Powell’s Right About the Resilient Economy, How it May Affects Some Stocks

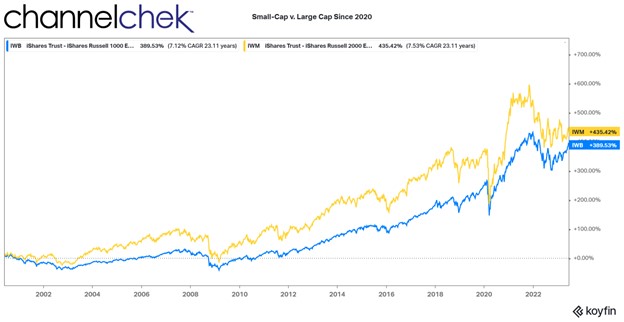

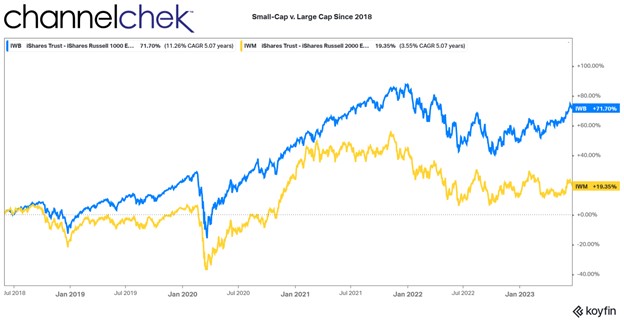

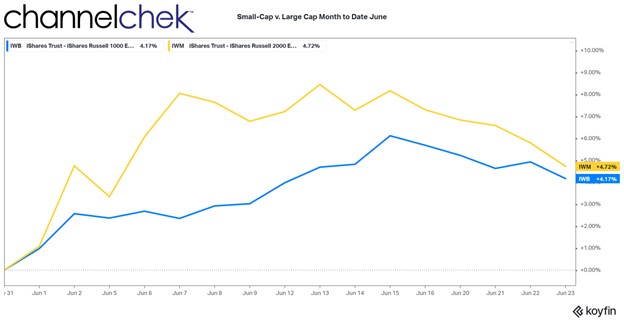

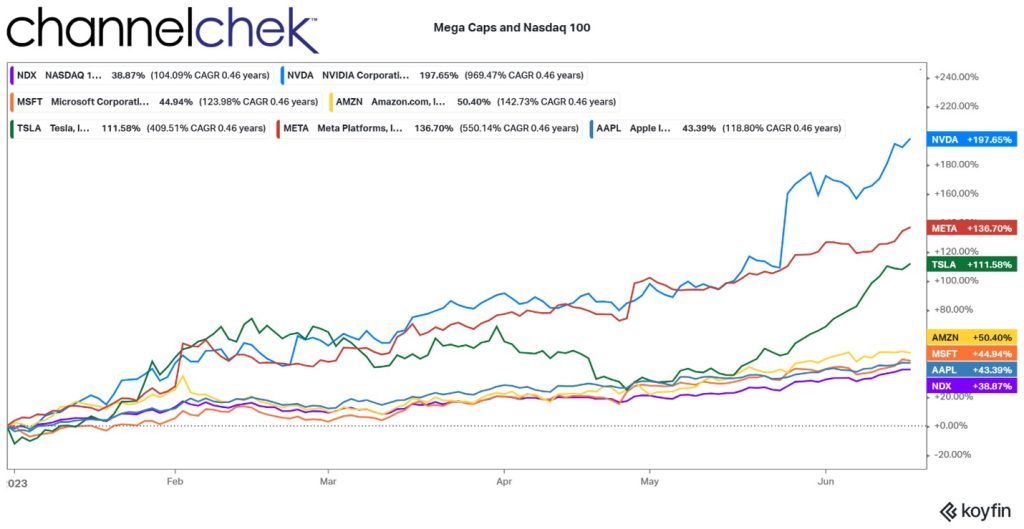

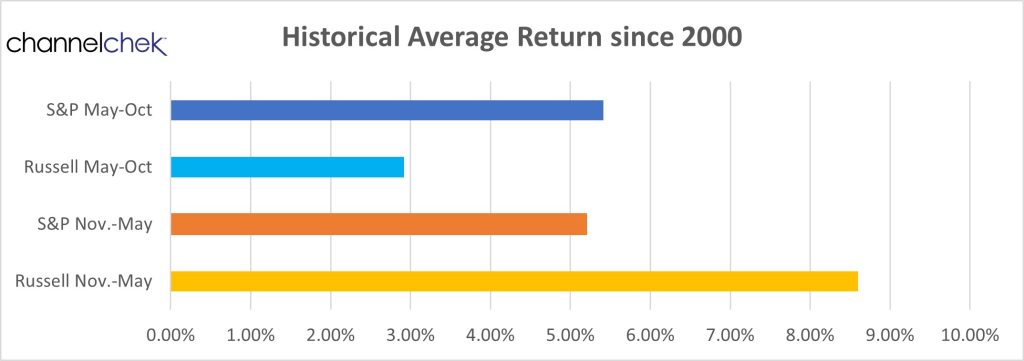

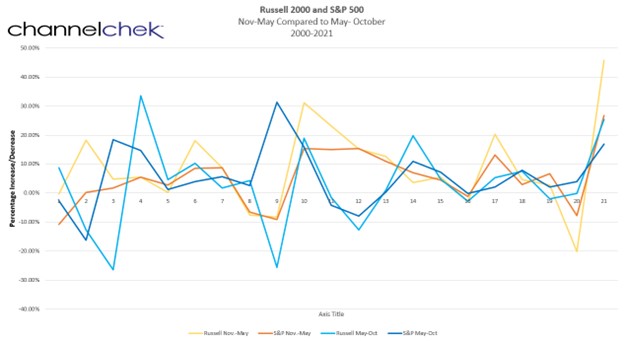

One can generalize and say small cap companies are more sensitive to recessions than large caps – and they would be correct. In his speech in Jackson Hole, Fed Chair Jerome Powell said, “But we are attentive to signs that the economy may not be cooling as expected. So far this year, GDP growth has come in above expectations and above its longer-run trend, and recent readings on consumer spending have been especially robust.” His words sound like a soft landing, no landing, or puts any hard landing far off into the future. Over the past few years, the performance of small-cap stocks has not held its own relative to the performance of large caps when highly weighting the stratospheric performance of mega caps.

After the most recent year and a half of both business news and investors expressing recession concerns, the newer conversation is one of an economic soft landing. Those mentioning the inverted yield curve “proof” has been silenced as rates out on the curve have begun to move steadily higher. The conversation has now been replaced with expectations of increased economic activity. Even if expectations don’t fully come to fruition, it is expectations that move markets – just look at last year’s down stock market which was the result of investors expecting a recession was imminent.

Will Small Caps Finally Run With the Bulls?

