Doomsday Investor Sees Ongoing Moves by Policymakers as Destructive

We’d all like to think that global decision-makers responsible for economic conditions have the best interest of the world’s citizenry in mind when making decisions – but doubts and concerns are growing. Among the most concerned are economic stakeholders that don’t believe “bad” things should always be prevented. One very credible voice highlighting this idea is hedge fund manager Paul Singer. He’s the CEO of Elliot Investment Management and recently moved his firm’s offices out of NY, NY, to the more business-friendly West Palm Beach, FL. Singer says a credit collapse and deep recession may be needed to restore financial markets.

Paul Singer is the founder and CEO of Elliott Investment Management. Its year-end 13F reportable AUM was $12.25 billion. The firms opportunity-based investment style allows Singer and Company, known for their corporate activism, to move to wherever profit may lie.

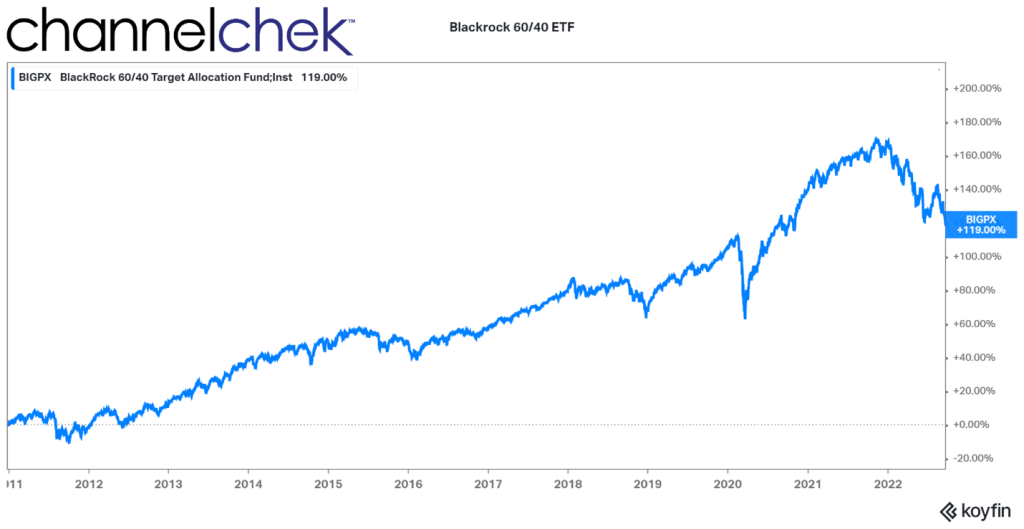

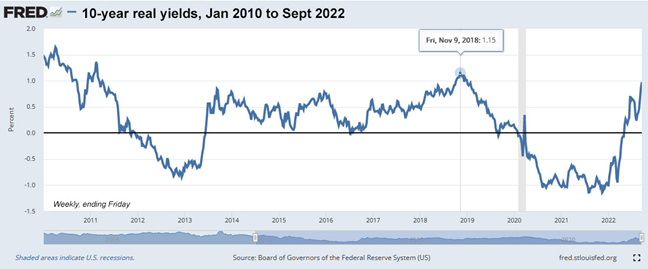

The current thinking of Singer, a registered Republican, has been making headlines. This includes a widely circulated opinion piece published in the Wall Street Journal last week. In it, he discusses more than a decade of what he believes are damaging easy-money policies and how a deep recession and even credit collapse will be necessary to purge financial markets of excesses.

“I think that this is an extraordinarily dangerous and confusing period,” Singer told The Journal, in his interview, he warns that trouble in markets may only be getting started now that a full year has passed from the start of tighter monetary policy.

One of the more chilling quotes from Singer is, “Credit collapse, although terrible, is not as terrible as hyperinflation in terms of destruction wrought upon societies.”

The idea that we are headed down either one path or the other, he doesn’t mention a third option, may be why the New Yorker magazine calls him “Doomsday Investor.” He explains, “Capitalism, which is economic freedom, can survive a credit crisis. We don’t think it can survive hyperinflation.”

