Research News and Market Data on SALM

August 08, 2023 4:05pm EDT

Related Documents

IRVING, Texas–(BUSINESS WIRE)– Salem Media Group, Inc. (the “company”) (Nasdaq: SALM) released its results for the three and six months ended June 30, 2023.

Second Quarter 2023 Results

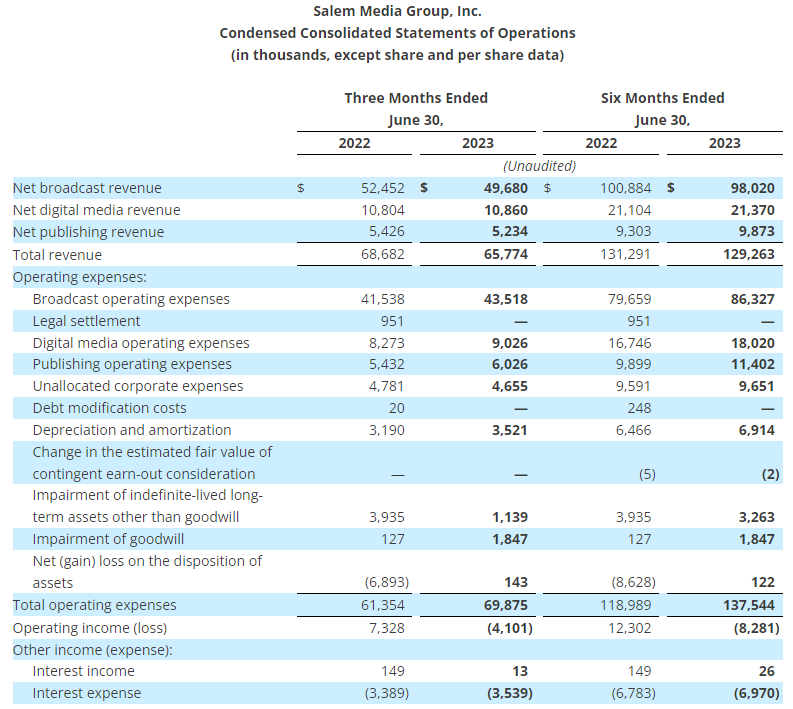

For the three months ended June 30, 2023 compared to the three months ended June 30, 2022:

Consolidated

- Total revenue decreased 4.2% to $65.8 million from $68.7 million;

- Total operating expenses increased 13.9% to $69.9 million from $61.4 million;

