Research News and Market Data on AUIAF

January 29, 2026 5:01 PM EST | Source: Aurania Resources Ltd.

Toronto, Ontario–(Newsfile Corp. – January 29, 2026) – Aurania Resources Ltd. (TSXV: ARU) (OTCQB: AUIAF) (FSE: 20Q) (“Aurania” or the “Company”) announces that its Chairman, President and Chief Executive Officer, Dr. Keith Barron (the “Lender”) has agreed to provide a loan of up to C$750,000 to the Company to be advanced from time to time in principal amounts as agreed by the parties (the “Loan”).

Dr. Keith Barron commented, “This loan provides the Company with additional working capital to continue advancing its projects while preserving shareholder value. Importantly, this structure avoids immediate dilution and reflects my confidence in our strategy and our projects as we continue work on multiple fronts.”

The Loan is unsecured, bears interest at 2% per annum and matures twelve months and one day after demand for repayment is given by the Lender, which may be provided at any time following the date hereof. The proceeds of the Loan will be used to fund the Company’s preliminary economic assessment on the Balangero tailings retreatment project in Italy, including related laboratory/assay fees, and general working capital.

Dr. Keith Barron is a related party of the Company by virtue of the fact that he is the Chairman, the President and Chief Executive Officer, a promoter and a principal shareholder of the Company, and as a result, each advance and repayment under the Loan constitutes a “Related Party Transaction” for the purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is relying upon an exemption from the formal valuation and minority shareholder approval requirements under MI 61-101 in respect of the Related Party Transactions, in reliance on Sections 5.5(a) and 5.7(1) of MI 61-101, respectively, as the fair market value of the Related Party Transaction, collectively, does not exceed 25% of the Company’s market capitalization, as determined in accordance with MI 61-101. The Company did not file a material change report related to the Loan more than 21 days before the expected closing of the Loan as required by MI 61-101, as the Company wished to organize the Loan on an expedited basis for sound business reasons.

The Loan was approved by the members of the board of directors of the Company who are independent for purposes of the related party transaction, being all directors other than Dr. Barron. No special committee was established in connection with the Loan, and no materially contrary view or abstention was expressed or made by any director of the Company in relation thereto.

About Aurania

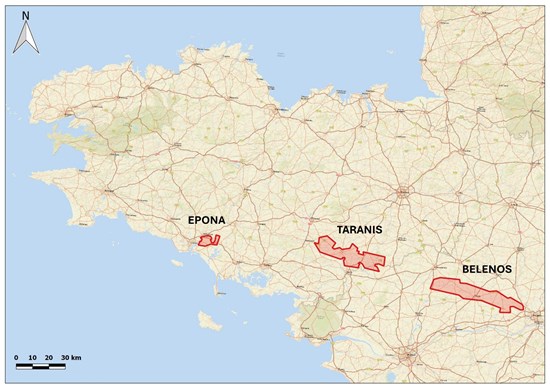

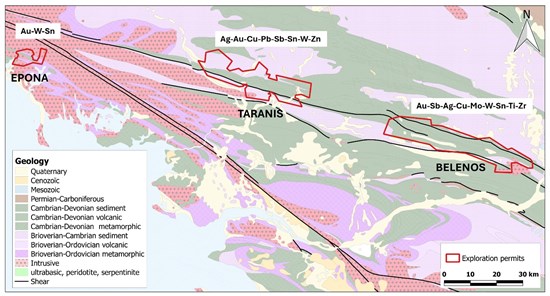

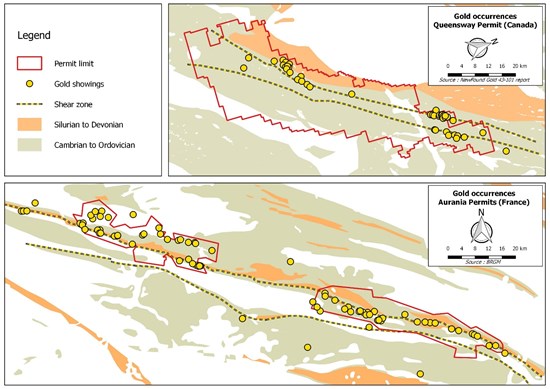

Aurania is a mineral exploration company engaged in the identification, evaluation, acquisition, and exploration of mineral property interests, with a focus on precious metals and critical energy in Europe and abroad.

Information on Aurania and technical reports are available at www.aurania.com and www.sedarplus.ca, as well as on Facebook at https://www.facebook.com/auranialtd/, Twitter at https://twitter.com/auranialtd, and LinkedIn at https://www.linkedin.com/company/aurania-resources-ltd-.

For further information, please contact:

| Carolyn Muir VP Corporate Development & Investor Relations Aurania Resources Ltd. (416) 367-3200 carolyn.muir@aurania.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains forward-looking information as such term is defined in applicable securities laws, which relate to future events or future performance and reflect management’s current expectations and assumptions. The forward-looking information includes Aurania’s objectives, goals, future plans or other statements of intent, Aurania’s ongoing engagement in the identification, evaluation, acquisition and exploration of mineral property interests, and any potential exploration results or potential mineralization resulting therefrom, Aurania’s ongoing exploration efforts in France, Italy, Ecuador and abroad, potential additional advances pursuant to the Loan, eventual repayment of the Loan or any part thereof by Aurania, and the use by Aurania of funds received pursuant to the Loan Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to Aurania, including the assumption that, there will be no material adverse change in metal prices and all necessary consents, licenses, permits and approvals will be obtained, including various local government licenses and the market. Investors are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected. Risk factors that could cause actual results to differ materially from the results expressed or implied by the forward-looking information include, among other things, the state of the capital markets generally and of the mining markets more particularly, any commodity prices supply chain disruptions, restrictions on labour and workplace attendance and local and international travel due to war, weather, pandemics or otherwise; a failure to obtain or delays in obtaining the required regulatory licenses, permits, approvals and consents; an inability to access financing as needed, including pursuant to the Loan; a general economic downturn, a volatile stock price, labour strikes, political unrest, changes in the mining regulatory regime governing Aurania; a failure to comply with environmental regulations; a weakening of market and industry reliance on precious metals, copper and critical minerals; and those risks set out in the Company’s public documents filed on SEDAR+. Aurania cautions the reader that the above list of risk factors is not exhaustive. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Source: Aurania Resources Ltd.