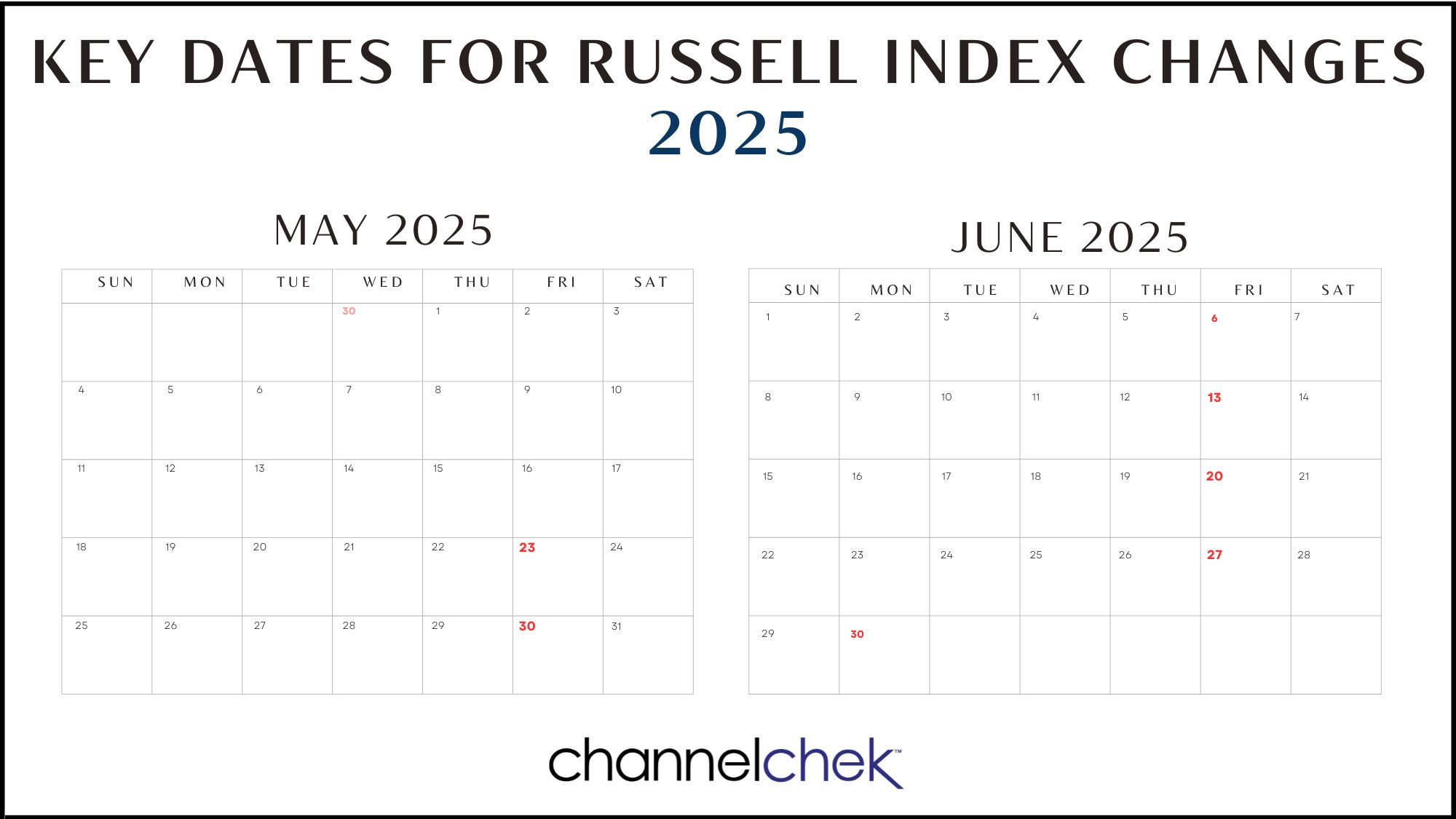

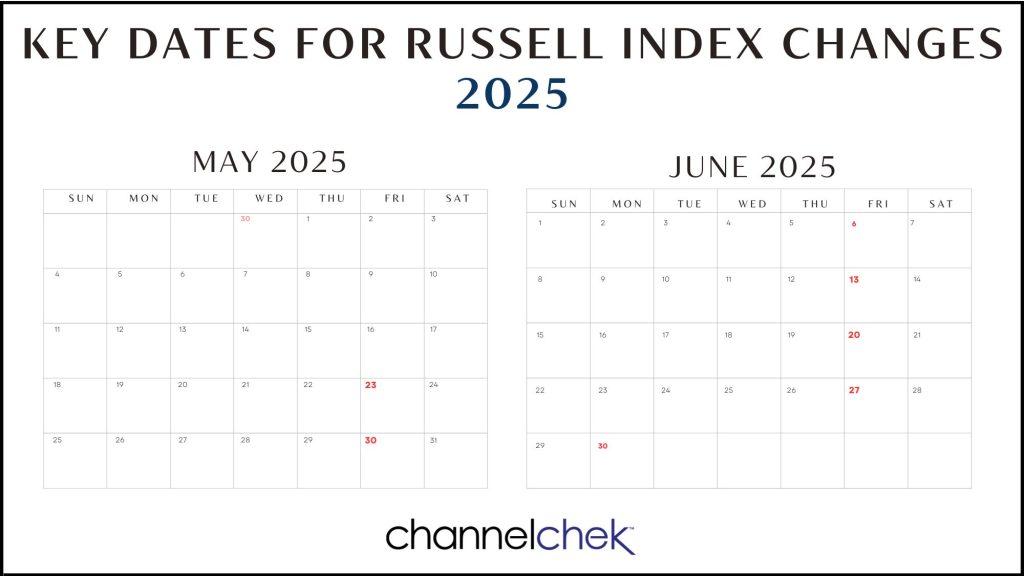

The annual Russell Index reconstitution, which took effect after market close on Friday, June 27, 2025, marked a significant milestone in the small and mid-cap investment landscape. This 37th annual reconstitution represents the final annual rebalancing before FTSE Russell transitions to a semi-annual schedule, making it particularly noteworthy for investors focused on emerging growth companies.

Historically, Russell Reconstitution Day represents the biggest trading close of the year, with last year’s event generating $220 billion in U.S. equity trading volume. This year’s rebalancing has brought several compelling additions to the Russell indexes, particularly in the biotechnology and technology sectors, offering new opportunities for investors seeking exposure to innovative small and mid-cap companies.

Notable New Additions to Watch

Among the most intriguing additions to the Russell indexes this year are several companies that exemplify the dynamic nature of today’s small-cap market. Tonix Pharmaceuticals (TNXP) announced its inclusion in both the broad-market Russell 3000 Index and the small-cap Russell 2000 Index, representing a significant validation of the fully-integrated biotechnology company’s market position and growth trajectory.

Tonix’s addition is particularly noteworthy given the company’s focus on developing treatments across multiple therapeutic areas. The inclusion in these widely-followed indexes is expected to increase institutional investor attention and potentially improve liquidity for the stock, making it more accessible to a broader range of portfolio managers and ETF providers.

