Image Credit: Diverse Stock Photos (Flickr)

Will Bankrupt Revlon Get a Makeover from a Self-Directed Investor Frenzy?

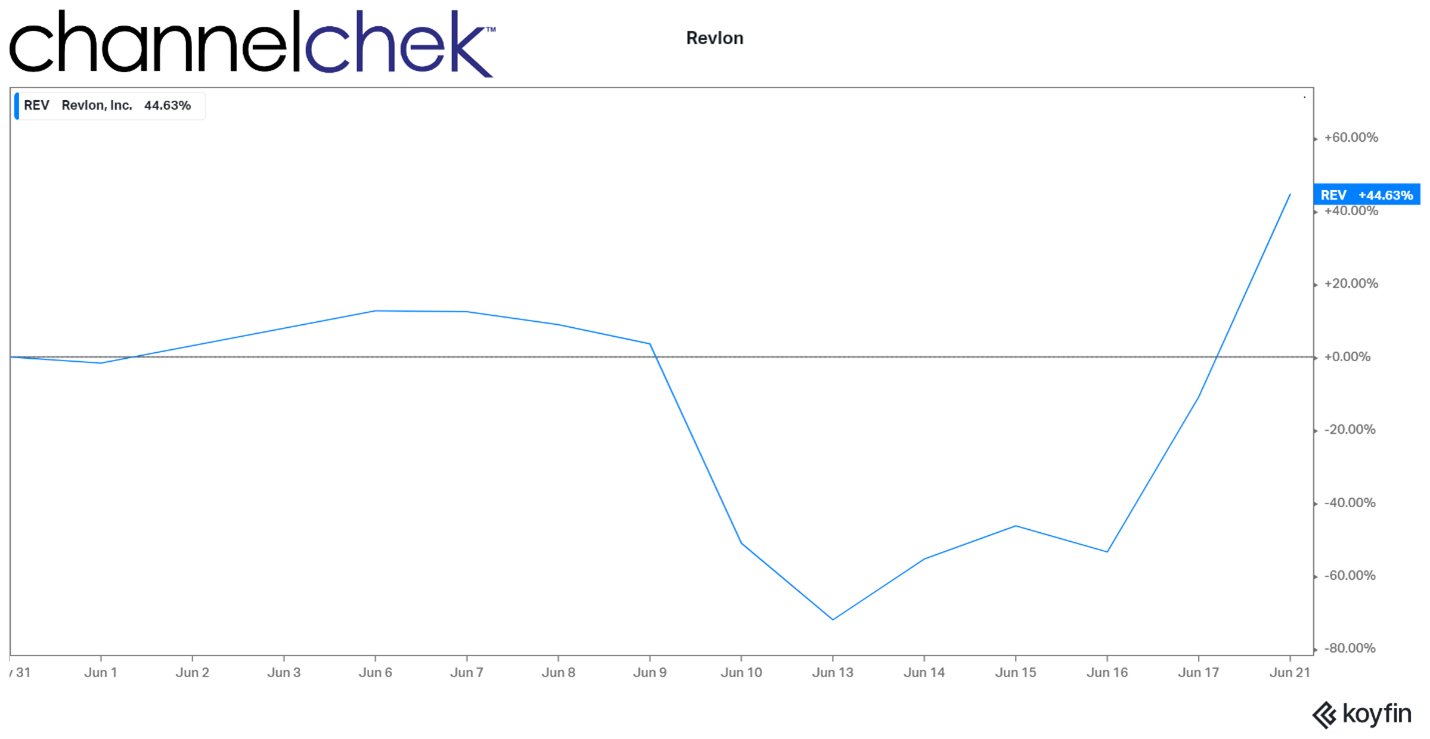

The 80% increase in Revlon’s (REV) price Tuesday (June 21) shows that strong influence remains in the hands of retail investors. The company, which declared bankruptcy last week, is now up 461% since that announcement. At play is the same social media communication network that helped drive up GameStop (GME) in early 2021, provided capital to AMC Theaters (AMC), and elevated values of cruise lines that sat mostly idle during the pandemic. This time, it’s again with a household name that was getting a large amount of short-seller attention.

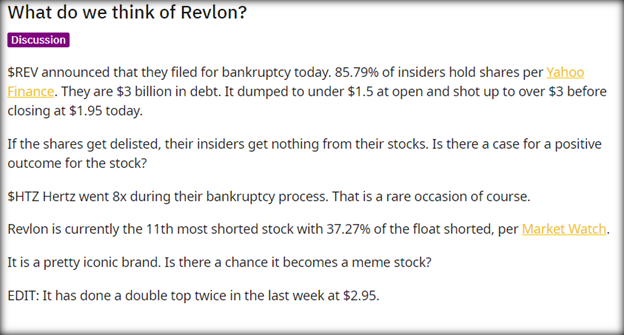

Revlon hit a low last week of $1.08 and has since rocketed up to $6.06 which it hit yesterday (June 21). The impetus seems to have begun with a Reddit post. A member of r/wallstreetbets compared the current setup in Revlon to Hertz (HTZ) in 2020, noting that the company has an iconic 90-year-old brand and also has a high short interest of 37%. Today, Revlon’s short interest as a percentage of the total float increased to more than 50%, and Fintel identified the company as a top short-squeeze candidate.

The Reddit post asked, “Is there a chance [Revlon] becomes a meme stock?”

Source: Koyfin

The strong buying by self-directed individual investors is reflected as it’s one of Fidelity’s top ten-traded tickers. The broker showed Revlon as the ninth most popular stock traded by their customers on Tuesday, with buying pressure outweighing selling pressure.

Image: upikatruuu (r/wallstreetbets)

Hertz was able to quickly resolve its bankruptcy as its market value and access to capital increased and protection from lenders allowed it to shed over $5 billion in debt.

This is a possible attempt to replicate the magic of Hertz, which soared nearly ten-fold in June 2020 after the company filed for bankruptcy, this activity could provide Revlon with more options.

For now, the stock is acting in a similar fashion to Hertz and other meme stocks. The rally has been intense and supported by volume. The company is using the bankruptcy process to reorganize its capital structure as it has high debt and struggles with declining sales due to people staying inside during the pandemic, the continued work-from-home environment, and competition from Kim Kardashian West and Kylie Jenner’s makeup brands, among others.

One unanswered question equity investors in Revlon may wish to resolve, is if Revlon’s equity holders will be left with anything after the bankruptcy proceedings or if the courts and company prioritize paying back notes and other loans. For now, retail investors are betting there might just be some equity value remaining, and that momentum carries the stock price even higher.

Managing Editor, Channelchek

Suggested Content

Is it Game-Over for Meme Stock Investors?

|

Exposure to Non-Travel Leisure Stocks

|

You Can Own a Piece of r/wallstreetbets

|

Michael Burry Uses Burgernomic’s Logic to Evaluate the US Dollar

|

Sources

https://www.bloomberg.com/news/articles/2022-06-16/revlon-files-for-bankruptcy-facing-high-debt-supply-chain-pain

https://www.reddit.com/r/wallstreetbets/comments/vdx78t/what_do_we_think_of_revlon/

https://www.vandatrack.com/

https://eresearch.fidelity.com/eresearch/gotoBL/fidelityTopO

https://investorplace.com/2022/06/revlon-is-bankrupt-what-comes-next-for-rev-stock/

Stay up to date. Follow us:

|