Research News and Market Data on NNBR

PDF Version

NN delivers third consecutive year of successful transformation; completes majority of heavy spending

NN forecasts fourth year of improvement, and a return to organic net sales growth in 2026

CHARLOTTE, N.C., March 04, 2026 (GLOBE NEWSWIRE) — NN, Inc. (NASDAQ: NNBR) (“NN” or the “Company”), a global diversified industrial company that engineers and manufactures high-precision components and assemblies, today reported its financial results for the fourth quarter and full-year ended December 31, 2025. Key results include:

Financial Highlights

- Q4 2025 net sales of $104.7 million and full-year 2025 net sales $422.2 million

- Q4 2025 gross margin of 9.2% and full-year 2025 gross margin of 14.1%

- Q4 2025 adjusted gross margin of approximately 18.8%, up 120 bps and approaching the Company’s five-year target of 20%

- Q4 2025 operating loss of $10.4 million, and full-year 2025 operating loss of $18.9 million, improving 38.3% and 31.3%, respectively

- Q4 2025 adjusted operating income of $3.3 million and full-year 2025 adjusted operating income of $14.2 million, improving 34.2% and 180.0%, respectively

- Q4 2025 GAAP net loss of $11.3 million or $0.35 per share and full year 2025 GAAP net loss of $24.4 million, or $1.07 per share

- Q4 2025 adjusted earnings per share of $0.00 and adjusted loss per share of $0.03 for the full-year 2025

- Q4 2025 adjusted EBITDA of $12.9 million (12.3% of net sales) and full year 2025 adjusted EBITDA of $49.0 million (11.6% of net sales), respectively

Commercial & Strategic Highlights

- Third consecutive year of achieving or beating target rate of new business wins, with approximately $70 million secured in 2025, exceeding guidance range, and bringing the three-year cumulative total to more than $200 million

- New wins are accretive to consolidated margin profile

- NN is achieving a >20% hit rate on new business opportunities

- NN has won more than 170 new sales program awards which have launched during 2025 or will launch in 2026

- NN secured its first new business win in the data center market with expanded commercial plans in the data center and electrical/power infrastructure ecosystem

- Sales pipeline of more than $800 million across more than 800 programs, concentrated in targeted areas.

- During 2025, NN significantly upsized the business development team for electrical products

- NN formed a Strategic Committee of the Board of Directors in December 2025 to evaluate a range of strategic and financing alternatives to enhance shareholder value.

“NN delivered a third consecutive year of improved financial performance in 2025, and we look ahead to 2026 with increased confidence in our trajectory for sales, margins, and adjusted EBITDA,” said Harold Bevis, Chief Executive Officer of NN, Inc. “In 2025 we drove adjusted EBITDA towards recent highs despite softness in automotive and commercial vehicle markets and record high precious metal prices. Importantly, we completed the most capital-intensive portion of our transformation plan that included plant closures, significant headcount realignment, and exiting dilutive business. As a result, NN enters 2026 as a healthier, leaner, and more focused company, performing on multiple fronts, while beginning our next chapter of net sales growth.”

Bevis continued, “We expect 2026 to be a meaningful inflection point, and we are guiding to a fourth consecutive year of improved adjusted EBITDA which we expect to range between $50 million to $60 million. Our forecasted sales growth is already underway in the first quarter of 2026, and we plan to launch approximately 100 new programs in 2026. These new programs carry accretive margins that will strengthen our EBITDA and cash flow profile as they ramp. Critically, the success of our new wins program, our planned launches, and more stable markets will return NN’s annual net sales growth. We expect real commercial momentum, and we are also increasing our goals for new business wins for the year to a range of $70 million to $80 million.”

Bevis concluded, “The progress we have made and the momentum we are carrying into 2026 and beyond gives us increasing confidence in NN’s forward net sales trajectory. Our business mix continues to shift toward higher-growth, higher-margin markets including data center power, electrical grid infrastructure, defense, and medical, and we recently secured our first direct data center win. We believe the combination of our operational transformation and accelerating sales growth positions NN to deliver meaningful and sustained value creation for shareholders both in 2026 and in the years ahead.”

