The Annual Russell Index Revision and Dates to Watch (2024)

The yearly process of recasting the Russell Indexes begins on Tuesday, April 30 and will be complete by market opening on June 30. During the period in between, FTSE Russell will rank stocks for additions, for deletions and evaluate the companies to make sure they conform overall. The methodology for inserting and removing tickers in the Russell 3000, Russell 2000, and Russell 1000 is intentionally transparent to help eliminate price shocks. Price movements do of course occur along the way, and investors try to foresee and capitalize on them. Channelchek will be providing updates that may uncover opportunities, or at least provide an understanding of stock price swings during this period.

Background

Russell index products are widely used by institutional and retail investors throughout the world. There is more than $20.1 trillion currently benchmarked to a Russell index. This includes approximately $12.1 trillion benchmarked to the Russell US Equity indexes. The trading volume of some companies moving into an index will heighten around the last Friday in June as fund managers seek to maintain level tracking with their benchmark target.

Opportunity

For non-passive investing, determining which stocks may benefit from moving up to a large-cap index, down to a smaller one, or into or out of the measurements is an annual event causing volatility around stocks. There has, of course, the potential for very profitable long and short trades. And the potential for an unwitting investor to be holding a company moving out of an index, which could cause less interest in the stock, and perhaps unfortunate performance.

Active investors should make themselves aware of the forces at play so they may either get out of the way or determine if they should become involved by taking positions with those being added or those at the end of their reign within one of the Russell measurements.

Dramatic Valuation Shifts

The leading industries and altered market-cap of companies of a year ago have changed dramatically from last year’s reconstitution. This will be reflected in the 2023 rebalancing and is going to impact a much larger number of companies than most years. That is to say, a higher percentage of companies than normal will move in, out, or to another index, and may be subject to amplified price movement.

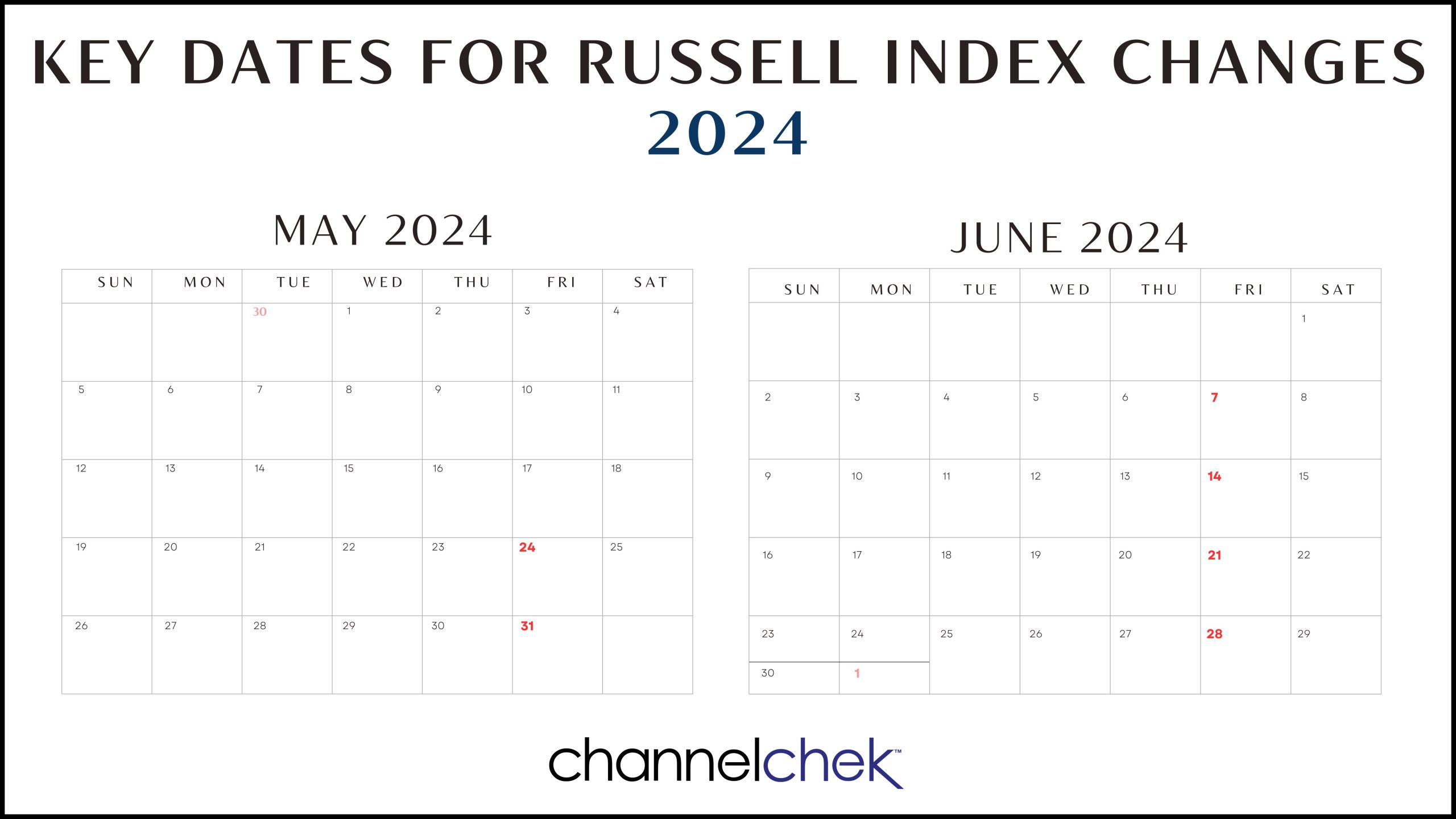

The 2024 Russell Reconstitution Schedule:

• Tuesday, April 30th – “Rank Day” – Index membership eligibility for 2024 Russell Reconstitution determined from constituent market capitalization at market close.

• Friday, May 24 – Preliminary index additions & deletions membership lists posted to the FTSE Russell website after 6 PM US eastern time.

• Friday, May 31st, June 7th, 14th and 21st – Preliminary membership lists (reflecting any updates) posted to the FTSE Russell website after 6 PM US eastern time.

• Monday, June 10th – “Lock-down” period begins with the updates to reconstitution membership considered to be final.

• Friday, June 28th – Russell Reconstitution is final after the close of the US equity markets.

• Monday, July 1st – Equity markets open with the newly reconstituted Russell US Indexes.

Take-Away

The annual reconstitution is a significant driver of dramatic shifts in some stock prices as portfolio managers have their holding needs shifted within a very short period of time. Longer-term demand for certain equities is altered as well. Sizable price movements and volatility are expected, especially around the last week in June. In fact, the opening day of the reconstitution is typically one of the highest trading-volume days of the year in the US equity markets.

The market event impacts more than $9 trillion of investor assets benchmarked to or invested in products based on the Russell US Indexes. Portfolio managers that are required to track one of these indexes will work to have minimal portfolio slippage away from their benchmark. The days and weeks from April 30 through the last Friday in June can create opportunities for investors seeking to benefit from price moves, Channelchek will be covering the event as stocks to be added to, or removed from this year’s Russell Reconstitution and other information plays out.

Take a look at the Russell Reconstitution Guide for 2025

Want small cap opportunities delivered straight to your inbox?

Channelchek’s free newsletter will give you exclusive access to our expert research, news, and insights to help you make informed investment decisions.