Stock Market Performance – Looking Back at April, Forward to May

Will the hawks at the Federal Reserve find their perch following the May FOMC meeting? After an aggressive year of tightening, many expect Powell will now signal a pause while the Fed keeps a sharp eye on inflation and other pests that thrive in an overly stimulated economy. Bearish investors that have pulled back are now beginning to have reasons to change their sentiment – their lack of aggressiveness or risk aversion during a solid stock market showing in April may turn their JOMO (joy of missing out) to FOMO (fear of missing out) in the coming weeks.

For a while, the markets have been paddling upstream, navigating a shaky economy with poor visibility. Once the FOMC meeting is in its wake, the stock market should have more visibility from which to make decisions.

Out of the Woods Yet?

The next scheduled FOMC meeting is May 2-3. The expectation is that they will decide to raise Fed Funds another 25bp and then just observe as higher interest rates and all-around tighter money play out in the U.S. economy. Investors will know during the first week of the month if this is what they can expect as Fed Chair Powell will offer guidance at his press conference on May 3.

If the barrage of rate hikes is over, investors will turn their focus toward other factors. These could include the U.S. debt ceiling which is expected to be reached in June, a weakening dollar which benefits U.S. exports, and whether the stock market, which has been pricing itself for a recession may have gone too far with the fear trade.

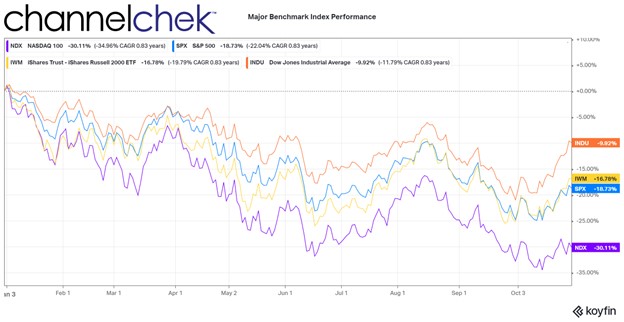

Not shown in these charts is performance since Silicon Valley Bank was closed (March 12). One might expect that this would have caused investors to run to the sidelines. Instead, the S&P 500 rose 8% since March 10. It may be that the event has served as a turning point.

Look Back

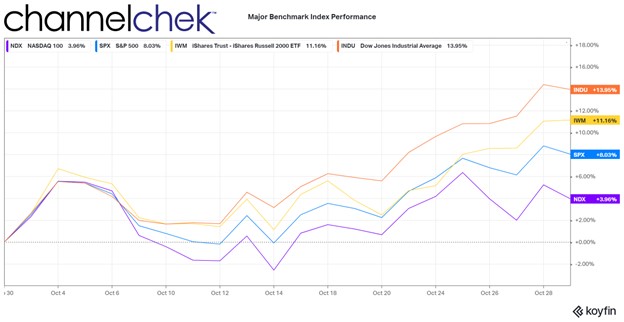

Three of four broad stock market indices (Dow 30, S&P 500, Nasdaq 100, and Russell 2000) were positive in April. The Russell Small-cap index demonstrates the caution that investors were still taking. In theory, small-cap stocks that have traditionally outperformed over longer periods, should make up for some of this lost ground at some point, and reward investors. April was not a month where the risk-on trade made this happen.

The Dow industrials, considered a more conservative index, was up nearly 2.50% during the month. The S&P 500 index was lower at nearly 1.50%, and the Nasdaq 100 rose nearly .50%.

