Much of Market Performance, in Some Cases All, Occur When the Market is Closed

All traders and most investors have experienced this. From one market close to the next, indexes or stocks rise by 1.5% – 3%, and yet there was never a clear opportunity to make a dime after the market open. The frustration is because the market opened with much or all of the day’s gain baked in. It has been proven to be accurate that the most significant revaluation of stocks occurs during the 17 hours when the market is closed, not the 7-hours when it’s open. And any long-term chart will show that the direction of revaluation over time has been upward. Details, along with other phenomena related to night moves, are discussed below.

Background

Historically, stock markets have had a positive return, and most of this change occurs while the exchanges are closed or not during regular trading hours. Historically the tendency is to make most of its daily move between the closing and opening bell.

This has been shown in research papers through the years, and there are even ETFs which purport to take advantage of this statistical phenomenon. Of course this is not an everyday occurrence, in fact today (4/6/23), the S&P 500 opened lower than its previous close but began moving higher than the open around noon.

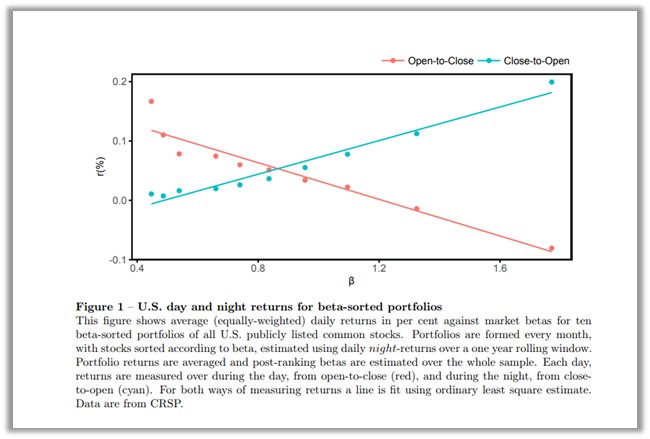

A well-researched scholarly paper had been published demonstrating these price movements and offered the explanation that stock prices behave very differently with respect to their sensitivity to beta when markets are open for trading versus when they are closed. The paper titled, Asset Pricing: A Tale of Night and Day, by Henderschott, Livdan, and Rösch explained, “stock returns are positively related to beta overnight whereas returns are negatively related to beta during the trading day.”

One goal of the research was to test the hypothesis that a securities performance relative to beta is only positive during certain periods. In the paper the researchers tested specific days or months by examining the CAPM validity during different time periods within each day, including all times and all days during the week. The authors wrote, “when the stock market is closed, beta is positively related to the cross section of returns. In contrast, beta is negatively related to returns when the market is open.”

The overall thrust of the findings in the 47-page paper are encapsulated in the chart above which plots the performance during opened and closed periods against different beta groupings of stocks over 25 years.

Can Investors Use this Information?

Most retail trading today is commission free, but there is still a bid offer spread and other slippage. For those that would prefer to not have to be active each day, twice a day, Nightshares ETFs were formed to exploit this phenomenon, with a set it and forget it approach. On the surface it would seem to make sense for long term investors. You could own the S&P 500 index ETF, or increase beta exposure for a potentially better performance with a small-cap index ETF.

The founder of Night Shares, Bruce Lavine, pointed out in an interview that over the 20 years through the end of 2022, the SPDR S&P 500 ETF SPY, 0.31% produced a buy-and-hold return of 9.7% annualized. Three-quarters of that return — 7.5% — was produced while the NYSE was closed.

The numbers are even more pronounced in the case of the small-cap Russell 2000 Index, according to Lavine. Over the same 20-year period, all of the index’s net return was produced overnight; during the day session, it actually lost ground on balance. In other words, small-cap portfolios that out-returned large-cap would have been better off if they were not exposed during the day.

Paul Hoffman

Managing Editor, Channelchek

Sources

https://faculty.wharton.upenn.edu/wp-content/uploads/2013/06/draft20130612pp-full.pdf