The CFA Institute and FINRA Study on Gen Z Investors Would Put Smiles on Their Parent’s Face

Google’s AI chatbot Bard defines Generation Z, or Gen Z, as “the demographic cohort succeeding Millennials and preceding Generation Alpha.” Broadly, the media use the mid-to-late 1990s as starting birth years and the early 2010s as ending birth years as Gen Z. If one looks at the dates, most had internet in their homes on the day they arrived from the hospital after birth. Technology has advanced since then, and the generation that never knew life without is well-equipped to make it work for them.

Generation Z is considered more proactive about their money than their parents or their parents parents. A survey by the CFA Institute and FINRA Investor Education Foundation determined that 60% or 6 out of 10 of the Gen Z population owned at least some investments. Some 41% said they were investing in individual stocks, and 35% in mutual funds. The most popular investment? Crypto. It was reported that 20% are invested in cryptocurrency and/or non-fungible tokens.

The report clarified that these investors are not yet retirement focused, but instead growing assets to have enough money for traveling or saving for unexpected expenses.

Why Gen Z’s Interest

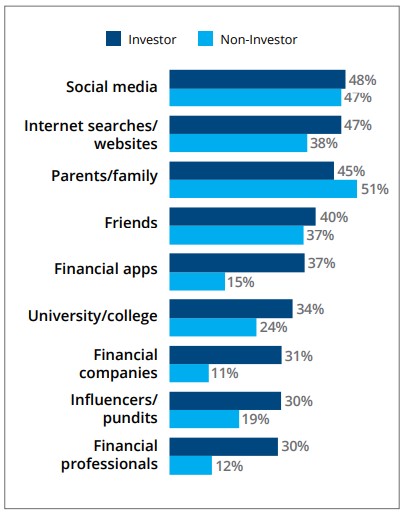

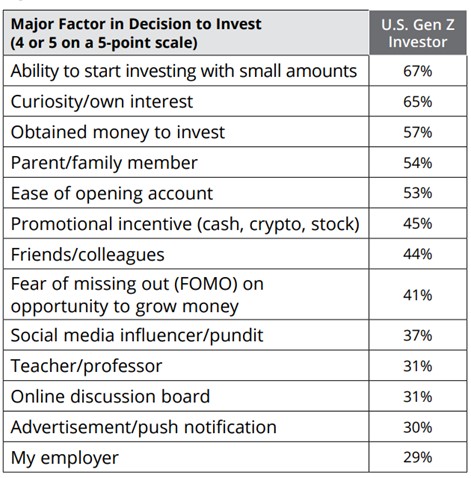

The FINRA/CFA Institute report gave multiple reasons why young people are getting into investing. These include the ability to learn about investing through social media and other online platforms, the existence of apps that let them invest small amounts, such as through fractional shares, as well as the underlying fear of missing out on a more passive way they could make money.

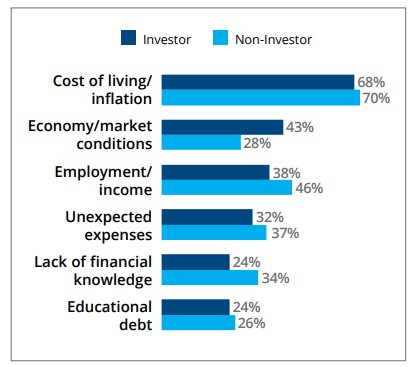

Top Challenges to Meeting Financial Goals

With many sources easily accessible to this connected generation, Generation Z literally have a world of information in their hand, some of it very good, and some of it is probably worthless or damaging. Social media and internet searches take up the top means of learning about investing for this generation. Still on the subject of learning, they are least likely to talk to a financial professional.

Sources of Information Gen Z Use to Learn About Investing

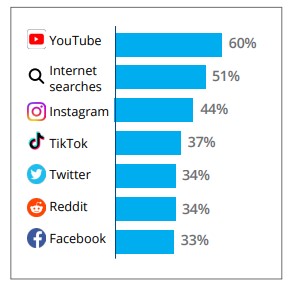

The FINRA/CFA study drilled down deeper to discover the most popular online sources used by Gen Z for investor information. The highest on the list is YouTube followed by internet searches. Lowest on this list is Facebook.

Portfolio Size and Nature

The median investor from this generation has an account worth $4,000. The women had smaller accounts averaging $3,000 versus Gen Z men, whose accounts averaged $5,000.

Investing began very early for some as 25% of Gen Z investors said they began investing before they turned 18. The report indicated that starting at a relatively young age is common in the U.S., Canada, and the U.K. The technology of today allows investors to start small and trade incrementally, even fractionally. This along with curiosity and comfort with technology, is the driver to the first step.

The report was based on a survey of 2,872 investors and non-investors who were aged 18 to 25, as well as millennial and Generation X investors in the U.S., Canada, U.K., and China.

When first starting out, Gen Z most of these investors (44%) gravitated toward cryptocurrencies, according to the report. The median average they first began investing with is $1,000.

Take Away

The youngest adults are finding themselves motivated to invest, more so than any generation before. The top reason is it is easier for the generation to be involved in the markets. Many trade crypto, and own individual stocks. Video content as well as online searches are the primary sources of investment information.

As an aside, this article prompted me to look at the age demographics provided by Google Analytics for Channelchek. Channelchek provides investor information in both written and video formats. Out of the six age groups that Google tracks, 14% of our site traffic since the beginning of the year is attributable to the Gen Z age group.

Should you have any requests for content, or if you are well-versed in a topic that you think Channelchek readers may benefit from, click my name below to send an email, I’d enjoy speaking with you.

Managing Editor, Channelchek

Sources

Bard, from Google AI Provided Minor Cross-reference Information