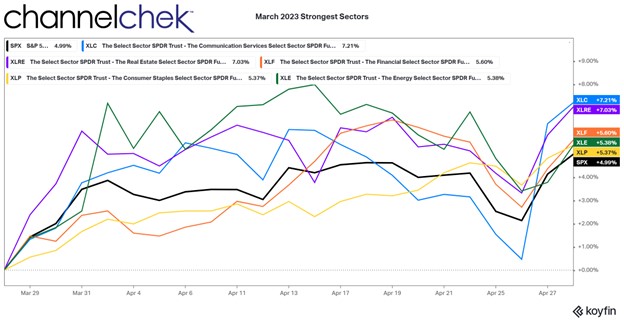

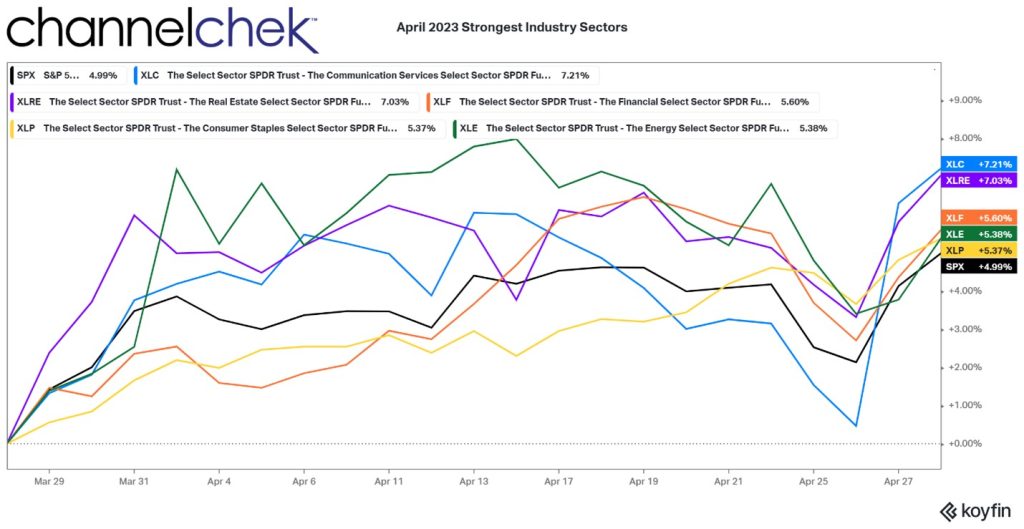

Market Sector Lookback

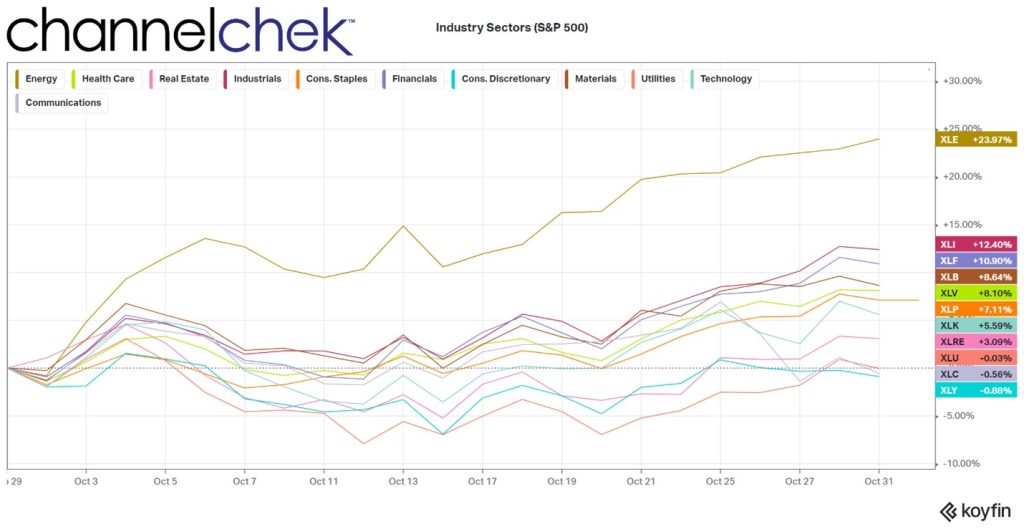

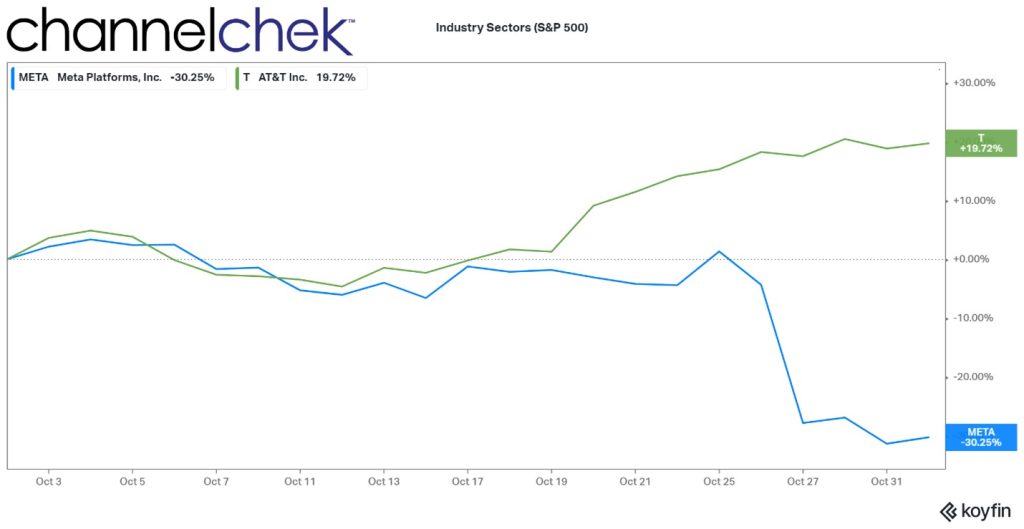

Of the 5 top performing S&P market sectors (SPDR) all exceeded a 5% return on the month. Top on this list was communications stocks in the XLC SPDR; it returned 7.21%. Real Estate rallied in the XLRE to return 7.03% in April, this marks a big turnaround after months of real estate weakness.

