January’s Stock Market Performance Bodes Well for the Rest of 2023

The stock market has put in a solid January in terms of overall performance. Following month after negative month last year, this is a welcome relief for those with money in the market which is beginning to look welcoming to those that have been on the sidelines. While the Fed is still looming with perhaps another 50-75 basis points in rate hikes left to implement over the coming months, the market has been resilient and has already made up for some of last year’s lost ground.

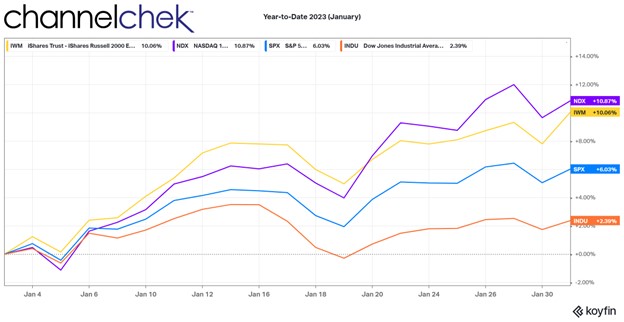

For the month (with an hour left before market close on January 31), the Nasdaq 100 is up over 10.8% for the month. Over 10% would be a good year historically, of course averaging in last year, it is still solidly underperforming market averages. The small-cap Russell 2000 index is also above 10%. Small-caps have underperformed larger cap stocks over several years and are seen to have more attractive valuations now than large caps as well as other fundamental strengths. These include a higher domestic US customer base in the face of a strong dollar, fewer borrowings that would be more costly with the increased rate environment, and an overall expectation that the major indexes will revert to their mean performance spreads which the small-cap indexes have been lagging. The S&P 500, the most quoted stock index is up over 6% in January, and the Dow 30 Industrials are up almost 2.4%.

Rate Increases

The stock and bond markets hope for a solid sign that the FOMCs rate increases will cease. The reduced fear of an ongoing tightening cycle will calm the nervousness that comes from knowing that higher rates hurt the consumer, increases unemployment, reduces spending and therefore hurts earnings which are most closely tied to stock valuations.

January Historically

January rallies, on their own, statistically have been a good omen for the 11 months ahead. When the S&P 500 posts a gain for the first month of the year, it goes on to rise another 8.6%, on average for the rest of the year according to statistics dating back to 1929. In more than 75% of these January rally years, the markets further gained during the year.

Other statistics indicate a bright year to come for the market as well. Using the S&P 500, it rallied for the final five trading days of last year and the first two of 2023, it gained for first five trading days of the new year, and rallied through January. When all three of these have occurred in the past, after a bear market (20%+ decline), the index’s average gain for the rest of the year is 13.9%. In fact it posted positive returns in almost all of the 17 post-bear market years that were ushered in with similar gains.

Follow Through

Beyond history, there is a reason for the follow-through years. January rallies are signs of confidence, they indicate that self-directed investors and professional money managers are buying stocks at the lower prices. It suggests they have a strong enough belief that conditions that caused the bear market have or will soon reverse.

And this is quite possibly where the markets are at today. The lower valuations seem attractive, this is especially true of the overly beaten down Nasdaq 100 stocks and the small-caps that had been trailing in returns since before the pandemic.

Federal Reserve Chair Powell is looking to make money more expensive in order to slow an economy that is still exhibiting inflationary pressures. He is not, however, looking to crush the stock market. Fed governors seem to be concerned that the bond market prices haven’t declined to match their tightening efforts, but a healthy stock market helps the Fed by giving it latitude to act. Powell will take the podium post FOMC meetings eight times this year.

Each time his intention will be to usher in a long term healthy economy, with reasonable growth, low inflation, and jobs levels that are in line with consumer confidence.

Managing Editor, Channelchek

Sources

https://tdameritradenetwork.com/video/how-to-read-the-technicals-before-the-market-changes

https://www.marketwatch.com/story/last-years-stock-market-volatility-has-carried-over-into-january

https://www.barrons.com/articles/stocks-january-gains-what-it-means-51675185839?mod=hp_LATEST