DWAC, Trump Media Merger Now With Fewer Hurdles

Digital World Acquisition Corp. (DWAC), the Special Purpose Acquisition Corp. (SPAC), which agreed to merge with a Twitter competitor, Trump Media & Technology Group (TMTG), reported news that is driving its stock price higher. The agreement to merge back in October 2021 has encountered a number of unexpected hurdles as it has moved toward a planned merger before September 8, 2023. This week, DWAC, which went public in September 2021, reached an agreement with the enforcement division of the SEC that should again clear the way to complete the planned merger.

DWAC announced on Friday that it had reached a preliminary settlement with the Enforcement Division of the U.S. Securities and Exchange Commission (SEC) involving an investigation started on December 2021 by the regulator, which on March 8, 2022, then issued a subpoena to DWAC seeking information about its merger with TMTG.

According to the proposed settlement, DWAC will make the requested revisions to its previously submitted Form S-4 (acquisition registration statement) to ensure its accuracy and alignment with the SEC’s findings. Along with the revised S-4, Digital World Acquisition Corp has agreed to pay an $18 million civil money penalty to the SEC following the completion of any merger, business combination, or transaction, whether with the Truth Network or another entity.

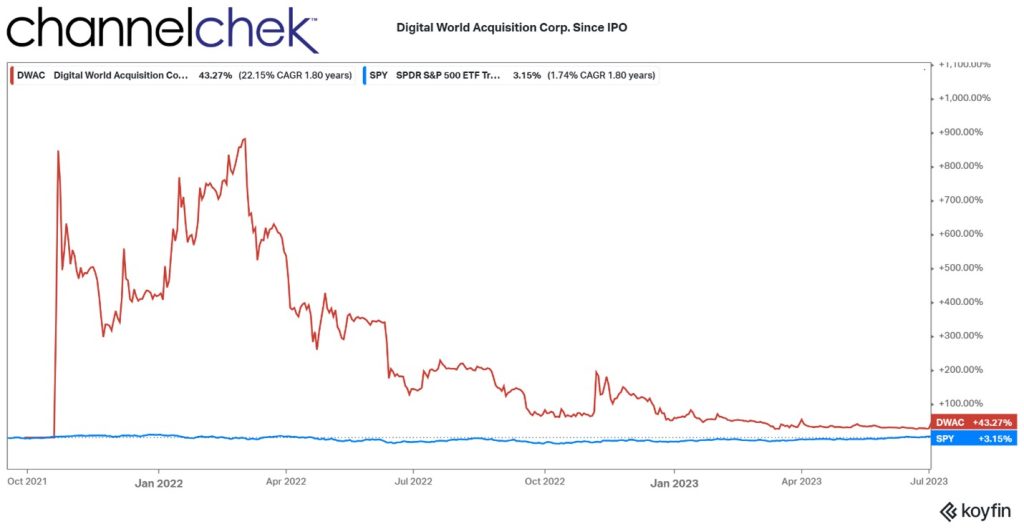

Shares of DWAC are well off the highs reached after the agreement to merge had been announced. For those in the initial public offering (IPO) they have still experienced performance better than the overall market, despite the roadblocks over almost two years.

In addition to the proposed SEC settlement, DWAC also just disclosed it received a note from TMTG expressing disagreement regarding a section of the Merger Agreement that relates to deadlines. According to the Company’s interpretation, upon obtaining approval from its shareholders to extend the liquidation date by three additional months (totaling 12 additional months from September 8, 2023, to September 8, 2024), DWAC then has the right to extend the Outside Date of the Merger Agreement for the same period.

This runs counter to what the TMTG believes which is that it is only bound by the Merger Agreement until September 8, 2023. Due to previous extensions of the liquidation date and Truth Network’s acknowledgment of being bound until September 8, 2023, the DWAC aims to now address this disagreement in good faith, considering the historical extensions and the delayed submission of required deliverables by TMTG.

DWAC remains interested in the transaction and hopes to resolve this discrepancy with Trump Media.

Managing Editor, Channelchek

Source

https://www.sec.gov/Archives/edgar/data/1849635/000119312523181415/d457685d425.htm

https://www.sec.gov/Archives/edgar/data/1849635/000119312523181415/d457685d425.htmhttps://tmtgcorp.com/