Small-Cap Stocks Have Shifted into Outperformance Mode

The behavior of drivers I witnessed while driving south from New York to Florida after Labor Day reminded me of reactions prevalent among market participants. Behaviors that literally drive travelers; from the professional (truck driver) to the guy in the sports car, or the family cruising in the SUV, also impact investor behaviors. There are people in the markets and on the road, especially professionals, that always seem to know things first and how to respond. There are also impatient drivers and investors, those that want fast results, and safer people just trying to be prudent. They’re all on the same road, but their level of expertise and reason for being there is different, so is their ability to change when needed.

My personal driving style is risk-averse; I just want to arrive alive. My normal pace is about 7 miles per hour above the posted speed limit. This is often a little slower than those around me, but not so slow as to annoy others on the road. During this most recent road trip, while just south of Annapolis, there was a significant number of cars on the road, yet the pace was brisk. We were all making good headway (just as investors in large-cap, especially tech, have over most of the summer had been). Like these investors, I let my guard down with everyone else who had grown comfortable with the velocity that we were moving. I was startled from my comfort when a car came past exceeding the average speed by 15-20 mph. I then noticed that a few of the cars around me increased their own pace. People are inclined to increase their risky behavior when they see others less cautious and benefitting from it. As far as I can tell, the truck drivers didn’t change their behavior. As professionals, they learned from experience and training what was best for them. A few miles past where the cars sped up, I saw a number of vehicles, mainly trucks exiting the interstate. This got my attention, and I considered doing the same as these drivers are often more in the know than the occasional vacationer like myself. Without a known alternative route to take me where I wanted to go, I decided not to.

It did not take long before I realized why the professional drivers exited. The car that startled me as it raced past earlier had just gotten into an accident. It was left overturned with steam coming from what I assume was the front. The cars around me quickly slowed their pace to the speed limit. I reduced my speed as well; I also lowered the volume on my music and placed my hands firmly at 10 & 2 o’clock on the steering wheel. Seeing what could happen caused us all to be safer drivers. For some of us, that lasted about ten miles. After that I saw people begin to resume their speed. For others, they shook off the reality of the possibility of crashing sooner and resumed their pace quickly. This wreck wasn’t the only one I witnessed on my 1200-mile drive. Each time I saw caution temporarily increase among those around me. The stock market has behaved the same way throughout 2020. On two occasions we’ve experienced severe and sudden downturns; after each, people have quickly resumed their pace.

Stock Market Highway

Leading up to the late February 2020 record-level highs in the major indexes, we saw many investors speeding into the market. Tech stocks were especially popular, but many sectors had continued strength as we ignored warnings of an overextended market, sorted out pandemic risks, and the idea that the pace may be dangerous. The markets did come screeching to a halt after President’s Day as some participants exited out of equities and others took alternative routes to stocks most likely to benefit from a response to the pandemic.

The 30% crash ending in March caused many to head to the sidelines as the reality of what could happen became reality. Some of these investors stayed cautious and missed opportunities as the market rose again. Others pivoted to companies that eventually proved to be the darlings of the situation. This included big tech, pharmaceuticals, and online retail.

Source TradingView.com – NASDAQ 100 E-Mini as Proxy for NASDAQ 100 Stocks (1 year)

