|

|

|

|

Will Small-Cap Stocks Continue to Outperform Large-Caps?

Introduction

Small-cap stocks rose 20% in the month of April to date, outpacing a 14% rise in the S&P 500 Index and a 13% rise in the Dow Jones Industrial Average. The outperformance came after an underperformance by small-cap stocks in March when concerns of the economic impact of the Coronavirus weighed on investors’ minds. With a government stimulus package spurring the economy and the stock market, is now the time for investors to shift focus towards small-cap stocks? Before doing so, a review of the pros and cons of small-cap versus large-cap stocks seems in order.

The Case for Small-Cap Stocks:

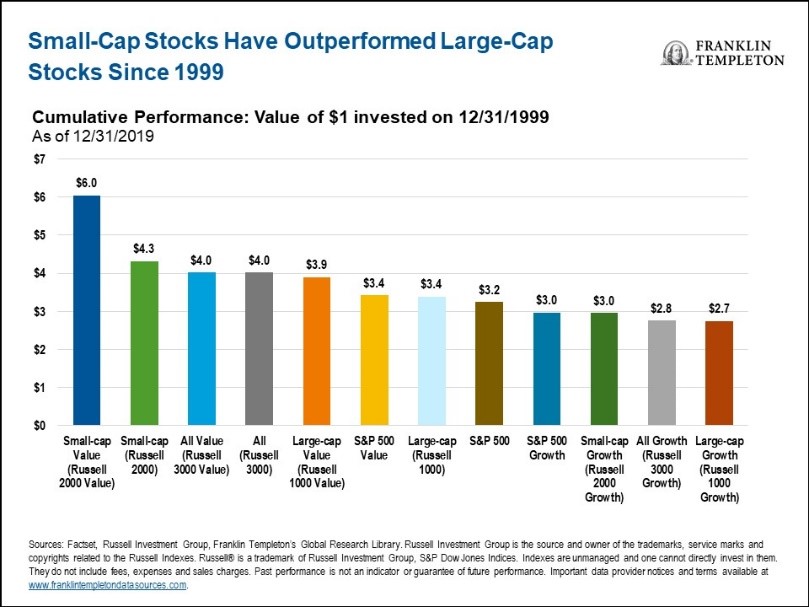

- Small-cap stocks have traditionally provided

higher returns. Small cap companies tend to be younger and grow at a faster rate than larger cap companies. A study published in the “Stocks, Bonds, Bills, Inflation (SBBI) Yearbook” showed that small-cap stocks returned 12.1% annually between 1926 and 2017 compared to 10.2% for large-cap stocks. Other studies have shown similar results for more recent time periods.

- Small-cap stocks outperform in an up market. Small-cap stocks tend to be higher growth stocks with higher Betas. They have historically outperformed large cap stocks during periods when stock markets are rising. TheStreet points out that small-cap stocks outperform large-caps in the four quarters following the official end of a period of contraction. Stock markets are performing well recently as they recover from a sell off related to the Coronavirus. If one believes the economy will grow as virus concerns dissipate, it is reasonable to believe small-cap stocks will outperform large-cap stocks.

- Small cap stocks are less impacted by global

issues. Small cap stocks tend to report a lower percent of sales from overseas. They are less affected by currency translation issues or trade wars. They would be impacted less by an overall slowdown in the global economy or a move to a more protectionist political stance by our government than large-cap stocks.

- Small-cap stocks add diversity. It is easy to invest in large-cap stocks. They sell the products investors use. You know the companies’ names from their advertising. It is harder to invest in small-cap companies without household names. However, they are an important component of a well-diversified portfolio.

- Small-cap stocks are less efficiently priced. Part of the appeal of investing in small-cap stocks is that the stocks are not followed by as many analysts as large-cap stocks. While that may make it more difficult to get information and advice, it also means there may be inefficiencies with small-cap stock prices. Inefficiencies create room for individual investors to find hidden investment opportunities. The chart below shows the average number of analysts following companies of differing market capitalization.

- Small-cap companies are more likely to be

takeover targets. It is easier to arrange the financing and handle the potential dilutionary effects of a small acquisition than a larger one. Consequently, it is reasonable to assume that small-cap companies are more likely to be acquired than large-cap companies.

