|

|

|

|

How High Can the Market Go?

The markets continued to defy gravity after NASA, with the help of Zoom, rang the Nasdaq opening bell from space on Tuesday, June 3. The major indexes have continued to reach higher each day since the March 23rd bottom, causing some to feel uncomfortable with the current level of the market. Nasdaq has been particularly ballistic. In just under six months this year, the Nasdaq 100 has gained 11.2%.

There are many economic, political, medical, and business concerns that would cause one to expect the market to be down. There are also various measures and valuation methods that suggest the most followed indexes are at their melting point. Rather than listing these concerns or rehashing the extreme valuations, it is helpful to understand the reason for the rise. In this way we are giving the market the benefit of the doubt. After all, successful investors know, the market is never wrong. To make money you must know where it is going, even if you don’t think it should go there.

The Sustainability

of Daily Market Increases

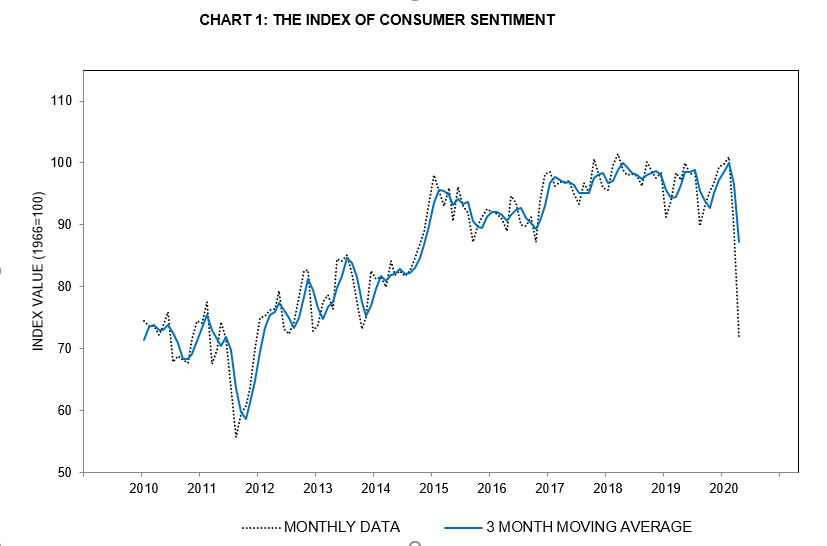

The Michigan Consumer Sentiment Index (MCSI) is a monthly survey of U.S. consumer confidence levels conducted by the University of Michigan. The current sentiment has not been this depressed in eight years. Obviously, with 14.7% now claiming unemployment, households are deciding which basic necessities they can afford and which they can put aside. For a large percentage of Americans, this makes discretionary spending out of the question.

With such a large population of consumers avoiding discretionary spending, corporate earnings will be squeezed in most sectors. Businesses already are going bankrupt at a record pace. Some of the more recognizable names that filed for bankruptcy in May included J. Crew, Neiman Marcus, Hertz, and Tuesday Morning. Airlines which had crew shortages in 2019 are laying off thousands this year.

Under even the best conditions, daily stock market increases are not sustainable. So it is safe to project they certainly will come to an end at some point. All rallies do. This latest rally has continued for three reasons. All three are positive expectations rather than actual experience.

- Expectations of a quick cure and/or vaccine for Covid-19 will get us back to work

- Expectations for built up post-pandemic demand will be highly stimulative

- Expectations that Government financial support will be immense and ongoing

These three by themselves are likely just fuel for the current height of the financial markets. After all, at the beginning of this year companies were guiding expectations lower. Channelchek discussed this in an article titled Is

the Market Disregarding Earnings Results? which we published on February 14th of this year. This was before the coronavirus lockdown and well before the riots that have spread out of Minneapolis. At that time it was easy to make an argument that markets were steamy and needed to cool off a bit. There are significantly more headwinds now, to say the least. Still, the Nasdaq 100 actually passed it’s February 19th high in midday trading this week.

