Research News and Market Data on MGMLF

Vancouver, British Columbia–(Newsfile Corp. – February 7, 2023) – Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF) (FSE: M3G) (“Maple Gold” or the “Company“) is pleased to announce the appointment of Paul Harbidge to its technical committee (the “Technical Committee”), which helps guide exploration, drilling and project management at the Company’s projects located in Québec, Canada, and to provide an update on the ongoing deep drilling programs at the Douay Gold Project (“Douay”) and the Joutel Gold Project (“Joutel”), which are held by a 50/50 joint venture (“JV”) between the Company and Agnico Eagle Mines Limited.

Mr. Harbidge is an accomplished geologist with more than 25 years of experience and a track record of discovering world-class gold deposits. He is currently President, Chief Executive Officer and a Director of Faraday Copper Corp., an emerging U.S. copper developer. Mr. Harbidge was previously President and Chief Executive Officer of GT Gold Corp. and led the company to a C$456 million acquisition by Newmont Mining Corp. in May 2021. Prior to that, Mr. Harbidge was Senior Vice President of Exploration for Goldcorp Inc. from 2016 until its acquisition by Newmont Mining Corp. in April 2019. He also led the exploration team at Randgold Resources Limited that was credited with five major gold discoveries. Mr. Harbidge holds a First-Class Honours Degree in Geology from Kingston University, London (UK) and a Master of Science in Mineral Exploration and Mining Geology from Leicester University (UK).

“We are thrilled to have Paul Harbidge join our Technical Committee, as his experience successfully leading teams to multiple world-class gold discoveries further strengthens our technical group during this critical phase of growth for the Company,” stated Matthew Hornor, CEO of Maple Gold. “2023 is shaping up to be an exciting year for the JV as we approach completion of the first phase (~6,000 m) of deep drilling at Joutel and with the planned deep drilling campaign (~10,000 m) at Douay testing beneath the known 6 x 2 km resource footprint already well underway.”