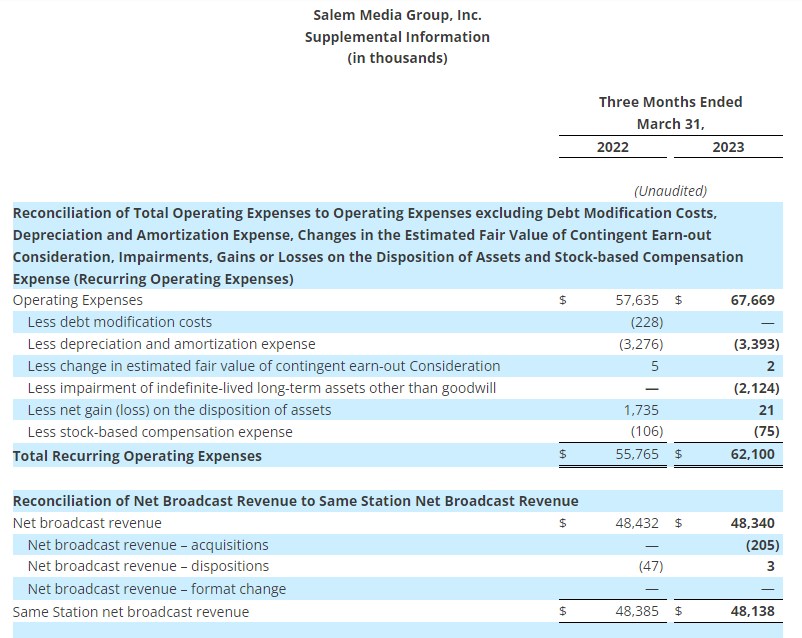

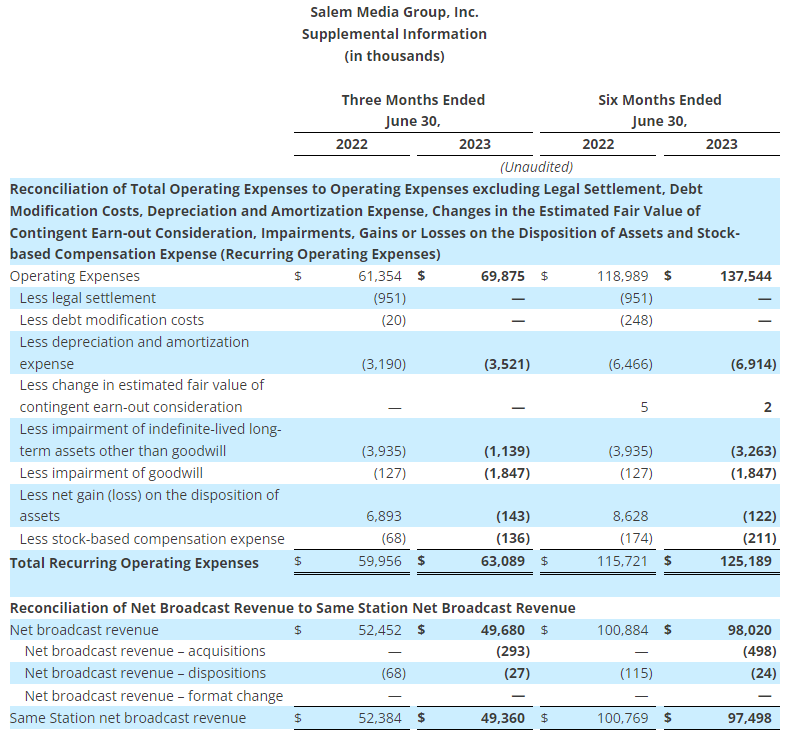

- Operating expenses, excluding stock-based compensation expense, debt modification costs, gains and losses on the sale or disposition of assets, impairments, depreciation expense and amortization expense (1) increased 5.2% to $63.1 million from $60.0 million;

- The company had an operating loss of $4.1 million as compared to operating income of $7.3 million;

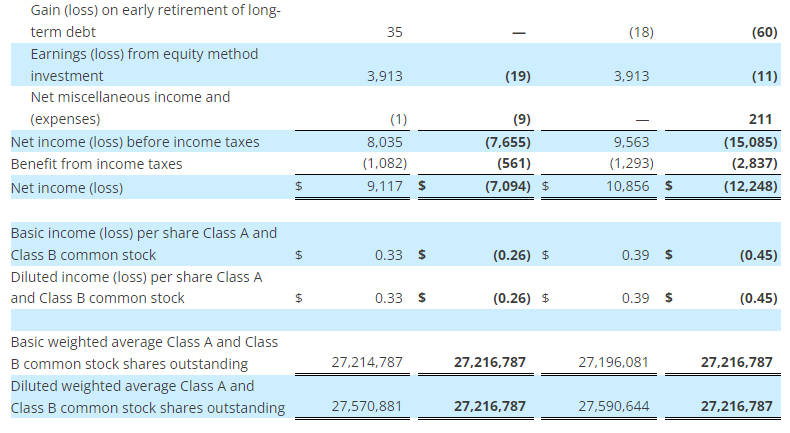

- The company had a net loss of $7.1 million, or $0.26 net loss per share, compared to net income of $9.1 million, or $0.33 net income per diluted share;

