Why So Much Money from Overseas is Flowing to Soft U.S. Markets

In 2016, Mohamed El-Erian, chief economic advisor at Allianz, and President of Queens’ College, Cambridge published a book called The Only Game in Town. It was written during a period approximately halfway between the last big stock market sell-off and the 2022 bear market. In it he suggests the only reason investment dollars from overseas are flocking to U.S. markets is because we are “the cleanest dirty shirt.” In other words, the U.S. economy and financial system may not be great, but it is far more appealing than the alternatives.

Labor Day 2022 is now behind us, the S&P 500 is down 16% YTD, the economy receded during the first half of the year and its growth is probably still stunted. The U.S. Treasury index indicates that bonds are down 11% YTD, so why are international money flows moving to U.S. markets? Do investors from overseas think this is a buying opportunity, are we the “cleanest dirty shirt,” or is there something else?

There are probably a number of correct answers, which, when taken together, provides the reason. Investors need to be aware of the dynamics as flows into and out of the U.S. impact all of the country’s markets, including real estate and currency.

“The U.S. looks the least challenged in a very challenging world,” Christopher Smart, chief global strategist at Barings and head of the Barings Investment Institute told the Wall Street Journal. “Everybody is slowing down, but the U.S., because of the continuing strength of the jobs market, still seems to be slowing more slowly,” he added.

And the data shows just how much money is reaching our markets. Assets have been withdrawn from international stock funds for 20 consecutive weeks, according to Refinitiv Lipper data. Money flows have been in to U.S. equity-focused stock and mutual funds for four of the past six weeks.

The U.S., relative to large economies outside of the states is better; employment is strong, there are expectations that a long protracted recession isn’t likely, and consumer spending hasn’t faded, while price increases (inflation) have been tapered.

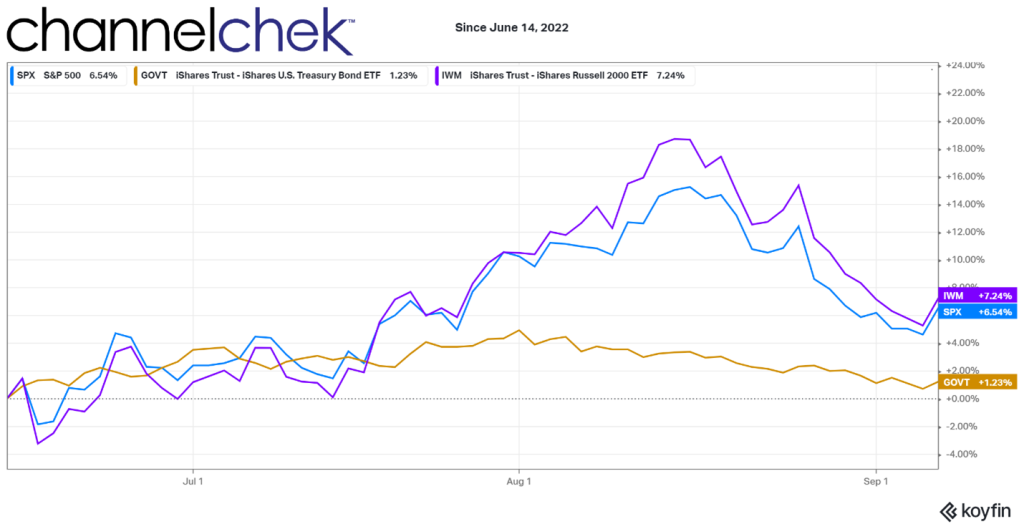

Recent performance of U.S. markets has been impressive. Since the low point of the year (June 14), the small-cap Russell 2000 index is up 7.2%, the S&P 500 is up 6.5% and even U.S. Treasuries are positive despite the Fed’s stated intention of higher rates.

The S&P 500 has outpaced major stock indexes in Europe and Asia since hitting its low for the year in mid-June, meanwhile the pan-continental Stoxx Europe 600 has added only 2.9%, Japan’s Nikkei 225 has advanced 4.5%. Germany’s DAX and the Shanghai Composite have slid 1.3% over the same period.

And there is one other self-fulfilling incentive for U.S. dollar-denominated assets; the dollar has surged to a 20-year high relative to a standard basket of global currencies. To date it is 25.2% stronger than the yen, it increased 12.2% higher versus the euro, and gained 15% above the British pound. Even with the U.S. major indices down, investor conversion back to non-U.S. native currency is a big win compared to what they would have lost. And for U.S. investors that were in international markets, they are better off having repatriated their dollars, even if they are down on the year.

The longer the dollar’s strength continues, the more the strength will feed on itself.

What investors should pay particular attention to now is anything that may trigger a turnaround, and money going back into international markets. This does not seem imminent, but it helps to know what is making “other shirts dirtier.”

Among Europe’s challenges are war-related supply shortages which have led to skyrocketing gas and electricity prices. Recently added to the list, Russia’s Gazprom PJSC said Friday (Sept. 2), that it would suspend the Nord Stream natural-gas pipeline to Germany. Winter is coming and the continent is on the path to a worsening energy problem, one that would add to upward inflation pressures for them.

China the world’s second-largest economy, has been severely weakened by the impact of its response to Covid-19. Other factors weighing on its economy are a real-estate downturn, heightened regulation of technology companies, and unusually bad weather. Weakness in China creates problems for economies around the globe since much of the world’s commodities and manufacturing come from the country.

A turnaround in these factors, such as a friendly resolution to the war, increased productivity from China, or lower inflation across Europe and the tide may turn causing more investment to gravitate away from the U.S., creating less demand for assets here. To date, there is no sign that any of these possibilities are imminent, and the longer the U.S. is the only game in town, the more money will be kept in U.S. dollar assets and the more upward pressure there will be on these assets.

Managing Editor, Channelchek

Sources

https://www.amazon.com/The-Only-Game-in-Town-audiobook/

https://www.refinitiv.com/en/financial-data/fund-data