AMC Theatres APE Units Will Cease to Exist After Thursday

The last day of trading for AMC Entertainment (AMC) Preferred Equity Units (APE) is Thursday, August 24th. The dividend shares that were provided 1:1 for AMC shareholders one year ago, will be converted to AMC common stock, which will then be the only class of stock AMC Entertainment has outstanding. But the company still has mounds of debt, which is part of the reason for rolling the preferreds into common shares. The move doubles the number of common shares outstanding, which the company then has plans to address.

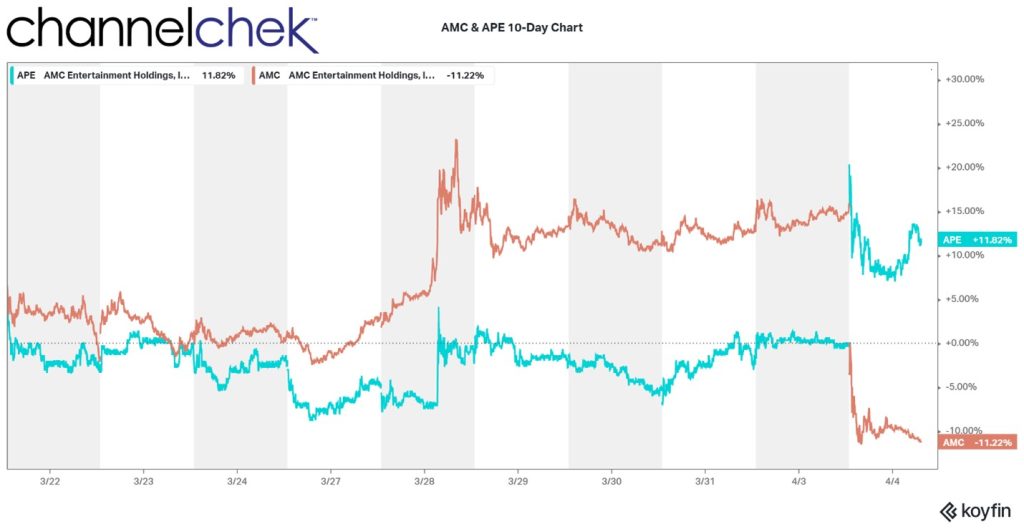

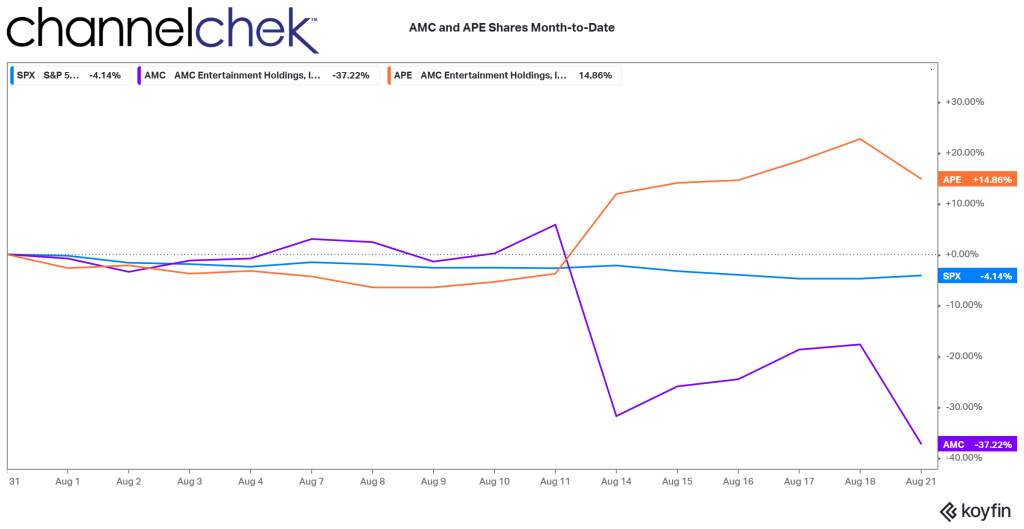

On August 11, the wild ride shareholders had been on got a bit wilder as a Delaware Court judge gave the green light to AMC proceeding with a revised plan to convert its preferred shares. This drove up shares of APE units and down the price of AMC common stock.

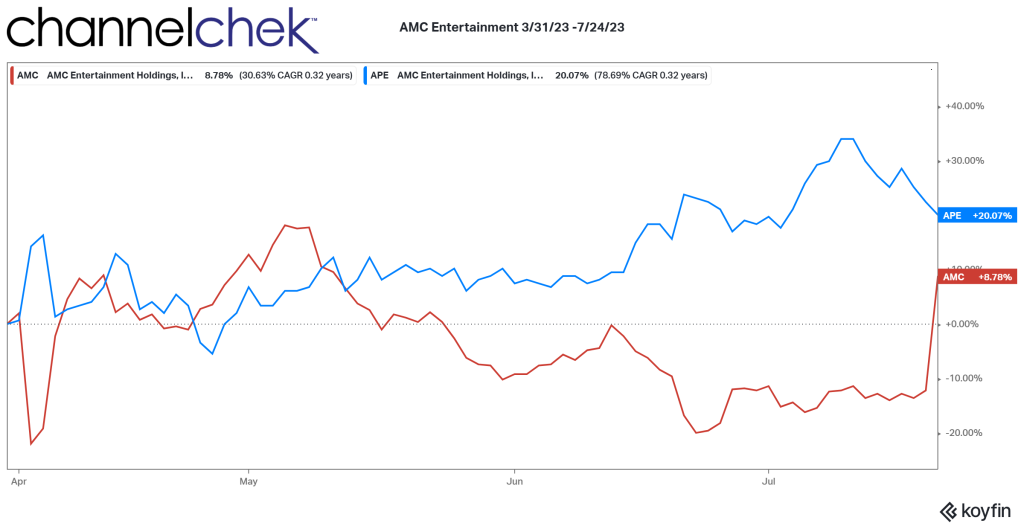

Month to date, APE units, which will not be trading by the end of the week, are up nearly 15% while AMC common stock is down over 37%. Since the court notice, volume has been significantly higher in both preferred and common.

The single AMC common share class is part of the movie theater chain’s recovery from the pandemic era debt built up. AMC is also planning a reverse 1-for-10 split of its common stock and an increase in its authorized common shares.

In Form 8-K filed with the SEC last week, AMC explained that the reverse stock split is expected to also occur on Aug. 24. The market will open on August 25th with the conversion complete, and the ticker APE delisted from the New York Stock Exchange.

Expectations of the stock-conversion is that AMC will be more resilient and will eliminate capital-raising inefficiencies of APE units trading at a significant discount to AMC shares, said CEO Adam Aron.

Analysts expect the shares to converge around the $3 price range.

Managing Editor, Channelchek

Sources

https://public.com/learn/ape-stock-amc-dividend#:~:text=%24APE%20is%20a%20new%20class,22.

https://courts.delaware.gov/Opinions/Download.aspx?id=351520