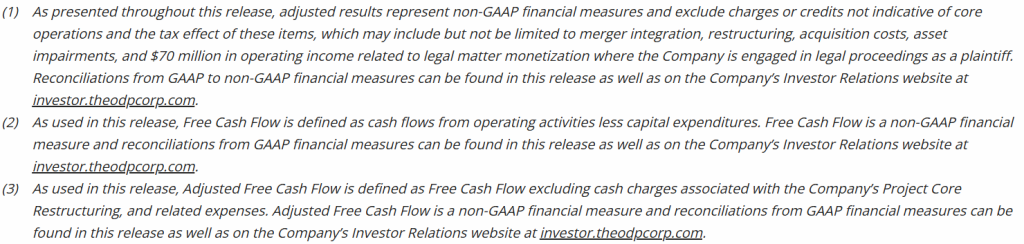

- Adjusted operating income of $41 million, compared to $112 million in the third quarter of 2023; adjusted EBITDA of $62 million, compared to $138 million in the third quarter of 2023. Adjusted operating income in the third quarter of 2024 excludes $70 million of income related to legal matter monetization where the Company is engaged in legal proceedings as a plaintiff

- Adjusted net income from continuing operations of $24 million, or adjusted diluted earnings per share from continuing operations of $0.71, versus $85 million or $2.17, respectively, in the prior year period. Adjusted net income from continuing operations in the third quarter of 2024 excludes $70 million of income or $51 million of income, net of tax related to legal matter monetization where the Company is engaged in legal proceedings as a plaintiff

- Operating cash flow from continuing operations of $81 million and adjusted free cash flow of $68 million, versus $120 million and $102 million, respectively, in the prior year period

- Repurchased 3 million shares at a cost of $102 million in the third quarter of 2024; Repurchased a total of approximately $141 million of shares when including purchases made in the third quarter and post quarter through the current date

- $728 million of total available liquidity including $192 million in cash and cash equivalents, of which $11 million is presented in Current assets held for sale related to the Varis Division, at quarter end

“Our results in the quarter were below expectations, primarily driven by our retail division, as challenging macroeconomic conditions impacted our performance,” said Gerry Smith, chief executive officer of The ODP Corporation. “Weaker macroeconomic conditions led to more cautious consumer and business spending, impacting demand in our B2C and B2B divisions during the highly competitive back-to-school season. This was further compounded by major hurricanes negatively affecting our customer base and operations in our largest service areas.

“Despite these challenges, we’re making significant progress on our B2B pivot and initiatives to improve top-line trends. We’re leveraging our differentiated core strengths to pivot towards higher growth B2B opportunities, and we are beginning to see promising traction at both our ODP Business Solutions and Veyer Divisions. At Veyer, we continue to attract new third-party relationships, including launching service for one of the world’s largest social media-focused e-commerce platforms, positioning our supply chain business to pursue growth in a new high value industry segment. At Business Solutions, we secured one of the largest multi-year B2B contracts in our history, potentially generating up to $1.5 billion in revenue over a 10-year period. Additionally, we are making progress and actively pursuing opportunities in new, higher growth, adjacent industry segments where our core strengths also resonate. We’re building key distribution relationships in growing industry segments that spotlight our supply chain proficiency, our ability to supply products beyond office supplies, and our commitment to service excellence,” Smith continued.

“We are excited about our progress and we’re allocating capital to fast-forward investments in our core business to capture these growth opportunities and generate the highest return for shareholders. Considering these core investments, along with our year-to-date performance against the challenging macroeconomic backdrop, we are amending our guidance for 2024. Additionally, we advanced Project Core and streamlined our operations by completing the sale of Varis, while continuing to assess and refine our retail strategy. While the progress we are making will take time to reflect in our results, we are confident that we’re on the right path, and our team is committed and focused on driving operational excellence to create long-term shareholder value,” Smith concluded.

Consolidated Results

Reported (GAAP) Results

Total reported sales for the third quarter of 2024 were $1.8 billion, a decrease of 11% compared with the same period last year, driven primarily by lower sales in both its consumer and business-to-business (B2B) divisions. Lower sales in its consumer division, Office Depot, was primarily due to lower retail and online consumer traffic and transactions, as well as 53 fewer stores in service compared to last year related to planned store closures. Sales at ODP Business Solutions Division were lower compared to last year and generally consistent with the first half of 2024, largely driven by macroeconomic factors causing more cautious spending among business customers and fewer transactions. Meanwhile, Veyer provided strong logistics support for the ODP Business Solutions and Office Depot Divisions, and continued to execute across its growth strategy, delivering supply chain and procurement solutions to new third-party customers and driving increases in external revenue.