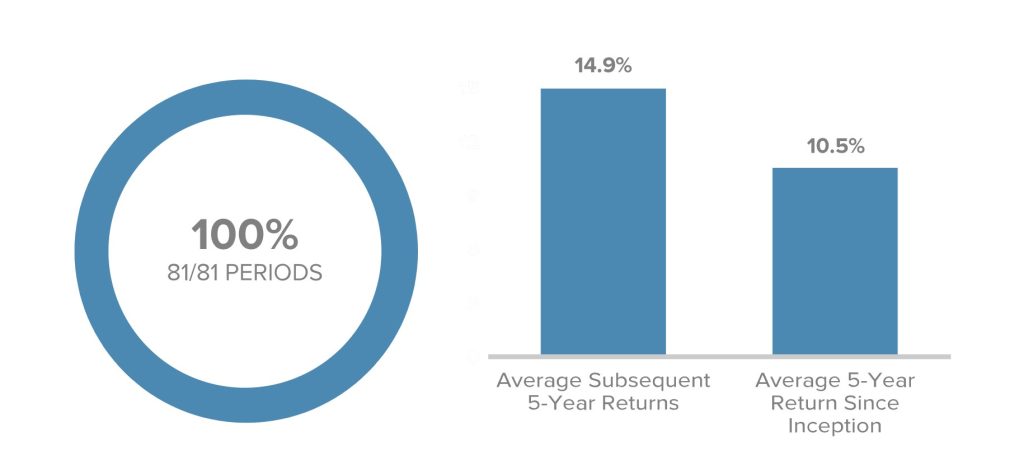

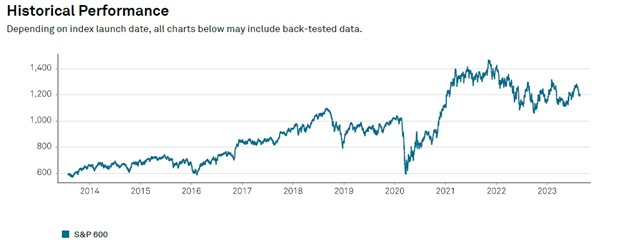

(Source: S&P Dow Jones Indices)

