The Debate Over the U.S. Spending Limit Opens Investment Opportunities

The U.S. debt-ceiling crisis, as Summer 2023 approaches, can go one of two ways. First, all parties in Congress could quickly meet and vote on fixing it, thus averting a catastrophe; alternatively, the debate could heat up as we approach the day when the U.S. Treasury can’t borrow to pay the country’s bills. At the risk of sounding negative, the timing of Washington finally ironing out a solution is likely to be hours before the moment the country would have been unable to fund maturing debt, minutes before it would have to send workers home and halted other spending.

Okay, so that was a bit pessimistic. But, as investors, we rely on past performance, even though we know it is no guarantee of future results. And past performance by Congress has been that it waits until the 11th hour after all hope seems to be lost.

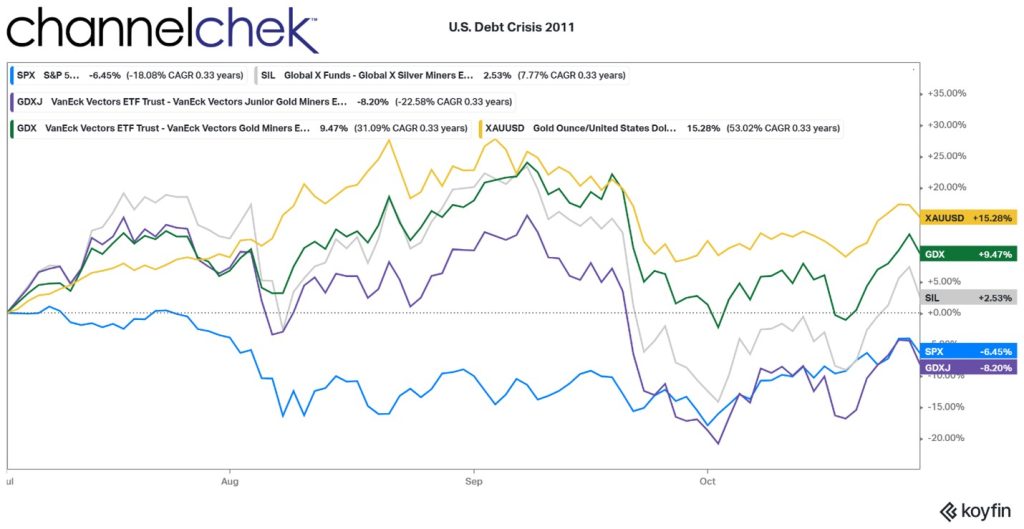

This has happened many times in the past. The last time it became truly scary was in 2011. For equity investors, stocks became volatile but overall averaged flat in the period. But, there were two investment sectors that attracted positive activity.

What’s Rallied in the Past?

The winning sector was U.S. Treasury bonds out along the yield curve with maturity dates not expected to be impacted by a possible non-payment at maturity. Today, bonds are rallying (rates down) even after the PCE inflation gauge showed little headway over the past two months, so this is an indication that government debt may still be considered an investor safe haven. But, investing in an entity headed toward insolvency is questionable practice, even when the entity speeding toward bankruptcy is the United States of America.

The second is precious metals (PM), a currency alternative – the longest-running safe haven of all. By precious metals, I’m speaking specifically of gold, silver, and the stock of companies whose main business it is to mine these metals.

The most recent nail-biting standoff was in 2011. It was a politically contentious time in Washington, arguably, today’s climate is even less agreeable. At the time, the U.S. government had reached its borrowing limit of $14.3 trillion and needed to raise the debt ceiling in order to continue paying its bills and avoid default. Congress, and the White House eventually agreed to a last-minute compromise, which included some spending cuts but avoided a U.S. default.

During this time, the financial markets whipsawed investors. However, gold-related investments, along with silver related, turned dramatically upward until a deal was struck the second week of September. Gold rose to an all-time high of around $1,900 per ounce in September 2011. Investors used gold as a hedge against the same concerns we are experiencing in 2023, namely inflation and currency debasement.

Silver also saw its price rise, although not to the same extent as gold. The price of silver reached a high of around $48 per ounce in April 2011, before retreating to around $30 per ounce by the end of the year.

Mining stocks also benefited from the uncertainty in the financial markets (see above graph). Shares of companies like Barrick Gold, Newmont Mining, and Goldcorp all saw significant gains while other industries were getting whipsawed. Junior miner Coeur mining (CDE) rose 25.7% during the period between July 1 and September 8, 2011. Endeavour Silver (EXK) rose a full 30% in the same period.

Mark Reichman the Senior Research Analyst covering Natural Resources at Noble Capital Markets pointed to additional macroeconomic events shaping precious metals investment, “We remain constructive on precious metals. Year-to-date, gold prices have risen more than silver, and the gold-to-silver ratio has widened since the beginning of the year. Mr. Reichman suggests, “Two things to track are changes in monetary policy and the strength of the U.S. dollar.” Outside of the U.S., Reichman informed, “Global demand for precious metals, particularly in Asia, is very strong, and is driven in part by global uncertainty.”

Take Away

Historically, investors asking, “what happened last time?” can be helpful when choosing a direction. The U.S. may avert a showdown on the debt ceiling/spending limit issue. But the month of June, when analysts expect the U.S. to run out of money, is fast approaching. There doesn’t seem to be any headway at this point.

Every challenge brings opportunities to investors. Market participants interested in precious metals mining companies can get detailed information on many companies here on Channelchek by clicking here.

Paul Hoffman

Managing Editor, Channelchek

Sources

https://en.wikipedia.org/wiki/History_of_the_United_States_debt_ceiling