Research News and Market Data on VVX

Second Quarter and Recent Highlights

- Record revenue of $1.07 billion, up 10% y/y

- Operating income of $27.4 million; adjusted operating income1 of $65.8 million

- Net loss of $6.5 million, down $8.3 million y/y

- Adjusted EBITDA1 of $72.3 million with a margin1 of 6.7%

- Diluted EPS of ($0.21); Adjusted diluted EPS1 of $0.83

- Over $4 billion of recent awards, including a new award valued up to $3.0+ billion to provide next generation readiness

- Successfully repriced and extended $904 million Term Loan B

2024 Guidance:

- Raising full-year revenue guidance and reaffirming Adjusted EBITDA, EPS, and Operating Cash Flow1

MCLEAN, Va., Aug. 6, 2024 /PRNewswire/ — V2X, Inc. (NYSE:VVX) announced second quarter 2024 financial results.

“I am honored to join the V2X team and look forward to leveraging our mission first culture, differentiated capabilities, and impressive past performance to achieve our next stage of growth,” said Jeremy C. Wensinger, President and Chief Executive Officer of V2X. “Our people, processes, agility and expertise to operate worldwide are a differentiator. This enables alignment to critical missions with an ability to operate at scale around the globe.”

Mr. Wensinger continued, “Demand remains strong for our mission based full lifecycle solutions and was demonstrated through several recent awards valued at over $4 billion. This includes a new five-year award valued at $3.0+ billion to deliver next generation readiness. In addition, we received a new production award from the U.S. Army for our Gateway Mission Routers valued at $49 million, an award valued at $265 million to support NASA’s operations in preparation for human spaceflight missions at the Johnson Space Center, and the award of the F-5 adversarial aircraft program from the U.S. Navy valued at $747 million.”

“Importantly, our ability to deliver a full range of assured communications has resulted in two awards, further expanding our relationship with the Navy and our footprint in the Pacific. Our $88 million Naval Computer and Telecommunications Pacific award will provide vital C4I support to forces across the Pacific and Indian Oceans. Our $141 million Fleet Systems Engineering Team (FSET) program will continue to deliver end-to-end C4I systems engineering solutions. FSET ensures that no U.S. Navy Strike Group deploys without V2X.”

Mr. Wensinger concluded, “V2X has great momentum and I believe there is substantial opportunity to build upon the impressive foundation by further leveraging technology and solutions to enhance business and customer outcomes.”

Second Quarter 2024 Results

“V2X reported record revenue of $1.07 billion in the quarter, which represents 10% year-over-year growth,” said Shawn Mural, Senior Vice President and Chief Financial Officer. “Revenue growth in the quarter was achieved through continued expansion of existing business in the Pacific and Middle East regions, as well as new programs. Revenue growth in the Pacific was 29% year-over-year and 23% on a sequential basis, driven by continued expansion of scope and services in the region. Revenue growth in the Middle East was also 29% year-over-year, driven primarily by expansion in Qatar and the continued phase-in of our longer-term Saudi Aviation Training and Support Services program.”

“For the quarter, the Company reported operating income of $27.4 million and adjusted operating income1 of $65.8 million. Adjusted EBITDA1 was $72.3 million with a margin of 6.7%. Second quarter GAAP diluted EPS was ($0.21). Adjusted diluted EPS1 for the quarter was $0.83. The adjusted tax rate in the second quarter was 28% due to the executive transition. Absent this, our adjusted tax rate would have been approximately 23% yielding adjusted EPS of $0.88.”

“Year to date, net cash used by operating activities was $31.6 million, reflective of working capital requirements to support growth. Adjusted net cash used by operating activities1 was $137.3 million, adding back approximately $12.1 million of M&A and integration costs and removing the contribution of the master accounts receivable purchase or MARPA facility of $117.8 million.”

