| Key Points: – Canada imposes 25% tariffs on $21 billion of U.S. goods in response to Trump’s steel and aluminum duties. – The tariffs target steel, aluminum, computers, sports equipment, and cast iron products. – The European Union has also announced its own tariffs on U.S. goods, signaling broader economic consequences. |

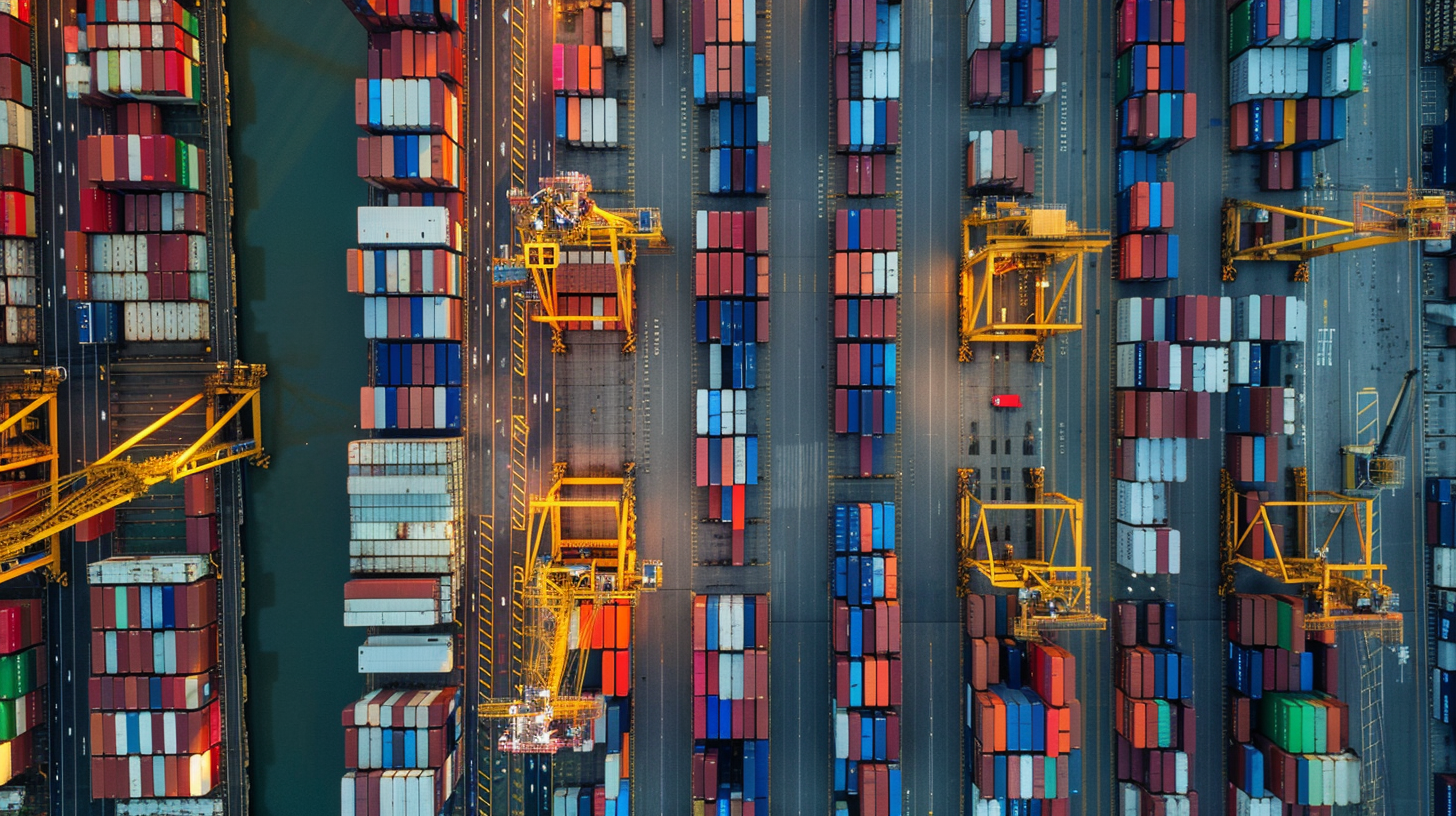

The ongoing trade tensions between the United States and Canada reached a new peak as Canada announced a fresh wave of retaliatory tariffs on more than $21 billion worth of American goods. The move comes in response to the Trump administration’s 25% duties on Canadian steel and aluminum, which took effect overnight. Canadian Finance Minister Dominic LeBlanc confirmed that these new tariffs, which will take effect immediately, add to the 25% counter-tariffs Ottawa imposed on $30 billion of U.S. goods earlier this month.

This latest round of tariffs escalates a trade conflict that has rattled markets and raised concerns among economists about supply chain disruptions. The affected goods include a broad range of industries, from steel and aluminum to computers, sports equipment, and cast iron products. As one of America’s largest trading partners, Canada’s decision underscores its commitment to defending its economy while further complicating trade relations with the U.S.

“This is much more than about our economy. It is about the future of our country,” said Melanie Joly, Canada’s foreign affairs minister. “Canadians have had enough, and we are a strong country.” The Canadian government’s firm stance reflects growing frustration with what it sees as aggressive economic tactics by the Trump administration.

The fallout from these tariffs is expected to ripple through multiple sectors. For businesses relying on U.S.-Canadian trade, the increased costs may lead to higher prices for consumers and disruptions in supply chains. Manufacturers, particularly in the auto and technology industries, will feel the strain as component costs rise. Meanwhile, small businesses on both sides of the border could struggle with the added burden of tariffs, limiting their competitiveness in an already volatile economic environment.

The trade dispute has also extended beyond North America. Following the U.S. steel and aluminum tariffs, the European Union announced it would impose tariffs on over $28 billion worth of U.S. goods starting in April. The global economic implications of these trade policies are becoming increasingly difficult to ignore, as countries respond with their own countermeasures, creating an environment of heightened uncertainty for businesses and investors alike.

Meanwhile, political tensions are also heating up. President Trump, a vocal advocate for tariffs, initially threatened to double the levies on Canadian steel and aluminum to 50% but later backed down after Ontario Premier Doug Ford threatened a retaliatory surcharge on electricity exports to the U.S. The back-and-forth illustrates the unpredictability of the current trade landscape and the challenges businesses face in navigating these policy shifts.

While the Trump administration argues that tariffs protect domestic industries and jobs, many economists warn that these measures can have the opposite effect. Higher costs for imported goods, potential job losses in export-dependent industries, and increased uncertainty on Wall Street are just some of the potential repercussions. As the situation continues to unfold, investors and businesses will be watching closely for signs of de-escalation or further trade confrontations.