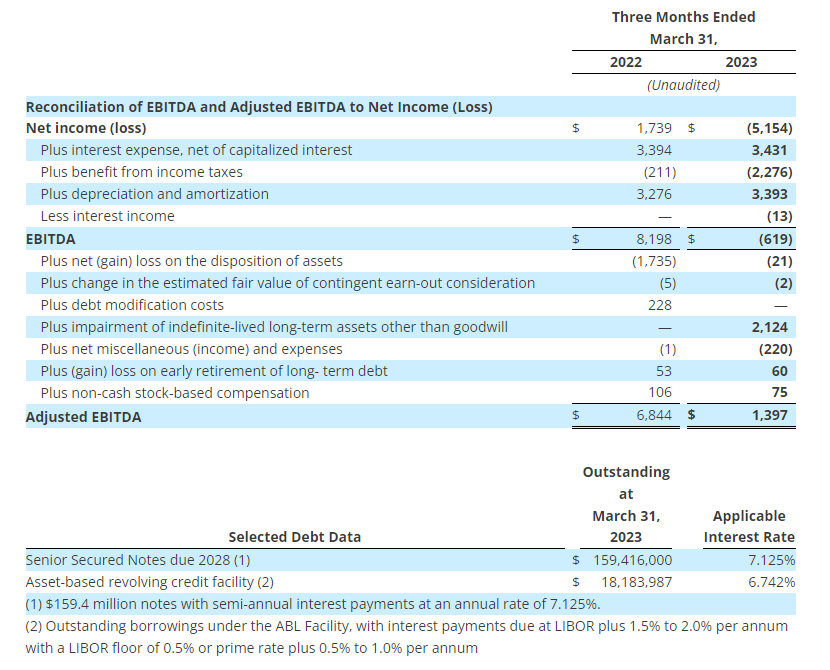

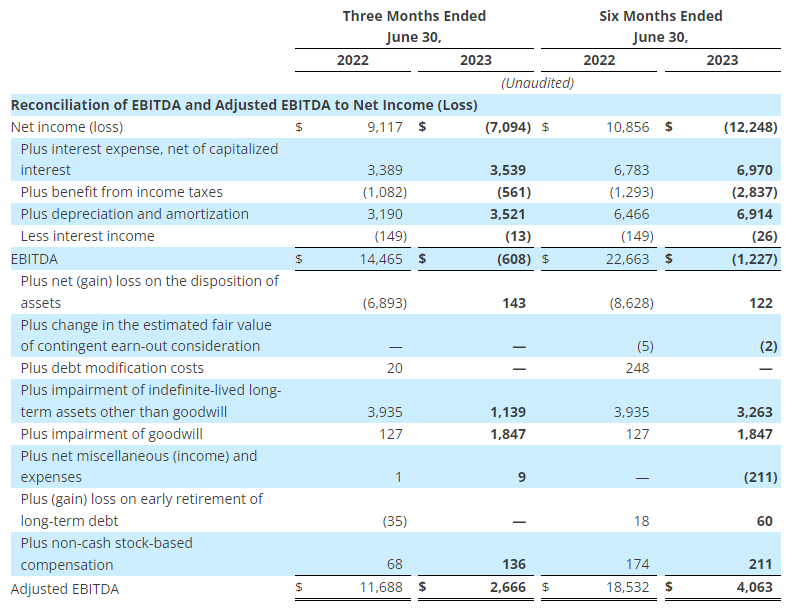

- EBITDA (1) decreased to $(0.6) million from $14.5 million; and

- Adjusted EBITDA (1) decreased 77.2% to $2.7 million from $11.7 million.

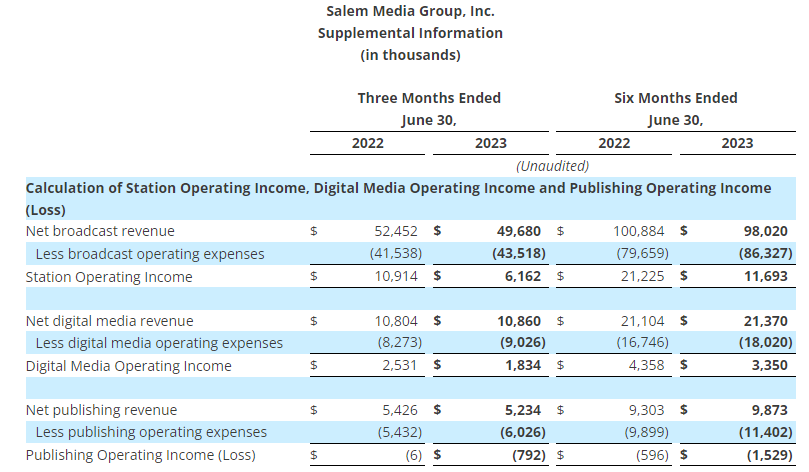

Broadcast

- Net broadcast revenue decreased 5.3% to $49.7 million from $52.5 million;

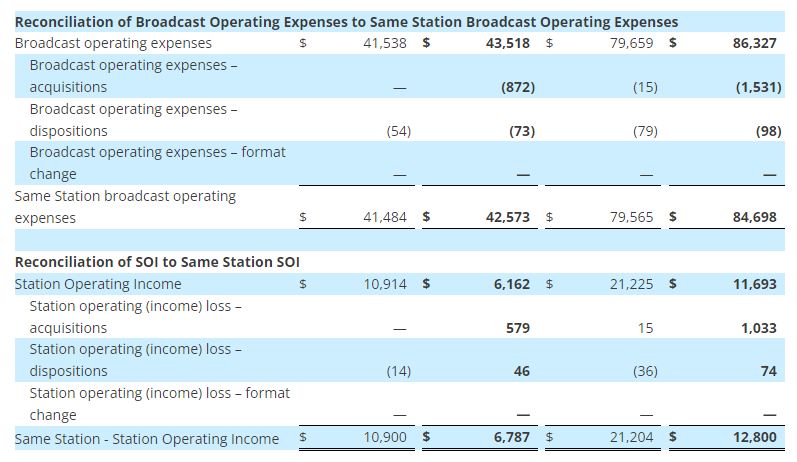

- Station Operating Income (“SOI”) (1) decreased 43.5% to $6.2 million from $10.9 million;

- Same Station (1) net broadcast revenue decreased 5.8% to $49.4 million from $52.4 million; and

- Same Station SOI (1) decreased 37.7% to $6.8 million from $10.9 million.

