Can Oil Companies Continue Their Outperformance?

If you predicted that oil prices would go up last year, you were correct. If you predicted they’d go down, you were also correct. I dare say that even with insight as to what was to come, many analysts would have had the timing completely reversed from what actually happened. Why? What caused the volatility? And most importantly, what can we learn from this to help us in 2023 and beyond? After all, in 2022, oil company Exxon increased in market value more than any other company in the S&P 500. It became the eighth largest with a 74.3% increase in share price, up from the 27th largest a year ago. In contrast, WTI Crude closed near its low for the year, the dynamics involved are certainly worth investor exploration.

Background

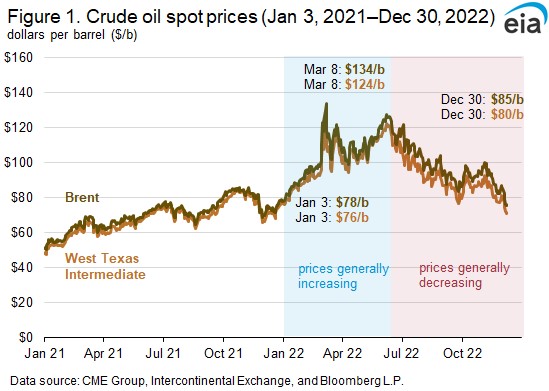

Twelve months ago, according to the Energy Information Administration (EIA) the price of West Texas Intermediate (WTI) crude oil was considered high at $75.99/bbl. WTI closed the year less than 6% higher at $80.47/bbl. But this is not indicative of the wild surprises in between. There are two events that had a major impact during those twelve months.

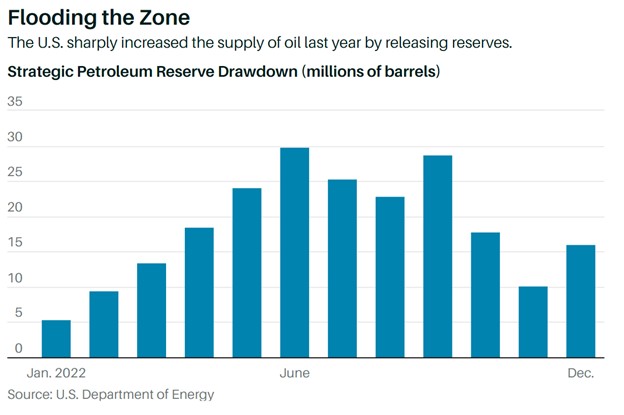

Russia’s late February invasion of its neighbor helped crude prices to shoot up above $120/bbl. Oil has only visited that level once before (2008). Very few could have expected this event, so the expectations leading up to the early months of 2022 were, at worst moderate price declines to moderate increases. Those expecting some price increases pointed to the ongoing supply shortfall related to the pandemic response. This is the period that surprised traders with oil on the way up. Then as it became evident the war would be prolonged and Europe and other regions would take steps to move away from Russia’s output, expectations were for further price increases. What was not anticipated was a massive release of oil from the U.S. Strategic Petroleum Reserves. Along with releases from reserves in other parts of the world, oil prices sank. But, fear of the European winter, lack of support from OPEC+, and anticipation of price caps on Russian oil creating a loss of supply had many talking about upward pressure by year-end. It has not materialized.

The Crude World Order (OPIC?)

What’s changed the expected results related to oil prices and even producer prices? First off, there was a level of unity never-before-experienced and organization among petroleum-importing countries among consuming nations. The pushback and, to some degree taking charge, by nations that are net consumers began in late Spring 2022 when 31 members of the International Energy Agency (IEA) decided to all release oil from reserves to quench demand and impact prices.

The Paris-based IEA promotes what it believes are beneficial energy situations for consumers. It had taken the lead on emergency measures before, but never with this much unity or on this scale. The amount of reserves sold into the oil market amounts to less than 1%, but it is estimated to have shaved $20 or more off per barrel oil prices in the spring and summer. Brent crude, the international oil benchmark, hit its peak settlement value of $127.98 per barrel in March but had fallen below $100 by July. Recently it has been trading near $80.

Certainly, the drawdown on reserves which borrowed from the future will need to be replenished. Pulling from reserves is unsustainable and therefore limits bargaining power. Nations have pledged to return their reserves to a level deemed in line with national security (the U.S. has a 50-day reserve supply), but the timing is uncertain.

What is positive for consumers is the IEA has learned to stand firm and work together.

Why are Oil Company Stocks Outperformers?

Crude is roughly the same price now as it was at the beginning of last year. Yet, factors including conservation efforts and China Covid policies have caused limited demand growth. And despite favorable economics currently, energy companies have been slow to drill new wells. U.S. rig count, as reported by Baker Hughes, crept up to 779 rigs by the end of the year. This compares to a peak level of 1,600 in 2014.

So why, as mentioned earlier, are oil companies performing as tech companies did in 2021?

On the surface, one might think energy company stock prices would be weakening, but this isn’t the case there are other factors at play. Michael Heim, Senior Energy Analyst, at Noble Capital Markets, explains in his newly released Q4 2022 Energy Industry Report, “Operating cash flow has soared over the last two years, but capital expenditures have barely increased. The result has been a large increase in dividend payments, share repurchases, and debt reduction.” Heim’s report further explains that while capital expenditures lagged well behind, it is inaccurate to conclude that oil production has not increased. The Noble Capital Markets analyst explains, “…current production levels are above that during peak drilling periods in 2014. The implication is that drilling has become more productive. While drilling advances such as the use of horizontal drill and fracking in shale deposits may be old hat, it is worth noting that drillers have been refining drilling techniques for individual drilling locations.” Drillers are improving techniques, improving efficiencies and maximizing production per dollar spent. Heim also attributes some of the efficiencies to well recompletions, which he explains are less expensive to put in service.

Read the Noble Capital Markets Energy industry report here.

Take Away

The S&P index that tracks the Energy sector gained 53.8% last year. If you had had a crystal ball that told you about the events that would transpire, such as the European war, and oil returning to its starting place, it’s a rare investor that would expect the drillers/producers to increase over 50%. While all situations have their own circumstances, understanding why price action happened can provide greater preparedness to face the markets each year.

Sign-up for no-cost Channelchek and receive research reports, articles, and even video interviews with company executives in your inbox each morning. Sign-up here.

Managing Editor, Channelchek

Sources

https://www.forbes.com/sites/rrapier/2022/12/31/the-year-in-energy-prices/?sh=59b071fa5314