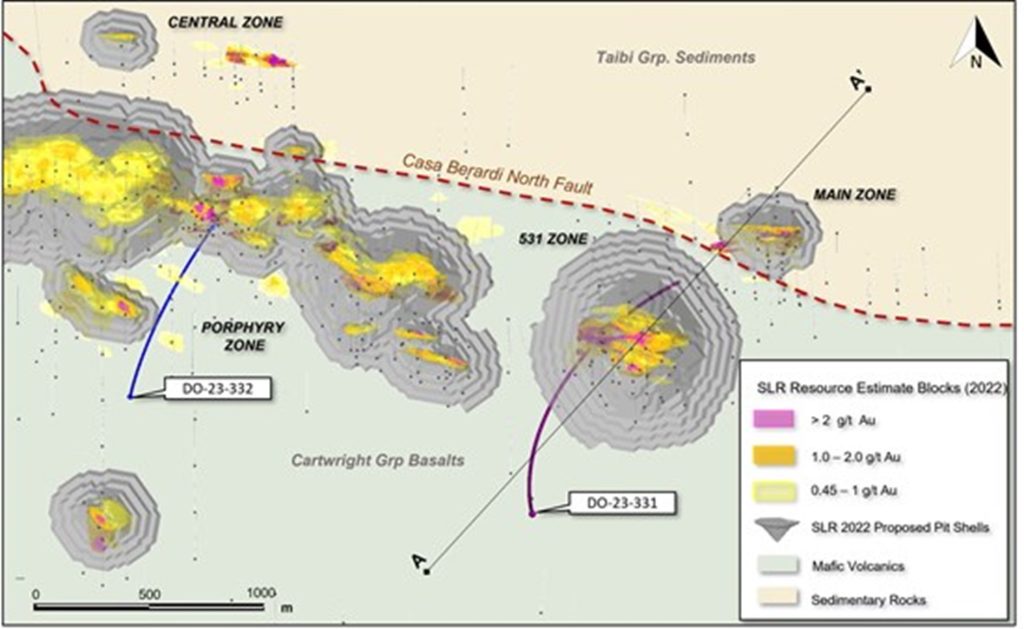

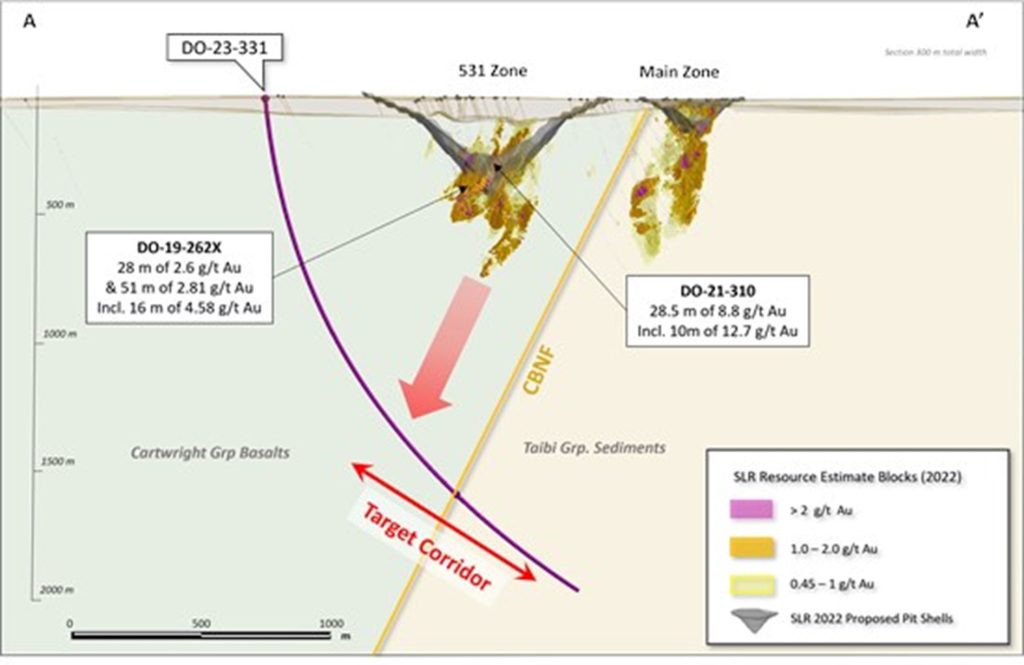

A total of six (6) drill holes and drillhole extensions are planned at Douay, several of which are expected to be drilled to 2,000 metres (“m”) downhole or more. Deep drilling will test beneath the current mineral resource (SLR 2022) and across the favorable Casa Berardi North Fault corridor, where modeled wireframes demonstrate the potential for higher-grade (>2 grams per tonne (“g/t”) gold (“Au”)) mineralization at greater depths.

Deep drilling at Douay commenced in early January 2023 with drill hole DO-23-331, which is collared approximately 400 m southwest of the conceptual pit limits at the 531 Zone (see Figure 1). Previous drilling at the 531 Zone has returned some of the highest-grade and largest gold accumulations (grade x thickness) to-date at Douay, including 8.8 g/t Au over 28.5 m at a depth of 295.0 m in drill hole DO-21-310 (see news from September 9, 2021). While the primary target for this hole is located approximately 1,900 m downhole, where it is expected to intersect the projection of the defined mineralized zone at the 531 Zone significantly down-plunge, DO-23-331 will also serve to test the full width of the mineralized corridor in this area (see Figure 2). DO-23-331 is currently approaching 1,100 m downhole and is proving to be more mineralized than anticipated in the hanging wall rocks (see drill core images with preliminary observations in Plate 1).

Two (2) additional drill rigs were recently mobilized to Douay and as previously reported the Company expects five (5) rigs to be turning concurrently throughout Q1/2023.

“We are encouraged and cautiously optimistic after observing significant pyrite mineralization in the upper portion of the first deep drill hole in an area well south of the 531 Zone with very limited drilling,” stated Fred Speidel, VP Exploration of Maple Gold. “These initial observations point to the potential for these deep drill holes to intersect new mineralized horizons enroute to the targeted depths.”

Figure 1: Plan view showing locations of DO-23-331 and DO-23-332 (both in progress) with line of section for DO-23-331.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3077/153909_b0ba8207d42d99db_001full.jpg

Figure 2: Cross section (300 m total width) looking WNW showing DO-23-331 drill hole trace with position of Casa Berardi North Fault (CBNF) and primary target corridor at depth.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3077/153909_b0ba8207d42d99db_002full.jpg

Plate 1: DO-23-331 drill core with fenitized (biotite-calcite-altered) and pyritized basalt at 324 m downhole.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3077/153909_b0ba8207d42d99db_003full.jpg

Assays for the entire deep drilling program (Douay and Joutel) are pending and results will be released on a periodic basis over the coming months once they are received and interpreted.

Option Issuance

The Company has approved the grant to certain consultants of stock options (“Options”) to purchase an aggregate of 200,000 common shares of the Company at an exercise price of $0.26 per common share. The Options have a 5-year term and vest 1/3 immediately, 1/3 in 12 months and 1/3 in 24 months from the date of grant until fully vested.

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work.

About Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Québec’s prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel. In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

The district-scale property package also hosts a significant number of regional exploration targets along a 55 km strike length of the Casa Berardi Deformation Zone that have yet to be tested through drilling, making the project ripe for new gold and polymetallic discoveries. The Company is well capitalized and is currently focused on carrying out exploration and drill programs to grow resources and make new discoveries to establish an exciting new gold district in the heart of the Abitibi. For more information, please visit www.maplegoldmines.com.

ON BEHALF OF MAPLE GOLD MINES LTD.

“Matthew Hornor”

B. Matthew Hornor, President & CEO

For Further Information Please Contact:

Mr. Joness Lang

Executive Vice-President

Cell: 778.686.6836

Email: jlang@maplegoldmines.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward Looking Statements:

This press release contains “forward-looking information” and “forward-looking statements” (collectively referred to as “forward-looking statements”) within the meaning of applicable Canadian securities legislation in Canada, including statements about exploration work and results from current and future work programs. Forward-looking statements are based on assumptions, uncertainties and management’s best estimate of future events. Actual events or results could differ materially from the Company’s expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.’s filings with Canadian securities regulators available on www.sedar.com or the Company’s website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/153909