Digital Media

- Digital media revenue increased 0.5% to $10.9 million from $10.8 million; and

- Digital Media Operating Income (1) decreased 27.5% to $1.8 million from $2.5 million.

Publishing

- Publishing revenue decreased 3.5% to $5.2 million from $5.4 million; and

- Publishing Operating Loss (1) increased to $0.8 million from $6,000.

Included in the results for the three months ended June 30, 2023 are:

- A $1.8 million ($1.4 million, net of tax, or $0.05 per share) impairment charge to the value of goodwill in Townhall;

- A $1.1 million ($0.8 million, net of tax, or $0.03 per share) impairment charge to the value of broadcast licenses in Portland and San Francisco;

- A $0.1 million ($0.1 million, net of tax) net loss on the disposition of assets; and

- A $0.1 million non-cash compensation charge ($0.1 million, net of tax) related to the expense of stock options.

Included in the results for the three months ended June 30, 2022 are:

- A $6.9 million ($5.1 million, net of tax, or $0.19 per diluted share) net gain on the disposition of assets reflects a $6.5 million pre-tax gain on the sale of land used in the company’s Denver, Colorado broadcast operations and a $0.5 million pre-tax gain on the sale of the company’s radio stations in Louisville, Kentucky that was offset by losses from various fixed asset disposals;

- A $3.9 million ($2.9 million, net of tax, or $0.11 per share) impairment charge to the value of broadcast licenses in Columbus, Dallas, Greenville, Honolulu, Orlando, Portland, and Sacramento;

- A $0.1 million ($0.1 million, net of tax) goodwill impairment charge; and

- A $0.1 million ($0.1 million, net of tax) non-cash compensation charge related to the expense of stock options.

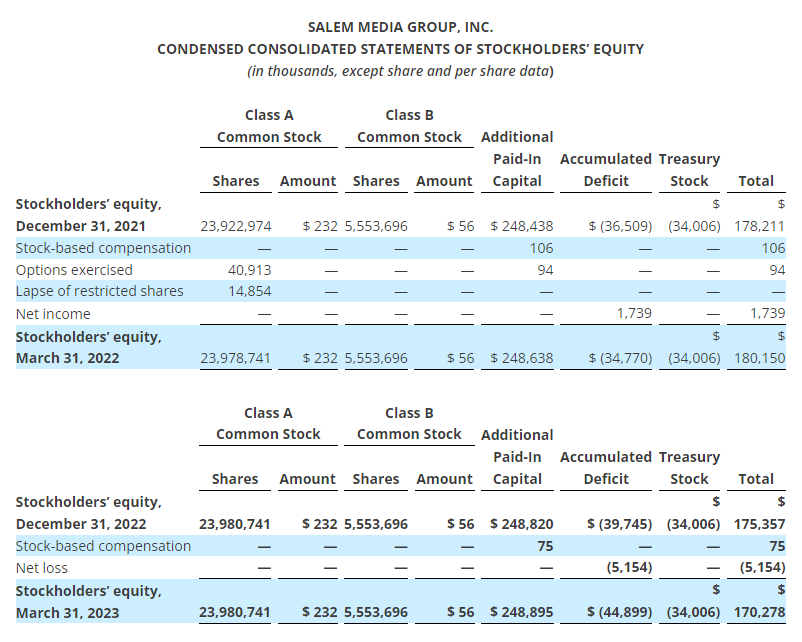

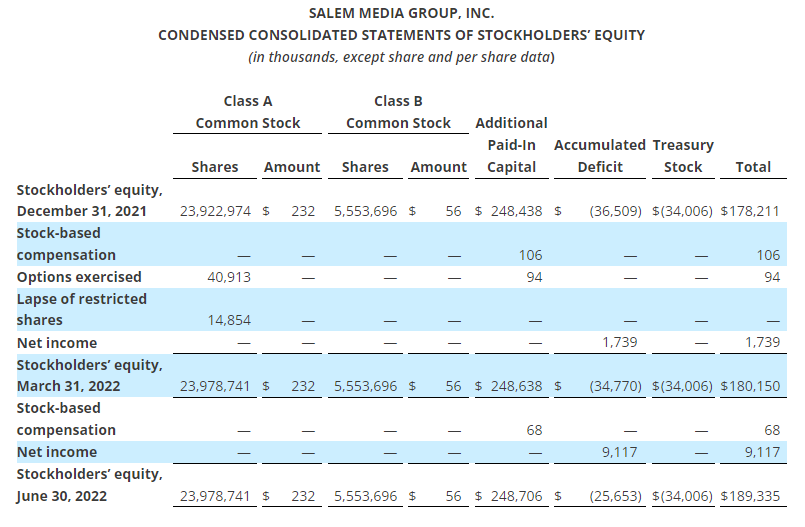

Per share numbers are calculated based on 27,216,787 diluted weighted average shares for the three months ended June 30, 2023, and 27,570,881 diluted weighted average shares for the three months ended June 30, 2022.