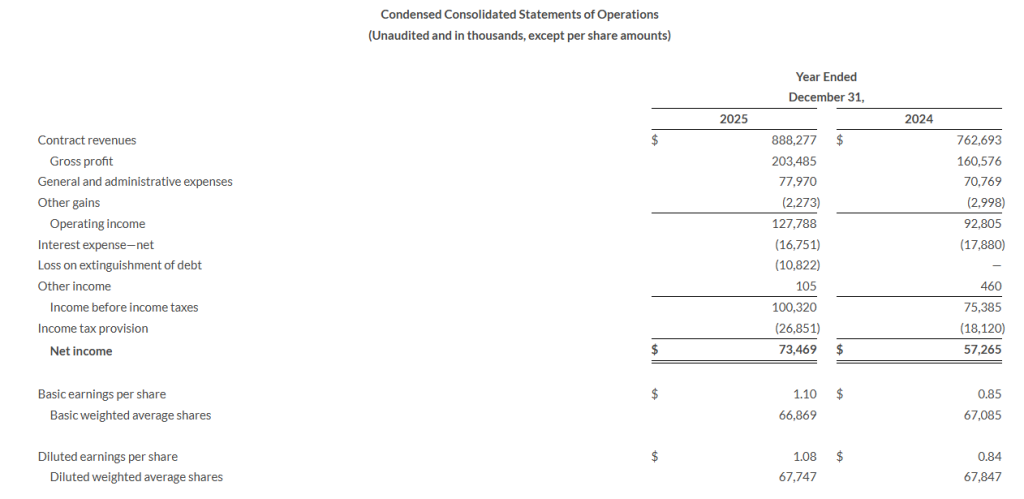

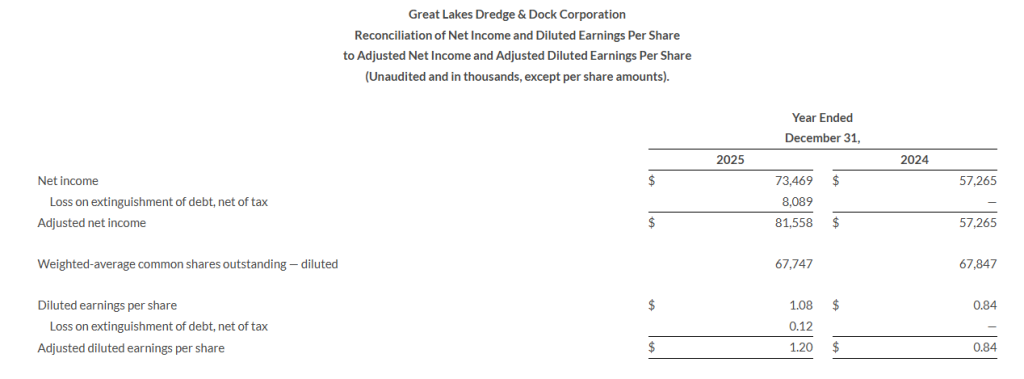

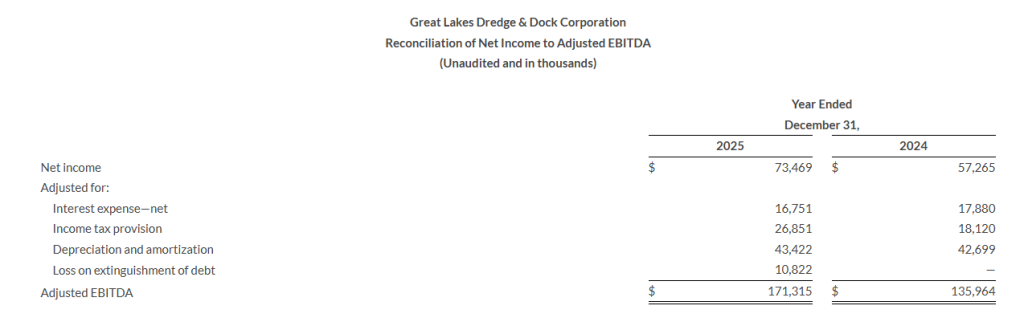

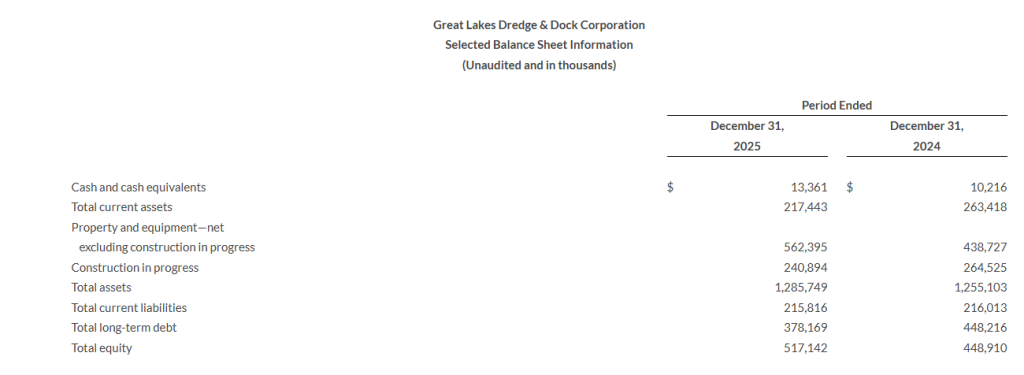

Fourth Quarter Results

Net sales were $104.7 million, a decrease of 1.7% compared to the fourth quarter of 2024 net sales of $106.5 million, which was primarily due to rationalization of underperforming business and plants and lower volumes partially offset by favorable foreign exchange impact of $2.1 million.