The Company reported GAAP operating income of $102 million in the third quarter of 2024, down compared to GAAP operating income of $108 million in the prior year period. Operating results in the third quarter of 2024 included $61 million of credits, primarily due to the Company recognizing $70 million of income in its Condensed Consolidated Statement of Operations related to legal matter monetization where the Company is engaged in legal proceedings as a plaintiff. This was partially offset by $2 million in net merger and restructuring expenses and $7 million non-cash asset impairment related to the operating lease right-of-use (ROU) assets associated with the Company’s retail store locations. Net income from continuing operations was $68 million, or $2.04 per diluted share in the third quarter of 2024, down compared to net income from continuing operations of $82 million, or $2.09 per diluted share in the third quarter of 2023.

Adjusted (non-GAAP) Results(1)

Adjusted results for the third quarter of 2024 exclude charges and credits totaling $61 million as described above and the associated tax impacts.

- Third quarter 2024 adjusted EBITDA was $62 million compared to $138 million in the prior year period. This included depreciation and amortization of $24 million in the third quarter of 2024 and 2023

- Third quarter 2024 adjusted operating income was $41 million, down compared to $112 million in the third quarter of 2023

- Third quarter 2024 adjusted net income from continuing operations was $24 million, or $0.71 per diluted share, compared to $85 million, or $2.17 per diluted share, in the third quarter of 2023, a decrease of 67% on a per share basis

Division Results

ODP Business Solutions Division

Leading B2B distribution solutions provider serving small, medium and enterprise level companies with an annual trailing-twelve-month revenue of $3.7 billion.

- Reported sales were $916 million in the third quarter of 2024, down 8% compared to the same period last year. The decrease in sales was related primarily to weaker macroeconomic conditions, more cautious business spending environment, lower sales conversion, and fewer customers

- Total adjacency category sales, including cleaning and breakroom, furniture, technology, and copy and print, were 44% of total ODP Business Solutions’ sales, flat with the prior year

- Executing initiatives to convert strong pipeline of potential new business and implementing several initiatives to regain top-line traction. Recent customer wins include signing one of the largest contracts in Company history, potentially generating up to $1.5 billion in revenue over a 10-year period

- Making progress on establishing presence in new, adjacent industry segments, where the Company’s core competencies resonate, leveraging its distribution and supply chain proficiency, ability to supply products beyond office supplies, and commitment to service excellence

- Operating income was $28 million in the third quarter of 2024, down compared to $56 million in the same period last year on a reported basis. As a percentage of sales, operating income margin was 3%, down 250 basis points compared to the same period last year

Office Depot Division

Leading provider of retail consumer and small business products and services distributed via Office Depot and OfficeMax retail locations and an eCommerce presence.

- Reported sales were $861 million in the third quarter of 2024, down 15% compared to the prior year on a reported basis. Lower sales were partially driven by 53 fewer retail outlets in service associated with planned store closures, as well as lower demand relative to last year in major product categories, lower average order volume, and lower online sales. The Company closed nine retail stores in the quarter and had 885 stores at quarter end. Sales were down 10% on a comparable store basis

- Store and online traffic were lower year over year due to macroeconomic factors causing sluggish consumer activity and demand during the highly competitive back-to-school season

- Operating income was $23 million in the third quarter of 2024, compared to operating income of $66 million during the same period last year, driven primarily by the flow through impact from lower sales. As a percentage of sales, operating income was 3%, down 380 basis points compared to the same period last year

Veyer Division

Nationwide supply chain, distribution, procurement and global sourcing operation supporting Office Depot and ODP Business Solutions, as well as third-party customers. Veyer’s assets and capabilities include 8 million square feet of infrastructure through a network of distribution centers, cross-docks, and other facilities throughout the United States; a global sourcing presence in Asia; a large private fleet of vehicles; and business next-day delivery to 98.5% of US population.

- In the third quarter of 2024, Veyer provided support for its internal customers, ODP Business Solutions and Office Depot, as well as its third-party customers, generating sales of $1.2 billion

- Operating income was $9 million in the third quarter of 2024, compared to $10 million in the prior year period driven by the flow through impact of lower sales to internal customers partially offset by the contribution related to services to third-party customers

- Launched supply chain services for one of the world’s largest social media-focused e-commerce companies to deliver warehousing and fulfillment services for their online sales

- In the third quarter of 2024, sales generated from third-party customers increased by approximately 30% compared to the same period last year, resulting in sales of $14 million. EBITDA of $3 million in the quarter represented a 3% decrease year over year, driven by Veyer’s investment in resources to support the launch of services for new customer additions

Share Repurchases

The Company continued to execute under its previously announced $1 billion share repurchase authorization valid through March 31, 2027. During the third quarter of 2024, the Company repurchased 3 million shares at a cost of $102 million. Since the end of the third quarter of 2024, the Company repurchased additional shares for $38 million.