Year to Date 2023 Results

For the six months ended June 30, 2023 compared to the six months ended June 30, 2022:

Consolidated

- Total revenue decreased 1.5% to $129.3 million from $131.3 million;

- Total operating expenses increased 15.6% to $137.5 million from $119.0 million;

- Operating expenses, excluding gains or losses on the disposition of assets, stock-based compensation expense, debt modification costs, changes in the estimated fair value of contingent earn-out consideration, impairments, depreciation expense and amortization expense (1) increased 8.2% to $125.2 million from $115.7 million;

- The company had an operating loss of $8.3 million as compared to operating income of $12.3 million;

- The company recognized $3.9 million in film distribution income from an unconsolidated equity investment in the six months ended June 30, 2022;

- The company had a net loss of $12.2 million, or $0.45 net loss per share, compared to net income of $10.9 million, or $0.39 net income per diluted share;

- EBITDA (1) decreased to $(1.2) million from $22.7 million; and

- Adjusted EBITDA (1) decreased 78.1% to $4.1 million from $18.5 million.

Broadcast

- Net broadcast revenue decreased 2.8% to $98.0 million from $100.9 million;

- SOI (1) decreased 44.9% to $11.7 million from $21.2 million;

- Same station (1) net broadcast revenue decreased 3.2% to $97.5 million from $100.8 million; and

- Same station SOI (1) decreased 39.6% to $12.8 million from $21.2 million.

Digital media

- Digital media revenue increased 1.3% to $21.4 million from $21.1 million; and

- Digital media operating income (1) decreased 23.1% to $3.4 million from $4.4 million.

Publishing

- Publishing revenue increased 6.1% to $9.9 million from $9.3 million; and

- Publishing Operating Loss (1) increased 156.5% to $1.5 million from $0.6 million.

Included in the results for the six months ended June 30, 2023 are:

- A $3.2 million ($2.4 million, net of tax, or $0.09 per share) impairment charge to the value of broadcast licenses in Miami, Portland and San Francisco;

- A $1.8 million ($1.4 million, net of tax, or $0.05 per share) impairment charge to the value of goodwill in Townhall;

- A $0.1 million loss on the early retirement of long-term debt associated with the 2024 Notes; and

- A $0.2 million ($0.1 million, net of tax, or $0.01 per share) non-cash compensation charge related to the expense of stock options.

Included in the results for the six months ended June 30, 2022 are:

- A $8.6 million ($6.4 million, net of tax, or $0.23 per diluted share) net gain on the disposition of assets relates primarily to the $6.5 million pre-tax gain on the sale of land used in the company’s Denver, Colorado broadcast operations, the $1.8 million pre-tax gain on sale of land used in the company’s Phoenix, Arizona broadcast operations, and $0.5 million pre-tax gain on the sale of the company’s radio stations in Louisville, Kentucky offset by various fixed asset disposals;

- A $3.9 million ($2.9 million, net of tax, or $0.11 per share) impairment charge to the value of broadcast licenses in Columbus, Dallas, Greenville, Honolulu, Orlando, Portland, and Sacramento;

- A $0.1 million ($0.1 million, net of tax) goodwill impairment charge;

- A $0.2 million ($0.2 million, net of tax, or $0.01 per share) charge for debt modification costs; and

- A $0.2 million ($0.1 million, net of tax) non-cash compensation charge related to the expense of stock options.

Per share numbers are calculated based on 27,216,787 diluted weighted average shares for the six months ended June 30, 2023, and 27,590,644 diluted weighted average shares for the six months ended June 30, 2022.