Loss from operations for the fourth quarter was $10.4 million compared to a loss from operations of $16.9 million for the same period of 2024. The year-over-year improvement was due to rationalization of underperforming business and plants, impairment of machinery and equipment recorded in 2024 at a plant that closed in 2025, and lower compensation expense due to decreased headcount.

Net loss for the fourth quarter was $12.5 million compared to net loss of $21.0 million for the same period in 2024. The year-over-year improvement was due to rationalization of underperforming business and plants, impairment of machinery and equipment recorded in 2024 at a plant that closed in 2025, and lower compensation expense due to decreased headcount.

Full-Year Results

Net sales for the year ended December 31, 2025, were $422.2 million compared to $464.3 million for the same period of 2024, a decrease of $42.1 million, or 9.1%. This was primarily due to the rationalization of underperforming business and plants, the sale of our Lubbock operations, lower volumes, and unfavorable foreign exchange effects of $0.6 million. These decreases were partially offset by the contribution of new business launches and higher precious metals pass-through pricing. Power Solutions sales were up while Mobile Solutions sales were down primarily due to a decline in low-margin auto parts business.

Loss from operations for the year ended December 31, 2025, was $18.9 million compared to a loss from operations of $27.5 million for the same period of 2024. The year-over-year improvement was due to rationalization of underperforming business and plants, impairment of machinery and equipment recorded in 2024 at a plant that closed in 2025, decrease in depreciation due to the impact of historical purchase accounting step-up basis being fully depreciated in the second half of 2024, and lower compensation expense due to decreased headcount. The improvement is partially offset by lower volumes.

Net loss for the year ended December 31, 2025, was $34.0 million compared to net loss of $38.3 million for the same period of 2024. The year-over-year improvement was primarily due to our improvement in loss from operations. The improvement is partially offset by loss on extinguishment of debt in 2025.

Fourth Quarter Adjusted Results

Adjusted EBITDA for the fourth quarter of 2025 was $12.9 million, or 12.3% of sales, compared to $12.1 million, or 11.3% of sales, for the same period of 2024. Adjusted income from operations for the fourth quarter of 2025 was $3.3 million compared to adjusted income from operations of $2.4 million for the same period of 2024.

Adjusted net loss for the fourth quarter of 2025 was $0.1 million, or $0.00 per diluted share, compared to adjusted net loss of $0.9 million, or $0.02 per diluted share, for the same period of 2024.

Power Solutions

Net sales for the fourth quarter of 2025 were $45.5 million compared to $39.2 million in the same period in 2024, an increase of 16.1%. The increase was primarily due to steady volumes, higher precious metals pass-through pricing and favorable foreign exchange effects.

Loss from operations for the fourth quarter was $3.9 million compared to income from operations of $1.3 million for the same period of 2024.

Adjusted income from operations for the fourth quarter was $4.9 million compared to adjusted income from operations of $4.6 million for the same period of 2024. The increase in adjusted income from operations was primarily due to lower administrative costs.

Net sales for the year ended December 31, 2025, were $178.6 million compared to $180.5 million for the same period of 2024, a decrease of $1.9 million, or 1.1%. This was primarily due to the sale of our Lubbock operations, lower volumes and unfavorable foreign exchange effects of $0.8 million. These decreases were partially offset by higher precious metals pass-through pricing.

Income from operations for the year ended December 31, 2025 was $10.3 million compared to income from operations of $13.1 million for the same period of 2024, a decrease of $2.8 million. This was primarily due to the sale of our Lubbock operations and lower volumes. The decrease is partially offset by lower administrative costs and lower depreciation and amortization expense due to sold or fully utilized assets.

Adjusted income from operations for the year ended December 31, 2025 was $26.9 million compared to adjusted income from operations of $24.7 million for the same period in 2024.

Mobile Solutions

Net sales for the fourth quarter of 2025 were $59.3 million compared to $67.4 million in the fourth quarter of 2024, a decrease of 12.0%. The decrease was primarily driven by rationalization of underperforming business and plants and lower volumes and partially offset by favorable foreign exchange impact.

Loss from operations for the fourth quarter was $1.4 million compared to loss from operations of $12.9 million for the same period of 2024. The improvement was primarily driven by rationalization of underperforming business and plants, impairment of machinery and equipment recorded in 2024 at a plant that closed in 2025, and lower compensation expense due to decreased headcount.