The Case Against Small-Cap Stocks

- Small cap stocks trade at higher

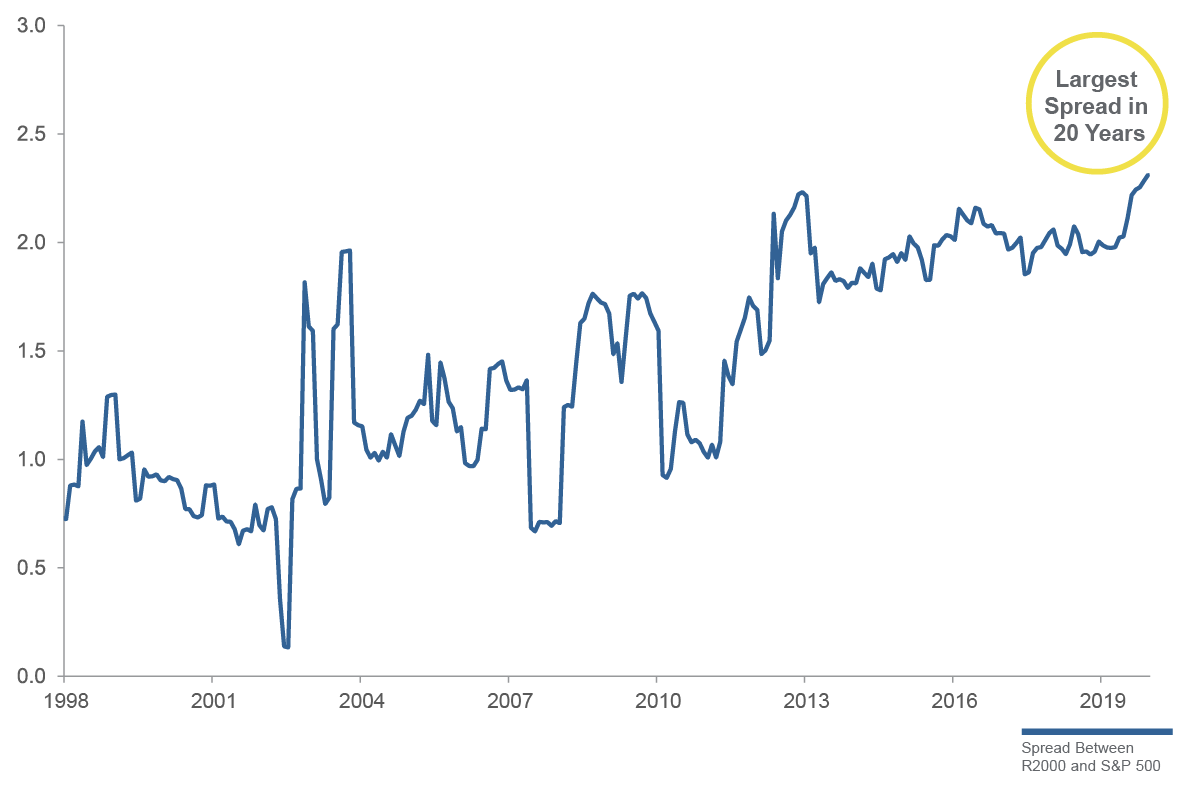

multiples. The Russel 2000 Index is currently trading at 27 times forward earnings as compared to a multiple of 19 times for the Dow Jones Industrial Average. Even when one adjusts for higher growth expectations by comparing P/E as a multiple of growth (PEG multiple) small-cap stocks trade at a higher multiple.

- Small cap stocks have more risk. Small cap stocks are less diverse than large cap stocks and often do not have cash reserves or the access to capital enjoyed by larger companies. In addition, small cap stocks are not as liquid as large cap stocks, which may make it more difficult for large investors to move in and out of the stock. A study by Westwood indicates that small-cap companies have been taking on more leverage than large-cap stocks in recent years.

Spread Between Small Caps and Large Caps (Net Debt to EBITDA)

Summary

Experts may never be able to give a definitive answer to the question about whether it is better to invest in small-cap or large-cap stocks. The correct answer lies in what the investor believes the overall economy and stock markets will do in the future. It also depends on individual investor risk tolerance and liquidity needs. Nevertheless, it is safe to say that small-cap stocks can be an important component of any investor’s equity portfolio as a means of providing diversity and growth. Historically, that has been especially true during periods after a market correction.

Suggested Reading:

Why

Index Funds Could be a Mistake in 2020

What

Now? Post Pandemic Stock Market Investing

Stock

Index Adjustments and Self-Directed Investing

Register for Channelchek Premium Content and Tools at No Cost!

Sources

https://www.thestreet.com/markets/what-the-russell-2000-can-tell-us-about-the-u-s-economy-14933740, Scott Bauer, The Street, April 23, 2019

https://money.usnews.com/investing/investing-101/articles/why-you-should-be-investing-in-the-russell-2000-index, Ellen Chang, US News, January 4, 2019

https://www.yardeni.com/pub/stockmktperatio.pdf, Dr. Edward Yardeni, Yardeni Research, April 27, 2020

https://westwoodgroup.com/insight/quality-is-the-key-to-getting-the-shift-to-small-cap-value-right/, Westwood

https://www.thebalance.com/when-is-the-best-time-to-invest-in-small-cap-stocks-2466854, Kent Thune, the balance, January 10, 2020

https://seekingalpha.com/article/4326493-5-reasons-to-consider-investing-in-small-cap-value-stocks, Franklin Templeton Investments, February 23, 2020