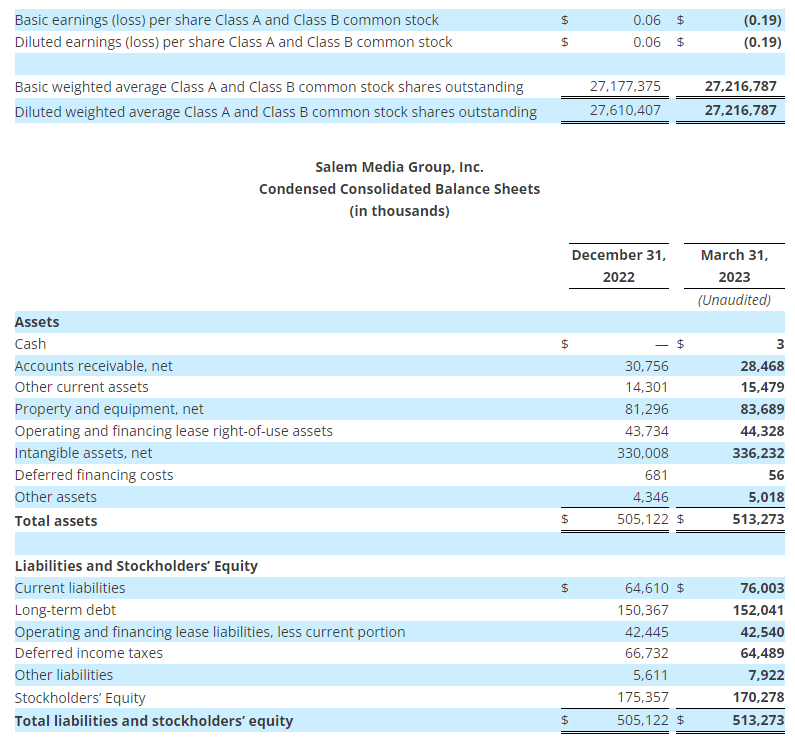

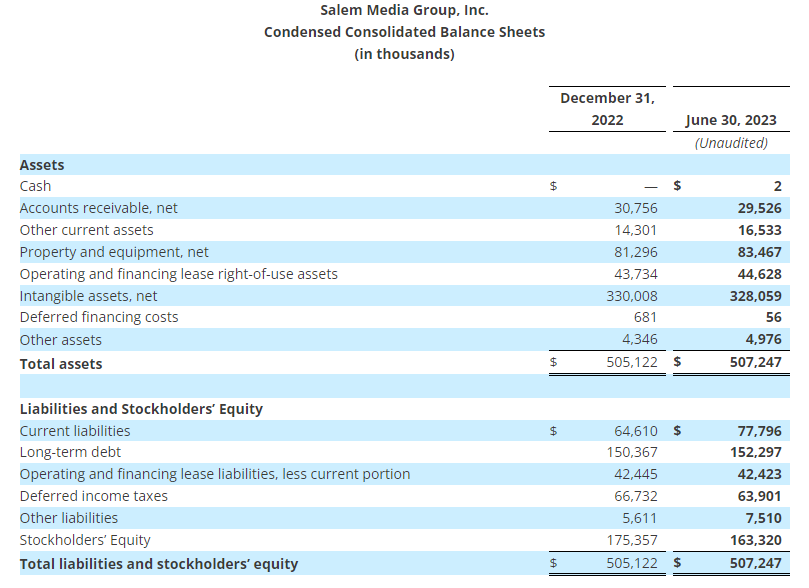

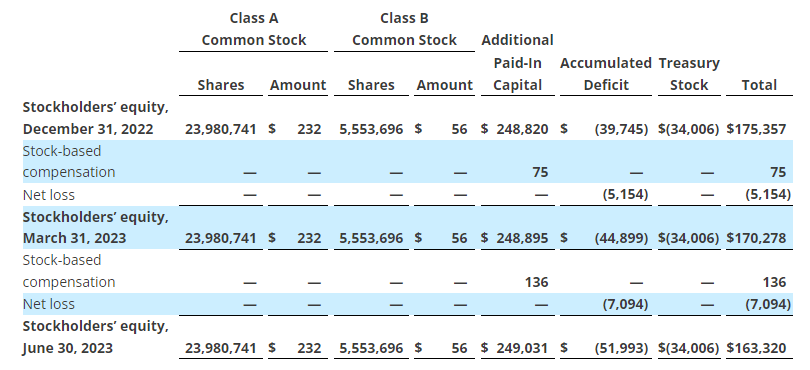

Balance Sheet

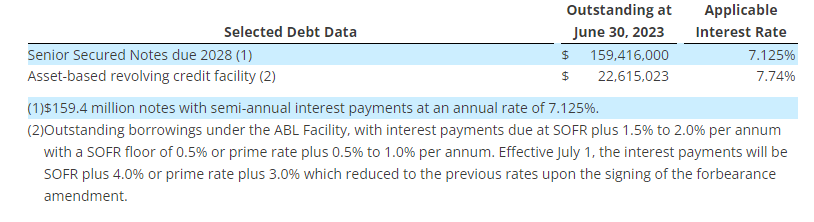

As of June 30, 2023, the company had $159.4 million outstanding on the 7.125% senior secured notes due 2028 (“2028 Notes”) and $22.6 million outstanding on the ABL facility.

Effective June 30, 2023, the company was not in compliance with its fixed charge coverage ratio. On August 7, 2023 the company signed a forbearance whereby the bank agreed not to exercise remedies on the default during the month of August. Additionally, the notional amount of the revolver was reduced from $30.0 million to $25.0 million with a minimum availability of $1.0 million. Finally, the interest rate associated with the revolver increased by two percentage points effective July 1, 2023 through the date of the forbearance amendment.

