The Warning Signs that the Mega-Cap Era Is Coming to an End are Growing

By Monday of next week, the Nasdaq 100 will be rebalanced to reduce the weighting of its top holdings and add weight to the smaller companies represented. This event can be grouped with the number of experts and outlets waving yellow and red flags warning U.S. stock market investors about the reliance on mega-caps for continued performance. The number of warnings has been increasing. The original purpose of any index is to measure overall market or sector performance. Currently reported performance in the most popular indexes is dependent on five to ten mega-cap names – this trend is not sustainable through time. JP Morgan (JPM) is the most recent firm to warn about an extreme concentration of a few stocks.

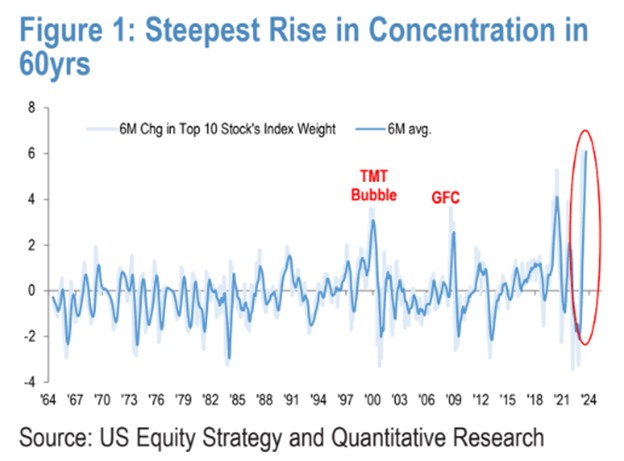

JPMorgan Chase & Co.’s equity analysts, led by Chief Global Markets Strategist Marko Kolanovic, warn that overweighting towards very few companies of extremely large-cap stocks could spell trouble ahead. In a research note published on July 24, the firm writes historically, such periods of extreme concentration have often led to negative outcomes. In fact, the current level of concentration is growing at the fastest pace since the 1960s, surpassing even the extremes seen during the infamous dot-com bubble in March 2000.

To illustrate the stark divergence between the largest U.S.-listed companies and the rest of the market, the JPM team compared the six-month change in the index weighting of the ten largest stocks in the S&P 500 with that of the next 40. This analysis revealed that over the past six months, the divergence has widened in favor of the biggest companies, reaching levels comparable to the “Nifty 50” era of the 1960s—a period when large-cap stocks were highly favored by investors.

Crowding in growth stocks represented in the S&P 500 is currently at the 97th percentile historically. This is a level not seen since the dot-com bubble period. While the team provided extensive data and analysis to support their concerns about overconcentration, they were less definitive about the timing or specific implications for the market.

A selloff is expected and appears likely according to JPM; predicting its timing is more challenging. The team pointed out several potential catalysts, such as a deep recession or a sudden resurgence of inflationary pressures, but it remains uncertain when the downturn may begin. Nonetheless, the JPM team believes that the peak in concentration will coincide with waning investor interest in the generative AI/large-language model theme, a trend that has contributed this year to the significant divergence in equity performance.

In light of Monday’s special rebalancing of the Nasdaq-100, the JPMorgan team suggested that this move could potentially mitigate concentration risk by easing the outperformance of mega-cap technology stocks, including Apple Inc., Microsoft Corp., Nvidia Corp., and Alphabet Inc., which have been major beneficiaries of the AI boom. If a larger percentage of dollars entering large-cap funds find their way to the ticker symbols below the giants at the top, the pace at which the markets have become unbalanced may slow or correct without a major problem.

The JPM team pointed out that if correct, speculators may capitalize on this by considering that the S&P 500 equal weight may be in a position to outperform the S&P 500 traditional weight methodology products over the next three to six months.

Interestingly, there are already signs that the overconcentration problem highlighted by JPMorgan are beginning to ease. Over the last month, the S&P 500 equal-weighted index has outperformed its market-cap-weighted counterpart by 2 percentage points, according to FactSet data.

Despite these concerns, the U.S. stock market closed higher on Monday, with the Dow Jones Industrial Average booking its 11th consecutive daily gain, marking its longest winning streak in nearly six years. The performance of the value-heavy Dow, which has been catching up, while the year-to-date rally of mega-cap tech stocks has stalled, highlights the ongoing dynamics in the market.

Take Away

While some market gurus like Michael Burry have been warning of a bubble brought about by index funds, since 2019, the weighting in indexes have only increased. By the last day in July, the Nasdaq 100 will have taken steps to relieve some of the pressure by shrinking the weighting of the top holdings. JP Morgan analysts are still concerned that the trend is strong and can end with a catalyst triggering an unwinding and move away from the larger high P/E names.

Managing Editor, Channelchek

Sources