A Hybrid Regulatory Approach by the NRC on Fusion

A fusion energy system is a power plant that harnesses energy released from the fusion of atomic nuclei to generate electricity. New commercial fusion designs intended to assist in the future of mass power, are being engineered with very little regulatory framework for them to design toward. The US Nuclear Regulatory Commission (NRC) Chairman Christopher Hanson wants the regulatory framework for fusion energy systems based on its existing process for licensing the use of byproduct materials. A new framework may add to the number of companies designing and developing pilot reactors.

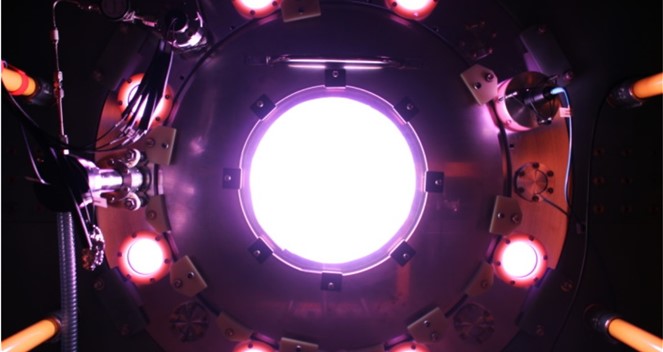

The process of fusion involves bringing together atomic nuclei under high temperatures and pressures to create a plasma state, where the positively charged nuclei fuse to form heavier elements, releasing a large amount of energy in the process. Unlike traditional nuclear power plants, which rely on nuclear fission, fusion power plants do not produce long-lived radioactive waste and have a virtually limitless supply of fuel in the form of hydrogen isotopes found abundantly in seawater. Fusion energy, holds great promise as a clean and sustainable source of energy as fossil fuels fall from favor.

“Dozens” of companies are developing pilot-scale commercial fusion designs, according to NRC Chair Christopher Hanson. In a press release by the NRC last Friday Hanson said the “precise future” for fusion in the USA is uncertain, the agency should provide “as much regulatory certainty as possible given what we know today.” The reason provided in the release said,”Licensing near-term fusion energy systems under a byproduct material framework will protect public health and safety with a technology-neutral, scalable regulatory approach.”

Is this overstepping on the part of the NRC? The Commission describes a fusion system as a device that contains nuclear fusion reactions as well as associated radioactive materials and supporting structures, systems and components – would generate electricity from the energy released when hydrogen atoms are combined to form helium, rather than the splitting, or fission, of uranium atoms. This very definition causes the systems to fall outside the requirements to be regulated by NRC as nuclear reactors, because they do not involve special nuclear material (plutonium, uranium-233 or enriched uranium) and cannot produce the self-sustained neutron chain reaction that defines nuclear fission reactors under NRC regulations.

The NRC staff outlined suggested options earlier in 2023 for the licensing and regulation of fusion systems. It categorized them as “utilization facilities”, with a novel regulatory framework developed to address associated specific hazards. These include a byproduct material approach, which adds to the existing regulations for byproduct material licenses. It also included a hybrid framework where the decision on whether a byproduct material or a utilization facility approach would be most appropriate for a particular system based on the potential dangers and hazards inherent to it – it would need to define what would be most applicable for that system. The NRC staff supported the use of a hybrid system in its submission.

Tritium and other radioactive materials which occur or are used in fusion systems have been categorized by the NRC as byproduct material. The NRC has now directed its staff to create a regulatory framework for fusion systems built on the agency’s existing process for licensing the use of such materials.

The Commission will move forward with a “limited revision” to materials licensing regulations, including consideration of whether the revision should include a new category specifically for fusion energy systems. The rule, according to the NRC, take into account fusion systems “that already have been licensed and are being regulated by the Agreement States, as well as those that may be licensed prior to the completion of the rulemaking”. The commission staff is also exected to expand materials license guidance to cover fusion systems across the US.

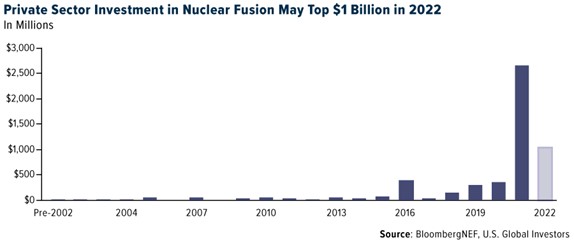

The US Department of Energy (DOE) announced in 2022 up to $50 million of federal funding to support experimental research in fusion energy science as part of the Biden administration’s vision to accelerate fusion energy. New designs are speeding along as a few fusion systems are likely reach design proof-of-concept, and even net power production later this decade, with deployment projected to follow in the 2030s, according to the NRC.

One US fusion system developer, Helion Energy, expressed support for the NRC’s announcement. “This approach provides a clear and effective regulatory path for our team to deploy clean, safe fusion energy,” the company said on Twitter.

Sources

https://www.nrc.gov/cdn/doc-collection-news/2023/23-029.pdf

https://mobile.twitter.com/Helion_Energy

https://www.utilitydive.com/news/nrc-regulations-nuclear-fusion-energy-systems/647766/

https://world-nuclear-news.org/Articles/NRC-starts-work-on-regulatory-framework-for-fusion