Acquisitions and Divestitures

The following transactions were completed since April 1, 2023:

- On July 21, 2023 the company closed the sale of radio station KNTS-AM in Seattle, Washington for $0.2 million.

- On July 13, 2023 the company closed the sale of radio station KLFE-AM in Seattle, Washington for $0.5 million. Radio station KLFE-AM was being programmed under a Time Brokerage Agreement (“TBA”) as of August 1, 2022.

- On May 25, 2023, the company entered into a rental income purchase agreement with a related party to sell the assignment of the rents from its Greenville, South Carolina radio transmitter site for $3.5 million commencing on June 1, 2023 resulting in a pre-tax gain of $3.3 million.

Pending transactions:

- On June 29, 2023 the company entered into an agreement to sell radio station KSAC-FM in Sacramento, California for $1.0 million subject to approval of the Federal Communications Commission (“FCC”). Radio station KSAC-FM will begin being programmed under a TBA on August 1, 2023. Based on its plan to sell the station, the company recorded an estimated pre-tax loss on the sale of assets of $3.3 million at June 30, 2023, reflecting the sales price as compared to the carrying value of the assets and the estimated cost to sell. The company expects to close the sale in the fourth quarter of this year.

Conference Call Information

The company will host a teleconference to discuss its results on August 8, 2023 at 4:00 p.m. Central Time. To access the teleconference, please dial (888) 770-7291, and then ask to be joined into the Salem Media Group Second Quarter 2023 call or listen via the investor relations portion of the company’s website, located at investor.salemmedia.com. A replay of the teleconference will be available through August 22, 2023 and can be heard by dialing (800) 770-2030, passcode 2413416 or on the investor relations portion of the company’s website, located at investor.salemmedia.com.

Follow us on Twitter @SalemMediaGrp.

Third Quarter 2023 Outlook

For the third quarter of 2023, the company is projecting total revenue to decline between 3% and 5% from the third quarter 2022 total revenue of $66.9 million. Excluding the impact of the 2022 political revenue, the company would project total revenue to decline between 1% and 3%. The company is also projecting operating expenses before gains or losses on the sale or disposal of assets, stock-based compensation expense, legal settlement, changes in the estimated fair value of contingent earn-out consideration, impairments, depreciation expense and amortization expense (“Recurring Operating Expenses”) to be between a decrease of 1% and increase of 2% compared to the third quarter of 2022 Recurring Operating Expenses of $60.8 million.

A reconciliation of Recurring Operating Expenses (a non-GAAP measure) to the most directly comparable GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the potential high variability, complexity and low visibility with respect to the charges excluded from this non-GAAP financial measure, in particular, the change in the estimated fair value of earn-out consideration, impairments and gains or losses from the disposition of fixed assets. The company expects the variability of the above charges may have a significant, and potentially unpredictable, impact on its future GAAP financial results.

About Salem Media Group, Inc.

Salem Media Group is America’s leading multimedia company specializing in Christian and conservative content, with media properties comprising radio, digital media and book and newsletter publishing. Each day Salem serves a loyal and dedicated audience of listeners and readers numbering in the millions nationally. With its unique programming focus, Salem provides compelling content, fresh commentary and relevant information from some of the most respected figures across the Christian and conservative media landscape. Learn more about Salem Media Group, Inc. at www.salemmedia.com, Facebook and Twitter.

Forward-Looking Statements

Statements used in this press release that relate to future plans, events, financial results, prospects or performance are forward-looking statements as defined under the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those anticipated as a result of certain risks and uncertainties, including but not limited to the ability of the company to close and integrate announced transactions, market acceptance of the company’s radio station formats, competition from new technologies, inflation and other adverse economic conditions, and other risks and uncertainties detailed from time to time in the company’s reports on Forms 10-K, 10-Q, 8-K and other filings filed with or furnished to the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The company undertakes no obligation to update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events.

| (1) | Regulation G | |

| Management uses certain non-GAAP financial measures defined below in communications with investors, analysts, rating agencies, banks and others to assist such parties in understanding the impact of various items on its financial statements. The company uses these non-GAAP financial measures to evaluate financial results, develop budgets, manage expenditures and as a measure of performance under compensation programs. | ||

| The company’s presentation of these non-GAAP financial measures should not be considered as a substitute for or superior to the most directly comparable financial measures as reported in accordance with GAAP. | ||