“We’ve executed on our capital plan throughout the year, both investing in our business and returning approximately $295 million in capital to shareholders through share repurchases thus far in 2024,” said Adam Haggard, senior vice president and interim co-chief financial officer of The ODP Corporation. “As we move forward, we are prioritizing our capital allocation towards investing in the core business to capture high-return B2B growth opportunities that we believe will generate long-term value for shareholders. Considering this focus, while mindful of the ongoing challenging macroeconomic environment and our results year-to-date, we expect to substantially moderate the pace of share repurchases.”

The number of shares to be repurchased under the authorization in the future and the timing of such transactions will depend on a variety of factors, including market conditions, regulatory requirements, and other corporate considerations. The new share repurchase authorization could be suspended or discontinued at any time as determined by the Board of Directors.

Balance Sheet and Cash Flow

As of September 28, 2024, ODP had total available liquidity of approximately $728 million, consisting of $192 million in cash and cash equivalents, including $11 million that is presented in Current assets held for sale related to the Varis Division, and $536 million of available credit under the Fourth Amended Credit Agreement. Total debt was $246 million.

For the third quarter of 2024, cash provided by operating activities of continuing operations was $81 million, which included $10 million in restructuring spend, compared to cash provided by operating activities of continuing operations of $120 million in the third quarter of the prior year, which included $3 million in restructuring spend. The year-over-year change in operating cash flow is related to lower sales and the timing of certain working capital items.

Capital expenditures in the third quarter of 2024 were $22 million versus $20 million in the prior year period, reflecting continued growth investments in the Company’s digital transformation, distribution network, and eCommerce capabilities. Adjusted Free Cash Flow(3) was $68 million in the third quarter of 2024, compared to $102 million in the prior year period.

Progress on Project Core

As the Company previously announced, Project Core is an enterprise-wide cost improvement plan designed to create further efficiencies throughout its business, focused on driving enhanced operating results and shareholder value. The Company continues to make significant progress under Project Core and is in position to realize in-year savings of approximately $50 million and annualized savings of over $100 million when fully implemented. Restructuring and related charges associated with these actions are now estimated to be in the range of $40 million to $50 million, excluding those related to the Varis Division, and are expected to be substantially incurred throughout 2024.

Varis Division Update

Subsequent to the quarter, the Company sold its Varis Division, while retaining a minority interest of 19.9% after the sale. Under the terms of the related agreement, the Company will fund up to $4 million of expenses that may be incurred by Varis following the transaction date until December 31, 2025, and has no further obligations to contribute capital to Varis. The terms of the sale of Varis did not result in a materially different impact than previously estimated on our financial statements.

“We have completed the sale of Varis that aligns with our stated objectives of finalizing our capital commitment to the business, while providing ODP with a continued invested interest in the opportunities ahead,” added Smith.

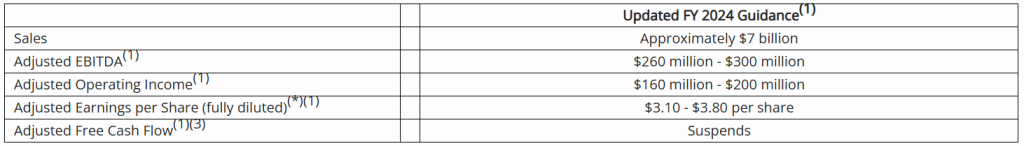

2024 Guidance

“Our performance to date in 2024 has clearly been below expectations, impacted by deteriorating macroeconomic conditions, a challenging competitive landscape, and severe weather conditions,” said Smith. “As we look at the balance of the year, we are working to reposition our business and are fast-forwarding investments in resources necessary to pursue the new and exciting opportunities in our B2B and supply chain businesses. As we continue to assess our retail operations, we believe that our investments in our B2B pivot will help position ODP to generate value in the very large and growing market segments where our competitive advantage and customer focus resonates,” he added.

The Company is amending its 2024 full-year guidance as follows:

Updated full-year guidance for 2024

The Company’s full year guidance for 2024 includes non-GAAP measures, such as Adjusted EBITDA, Adjusted Operating Income, and Adjusted Earnings per Share (fully diluted). These measures exclude charges or credits not indicative of core operations, which may include but not be limited to restructuring charges, capital expenditures, acquisition-related costs, executive transition costs, asset impairments and other significant items that currently cannot be predicted without unreasonable efforts. The exact amount of these charges or credits are not currently determinable but may be significant. Accordingly, the Company is unable to provide equivalent GAAP measures or reconciliations from GAAP to non-GAAP for these financial measures.

The ODP Corporation will webcast a call with financial analysts and investors on November 6, 2024, at 9:00 am Eastern Time, which will be accessible to the media and the general public. To listen to the conference call via webcast, please visit The ODP Corporation’s Investor Relations website at investor.theodpcorp.com. A replay of the webcast will be available approximately two hours following the event.

