Research News and Market Data on VNCE

01/12/2026

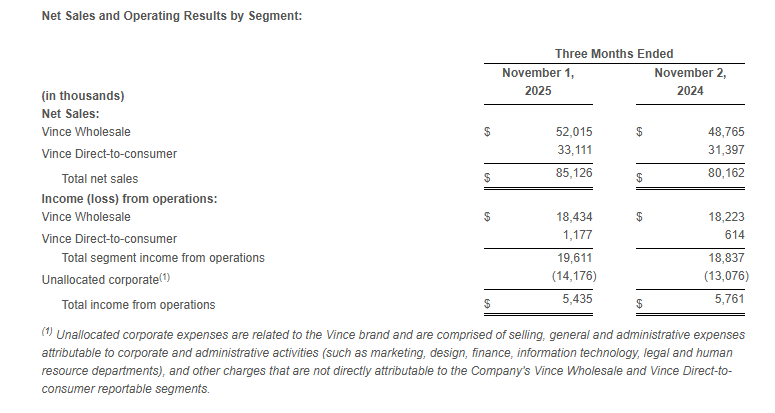

Holiday Period Total Net Sales Increased 5.3% vs. Last Year Led by 9.7% Growth in Direct-to-Consumer Segment

NEW YORK–(BUSINESS WIRE)– Vince Holding Corp., (Nasdaq: VNCE) (“VNCE” or the “Company”), a global retail platform, today announced sales for the nine-week holiday period ended January 3, 2026.

Holiday Sales Highlights (Unaudited Results for Nine-Week Period Ended January 3, 2026)

- Total company net sales increased 5.3% compared to the prior year period

- Direct-to-Consumer segment sales increased 9.7% compared to the prior year period

- Wholesale segment sales decreased 2.7% compared to the prior year period

Brendan Hoffman, Chief Executive Officer of VNCE commented, “Our direct-to-consumer segment continues to deliver exceptional results, building on the strong momentum from our strategic investments in customer experience enhancements and e-commerce capabilities. Within wholesale, we have continued to see strong performance at the register with key partners helping to offset disruption in receipt flow with Saks Global given current dynamics. This overall performance, combined with our disciplined approach to balancing strategic pricing changes, promotional activity, and cost management, demonstrates the strength of our business model. As we look ahead, we will continue to execute and deliver on our strategic priorities that we believe will position us well for long-term profitable growth.”

Based on holiday sales performance, total company net sales have trended in line with prior guidance and Adjusted EBITDA as a % of Net Sales and Adjusted Operating Income as a % of Net Sales have trended in line with the higher end of prior guidance ranges for the fourth quarter and full year fiscal 2025.

The Company continues to monitor developments with its wholesale partner, Saks Global, and guidance does not reflect any outcome of its reported status. Saks Global represented less than 7% of total company net sales as of Fiscal 2024.

The holiday sales results reported in this press release are unaudited and preliminary. These amounts are based on currently available information and are subject to change following the completion of any customary financial closing procedures for the fiscal quarter ending January 31, 2026.

ICR Conference

As previously announced, the Company will be presenting at the 28th Annual ICR Conference today, Monday, January 12, 2026, at 8:30 AM Eastern Time. The audio portion of the presentation will be webcast live on the investor relations section of the Company’s website, http://investors.vince.com/.

ABOUT VINCE HOLDING CORP.

Vince Holding Corp. is a global retail platform that operates the Vince brand women’s and men’s ready to wear business. Vince, established in 2002, is a leading global luxury apparel and accessories brand best known for creating elevated yet understated pieces for every day effortless style. Vince Holding Corp. operates 46 full-price retail stores, 14 outlet stores, and its e-commerce site, as well as through premium wholesale channels globally. Please visit www.vince.com for more information.

Forward-Looking Statements: This document, and any statements incorporated by reference herein contain forward-looking statements under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements regarding, among other things, our current expectations about possible or assumed future results of operations of the Company and are indicated by words or phrases such as “may,” “will,” “should,” “believe,” “expect,” “seek,” “anticipate,” “intend,” “estimate,” “plan,” “target,” “project,” “forecast,” “envision” and other similar phrases. Although we believe the assumptions and expectations reflected in these forward-looking statements are reasonable, these assumptions and expectations may not prove to be correct and we may not achieve the results or benefits anticipated. These forward-looking statements are not guarantees of actual results, and our actual results may differ materially from those suggested in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control, including, without limitation: changes to and unpredictability in the trade policies and tariffs imposed by the U.S. and the governments of other nations; our ability to maintain our larger wholesale partners; our ability to maintain adequate cash flow from operations or availability under our revolving credit facility to meet our liquidity needs; general economic conditions; restrictions on our operations under our credit facilities; our ability to improve our profitability; our ability to accurately forecast customer demand for our products; our ability to maintain the license agreement with ABG Vince, a subsidiary of Authentic Brands Group; ABG Vince’s expansion of the Vince brand into other categories and territories; ABG Vince’s approval rights and other actions; our ability to realize the benefits of our strategic initiatives; the execution of our customer strategy; our ability to make lease payments when due; our ability to open retail stores under favorable lease terms and operate and maintain new and existing retail stores successfully; our operating experience and brand recognition in international markets; our ability to remediate the identified material weakness in our internal control over financial reporting; our ability to comply with domestic and international laws, regulations and orders; increased scrutiny regarding our approach to sustainability matters and environmental, social and governance practices; competition in the apparel and fashion industry; the transition associated with the appointment of new chief executive officer and new chief financial officer; our ability to attract and retain key personnel; seasonal and quarterly variations in our revenue and income; the protection and enforcement of intellectual property rights relating to the Vince brand; our ability to successfully conclude remaining matters following the wind down of the Rebecca Taylor business; the extent of our foreign sourcing; our reliance on independent manufacturers; our ability to ensure the proper operation of the distribution facilities by third-party logistics providers; fluctuations in the price, availability and quality of raw materials; the ethical business and compliance practices of our independent manufacturers; our ability to mitigate system or data security issues, such as cyber or malware attacks, as well as other major system failures; our ability to adopt, optimize and improve our information technology systems, processes and functions; our ability to comply with privacy-related obligations; our status as a “controlled company”; our status as a “smaller reporting company”; and other factors as set forth from time to time in our Securities and Exchange Commission filings, including those described under “Item 1A—Risk Factors” in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. We intend these forward-looking statements to speak only as of the time of this release and do not undertake to update or revise them as more information becomes available, except as required by law.

Investor Relations Contact:

ICR, Inc.

Caitlin Churchill, 646-277-1274

Caitlin.Churchill@icrinc.com

Source: Vince Holding Corp.