Looking Back at September and Forward to the Fourth Quarter

September is behind us, and so are the first three quarters of 2022. Yet still, other than the U.S. dollar, there hasn’t been a moonshot in any major market or sector. September 2022 is best characterized by saying a few markets tried to get off the ground, but not unlike the Artemis rocket that was scheduled to go to the moon on September 3rd, the launches were scrubbed and are now on-hold. Maybe they’ll fly in October.

Below we look at the month behind us in stocks, bonds, gold, and crypto. We do this with confidence that they won’t all be grounded forever – and look to find clues as to how the final quarter of the year may treat investors.

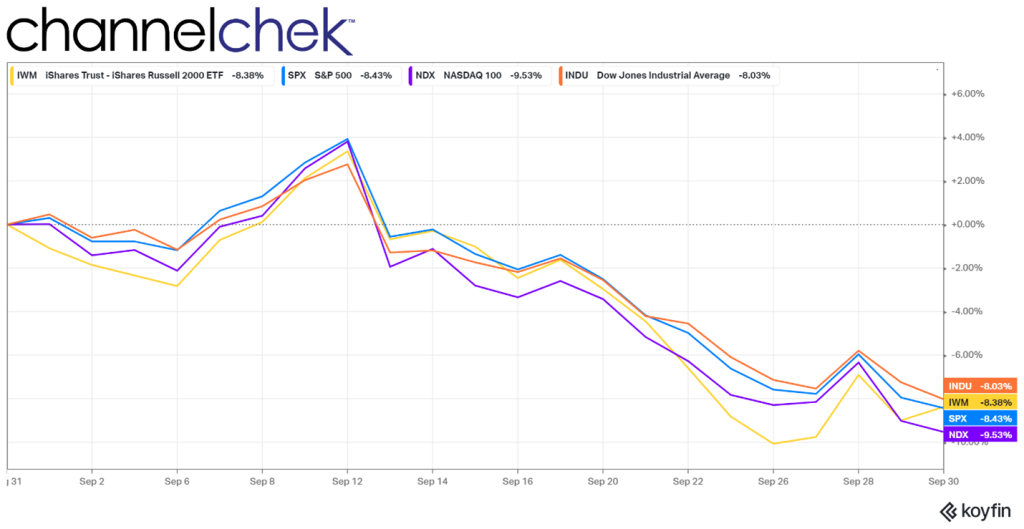

Major Market Indicators Tracked Closely

Source: Koyfin

Out of the four closely followed benchmarks, Nasdaq 100, S&P 500, Russell 2000, and Dow 30, there was no runaway index either massively outperforming or underperforming. During the second week in September, the indexes teased that they were ready for take-off after they strung together several consecutive days where they were each up 1%-3%.

Reasons for the bounce that week include that a few of the indexes were approaching a technical floor, through which they’d be considered in a bear market. Stocks rarely break through support levels on their first try. In fact, they often bounce by a large degree.

Adding to the stock market’s climb to as much as up 4% on the month were strong economic numbers, which gave some participants comfort that the economy is still producing jobs and will withstand the Fed’s withdrawing accommodation. Others saw the sign of strong numbers as a sign that the Fed would drive up rates, drag the economy into a recession, and then ease policy by bringing rates back down. This forward-looking reasoning had them bullish.

Eventually, as the month moved along and Jay Powell, the chairman of the Federal Reserve, continued reiterating the central bank’s resolve, stock market investors stopped fighting the Fed – from September 12th, until month-end, the indexes dropped between 12%-14%

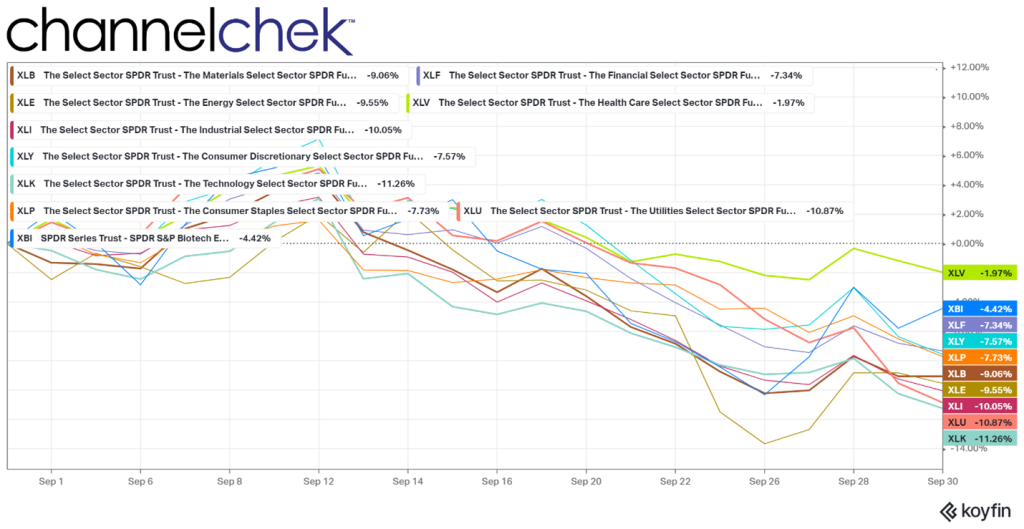

Sectors Within S&P Index

Source: Koyfin

The two standout sectors within the S&P 500 include Health Care which was least negative at down 1.90%, and Biotech, down 4.42%. While this performance doesn’t seem like something to get overly excited about, the dynamics which have taken these two only half as down as the broader index are worth looking into. Both health care and biotech had once been in the stratosphere during the early and mid-pandemic era. As the potential for further benefit waned, these segments fell from their stratospheric highs. Currently, there is potential as large pharmaceutical companies are flush with cash from the pandemic, sit with patents approaching expiration, and biotech, with fresh patents and current R&D on the next generation of medicine, running low on funds. These conditions are ripe for partnerships and acquisitions to accelerate between the two. This may include some individual biotech companies surprising investors with some very good news in the coming months.