About The ODP Corporation

The ODP Corporation (NASDAQ:ODP) is a leading provider of products, services, and technology solutions through an integrated business-to-business (B2B) distribution platform and omni-channel presence, which includes supply chain and distribution operations, dedicated sales professionals, online presence, and a network of Office Depot and OfficeMax retail stores. Through its operating companies ODP Business Solutions, LLC; Office Depot, LLC; and Veyer, LLC, The ODP Corporation empowers every business, professional, and consumer to achieve more every day. For more information, visit theodpcorp.com.

ODP and ODP Business Solutions are trademarks of ODP Business Solutions, LLC. Office Depot is a trademark of The Office Club, LLC. OfficeMax is a trademark of OMX, Inc. Veyer is a trademark of Veyer, LLC. Grand&Toy is a trademark of Grand & Toy, LLC in Canada. ©2024 Office Depot, LLC. All rights reserved. Any other product or company names mentioned herein are the trademarks of their respective owners.

FORWARD LOOKING STATEMENTS

This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, or state other information relating to, among other things, the Company, based on current beliefs and assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “expectations”, “outlook,” “intend,” “may,” “possible,” “potential,” “predict,” “project,” “propose” or other similar words, phrases or expressions, or other variations of such words. These forward-looking statements are subject to various risks and uncertainties, many of which are outside of the Company’s control. There can be no assurances that the Company will realize these expectations or that these beliefs will prove correct, and therefore investors and stakeholders should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, among other things, highly competitive office products market and failure to differentiate the Company from other office supply resellers or respond to decline in general office supplies sales or to shifting consumer demands; competitive pressures on the Company’s sales and pricing; the risk that the Company is unable to transform the business into a service-driven, B2B platform or that such a strategy will not result in the benefits anticipated; the risk that the Company will not be able to achieve the expected benefits of its strategic plans, including benefits related to Project Core; the risk that the Company may not be able to realize the anticipated benefits of acquisitions due to unforeseen liabilities, future capital expenditures, expenses, indebtedness and the unanticipated loss of key customers or the inability to achieve expected revenues, synergies, cost savings or financial performance; the risk that the Company is unable to successfully maintain a relevant omni-channel experience for its customers; the risk that the Company is unable to execute the Maximize B2B Restructuring Plan successfully or that such plan will not result in the benefits anticipated; failure to effectively manage the Company’s real estate portfolio; loss of business with government entities, purchasing consortiums, and sole- or limited- source distribution arrangements; failure to attract and retain qualified personnel, including employees in stores, service centers, distribution centers, field and corporate offices and executive management, and the inability to keep supply of skills and resources in balance with customer demand; failure to execute effective advertising efforts and maintain the Company’s reputation and brand at a high level; disruptions in computer systems, including delivery of technology services; breach of information technology systems affecting reputation, business partner and customer relationships and operations and resulting in high costs and lost revenue; unanticipated downturns in business relationships with customers or terms with the suppliers, third-party vendors and business partners; disruption of global sourcing activities, evolving foreign trade policy (including tariffs imposed on certain foreign made goods); exclusive Office Depot branded products are subject to additional product, supply chain and legal risks; product safety and quality concerns of manufacturers’ branded products and services and Office Depot private branded products; covenants in the credit facility; general disruption in the credit markets; incurrence of significant impairment charges; retained responsibility for liabilities of acquired companies; fluctuation in quarterly operating results due to seasonality of the Company’s business; changes in tax laws in jurisdictions where the Company operates; increases in wage and benefit costs and changes in labor regulations; changes in the regulatory environment, legal compliance risks and violations of the U.S. Foreign Corrupt Practices Act and other worldwide anti-bribery laws; volatility in the Company’s common stock price; changes in or the elimination of the payment of cash dividends on Company common stock; macroeconomic conditions such as higher interest rates and future declines in business or consumer spending; increases in fuel and other commodity prices and the cost of material, energy and other production costs, or unexpected costs that cannot be recouped in product pricing; unexpected claims, charges, litigation, dispute resolutions or settlement expenses; catastrophic events, including the impact of weather events on the Company’s business; the discouragement of lawsuits by shareholders against the Company and its directors and officers as a result of the exclusive forum selection of the Court of Chancery, the federal district court for the District of Delaware or other Delaware state courts by the Company as the sole and exclusive forum for such lawsuits; and the impact of the COVID-19 pandemic on the Company’s business. The foregoing list of factors is not exhaustive. Investors and shareholders should carefully consider the foregoing factors and the other risks and uncertainties described in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the U.S. Securities and Exchange Commission. The Company does not assume any obligation to update or revise any forward-looking statements.