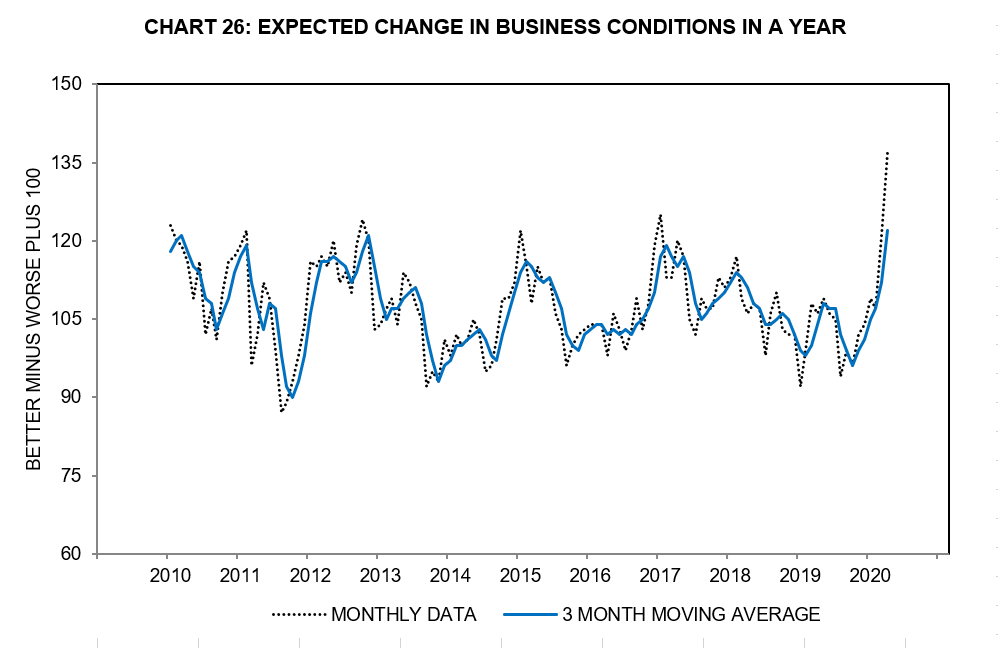

The University of Michigan also polls consumers on their expectations on improving business conditions. These numbers are quite positive. A higher percent of consumers than any time in the past ten years views the outlook as improving. This survey doesn’t ask “better than last year?”, it asks “better than now?” With this, it isn’t surprising that such a high percentage sees an improvement. Feeling that things will get better may have been the initial spark that stopped the fall in March.

University of Michigan Survey Data

Fear of Missing Out (FOMO)

The average daily growth in the S&P 500 over the past 50 days is 0.78%, while the return for owning a US Treasury 10-year for 365 days is 0.76%. That’s less than 1/365 in return. Risk versus return is one driver of investor behavior. Confidence is another driver. On the day after election day in 2016 the Dow hit an all-time after a dramatic late-day rally. Nothing had fundamentally changed in the market except increased confidence in business conditions. This stoked some buying which then prompted more buying.

It often only takes a couple of strong days before the attention of a larger pool of investors begins to want in on the rise in prices. This then feeds on itself as more and more see the movement and fear they will miss out. This happened when US stocks bottomed in March 2009. The economy was still bad and quite uncertain. The result, confidence in the future, and governmental support led to the longest bull market in American history.

Take-Away

There are some faint signs that the economy is bottoming. For instance, the number of unemployment claims has slowly declined, and mortgage applications, both refinancing and new purchases, are rising. Airline passenger activity and restaurant traffic are climbing as well.

The opposite of the fear of missing out is fear of staying at the party too long — not booking profits on the way up. This causes a downward movement that is often more rapid than the upward climb. The Fed and participants long the market certainly hope that after defying gravity amid so much uncertainty, that any reduction in pace leads to a soft landing.

Suggested Reading:

The

Feds ETF Purchases Will Impact Investors

The

Correlation Between Passive Investing and Underperformance

Can

the Market Continue to Defy Gravity?

Enjoy Premium Channelchek Content at No Cost

Sources:

https://www.nasdaq.com/articles/how-nasdaqs-opening-bell-defied-gravity-2020-06-03