The Surprisingly High Economic Growth Numbers Aren’t Spooking Investors

Gross Domestic Product, or GDP, is one of the best measures of U.S. economic health. The second quarter GDP report as well as the first quarter upward revision, fully support the idea that the economy is growing above expectations and that the Fed’s rate hike in July was justified. This places equity investors in the position they have become very familiar with, wondering if they should be bullish on stocks as the economy rolls on, or should they be bearish as the Fed’s reaction could cause a period of negative growth (recession). Seeing how the Dow is on a winning streak of a dozen days in a row, even as the Fed resumed tightening, it may be that the forward-looking stock market has turned the corner and is now taking good news as good news, and bad news as bad, once again.

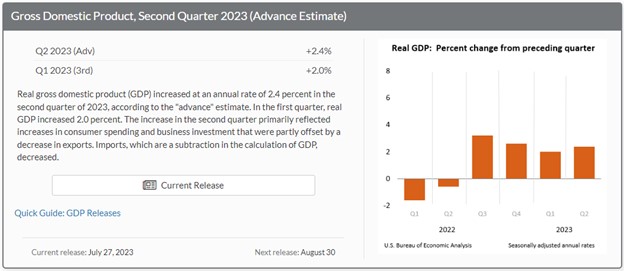

GDP was much stronger than expected – economists surveyed by FactSet were expecting a 1.5% gain. This was the first data release since the July FOMC meeting; it will however be followed on Friday by two other key indicators. The U.S. economy grew at a 2.4% annual rate in the second quarter (first estimate of GDP). This is significantly better than economists’ projections and makes abundantly clear that through last quarter, the economy was far from contracting or recessionary.

Contributors to the better-than-expected growth are increases in consumer spending, nonresidential fixed investment, state and local government spending, private inventory investment, and federal government spending, according to the BEA. Non-manufacturing contributors (services) included housing and utilities, health care, financial services and insurance, and transportation services. The contribution to goods spending was led by recreational goods and vehicles as well as gasoline and other energy goods.

Other Market-Moving Releases

The GDP report was the first piece of economic data following the Federal Reserve’s meeting on Tuesday and Wednesday; this concluded with a quarter-point increase in the central bank’s target for the fed-funds rate. That now leaves the Fed’s benchmark rate at a range of 5.25% to 5.5%.

Jobs and the tight employment market, where there are currently more jobs available than workers looking for employment, should still be a big focus of monetary policymakers. On Friday July 28, the employment cost index (ECI) is expected to show that the hourly labor cost to employers in the second quarter grew at a 4.8% annual rate, and by 1.1% quarter to quarter, according to the consensus estimate by FactSet. That’s little changed from the first quarter, when compensation costs for civilian workers increased by 4.8% annually and at a 1.2% rate quarter over quarter, according to the Bureau of Labor Statistics. Labor tightness and wage inflation are both concerning for the Fed and provide evidence that a more restrictive policy is needed.

Investors should look for ECI to provide some insight into how sticky service inflation is right now. This is of high importance because, within the service sector, wages tend to be the highest input cost. If the number comes in higher than expected, that could be a worrisome sign of continued stubborn inflation, which then indicates the need for additional rate hikes.

At the same time the ECI report is released on Friday, the PCE data is released. While the market’s tendency over the months has been to hyperfocus on the “Fed’s favorite inflation measure,” PCE may take a back seat in terms of significance to ECI data.

Take Away

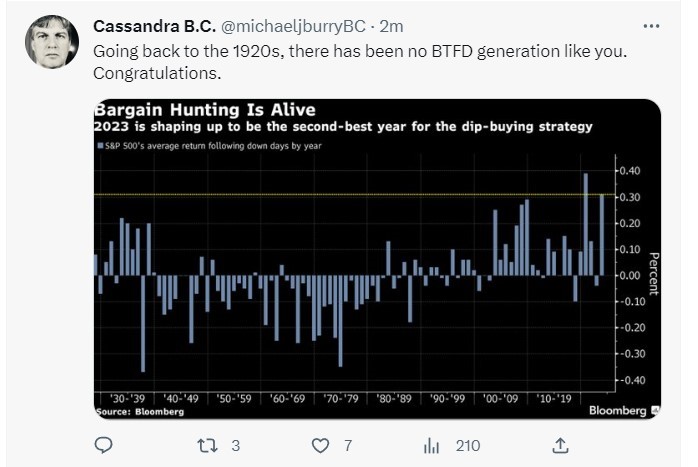

Inflation rates coming down while the economy grows is, if inflation declines enough, a soft economic landing. The stock market, which had been reacting negatively to strong economic news, is beginning to show signs that it expects a soft landing – while this lasts, the markets could continue their winning streak.

Managing Editor, Channelchek

Sources

https://www.barrons.com/articles/us-gdp-growth-report-data-8468fd3b?mod=hp_LEAD_1