Eledon Pharmaceuticals (ELDN) represents another compelling story in the clinical-stage biopharmaceutical space. The company focuses on developing immune-modulating therapies for life-threatening conditions, positioning it at the forefront of innovative medical treatment development. With analyst price targets averaging $10.40 and ranging from $8.00 to $16.00, representing a potential 230% upside from recent trading levels, the stock demonstrates the significant growth potential that Russell Index inclusion can help unlock.

Comstock (LODE) and SKYX Platforms (SKYX) round out a diverse group of new additions that span multiple sectors, from natural resources to technology platforms. These companies represent the type of emerging businesses that the Russell reconstitution process is designed to capture, ensuring that the indexes remain representative of the evolving U.S. equity market landscape.

The Russell reconstitution process serves as a crucial barometer for middle market health and provides institutional validation for growing companies. The process realigns membership across the Russell 1000, Russell 2000, Russell 3000, and Russell Microcap indexes to reflect changes in market capitalization and structure, ensuring these benchmarks accurately represent the current market environment.

For investors focused on small and mid-cap opportunities, these new additions represent companies that have demonstrated sufficient growth, liquidity, and market acceptance to meet Russell’s stringent inclusion criteria. The reconstitution process, which began on April 30 and culminated with the June 27 implementation, involves comprehensive evaluation of company fundamentals and market positioning.

As the Russell indexes transition to semi-annual reconstitution in the future, this year’s additions take on added significance, representing the final cohort selected through the traditional annual process that has guided small-cap investing for decades.

To learn more about emerging opportunities in the small and mid-cap market, join us at Noble Capital Markets’ upcoming Virtual Equity Conference on October 8-9, where we’ll feature presentations from promising growth companies and insights from leading market experts.