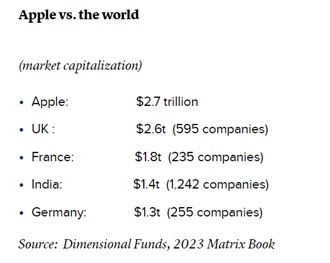

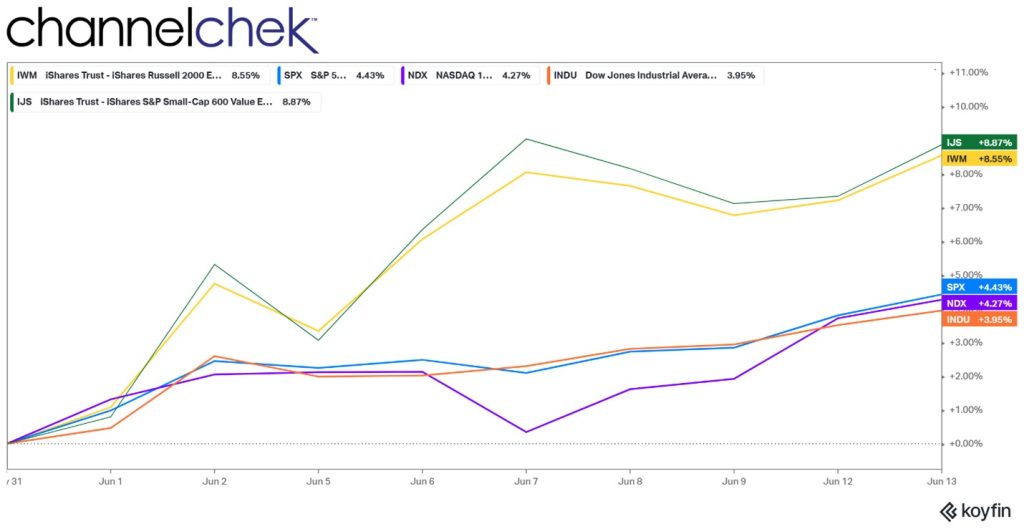

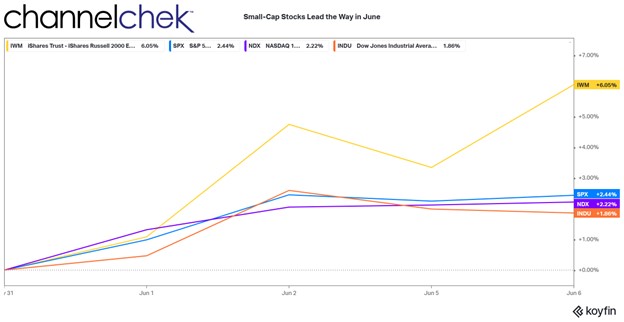

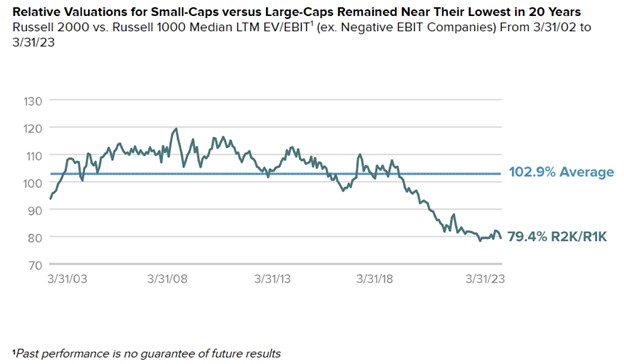

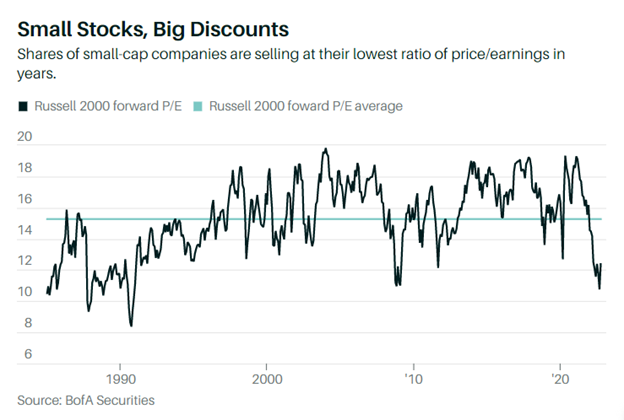

The S&P 600 small cap index is up by nearly a third as much as the S&P 500 this year (4.40% versus 13.98%) and trades at only 15 times earnings. BofA Securities using Russell Index numbers for its analysis of Russell 1000 large cap and Russell 200 small cap indexes, calculated that small companies are 30% cheaper than usual in comparison to big ones. Over the next decade, according to BoA Securities estimates, small caps are poised to gain an average of 11% a year versus 4% for large caps.

The S&P 600 Small Cap Index has underperformed the S&P Large Cap Index by nearly 10% over the past year. Another well-respected firm, T. Rowe Price, takes the expectations in small-caps a step further in its August insight report titled: The Outlook for U.S. Smaller Companies Looks Increasingly Compelling (Now is not the time to wait on the sidelines). The report highlights additional factors supporting the increased probabilities of small-cap performance.

T. Rowe Price discussed how smaller companies are more oriented towards U.S. economic activity. The author, Curt Organt, the portfolio manager of the firms smaller company equity strategy, also pointes to the many bills in Congress that support capital spending projects in the U.S., explaining this will also provide a tailwind.

• “While the U.S. equity market has become increasingly concentrated at the top end over the past decade, smaller‑company valuations are at their most compelling levels in decades.”

• “History shows that as high concentration in the S&P 500 Index begins to unwind, a new cycle of small‑cap outperformance usually begins.”

• “Shifting trends in the U.S. economy are particularly supportive of smaller companies, providing a potential catalyst for higher earnings growth.”