Adjusted income from operations for the fourth quarter was $3.1 million compared to adjusted income from operations of $2.5 million for the same period of 2024. The increase in adjusted income from operations was primarily due to the rationalization of underperforming business and plants.

Net sales for the year ended December 31, 2025, were $244.0 million compared to $283.9 million for the same period of 2024, a decrease of $39.9 million, or 14.1%. This was primarily due to rationalization of underperforming business and plants, lower volume in North America, and partially offset by favorable foreign exchange effects.

Loss from operations for the year ended December 31, 2025, was $8.0 million compared to loss from operations of $18.1 million for the same period of 2024. The improvement was primarily driven by rationalization of underperforming business and plants, impairment of machinery and equipment recorded in 2024 at a plant that closed in 2025, lower depreciation expense due to the impact of historical purchase accounting step-up becoming fully depreciated in the second half of 2024, and lower compensation expense due to decreased headcount.

Adjusted income from operations for the year ended December 31, 2025, was $7.3 million compared to adjusted income from operations of $1.5 million for the same period of 2024. The increase was primarily due to rationalization of underperforming business and plants and lower depreciation expense due to the impact of historical purchase accounting step-up becoming fully depreciated in the second half of 2024.

2026 Outlook

- Revenues are expected to range between $445 to $465 million with modest organic growth coupled with new business launches, values may vary based on metals cost

- Adjusted EBITDA expected to range between $50 and $60 million with modest operating leverage

- New business wins are expected to increase to $70 to $80 million

Chris Bohnert, Senior Vice President and Chief Financial Officer commented, “For fiscal 2026, we are guiding net sales in the range of $445 million to $465 million and adjusted EBITDA in the range of $50 million to $60 million, reflecting a return to year-over-year net sales growth, and a notable expansion versus prior year. Importantly, this top-line growth will flow through a cost structure that has been fundamentally improved over the course of our transformation. The resulting operating performance is expected to drive adjusted EBITDA growth and margin expansion.”

Conference Call

NN will discuss its results during its quarterly investor conference call on March 5, 2026, at 9 a.m. ET. The call and supplemental presentation may be accessed via NN’s website, www.nninc.com. The conference call can also be accessed by dialing 1-877-255-4315 or 1-412-317-6579. For those who are unavailable to listen to the live broadcast, a replay will be available shortly after the call until March 6, 2027.

NN discloses in this press release the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of restructuring and integration expense, acquisition and transition expenses, foreign exchange impacts on inter-company loans, amortization of intangibles and deferred financing costs, and other non-operating impacts on our business.

The financial tables found later in this press release include a reconciliation of adjusted income (loss) from operations, adjusted operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow to the U.S. GAAP financial measures of income (loss) from operations, net income (loss), net income (loss) per diluted common share, and cash provided (used) by operating activities.

The Company is unable to include a reconciliation of forward-looking Adjusted EBITDA to net loss, the most directly comparable GAAP measure, without unreasonable effort due to the high variability with respect to the impact of items such as income taxes, depreciation and amortization, stock-based compensation expense and other items that are excluded from this non-GAAP measure.

About NN, Inc.

NN, Inc., a global diversified industrial company, combines advanced engineering and production capabilities with in-depth materials science expertise to design and manufacture high-precision components and assemblies for a variety of markets on a global basis. Headquartered in Charlotte, North Carolina, NN has facilities in North America, Europe, South America, and Asia. For more information about the company and its products, please visit www.nninc.com.

This press release contains express and implied forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our financial outlook for full year 2026, the impact of, and our ability to execute, our corporate strategies and business initiatives, the potential impact tariffs, high interest rates, high metal costs and additional economic uncertainties may have on our financial condition and results of operations, and the results and timing of our strategic review process. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project”, “achieve”, “growth”, “enable”, “improve”, or the negative of those terms, and similar words, phrases or expressions that convey uncertainty of future events or outcomes. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the impacts of pandemics, epidemics, disease outbreaks and other public health crises on our financial condition, business operations and liquidity; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; our ability to secure, maintain or enforce patents or other appropriate protections for our intellectual property; new laws and governmental regulations; the impact of climate change on our operations; uncertainty of government policies and actions after recent U.S. elections in respect to global trade, tariffs and international trade agreements; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings made with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this press release, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements.

With respect to any non-GAAP financial measures included in the following document, the accompanying information required by SEC Regulation G can be found in the back of this document or in the “Investors” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

With respect to any non-GAAP financial measures included in the following document, the accompanying information required by SEC Regulation G can be found in the back of this document or in the “Investors” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

Investor & Media Contacts:

Joe Caminiti or Abe Plimpton

NNBR@alpha-ir.com

312-445-2870

View full release here.