| Key Points: – Dow Jones, S&P 500, and Nasdaq post significant gains following Trump’s presidential win. – S&P Regional Banking ETF jumps over 10%, fueled by expectations of favorable financial policies. – Tesla shares climb over 10% in response to anticipated business-friendly conditions. |

U.S. stocks soared on Wednesday as investors reacted to Donald Trump’s election victory over Kamala Harris, marking his return to the White House. A pivotal call in Wisconsin by the Associated Press early that morning secured Trump the necessary electoral votes, generating a major market response across sectors. With Trump set to be the 47th president, major indices surged. The Dow Jones Industrial Average spiked more than 1,100 points, or 2.7%, leading the rally. Following closely, the S&P 500 gained about 1.5%, while the tech-centric Nasdaq Composite rose approximately 2%.

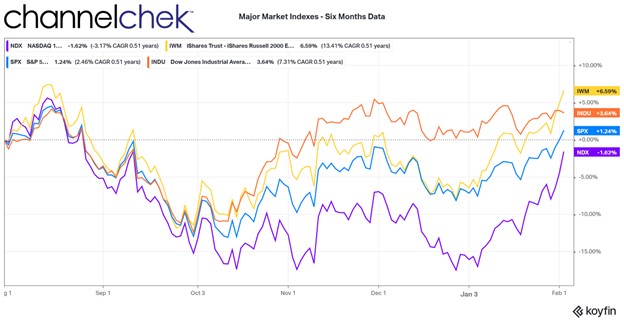

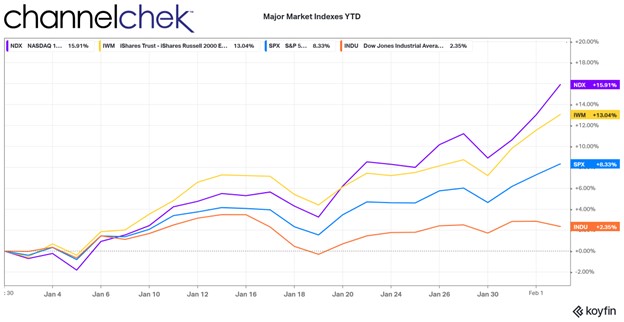

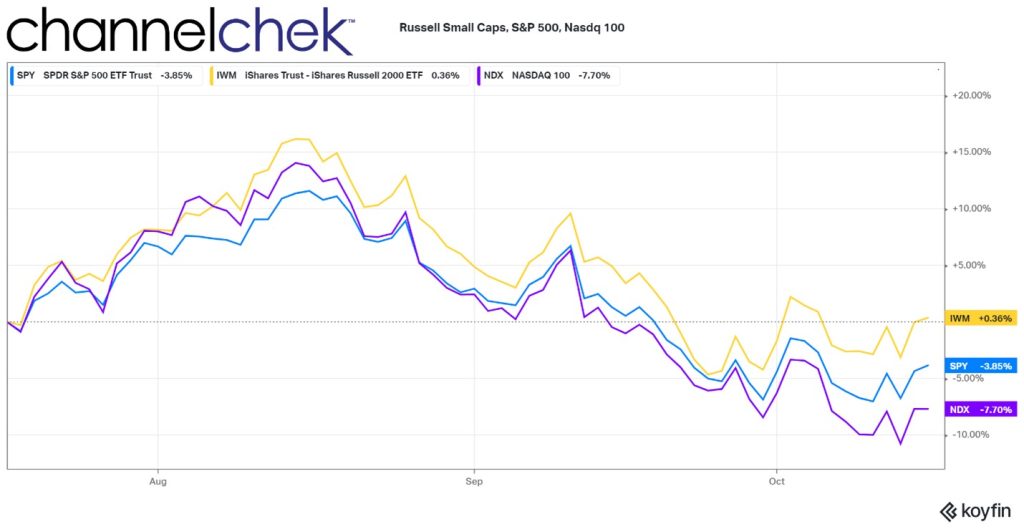

The small-cap Russell 2000 posted particularly strong gains, jumping over 4.2% at the open, spurred by a surge in regional banks and financials. Many investors interpret Trump’s return as a sign of pro-business policies that could favor financial and industrial sectors, given his history of lower tax policies and financial deregulation during his previous term. The S&P Regional Banking ETF (KRE) rose more than 10% early Wednesday, underscoring this trend. Analysts believe that smaller regional banks are set to benefit from a more relaxed regulatory environment, making financials one of the day’s top-performing sectors.

Beyond financial stocks, the 10-year Treasury yield climbed to 4.46%, reflecting higher confidence in economic growth under the incoming administration. Rising yields often signal investor optimism, though they also reflect anticipated inflation. The dollar also strengthened against major global currencies, and Bitcoin surged to an all-time high, with investors anticipating a favorable climate for cryptocurrency investments. The gains in both the dollar and Bitcoin underscore how investors are re-evaluating asset allocation based on the potential for significant economic and regulatory shifts in the U.S.

Technology stocks, and particularly Tesla, were other standout winners. Tesla’s stock shot up by more than 10%, propelled by CEO Elon Musk’s open support of Trump and the potential for business-friendly policies. Musk has previously praised Trump’s tax and regulatory agenda, and with renewed market optimism, analysts expect Tesla and other growth-driven tech companies to benefit from potentially eased restrictions. The strong performance across tech stocks highlights broader investor enthusiasm for sectors with substantial growth potential under Trump’s policies.

Meanwhile, uncertainty around Congress control remains, as Republicans have flipped the Senate, while the House remains too close to call. Control of both chambers could substantially influence the type and extent of economic policies Trump can implement. As of now, investors are weighing scenarios around tax reform, stimulus packages, and regulatory adjustments that could impact sectors like energy, infrastructure, and finance.

The presidential election outcome is expected to drive market momentum in the near term, particularly in areas like financial services, infrastructure, and industrials. The anticipated mix of fiscal stimulus, tax policy changes, and deregulation, while not fully certain, reflects investor sentiment in favor of economic expansion under Trump’s leadership. How the markets react in the longer term will depend on the clarity of legislative actions and potential shifts in U.S. trade policy.