The portfolio manager discussed how, through history, investors in small-cap stocks ordinarily command higher relative valuations compared to their larger counterparts. At present, as mentioned before, small-cap stocks are currently trading at a substantial discount in relation to large-cap stocks.

Downside protection is also seen as a positive in small-caps, whether compared to its own history, or to today’s large cap valuations. The low valuations in the smaller companies do offer a degree of downside protection during market downturns.

Take Away

At the conclusion of his Jackson Hole speech, Powell said, “As is often the case, we are navigating by the stars under cloudy skies. In such circumstances, risk-management considerations are critical.” Although he was talking about U.S. monetary policy, the words apply equally well if applied to a portfolio’s investment policy. One can never be completely sure of what is around the corner that can either accelerate returns or set the portfolio back. But, placing probabilities on your side, over time, is good practice.

One can never have too much information when selecting companies to invest in. Small company information is particularly challenging for investors to find. Creating a login to Channelchek allows access to data on 6,000 small and microcap companies; this may be the key to further placing investment probabilities on your side. And, if you’d like to take your exploration for the ideal smaller companies to invest in to a higher level, join Noble Capital Markets and Channelchek at its annual investment conference, NobleCon19, this fall.

Managing Editor, Channelchek

Sources

https://www.spglobal.com/spdji/en/indices/equity/sp-600/?utm_source=pdf_commentary#overview

https://www.spglobal.com/spdji/en/indices/equity/sp-600/#overview

https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview