| Key Points: – Political attention on cryptocurrency is growing, potentially influencing future regulations and market dynamics. -Trump and other politicians are making pro-crypto promises, but implementation challenges remain. – Investors should watch for policy shifts that could impact crypto markets and related investments. |

As the 2024 U.S. presidential election looms, cryptocurrency has unexpectedly taken center stage, promising to reshape both the political and investment landscapes. The recent Bitcoin 2024 conference in Nashville served as a lightning rod for political attention, with figures from across the spectrum – most notably former President Donald Trump – making bold commitments to the crypto community.

Trump’s promises were sweeping: appointing a crypto Presidential Advisory Council, ousting SEC chair Gary Gensler, introducing crypto-friendly regulations, and even establishing a “strategic national bitcoin stockpile.” These pledges were echoed and amplified by other politicians, including Senator Cynthia Lummis and independent candidate Robert F. Kennedy Jr., who proposed acquiring up to 4 million bitcoins for a national reserve.

For investors, this surge in political interest signals potential seismic shifts in the regulatory environment. However, it’s crucial to approach these promises with a healthy dose of skepticism. Many proposed actions face significant legislative and legal hurdles, even in a favorable political climate.

The crypto industry’s growing political clout is evident in its fundraising prowess. FairShake, the largest crypto Super PAC, has amassed over $200 million, positioning itself as a formidable force in upcoming elections. This financial muscle could translate into increased lobbying power and potentially more favorable policies for the sector.

From an investment perspective, this political momentum could lead to several outcomes:

- Regulatory Clarity: A pro-crypto administration could usher in clearer regulations, potentially reducing market uncertainty and attracting more institutional investors.

- Market Volatility: Political developments will likely trigger significant price movements, creating both opportunities and risks for traders and investors.

- Mainstream Adoption: Increased political legitimacy could accelerate crypto’s integration into traditional financial systems, opening new investment avenues.

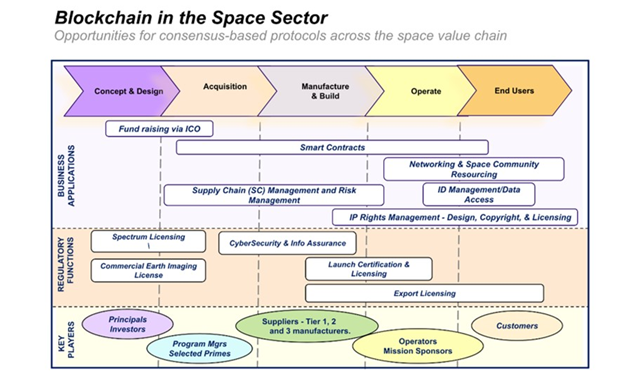

- Sectoral Impact: Companies in blockchain technology, cybersecurity, and fintech could see increased interest as crypto gains political traction.

- Global Competition: A U.S. pivot towards crypto-friendly policies could influence global crypto regulations and investments.

However, investors should remain cautious. The crypto market’s notorious volatility persists, and political promises often face significant obstacles in implementation. The recent ascension of Vice President Kamala Harris as the presumptive Democratic nominee adds another layer of uncertainty, given her undeclared stance on crypto regulation.

Bitcoin’s price action following the conference – surging above $70,000 before retreating – underscores the market’s sensitivity to political developments. Year-to-date, Bitcoin has risen over 50%, buoyed by increased institutional interest following the launch of Bitcoin ETFs.

As the election approaches, savvy investors should monitor several key areas:

- Proposed legislation affecting crypto regulations

- Appointments to key regulatory positions, especially at the SEC and CFTC

- Statements from major political figures on crypto policy

- Progress on initiatives like a national bitcoin reserve

- International reactions and policy shifts in response to U.S. developments

While political attention on crypto is growing, it’s important to note that widespread adoption and understanding remain limited. As Trump candidly observed, “most people have no idea what the hell it is.” This gap between political rhetoric and public comprehension presents both challenges and opportunities for investors.

For those considering crypto investments, a multifaceted approach is crucial:

- Diversification: Balance crypto investments with traditional assets to manage risk.

- Due Diligence: Thoroughly research projects and platforms before investing.

- Regulatory Awareness: Stay informed about evolving regulations both domestically and internationally.

- Technology Understanding: Grasp the underlying technology and its potential applications beyond currency.

- Long-term Perspective: Consider the long-term potential of blockchain technology beyond short-term price fluctuations.

As the 2024 election unfolds, the interplay between politics, regulation, and crypto markets will likely intensify. For investors, this evolving landscape presents a unique set of opportunities and risks. Those who can navigate the complex intersection of technology, finance, and politics may find themselves well-positioned in this new frontier of investing.

Remember, while the potential for high returns exists, so too does the risk of significant losses. As always, it’s crucial to approach any investment, especially in the volatile crypto space, with caution and in alignment with one’s risk tolerance and financial goals.