| Regulation G defines and prescribes the conditions under which certain non-GAAP financial information may be presented in this earnings release. The company closely monitors EBITDA, Adjusted EBITDA, Station Operating Income (“SOI”), Same Station net broadcast revenue, Same Station broadcast operating expenses, Same Station Operating Income, Digital Media Operating Income, Publishing Operating Loss, and operating expenses excluding gains or losses on the disposition of assets, stock-based compensation, changes in the estimated fair value of contingent earn-out consideration, impairments, depreciation and amortization, all of which are non-GAAP financial measures. The company believes that these non-GAAP financial measures provide useful information about its core operating results, and thus, are appropriate to enhance the overall understanding of its financial performance. These non-GAAP financial measures are intended to provide management and investors a more complete understanding of its underlying operational results, trends and performance. | ||

| The company defines Station Operating Income (“SOI”) as net broadcast revenue minus broadcast operating expenses. The company defines Digital Media Operating Income as net Digital Media Revenue minus Digital Media Operating Expenses. The company defines Publishing Operating Loss as net Publishing Revenue minus Publishing Operating Expenses. The company defines EBITDA as net income before interest, taxes, depreciation, and amortization. The company defines Adjusted EBITDA as EBITDA before gains or losses on the disposition of assets, before debt modification costs, before changes in the estimated fair value of contingent earn-out consideration, before impairments, before net miscellaneous income and expenses, before (gain) loss on early retirement of long-term debt and before non-cash compensation expense. SOI, Digital Media Operating Income, Publishing Operating Loss, EBITDA and Adjusted EBITDA are commonly used by the broadcast and media industry as important measures of performance and are used by investors and analysts who report on the industry to provide meaningful comparisons between broadcasters. SOI, Digital Media Operating Income, Publishing Operating Loss, EBITDA and Adjusted EBITDA are not measures of liquidity or of performance in accordance with GAAP and should be viewed as a supplement to and not a substitute for or superior to its results of operations and financial condition presented in accordance with GAAP. The company’s definitions of SOI, Digital Media Operating Income, Publishing Operating Loss, EBITDA and Adjusted EBITDA are not necessarily comparable to similarly titled measures reported by other companies. | ||

| The company defines Same Station net broadcast revenue as broadcast revenue from its radio stations and networks that the company owns or operates in the same format on the first and last day of each quarter, as well as the corresponding quarter of the prior year. The company defines Same Station broadcast operating expenses as broadcast operating expenses from its radio stations and networks that the company owns or operates in the same format on the first and last day of each quarter, as well as the corresponding quarter of the prior year. The company defines Same Station SOI as Same Station net broadcast revenue less Same Station broadcast operating expenses. Same Station operating results include those stations that the company owns or operates in the same format on the first and last day of each quarter, as well as the corresponding quarter of the prior year. Same Station operating results for a full calendar year are calculated as the sum of the Same Station operating results for each of the four quarters of that year. The company uses Same Station operating results, a non-GAAP financial measure, both in presenting its results to stockholders and the investment community, and in its internal evaluations and management of the business. The company believes that Same Station operating results provide a meaningful comparison of period over period performance of its core broadcast operations as this measure excludes the impact of new stations, the impact of stations the company no longer owns or operates, and the impact of stations operating under a new programming format. The company’s presentation of Same Station operating results is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. The company’s definition of Same Station operating results is not necessarily comparable to similarly titled measures reported by other companies. | ||

| For all non-GAAP financial measures, investors should consider the limitations associated with these metrics, including the potential lack of comparability of these measures from one company to another. | ||

| The Supplemental Information tables that follow the condensed consolidated financial statements provide reconciliations of the non-GAAP financial measures that the company uses in this earnings release to the most directly comparable measures calculated in accordance with GAAP. The company uses non-GAAP financial measures to evaluate financial performance, develop budgets, manage expenditures, and determine employee compensation. The company’s presentation of this additional information is not to be considered as a substitute for or superior to the directly comparable measures as reported in accordance with GAAP. |

The company defines EBITDA (1) as net income before interest, taxes, depreciation, and amortization. The table below presents a reconciliation of EBITDA (1) to Net Income (Loss), the most directly comparable GAAP measure. EBITDA (1) is a non-GAAP financial performance measure that is not to be considered a substitute for or superior to the directly comparable measures reported in accordance with GAAP. The company defines Adjusted EBITDA (1) as EBITDA (1) before gains or losses on the disposition of assets,before debt modification costs, before changes in the estimated fair value of contingent earn-out consideration, before impairments, before net miscellaneous income and expenses, before (gain) loss on early retirement of long-term debt, and before non-cash compensation expense. The table below presents a reconciliation of Adjusted EBITDA (1) to Net Income (Loss), the most directly comparable GAAP measure. Adjusted EBITDA (1) is a non-GAAP financial performance measure that is not to be considered a substitute for or superior to the directly comparable measures reported in accordance with GAAP.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230807353391/en/

Evan D. Masyr

Executive Vice President and Chief Financial Officer

(805) 384-4512

evan@salemmedia.com

Source: Salem Media Group, Inc.

Released August 8, 2023