On the weak side is technology, which also is still coming down from the pandemic-induced high. The index is down 11.09%. Utilities are also underperforming the broader indexes as higher fuel costs for electric companies and higher interest rates erode the attractiveness of dividends paid on these stocks.

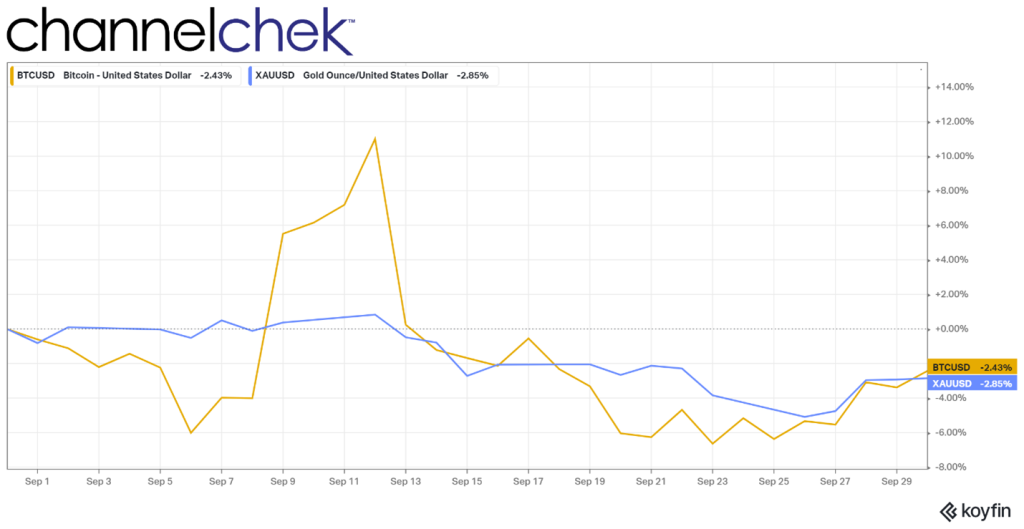

Gold and Bitcoin Performance

Source: Koyfin

Two non-equity assets, each claiming to be a safe haven during any market, political, or economic upheaval, outperformed the broader stock markets during September. Gold maintained its steady as she goes pace with very little volatility, while bitcoin had dramatic days on the up and downside, with each less than 3% lower than where they began the month.

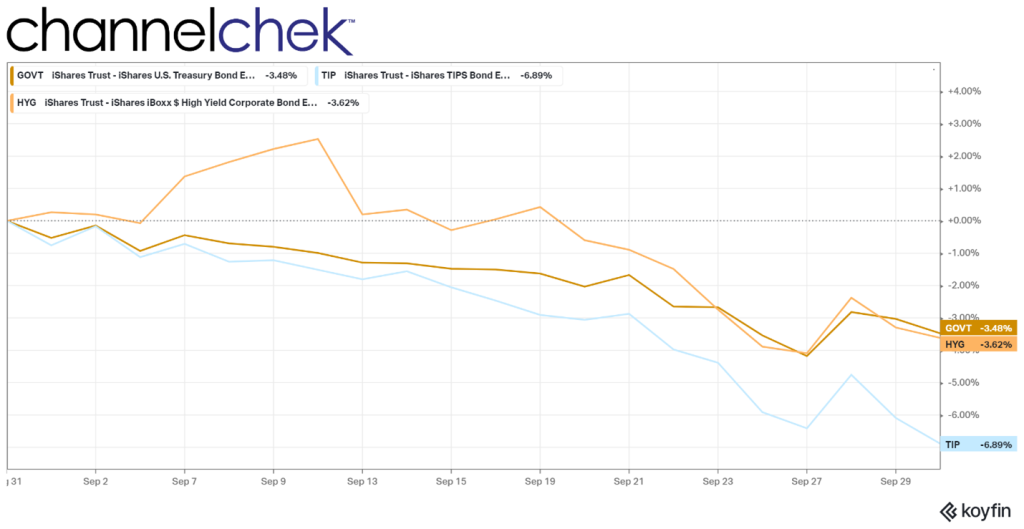

Fixed Income Performance

Source: Koyfin

Interest rates were the topic on everyone’s mind throughout the month. Government bonds are valued 3.48% less than they were at the start of September, with uncharacteristic volatility late in the month as markets first began to fear the worst and then reversed with the BOE announcement that it would resume a less restrictive and possibly easier monetary policy.

High-yield bonds more closely track equities (and even bitcoin) than the interest rate markets. These bonds of less creditworthy issuers spent almost half the month in the positive before underperforming treasuries, which were in the red for all of the month. Tips or inflation-indexed treasuries shed 6.89% for its investors. The securities are sold off a spread to a similar maturity treasury, so they will generally move in the same direction. The Fed holds on its balance sheet a large (as a percentage outstanding) of these securities, this has disrupted the bonds’ use as either a hedge against inflation or a gauge to see where the markets think inflation is heading.

A number of Fed governors spoke during the last week of September. They are united in their message that they are only just beginning to move monetary policy to a place where the economy is in a healthy situation where inflation isn’t eroding the dollar’s purchasing power. None have begun to hint that the policy statement from the November 2nd meeting will look any different than the last.

Managing Editor, Channelchek

Sources

https://www.washingtonpost.com/technology/2022/09/03/artemis-launch/