One might think that the markets are irrational when they see the financial stocks in the XLF is the third best performer. But the index which includes large banks such as JP Morgan Chase, and Wells Fargo benefitted from investors that quickly decided that the Silicon Valley Bank failure brought financial stocks below where they should be valued.

Energy, as benchmarked by the XLE SPDR rallied as the price of oil began rising after an OPEC decision last month. The price of oil carried energy stocks with it. Lastly, consumer staples indicated by XLP moved up to perform slightly better than the overall S&P 500 Index (SPX).

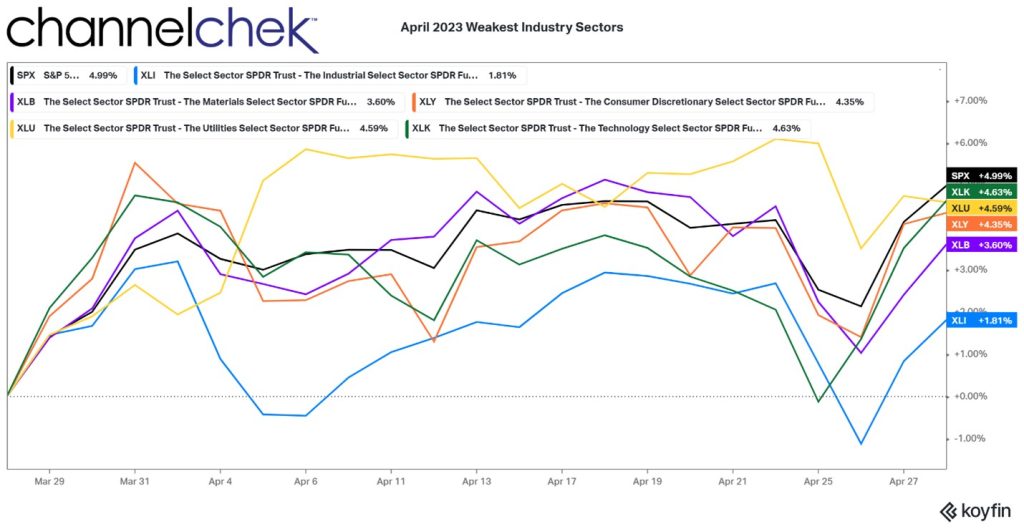

Of the bottom 5, or lowest performing SPDR benchmark ETFs, all were positive performers. The worst of which is Industrials (XLI) returning 1.81%. Second from the bottom was the materials sector shown as XLB, this returned 3.60%. Consumer discretionary companies, or XLY, includes companies like Starbucks, Home Depot, and Nike. This index was third worst, but still approached the average of the full S&P 500 at 4.35%.

XLU are utilities, since utilities usually attract dividend investors, rising rates can weigh on these companies. Many utilities also find their costs increase as energy prices rise. However, the 4.59% increase in the index ETF was part of a broad-based upward move in stocks last month.

The best of the worst was the technology sector or XLK. The return of 4.63% during April shows that big tech was not favored last month. Investors have learned how this sector can roar up and also roar down, this may be causing some to diversify more broadly.

Looking Forward

Should the Fed indicate they are going to pause the tightening cycle, the yield curve may take its more natural upward slope. Fear of recession may be replaced with greater inflation fears with the Fed standing aside. This would cause market factors to reshape the longer end of rates. A positive sloping yield curve would be a positive for the earnings of lending institutions.

Rates in the very short end may begin to spike as no investor wants to be holding a maturing U.S. Treasury if the U.S. doesn’t raise the debt ceiling. This would only impact T-Bills and T-Notes coming due in weeks and months.

Will bearish sentiment turn to bullishness? Those not in the market missed a rally across all industries. This suggests that there was money flowing in as experienced investors and traders know to buy when there is a “sale,” not after the prices have already been jacked up.

Does this mean the risk-on trade is getting started? The broad S&P 500 rising in every industry could demonstrate that fears over a recession, the banking crisis, the war in Europe, and other “hide under your covers” events, were more than priced in. If that is true, strength will continue. With that strength, investors will begin to look for areas that have not participated in the rally. Perhaps this is when small-cap stocks will retake their position as the better performers.

Take-Away

The market has been given a lot to think about recently. First Republic Bank and a forced FDIC take-over, inflation trending up, debt ceiling fears, unexciting earnings, and the realization that higher interest rates on bonds does not mean total return on a bond portfolio can’t be negative. So the “guaranteed return trade” isn’t guaranteed to have a positive return.

The stock market reacts before there is complete clarity. In fact, traders don’t want complete clarity, it’s when a positive economic outlook is most certain is often when the market has peaked. The current lack of sure visibility may now be handing us the opposite effect.

Managing Editor, Channelchek

Sources