The Doomsday Investor has been outspoken against government safety nets for a while, including the sweeping banking regulations from the Dodd-Frank Act of 2010. This act created the Financial Protection Bureau (CFPB) and established the Financial Stability Oversight Council (FSOC). Singer strongly opposed prolonged market interventions by global central banks following the 2008 global financial crisis. Interventions that still haven’t been drained from the U.S. monetary system.

Singer, who is 78 called crypto, “completely lacking in any value,” in his WSJ interview. He also said: “There are thousands of cryptocurrencies. That’s why they’re worth zero. Anybody can make one. All they are is nothing with a marketing pitch—literally nothing.”

While his funds performance have placed him near the top of hedge fund manager performance, Singer personally worries the Fed and other central banks will respond to the next downturn by referring to the failed playbook of slashing interest rates and potentially resuming large-scale asset purchases. The point was shown to be current, as Singer called the regulatory response to the collapse of Silicon Valley Bank and Signature Bank, including the guaranteeing of all deposits from the two lenders akin to “wrapping all market movements in security blankets.”

He complained, “…all concepts of risk management are based around the possibilities of loss.” He encouraged decision makers to, “Take it away, it’s going to have consequences.”

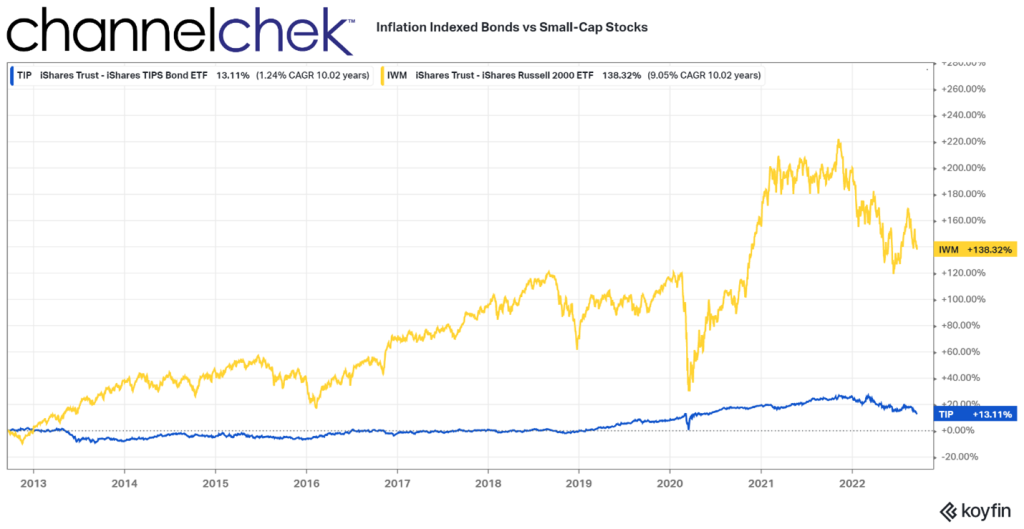

Where Can Investors Hide

Paul Singer said in his interview there may be a few places for investors to ride out what he sees as a coming storm. One place comes as no surprise, “At such times, some consider the safest bet to be relatively short-term U.S. government debt,” he said, adding that “such debt pays a decent return with virtually no chance of a negative outcome.” He is likely speaking of U.S. Treasuries two years and shorter as the longer duration bonds would be more volatile as rates shift, and other government debt like GNMAs are fraught with extension risk.

Singer also believes some gold in portfolios may make sense.

Take Away

Without some rain, nothing could flourish. Without an occasional brush fire, the risk of massive forest fire greatly increases. Paul Singer, in his interview with the WSJ, indicates he believes the economic brushfires that decision-makers have been preventing should have been allowed to run their course. Preventing them is a big mistake and a collapse may not be far off.

This collapse in easy credit and crypto, among other bubble-type excesses Singer believes could be destructive but preferred by society over continuing to move toward hyperinflation.

Managing Editor, Channelchek

Sources

https://www.newyorker.com/magazine/2018/08/27/paul-singer-doomsday-investor