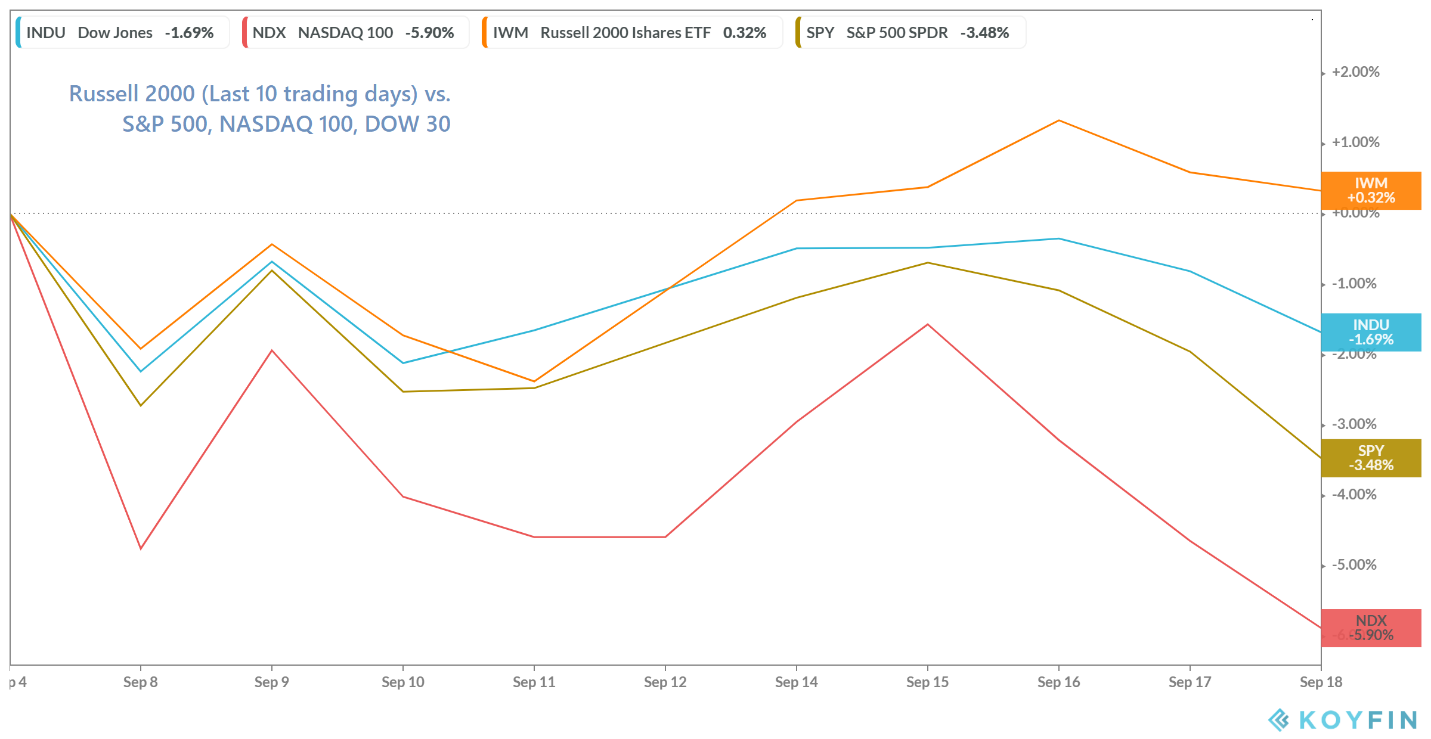

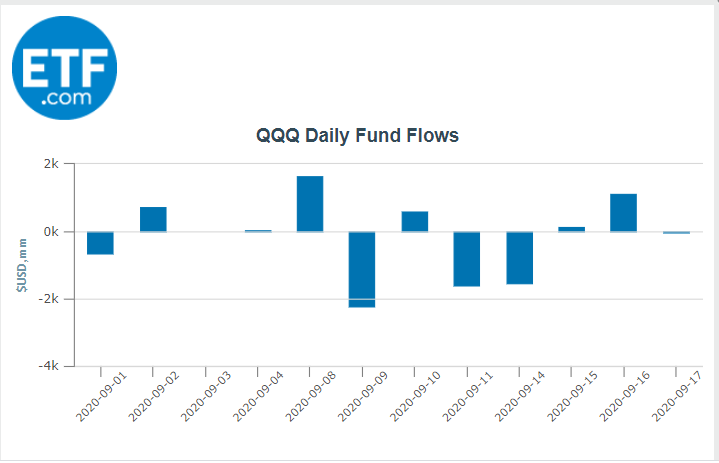

In the past few weeks, these darlings, the companies that had been speeding the most after the earlier crash, have hit another rough patch. During the last 14 days (Since September 4) the NASDAQ 100 is down 5.9% as investors move money out and find different avenues.

