The BRICS Currency Project Picks Up Speed

On Friday, July 7, 2023, news broke in the financial market media that the “BRICS” (that is, Brazil, Russia, India, China, and South Africa) will implement their plan to create a new international currency for trading and financial transactions, and that this new currency will be “gold-backed”. Most recently, on June 2, 2023, the foreign ministers of the BRICS – as well as representatives from more than 12 countries – met in Cape Town, South Africa (interestingly at the “Cape of Good Hope”). Among other things, it was emphasized that they wanted to create an international trading currency. Undoubtedly, this is an undertaking that could have consequences of epic proportions.

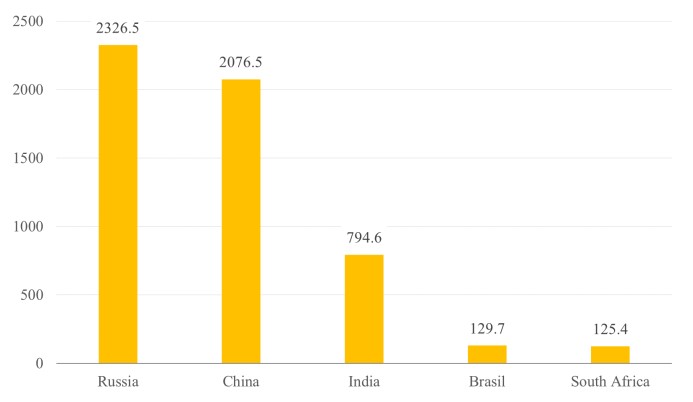

After all, the BRICS countries represent about 3.2 billion people, approximately 40 percent of the world’s population, with a combined economic output nearly the size of the economy of the United States of America. And there are also many other countries (such as Saudi Arabia, United Arab Emirates, Egypt, Iran, Algeria, Argentina, and Kazakhstan) that might want to join the BRICS club.

The goal of the BRICS countries is to reduce their economic and political dependence on the US dollar, challenging “US dollar imperialism”. To this end, they want to create a new international currency for commercial and financial transactions, replacing the US dollar as the means of transaction unit.

The reason is obvious. The US administration has on many occasions used the greenback as a “geopolitical weapon” and engaged in a kind of “financial warfare”: Washington sanctions enemy countries by denying them access to the US dollar capital market, but above all, it shuts them off from the international US dollar-centric payment system.

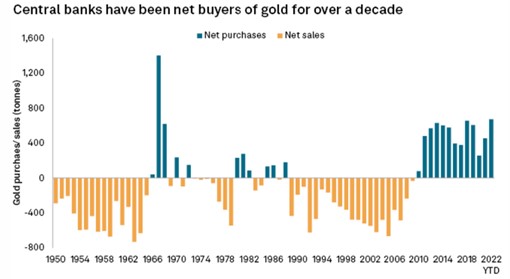

The freezing of Russia’s currency reserves (the equivalent of almost 600 billion US dollars is currently at stake) has set off alarm bells in many non-Western countries. It has reminded a number of them that holding US dollars comes with a political risk. This, in turn, has prompted many to restructure their international foreign reserves: holding fewer US dollars, switching to other (smaller) currencies, but above all, buying more gold.

But how might the BRCIS manage to swim away from the US dollar? While no details are available yet about how the new BRICS currency might be structured, it should not stop us from speculating about what lies ahead.

The BRICS could establish a new bank (the “BRICS-Bank”), funded by gold deposits from BRICS central banks. The physically deposited gold holdings would be shown on the asset side of the BRICS bank’s balance sheet – and could be denominated, for example, “BRICS-Gold”, where 1 BRICS-Gold represents 1 gram of physical gold.

The BRICS-Bank can then grant loans denominated in BRICS-Gold (for example, to exporters from BRICS countries and/or to importers of goods from abroad). To fund the loans, the BRICS-Bank makes a credit contract with the holders of BRICS-Gold: The holders of BRICS-Gold agree to transfer their deposit to the BRICS-Bank for, say, one month, or one or two years, against receiving an interest rate. What is more, the BRICS-Bank, and it can also accept further gold deposits from international investors, who can hold (interest-bearing) BRICS-Gold deposits this way.

