| Key Points: – Oil prices remain vulnerable to the global trade war, impacting Gulf economies dependent on crude exports. – Currency pegs to the U.S. dollar pose challenges, particularly for countries with high external debt. – New trade corridors, particularly between the Gulf and Asia, offer potential opportunities amid shifting global supply chains. |

The Middle East has largely avoided direct tariffs in the ongoing global trade war, but its economies remain vulnerable to broader economic shifts. With oil demand at risk, currency pressures mounting, and global trade flows changing, the region must navigate an increasingly uncertain landscape while also seizing new opportunities.

One of the most immediate concerns for the Middle East is oil. While a weaker U.S. dollar initially benefits oil-exporting nations by making crude cheaper for foreign buyers, tariffs and economic slowdowns could lead to lower global demand. Brent crude prices remain sensitive to global trade conditions, and a prolonged trade war could weigh on revenues for major producers like Saudi Arabia and the UAE. Despite efforts to diversify their economies, oil remains the backbone of many Gulf nations, making them particularly exposed to shifts in global demand.

Another challenge comes from currency pegs. Several Gulf states, including Saudi Arabia, the UAE, Qatar, Oman, and Bahrain, have their currencies tied to the U.S. dollar. As the dollar fluctuates in response to tariffs and economic policies, these countries face higher import costs. This could lead to inflationary pressures, especially in economies heavily reliant on imported goods. At the same time, countries with significant external debt, such as Lebanon, Jordan, and Egypt, could struggle with higher debt-servicing costs if the dollar strengthens further.

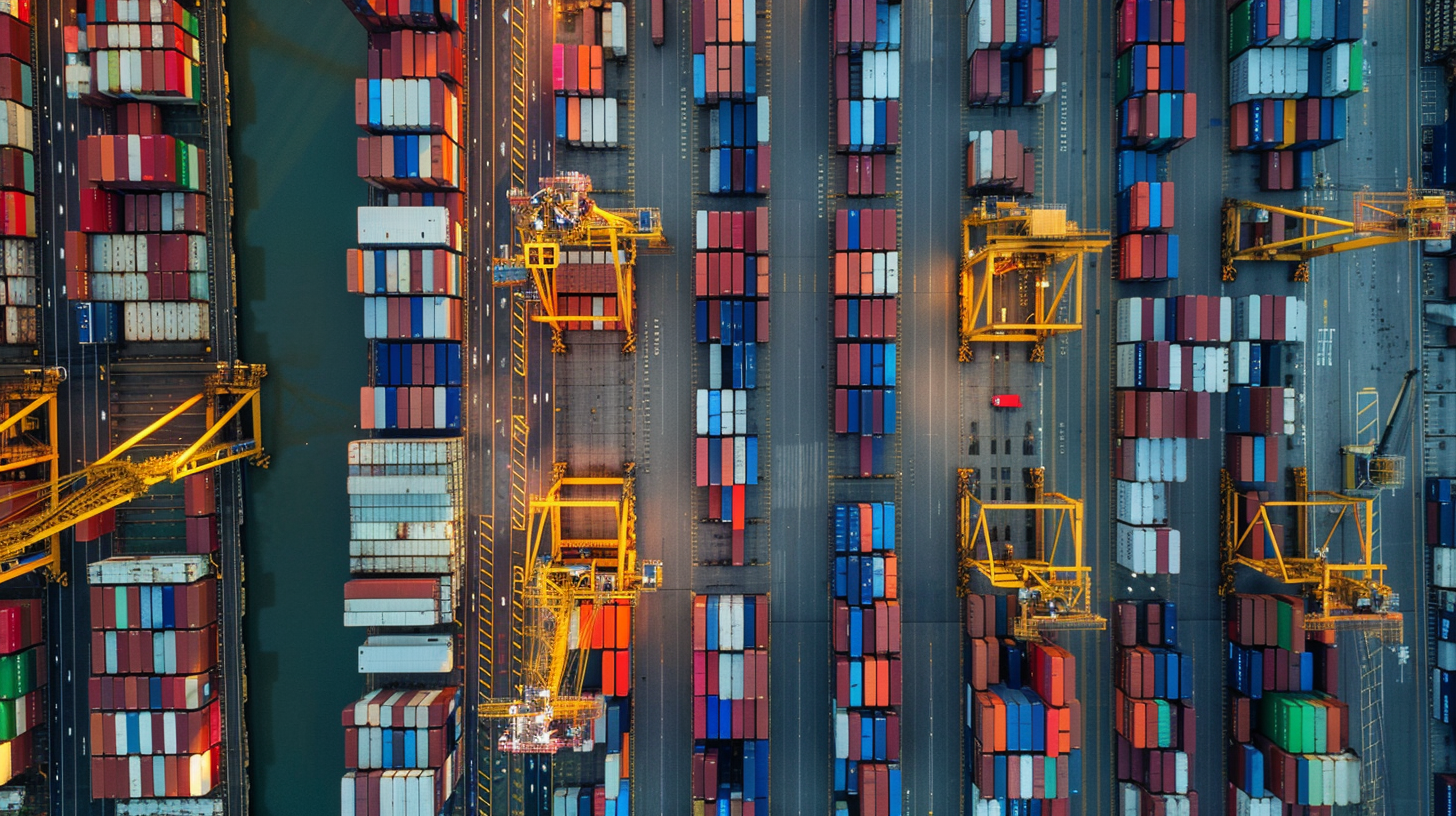

Trade tensions also pose risks to regional trade hubs like the UAE, which depend on global trade flows. As a logistics and financial center, Dubai has built its economy around international commerce, meaning a prolonged global slowdown could impact its growth. Economists warn that while Gulf economies have taken steps to diversify, the effects of reduced trade volumes could still be felt.

However, the situation is not entirely negative. The trade war has also encouraged the creation of new trade corridors, particularly between the Gulf and Asia. The GCC-Asia trade relationship has seen sustained growth, with increasing investment and business ties. China’s Belt and Road Initiative has already deepened economic connections, and as global supply chains shift, Middle Eastern economies could benefit from a larger role in these emerging trade networks.

Political factors could also play a role in shaping the region’s economic resilience. U.S. President Donald Trump has maintained strong ties with Gulf nations, particularly Saudi Arabia, and has shown an interest in keeping them aligned with U.S. economic and geopolitical priorities. This relationship may provide some buffer against trade war fallout, as evidenced by Jordan’s ability to secure exemptions from certain U.S. tariffs due to its strategic importance.

Looking ahead, Middle Eastern economies must continue to adapt to changing global conditions. Strengthening domestic demand, securing diversified trade partnerships, and managing currency risks will be key strategies for mitigating potential downturns. While challenges remain, opportunities exist for the region to carve out a more influential role in global trade as supply chains and economic alliances shift.