“At the end of the quarter, net debt for V2X was $1,150 million. Net leverage ratio1,2 was 3.56x, essentially flat compared to the first quarter 2024. We expect to achieve a net leverage ratio of 3.0x, by the end of 2024. During the quarter, we successfully repriced and extended our $904 million Term Loan B. This outcome is a testament to the strength in our business and is yielding additional interest expense savings while lowering our overall cost of capital.”

“Total backlog as of June 28, 2024, was $12.2 billion. Funded backlog was $2.9 billion. Bookings in the quarter were $759 million. We expect backlog to increase in the second half of the year due to awards and contract definitizations.”

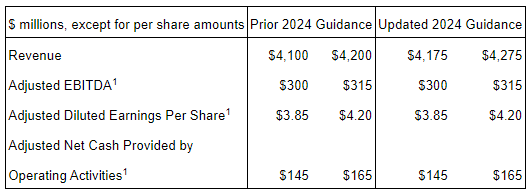

Raising 2024 Revenue Guidance

Mr. Mural concluded, “Given our strong revenue performance in the first half of the year we are updating our total year guidance.”

Guidance for 2024 is as follows:

The Company is not providing a quantitative reconciliation with respect to this forward-looking non-GAAP measure in reliance on the “unreasonable efforts” exception set forth in SEC rules because certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. For example, unusual, one-time, non-ordinary, or non-recurring costs, which relate to M&A, integration and related activities cannot be reasonably estimated. Forward-looking statements are based upon current expectations and are subject to factors that could cause actual results to differ materially from those suggested here, including those factors set forth in the Safe Harbor Statement below.

Second Quarter Conference Call

Management will conduct a conference call with analysts and investors at 8:00 a.m. ET on Tuesday, August 6, 2024. U.S.-based participants may dial in to the conference call at 877-506-6380, while international participants may dial 412-542-4198. A live webcast of the conference call as well as an accompanying slide presentation will be available here: https://app.webinar.net/Aba2LPOkBXe

A replay of the conference call will be posted on the V2X website shortly after completion of the call and will be available for one year. A telephonic replay will also be available through August 20, 2024, at 844-512-2921 (domestic) or 412-317-6671 (international) with passcode 10190283.

Presentation slides that will be used in conjunction with the conference call will also be made available online in advance on the “investors” section of the company’s website at https://gov2x.com. V2X recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with its obligations under the U.S. Securities and Exchange Commission (“SEC”) Regulation FD.

Footnotes:

1 See “Key Performance Indicators and Non-GAAP Financial Measures” for descriptions and reconciliations.

2 Net leverage ratio of 3.6x equals net debt of $1,150 million divided by trailing twelve-month (TTM) bank EBITDA of $322.7 million.

About V2X

V2X builds innovative solutions that integrate physical and digital environments by aligning people, actions, and technology. V2X is embedded in all elements of a critical mission’s lifecycle to enhance readiness, optimize resource management, and boost security. The company provides innovation spanning national security, defense, civilian, and international markets. With a global team of approximately 16,000 professionals, V2X enables mission success by injecting AI and machine learning capabilities to meet today’s toughest challenges across all operational domains.

| Investor Contact | Media Contact |

| Mike Smith, CFA | Angelica Spanos Deoudes |

| IR@goV2X.com | Communications@goV2X.com |

| 719-637-5773 | 571-338-5195 |

Safe Harbor Statement

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 (the “Act”): Certain material presented herein includes forward-looking statements intended to qualify for the safe harbor from liability established by the Act. These forward-looking statements include, but are not limited to, all the statements and items listed under “2024 Guidance” above and other assumptions contained therein for purposes of such guidance, other statements about our 2024 performance outlook, revenue, contract opportunities, and any discussion of future operating or financial performance.

Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “could,” “potential,” “continue” or similar terminology. These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management.

These forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown risks, uncertainties, assumptions, and other important factors, many of which are outside our management’s control, which could cause actual results to differ materially from the results discussed in the forward-looking statements. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company’s historical experience and our present expectations or projections. For a discussion of some of the risks and uncertainties that could cause actual results to differ from such forward-looking statements, see the risks and other factors detailed from time to time in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the SEC.

We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.