BRICS-Gold could henceforth be used by the BRICS countries and their trading partners as international money, as an international unit of account in global trade and financial transactions. Incidentally, the new de facto gold currency would not even have to be physically minted but could be and remain an accounting-only unit while being redeemable on demand.

The exporters from the BRICS countries and the other member countries would, however, have to be willing to sell their goods against BRICS-Gold instead of US dollars and other Western fiat currencies, and the importers from the Western countries would have to be willing and able to pay their bills in BRICS gold.

How do you get BRICS-Gold? Those demanding BRICS-Gold must either get a BRICS-Gold loan from the BRICS-Bank or purchase gold in the market and deposit it with the BRICS-Bank or a designated custodian, and the gold deposit is then credited to his account in the form of BRICS-Gold.

For example, in payment transactions, the goods importer’s BRICS-Gold deposits (held, for example, at the BRICS-Bank) are credited to the account of the exporter of goods (also held at the BRICS-Bank or at a correspondent bank or gold custodian).

However, the transition, the use of BRICS-Gold as an international trade and transaction currency, would most likely have far-reaching consequences:

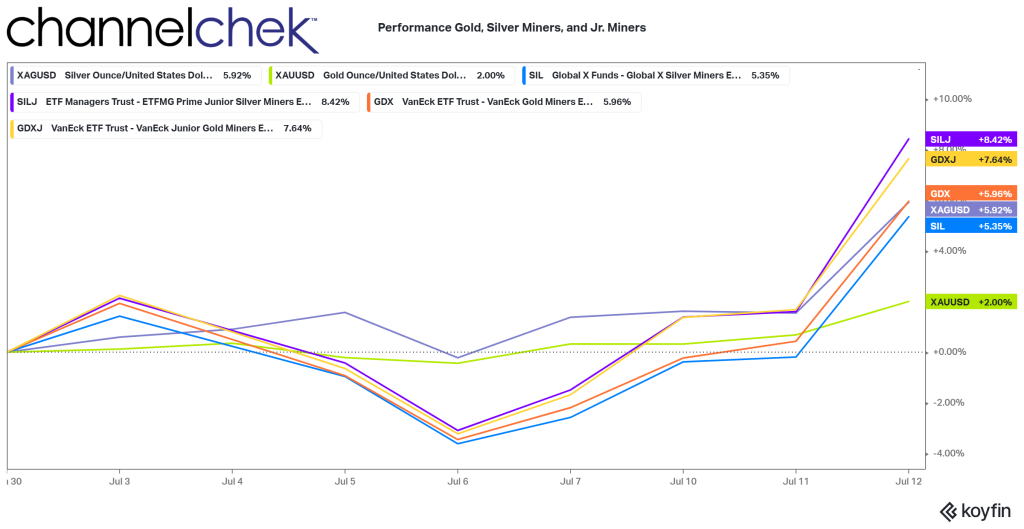

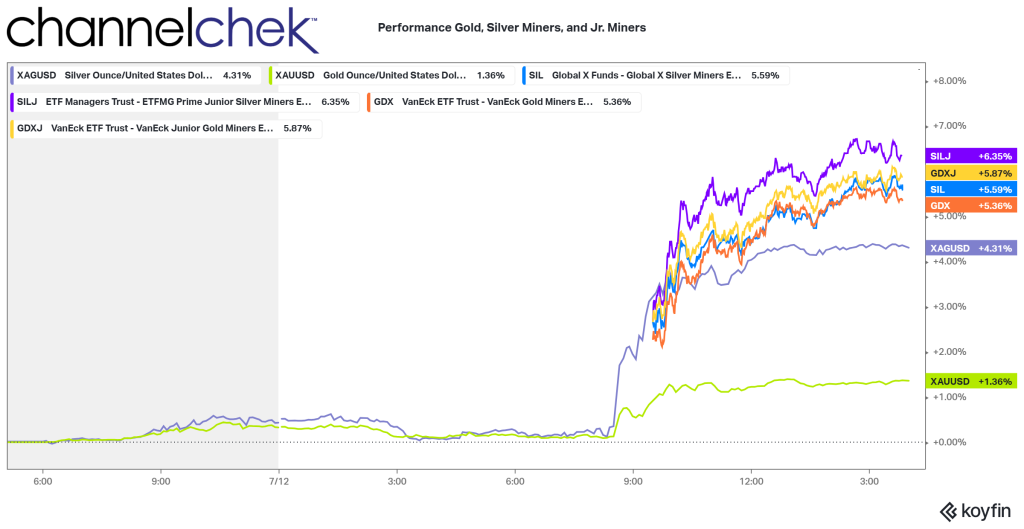

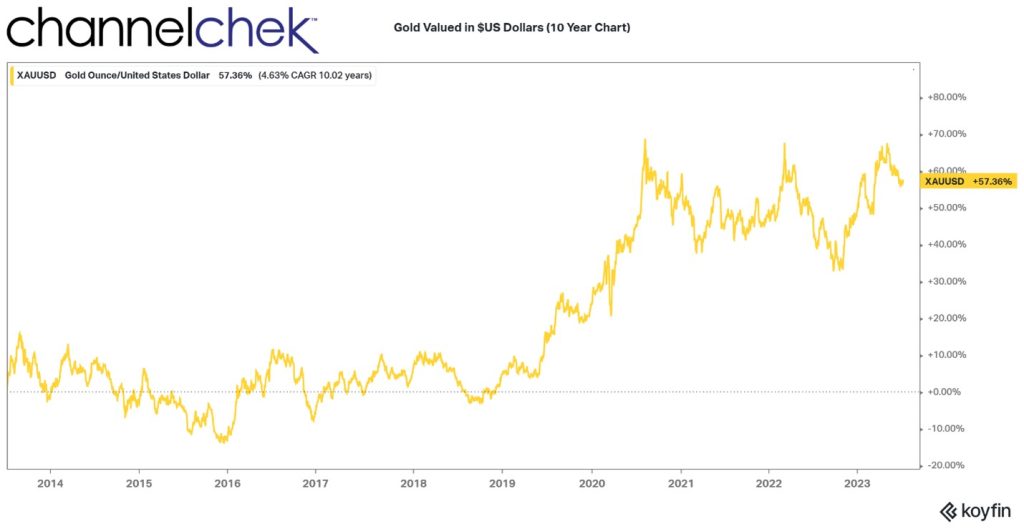

(1.) It would presumably lead to a (sharp) increase in the demand for gold compared to current levels, with not only gold prices measured in US dollars, euros, etc. but also in the currencies of the BRICS countries increasing (substantially).

(2.) Such an increase in the gold price would devalue the purchasing power of the official currencies – not only the US dollar but also the BRICS currencies – against the yellow metal. Also, the prices of goods in terms of the official fiat currencies would most likely skyrocket, debasing the purchasing power of presumably all existing fiat currencies.

(3.) The BRICS countries would build up gold reserves to the extent that they run, or will run, trade surpluses. They would presumably be the winners of the “currency switch”, while the countries with trade deficits (first and foremost, the US) would lose out.

BRICS official gold holdings, in billion US dollars, Q1 2023

These few considerations already show how disrupting the topic of “creating a new gold-backed international trading currency” could be: The BRICS could well trigger landslide-like changes in the global economic and financial structure. Still, it will be interesting to see how the BRICS countries intend to proceed at their August 22-24 meeting in Johannesburg, South Africa.

About the Author:

Dr. Thorsten Polleit is Chief Economist of Degussa and Honorary Professor at the University of Bayreuth. He also acts as an investment advisor.