Taking an Exit

On September 2, thanks to tech stocks and other COVID related plays, the large-cap indexes had reached a new all-time high. In the short time since then, they have given up more than 10% (NASDAQ 100). Although this rapid selloff is not currently as large as the 30% route in March, it was rapid and exceeds the psychological 10% level that investors react to.

The question now is, is this a pause before large tech investors begin “bargain” hunting, or have they shifted their focus. Chart comparisons for popular indexes may be able to answer this. If the pattern holds, it looks like investors may have exited the large-cap tech highway and found an alternative route in small-cap investments. This is starting to become visible when comparing major index results over the past 14 days, and money flows among ETFs.

While the three most quoted large-cap indices are down over the past two weeks, the small-cap stocks, which weren’t getting much attention during the race to the new peak, have significantly outperformed as money was taken off the table in the high flying large caps and placed instead in companies with lower market caps. This may prove to be a smart detour as the economy gets on a stronger footing.

From Friday, September 4 through Friday, September 18, the Russell 2000 index showed positive results while the DOW 30, S&P 500, and NASDAQ 100 were down meaningfully.

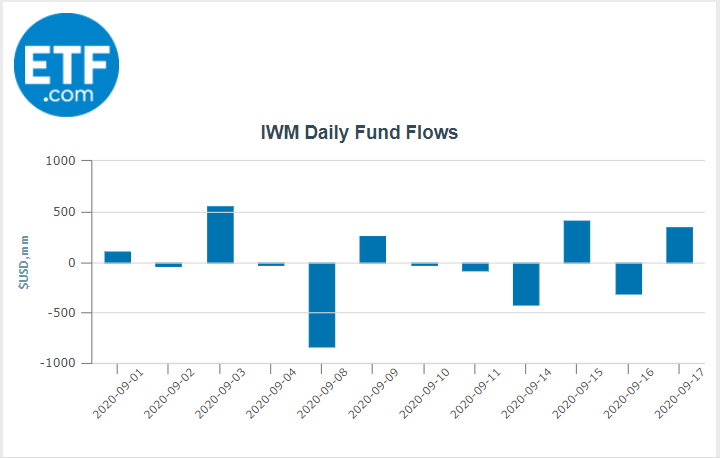

Fund flows into ETFs with performance that tracks small-cap indices have outpaced flows into large-cap funds. This change suggests that market participants selling out of large-cap have not left the market. They have just adjusted the road they believe is now safer and could offer a better return.

Shifting Gears

The small-cap companies represented in the Russell 2000 rely less on profits from doing business overseas than the large-cap indexes. As the U.S. pace of recovery is strong, it makes sense to look domestically for value. Larger corporations with stable and stronger financials were the “flight-to-quality” trade early in the pandemic. Unwinding these trades also has the effect of cash moving back into a more diversified position. Domestic small-caps also have less international exposure, they are more shielded from sovereign and other geopolitical risks. The U.S. relationship with China, Brexit concerns, and a Presidential election may complicate global investing. This bodes well for companies that primarily have their operations in North America.

Though far from the “best-ever” economic levels we saw pre-pandemic, data has been improving. The unemployment rate is at 8.4%, this is much better than what many economists had forecasted for the remainder of the year, manufacturing has also expanded, and confidence is high

Take-Away

The relative increase in small-cap stock interes shows that investors think the run-up in companies that benefit from social distancing are low on gas.

Small-cap stocks are providing somewhat of a refuge from the rout that tore through equity markets this month. This signals that investors see brighter days ahead for the economy as pandemic lockdowns are lifted.

Not unlike highway driving, market movement is the cumulative effects of all the behaviors of those involved. It makes sense that there are some investors who have already begun leaving the large-cap companies that had treated them well and are now taking other routes. The conditions are changing, it may be time for investors to take it off autopilot and adjust once again for what may be called for.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

Do Analyst Price Targets Matter?

Fear of Missing the Next Apple

A Virtually Perfect Time to be in This Business

Enjoy Premium Channelchek Content at No Cost

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 online investors. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 online investors. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

Nasdaq, tech stocks coming out of correction

Small Caps Emerge Relatively Unscathed in Megatech Bludgeoning