Using Short Interest as an Evaluation Tool

Not everyone involved in the stock market are buying stocks in expectation of them rising. Some market participants are selling, in the expectation that the price will fall. This selling is one of many factors impacting a stocks current price – and could influence future moves. Understanding short interest in a stock that you are active with may provide trading ideas or send warning signs. Below we define short interest, its impact on stock prices, where to look to find the short interest on a particular company, how the information is used, and of course, risks.

What Short Interest Is

Short interest refers to the total number of shares of a particular stock that have been sold short by investors. In simple terms, when an investor “shorts” a stock, they borrow shares from a broker and sell the borrowed shares in the stock market. If all goes well, they buy the shares back in the future, then return them to the broker along with the interest cost (rebate rate) of the borrowed amount.

Short interest is expressed as a percentage or a number, indicating the total shorted shares relative to the stock’s total float or outstanding shares.

What it May Do to the Stock Price

There is more than one possible meaning of a stock having high short interest. One is that the high percentage of short stock outstanding could mean that there is a large number of investors betting against the stock’s performance. This suggests a bearish sentiment and potential bearishness regarding the stock’s future price moves. If many market players continue to remain bearish, the high or escalating short interest can put downward pressure on the stock’s price.

Conversely, a low short interest might suggest a positive sentiment among investors or confidence in the stock’s future performance. It shows the stock has limited potential for a short squeeze, where short sellers are forced to cover positions and the buying causes the price to rise.

How to know the Short Interest of a Stock

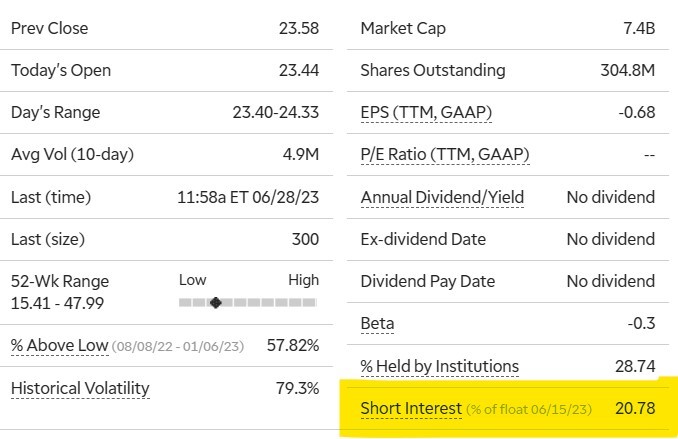

Investors can find short-interest information through many sources, online brokerage platforms, financial news websites, and some stock market research portals. Notable financial websites often provide this data alongside other relevant stock information. Additionally, the U.S. Securities and Exchange Commission (SEC) requires institutional investors to disclose their short positions in certain cases, making this information publicly available.

Example of Short Interest Reported on a Popular Brokerage Platform

Trading With Short Interest Information

Knowing if the short-interest in a company is trending higher, lower, or is stagnant is more helpful than a snapshot of one day’s percentage.

The short interest data can be traded on in a few ways. High short interest can serve as a contrarian indicator. If an investor believes the company has good prospects and it has a high short interest, a price-moving short squeeze could occur if positive news unfolds or strong financial performance triggers buying. This scenario can push short sellers, that are perhaps faced with margin calls, to cover their positions rapidly, resulting in a sharp upward movement in price.

The use as a gauge in market sentiment toward the company, and which way it is trending, can allow you to understand investor behavior over a period of time toward the stocks. Combine this with other fundamental and technical analysis, and short interest data can aid in improving your probability of either a successful trade or successfully avoiding a potential problem.

Short Interest Not Definitive

While short interest can provide valuable insights, it is crucial to understand the risks involved. Short interest data alone is rarely enough to be the sole basis for an investment decision. It is important to conduct or gather comprehensive research and analysis of the stock’s fundamentals, industry trends, and market conditions. Evaluating short interest comes after higher level filtering of a company’s prospects.

Remember, short interest size and trend might not always accurately reflect the actual market sentiment. Market dynamics can change rapidly, and short sellers might cover their positions quickly, resulting in a shift in the stock’s performance. Therefore, investors should consider short-interest data as just one piece of the puzzle and not solely rely on it for investment decisions.

Take Away

Short-interest statistics hold a role in providing insights into market sentiment and potential investment probabilities. Investors can find short-interest information through various sources, enabling them to assess market sentiment and potential short squeezes. However, it is best to use short-interest data in conjunction with comprehensive research and analysis, as it should not be the sole basis for investment decisions. More informed investment choices, it stands to reason, lead to a higher likelihood of success or avoiding failure. By understanding short interest and its implications, investors can enhance their understanding of either a stock, or even the market in the aggregate.

Managing Editor, Channelchek